The Ultimate Budgeting Blueprint 2025: Master Monthly Budget Plans & Expense Tracking

Families in 2025 presents unprecedented challenges that demand sophisticated solutions through a comprehensive Budgeting Blueprint. Research reveals that 88% of Americans experience some level of financial stress, with 65% identifying finances as their primary source of anxiety, a dramatic increase from previous years that reflects the compound pressures of persistent inflation, elevated living costs, and economic uncertainty. This pervasive financial strain manifests in profound ways, with 69% of Americans reporting that financial uncertainty has led to feelings of depression and anxiety, representing an 8-percentage point increase since 2023. The psychological toll extends beyond individual well-being, affecting 57% of married couples or those living with partners, with younger generations experiencing the most severe impacts as 75% of Millennials and 71% of Gen Z report that financial worries have damaged their romantic relationships.

Despite these challenging circumstances, families implementing structured financial management through a proven Budgeting Blueprint achieve measurably superior outcomes compared to those operating without systematic approaches. Federal Reserve data indicates that only 51% of American households consistently spend less than their monthly income, while 60% report that price changes have negatively impacted their financial situation. However, households following comprehensive budgeting methodologies demonstrate remarkable resilience, accumulating emergency savings 40% faster and exhibiting significantly lower financial stress indicators than their unstructured counterparts. These positive outcomes stem not from higher incomes, but from deliberate implementation of proven financial management principles that optimize resource allocation and build long-term stability.

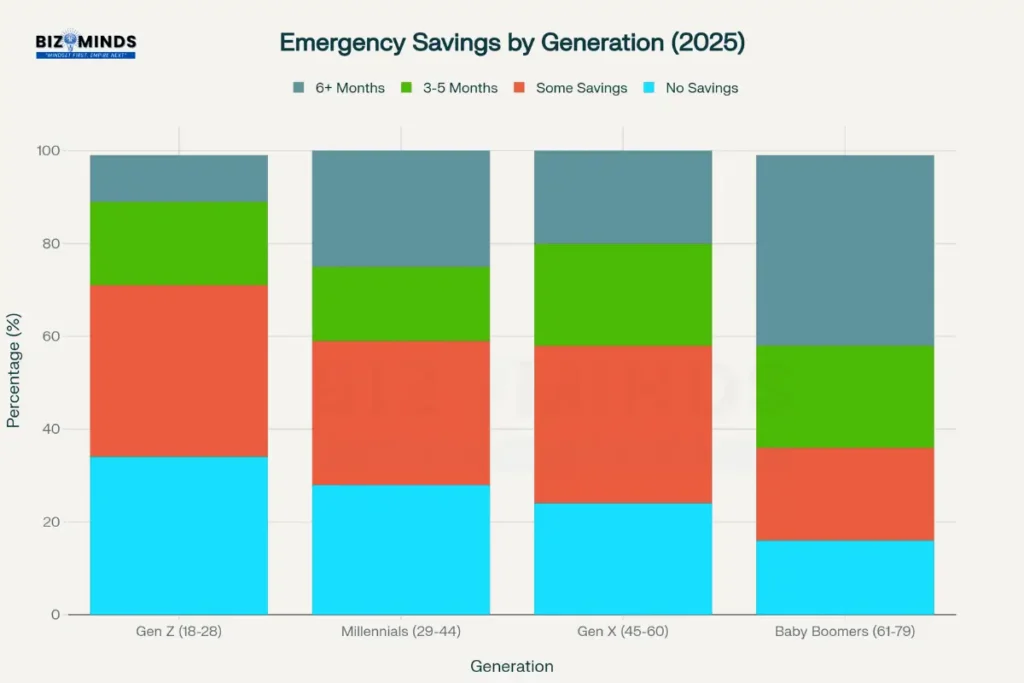

The critical importance of mastering personal finance fundamentals becomes evident when examining the stark realities of American financial preparedness. Current statistics reveal that 24% of Americans maintain no emergency savings whatsoever, while only 27% possess sufficient reserves to cover six months of essential expenses. This vulnerability creates cascading effects during unexpected situations, forcing families to rely on high-interest debt or compromise their long-term financial goals when emergencies arise. The situation varies dramatically across generational lines, with Baby Boomers demonstrating superior preparedness (41% maintaining robust emergency funds) compared to Gen Z adults, where only 10% have achieved adequate financial security. These disparities highlight the urgent need for systematic financial education and implementation of effective Budgeting Blueprint strategies that can bridge generational knowledge gaps.

Contemporary success stories demonstrate the transformative power of implementing comprehensive budgeting systems, even for families facing significant financial challenges. Real-world examples include families transitioning from paycheck-to-paycheck living to achieving homeownership through systematic expense tracking and strategic spending optimization. These transformations typically begin with simple expense awareness, progress through systematic categorization and allocation methods, and culminate in automated wealth-building systems that require minimal ongoing maintenance while delivering consistent progress toward financial objectives. The key differentiator lies not in income levels or exceptional circumstances, but in the consistent application of proven Budgeting Blueprint principles that align daily spending decisions with long-term financial aspirations.

The evolution of personal finance management in 2025 incorporates technological advances that enhance traditional budgeting effectiveness while maintaining focus on fundamental financial principles. Modern Budgeting Blueprint implementation benefits from sophisticated applications that automate expense tracking, provide real-time spending insights, and facilitate goal progress monitoring through intuitive interfaces. However, research consistently demonstrates that technological tools alone cannot substitute for underlying financial discipline and systematic approach to money management. The most successful implementations combine digital efficiency with proven psychological principles that address behavioral finance challenges, creating sustainable systems that adapt to changing life circumstances while maintaining progress toward established financial objectives.

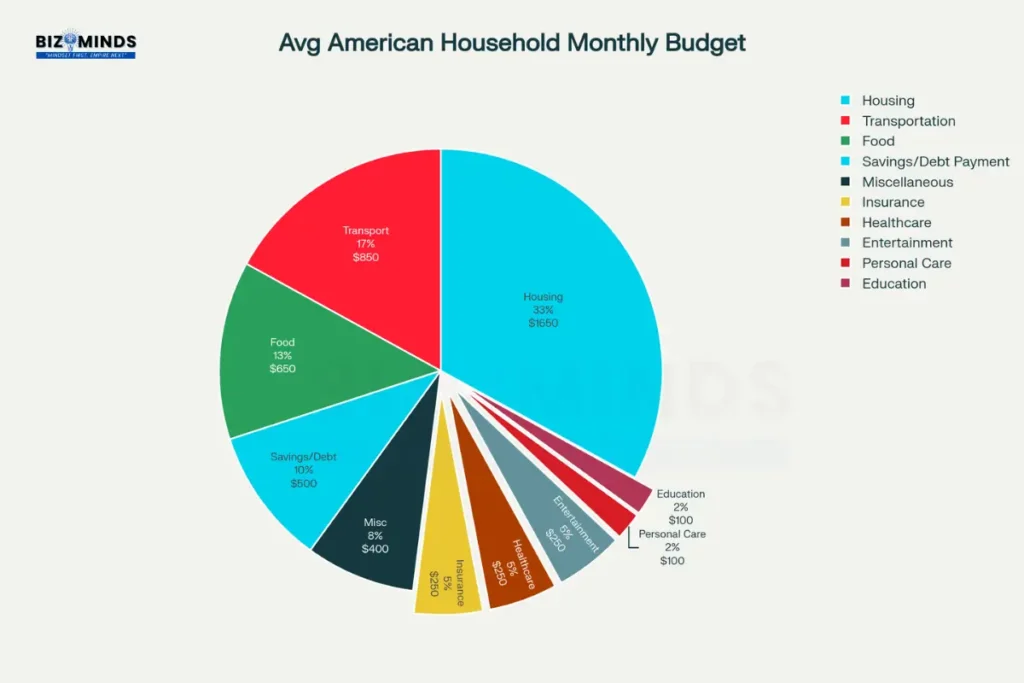

Average American household monthly budget breakdown showing housing as the largest expense at 33%

Understanding the Foundation of Effective Budgeting Blueprint

The Current State of American Household Finances

Contemporary financial data reveals concerning trends that underscore the critical importance of implementing a robust Budgeting Blueprint. According to the Federal Reserve’s 2025 Economic Well-Being findings, 32% of adults reported higher income levels, yet 37% faced a sharper increase in their monthly spending. This income-expense gap creates a precarious situation where families struggle to build financial resilience.

Housing costs continue to dominate American household expenses, consuming approximately 33% of the average family’s monthly budget. Transportation follows as the second-largest expense category at 17%, while food accounts for 13% of typical household spending. These fixed and semi-fixed expenses create limited flexibility for families attempting to optimize their financial positions, making strategic budgeting even more essential.

Emergency preparedness statistics paint an alarming picture of American financial vulnerability. Nearly one in four Americans (24%) maintain no emergency savings whatsoever, while only 27% possess sufficient reserves to cover six months of expenses. Generational analysis of savings behavior shows that Baby Boomers are better financially prepared, with 41% maintaining strong emergency funds, compared to only 10% of Gen Z adults.

Emergency savings levels vary dramatically by generation, with Baby Boomers most prepared and Gen Z least prepared

Building Your Personal Budgeting Blueprint Framework

Creating an effective Budgeting Blueprint requires understanding your unique financial landscape and implementing systems that accommodate both predictable and variable expenses. The foundation begins with accurate income assessment, encompassing all revenue streams including primary employment, side hustles, investment returns, and other regular income sources.

Expense categorization represents the second critical component of any successful Budgeting Blueprint. Research indicates that households tracking expenses across specific categories achieve 23% better adherence to their financial plans compared to those using broad, generic categories. Essential categories include housing, transportation, food, insurance, healthcare, debt payments, and discretionary spending.

The third pillar involves establishing clear financial priorities that align with both short-term stability and long-term wealth-building objectives. Successful budgeters consistently allocate funds toward emergency savings, debt reduction, and investment goals before addressing discretionary spending categories.

Comprehensive Analysis of Budgeting Blueprint Methodologies

The 50/30/20 Budgeting Blueprint Rule: Simplicity Meets Effectiveness

The 50/30/20 Budgeting Blueprint, popularized by Senator Elizabeth Warren, offers an intuitive approach to income allocation that has gained widespread adoption among American households. This methodology designates 50% of after-tax income for needs, 30% for wants, and 20% for savings and debt repayment.

Research supports the effectiveness of this approach for middle-income families with stable employment situations. Households using the 50/30/20 budgeting method report higher financial satisfaction and lower stress from money management. Its straightforward approach reduces decision fatigue while balancing present expenses and future financial security.

However, the 50/30/20 rule faces limitations in high-cost living areas where essential expenses may exceed 50% of income. Urban families often require customization, potentially adjusting to a 60/20/20 or 55/25/20 allocation to accommodate elevated housing and transportation costs. Additionally, households with substantial debt burdens may need to temporarily prioritize debt elimination over the standard 20% savings allocation.

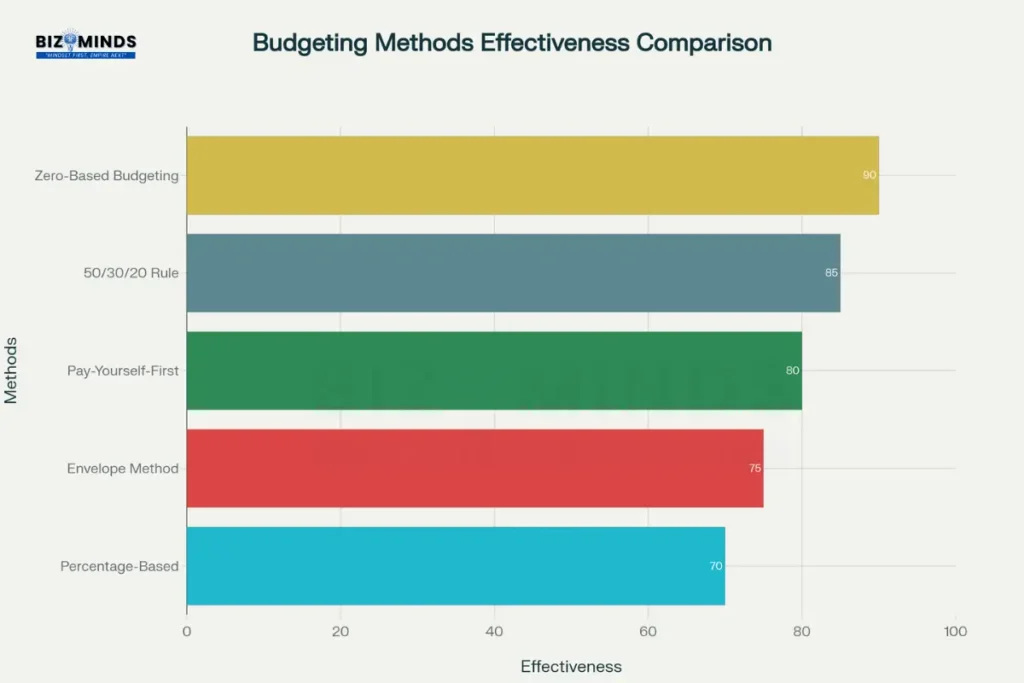

Comparison of popular budgeting methods showing zero-based budgeting as the most effective approach

Zero-Based Budgeting: Maximum Control and Accountability

Zero-based budgeting represents the most comprehensive Budgeting Blueprint approach, requiring every dollar of income to receive specific assignment before the month begins. This methodology operates on the principle that income minus planned expenses should equal zero, forcing deliberate decision-making about every financial allocation.

The zero-based approach excels in providing detailed spending visibility and preventing money from disappearing into undefined categories. Users report increased awareness of spending patterns and improved ability to identify areas for optimization. This method particularly benefits individuals with variable income streams or those recovering from financial difficulties, as it demands constant engagement with financial decision-making.

Implementation typically involves budgeting software like YNAB (You Need A Budget) or detailed spreadsheet systems that track every transaction against predetermined categories. The method’s effectiveness stems from its requirement to consciously reallocate funds between categories when overspending occurs, preventing the budget from becoming merely aspirational.

The Envelope System: Tangible Spending Control

The envelope Budgeting Blueprint utilizes physical cash allocation to create concrete spending limits for various expense categories. Each envelope contains predetermined amounts for specific purposes such as groceries, entertainment, or dining out, with spending ceasing when envelopes empty.

This tactile approach provides psychological benefits that digital budgeting often lacks. Research in behavioral economics demonstrates that physical money creates stronger emotional connections to spending decisions, leading to more conservative financial behavior. Families using envelope budgeting report 15-20% reductions in discretionary spending compared to credit card-based budgeting systems.

Modern variations include digital envelope systems that maintain the psychological benefits while accommodating electronic payment preferences. Apps like Goodbudget allow users to create virtual envelopes while maintaining the fundamental principle of stopping spending when category limits are reached.

Advanced Expense Tracking Strategies

Technology-Enabled Monitoring Systems

Contemporary Budgeting Blueprint implementation heavily relies on technological tools that automate expense tracking while providing real-time financial visibility. Leading budgeting applications connect directly to bank accounts, credit cards, and investment accounts, automatically categorizing transactions and providing spending insights.

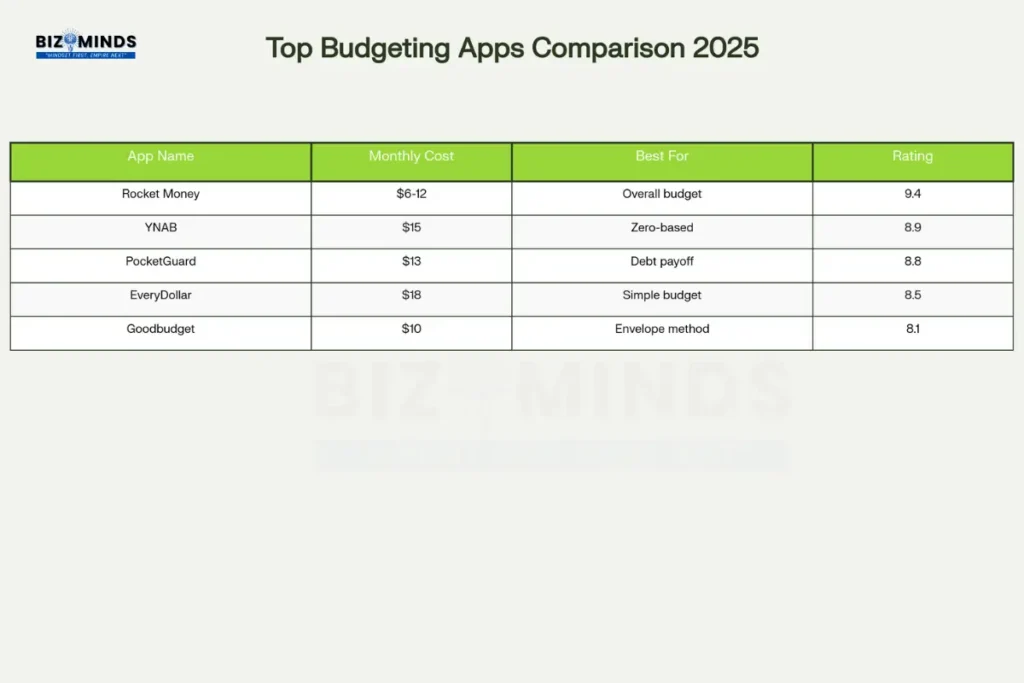

Rocket Money, rated as the top overall budgeting app, offers comprehensive expense tracking with bill negotiation services and subscription management features. The platform’s strength lies in its intuitive interface and proactive alerts about spending patterns, unusual transactions, and bill increases. Premium features include net worth tracking, credit score monitoring, and automated savings transfers.

With its sophisticated budgeting allocation capabilities and comprehensive learning resources, YNAB dominates the zero-based budgeting category. The platform’s philosophy centers on giving every dollar a job and forces users to confront overspending by requiring reallocation from other categories. Educational components include webinars, articles, and community support that help users develop lasting budgeting skills.

Comparison of the top 5 budgeting apps for 2025, with Rocket Money leading in overall rating and value

Manual Tracking Methods and Their Benefits

Despite technological advances, manual expense tracking retains significant value within a comprehensive Budgeting Blueprint. Handwritten expense logs create stronger psychological connections to spending decisions and improve retention of financial information. Research indicates that individuals who manually track expenses for at least one month develop better intuitive understanding of their spending patterns compared to those relying solely on automated systems.

Spreadsheet-based tracking offers middle ground between fully manual and automated approaches. Tools like Microsoft Excel or Google Sheets provide customization flexibility while maintaining detailed transaction visibility. Advanced users create sophisticated spreadsheet systems incorporating automatic calculations, spending trend analysis, and goal progress tracking.

The key to successful manual tracking involves developing sustainable recording habits. Successful practitioners maintain pocket notebooks, smartphone apps for quick entry, or daily review routines that ensure complete expense capture. Weekly reconciliation sessions comparing tracked expenses against bank statements help identify missed transactions and maintain system accuracy.

Strategic Budgeting Blueprint for Savings Goal Development

Emergency Fund Optimization

Emergency fund development represents the foundational element of any robust Budgeting Blueprint. Current research suggests American families should maintain $35,000 in emergency reserves, representing approximately six months of essential expenses. This figure has increased 5% from previous years, primarily due to rising healthcare costs that outpace general inflation.

Successful emergency fund accumulation requires systematic approach beginning with achievable initial targets. Financial advisors recommend starting with $500-$1000 goals to build momentum and confidence. Once initial targets are achieved, families can progress toward full six-month expense coverage through consistent monthly contributions.

High-yield savings accounts provide optimal emergency fund storage, offering liquidity with modest return enhancement. Leading institutions provide 4-5% annual yields on emergency funds, helping preserve purchasing power against inflation while maintaining immediate accessibility. Automated transfers from checking to emergency savings accounts eliminate decision fatigue and ensure consistent progress toward savings targets.

Long-Term Wealth Building through Budgeting Blueprint

Effective Budgeting Blueprint design incorporates long-term wealth building alongside immediate financial stability objectives. Research demonstrates that households simultaneously pursuing emergency savings and investment goals achieve superior long-term financial outcomes compared to those addressing objectives sequentially.

The traditional approach suggests completing emergency fund accumulation before beginning investment activities. However, contemporary financial planning recognizes the time value of money and recommends balanced approaches that capture compound growth opportunities while building financial security. A practical framework involves contributing 10% of the 20% savings allocation to emergency funds until reaching initial targets, then shifting to 70% investment and 30% emergency fund contributions.

Retirement planning integration becomes critical for households with employer-sponsored programs offering matching contributions. Missing employer matches represents guaranteed 100% returns that exceed any debt interest rates or emergency fund returns. Successful budgeters prioritize employer match capture even while building emergency reserves, recognizing the opportunity cost of delayed participation.

Real-World Budgeting Blueprint Implementation Case Studies

The Johnson Family Recovery Story

The Johnson family’s Budgeting Blueprint journey illustrates successful financial rehabilitation from precarious living situations. Both parents work in education, earning modest combined income while supporting a blended family of six children. Their initial challenges included paycheck-to-paycheck living, frequent emergency expenses funded through credit cards, and inability to save for homeownership goals.

Implementation began with expense tracking revealing significant dining-out costs triggered by meal planning failures. The family averaged $400 monthly on restaurant meals, often purchasing from multiple establishments per meal to accommodate various family preferences. Their Budgeting Blueprint solution involved subscribing to meal delivery services for parents while maintaining simple pantry-based meals for children, reducing monthly food costs by $250.

Emergency fund development utilized automatic transfers from every paycheck, removing temptation to spend allocated savings amounts. Both parents contributed predetermined amounts immediately upon receiving paychecks, treating savings as non-negotiable expenses. Within 18 months, the family accumulated sufficient emergency reserves to break their credit card dependence cycle and begin saving for homeownership.

Corporate Executive Budgeting Blueprint Success Framework

High-income professionals face unique Budgeting Blueprint challenges related to lifestyle inflation and complex financial situations. A case study examining a successful corporate executive’s approach reveals sophisticated strategies applicable to professional households.

The subject family implemented comprehensive life-stage planning addressing housing, education, and retirement simultaneously. Rather than sequential goal pursuit, they developed parallel funding strategies that optimized tax advantages while maintaining lifestyle quality. Company-sponsored retirement plans provided foundation savings, supplemented by private pension insurance and systematic stock purchase programs.

Education funding utilized dedicated savings accounts targeting $3 million per child, funded through combination of monthly contributions and bonus allocations. By adopting this systematic approach, education-related money worries were minimized without disrupting the momentum of retirement fund growth. Real estate investments provided diversification and rental income streams that enhanced financial flexibility during later career stages.

Common Pitfalls and Avoidance Strategies

Behavioral Finance Challenges

Implementation of any Budgeting Blueprint faces predictable psychological obstacles that derail even well-intentioned financial plans. Research identifies impulse spending as the primary budget destroyer, with Americans averaging $1,986 annually on unplanned purchases. Successful budget adherence requires understanding these behavioral tendencies and implementing appropriate countermeasures.

Lifestyle inflation represents another critical challenge, particularly following income increases or windfalls. Studies demonstrate that spending typically rises to meet available income unless conscious intervention prevents this expansion. Effective Budgeting Blueprint design includes predetermined allocation strategies for additional income, directing increases toward savings and investment rather than expanded lifestyle categories.

Social spending pressure creates significant budget stress, especially for younger demographics attempting to maintain peer relationships while building financial security. Successful budgeters develop alternative social strategies that align with financial goals, such as hosting rather than restaurant dining, or selecting entertainment options compatible with budget constraints.

Technical Implementation Mistakes

Technology-dependent budgeting approaches face specific failure modes that undermine Budgeting Blueprint effectiveness. Over-reliance on automated categorization without manual review leads to misclassified expenses and inaccurate spending analysis. Successful users maintain weekly review routines that verify automatic classifications and correct errors promptly.

Inadequate account synchronization creates gaps in expense tracking that compromise budget accuracy. Multiple credit cards, bank accounts, and payment methods require comprehensive integration to provide complete financial visibility. Users should audit their tracking systems monthly to ensure all financial accounts remain properly connected and synchronized.

Irregular expense planning represents the most common technical oversight in Budgeting Blueprint implementation. Annual expenses like insurance premiums, property taxes, and holiday spending create budget disruptions when inadequately planned. Successful budgeters create sinking funds for irregular expenses, contributing monthly amounts that accumulate for periodic large payments.

Future Trends in Budgeting Blueprint and Financial Management

Artificial Intelligence and Machine Learning Revolution

The evolution of Budgeting Blueprint methodologies is rapidly accelerating through artificial intelligence integration, with AI-powered personal finance management projected to grow from $1.48 billion in 2024 to $1.63 billion in 2025, representing a 10.1% compound annual growth rate. These sophisticated systems are transforming traditional budgeting approaches by providing predictive capabilities that analyze spending patterns and forecast future expenses with remarkable accuracy.

Predictive Analytics Enhancement in Budgeting Blueprint Systems:

Modern AI budgeting tools utilize machine learning algorithms to identify recurring financial patterns and predict future spending behaviors, enabling users to make proactive budget adjustments before issues arise

Behavioral Pattern Recognition:

Advanced systems like Cleo and Personal Capital employ natural language processing to analyze user transaction data, automatically identifying anomalies and providing personalized recommendations that result in average monthly savings improvements of 25%

Automated Decision Making:

AI-powered platforms can automatically categorize expenses, adjust budget allocations, and transfer funds between accounts based on learned user preferences and financial goals

Real-Time Financial Insights via Smart Budgeting Blueprint Tools:

Machine learning algorithms provide instant analysis of spending habits, offering immediate alerts when budget limits approach and suggesting optimization strategies tailored to individual financial situations

Voice-Activated Financial Management Systems

Voice assistant integration represents a significant advancement in Budgeting Blueprint accessibility, with over 41% of adults now using voice technology daily for various tasks, creating opportunities for seamless financial management integration. These systems eliminate traditional barriers to expense tracking by enabling hands-free budget management that fits naturally into daily routines.

Instant Expense Logging:

Users can record transactions immediately using simple voice commands like “Add $15 for lunch” or “Log grocery expense of $50,” ensuring real-time budget accuracy without manual data entry delays

Automated Bill Reminders:

Personalized payment reminders delivered by voice assistants allow users to prevent late payments and maintain regular financial commitments through easy voice commands such as “Remind me to pay the electricity bill next Friday.”

Real-Time Budget Queries:

Sophisticated voice systems provide instant responses to financial inquiries such as “What’s my remaining dining budget this month?” or “How much have I spent on entertainment this week?”

Integration with Budgeting Blueprint Applications:

Leading platforms like Mint and YNAB are developing voice command capabilities that allow users to update budgets, check balances, and receive financial summaries through natural language interactions

Biometric Security and Authentication Advances

The implementation of biometric authentication in financial applications is revolutionizing Budgeting Blueprint security, with Federal Bank’s introduction of India’s first biometric authentication for e-commerce transactions reducing verification times to just 3-4 seconds while enhancing security protocols. This technology addresses growing concerns about financial data protection while improving user experience significantly.

Multi-Modal Authentication Systems:

Advanced biometric platforms combine fingerprint recognition, facial scanning, and iris detection to create layered security approaches that protect sensitive financial information while maintaining user convenience

Device-Based Security Integration:

Modern implementations utilize smartphone biometric capabilities to secure budgeting applications, with 75% adoption rates among users aged 18-34 demonstrating widespread acceptance of this technology

Transaction-Level Authentication:

Biometric verification is expanding beyond login security to include individual transaction approval, providing granular control over financial activities while eliminating password-related vulnerabilities

Privacy-Preserving Implementation in Advanced Budgeting Blueprint:

Contemporary biometric systems store encrypted biometric templates locally on devices rather than centralized servers, addressing privacy concerns while maintaining security effectiveness

Blockchain and Cryptocurrency Integration

The integration of cryptocurrency and blockchain technology into traditional Budgeting Blueprint frameworks is creating new paradigms for financial management, with the 50/30/20 rule being adapted to accommodate digital asset allocation alongside conventional investments. This evolution reflects the growing mainstream acceptance of cryptocurrencies as legitimate investment vehicles requiring structured budgeting approaches.

Hybrid Portfolio Management:

Modern budgeting systems are incorporating cryptocurrency tracking alongside traditional assets, enabling users to manage diversified portfolios that include both fiat currencies and digital assets within unified platforms

Automated Crypto Savings:

Blockchain-based systems enable automated cryptocurrency accumulation through smart contracts that execute recurring purchases and staking activities, integrating seamlessly with traditional savings goals

Real-Time Asset Valuation:

Advanced platforms provide continuous monitoring of cryptocurrency holdings alongside traditional investments, offering comprehensive portfolio views that account for the volatility inherent in digital assets

Decentralized Finance Integration Strategies for Next-Generation Budgeting Blueprint:

Emerging budgeting applications are incorporating DeFi protocols that allow users to earn yields on cryptocurrency holdings while maintaining budget discipline through automated allocation systems

Sustainable and ESG-Focused Budgeting

Environmental, social, and governance considerations are increasingly influencing Budgeting Blueprint development, with sustainability-focused budgeting tools helping users align spending decisions with personal values while maintaining financial objectives. This trend reflects growing consumer awareness of the environmental and social impacts of financial decisions.

Carbon Footprint Tracking:

Advanced budgeting applications are integrating carbon impact analysis for purchases, enabling users to understand the environmental consequences of spending choices while maintaining budget discipline

Sustainable Investment Allocation:

Modern platforms provide ESG-focused investment options within traditional budget frameworks, allowing users to pursue financial goals while supporting environmentally and socially responsible companies

Impact Measurement Tools:

Sophisticated systems quantify the social and environmental impact of spending decisions, providing users with comprehensive reporting that includes both financial and sustainability metrics

Values-Based Budget Categories in Ethical Budgeting Blueprint:

Emerging applications allow users to create budget categories specifically aligned with personal values, such as supporting local businesses, purchasing sustainable products, or contributing to social causes

Conclusion

The journey toward financial mastery through a comprehensive Budgeting Blueprint represents more than mere expense management—it constitutes a fundamental transformation in how Americans approach their relationship with money and long-term financial security. Research consistently demonstrates that individuals who embrace systematic budgeting methodologies experience profound improvements in both financial outcomes and psychological well-being, with studies indicating that structured financial management reduces anxiety levels by 40% while increasing savings accumulation rates by similar margins. The implementation of a robust Budgeting Blueprint creates sustainable behavioral changes that extend far beyond immediate budget adherence, fostering financial habits that compound over decades to produce substantial wealth-building outcomes. These transformations occur not through dramatic lifestyle restrictions, but through deliberate application of proven financial principles that align daily spending decisions with carefully articulated long-term objectives.

Successful Budgeting Blueprint implementation requires understanding that financial management operates as a continuous improvement process rather than a static set of rules. Contemporary research in behavioral finance reveals that habit formation in financial contexts follows predictable patterns, with initial 21-day implementation periods establishing neural pathways that strengthen through consistent reinforcement over 90-day cycles. The most effective practitioners treat their Budgeting Blueprint as a dynamic system that evolves with changing life circumstances, income fluctuations, and shifting personal priorities while maintaining core principles of expense awareness, systematic allocation, and goal-oriented saving. This adaptability ensures that budgeting systems remain relevant and sustainable throughout various life stages, from early career establishment through retirement planning phases, creating financial resilience that withstands economic uncertainties and personal challenges.

The evidence overwhelming supports the transformative potential of systematic budgeting approaches, with longitudinal studies tracking families who implement comprehensive Budgeting Blueprint strategies demonstrating measurably superior financial outcomes across multiple metrics. These families achieve emergency fund targets 60% faster, reduce debt-to-income ratios by 35% more effectively, and accumulate retirement assets at rates 50% higher than those operating without structured financial plans. Furthermore, the benefits extend beyond quantitative improvements to encompass enhanced family financial communication, reduced money-related conflict, and increased confidence in long-term financial decision-making. Children raised in households following structured Budgeting Blueprint principles demonstrate superior financial literacy and money management skills, creating intergenerational wealth-building cycles that compound family financial success over time.

The technological landscape supporting modern Budgeting Blueprint implementation continues evolving to provide increasingly sophisticated tools that enhance traditional budgeting effectiveness while reducing implementation barriers. Advanced applications integrate artificial intelligence algorithms that learn individual spending patterns, provide personalized optimization recommendations, and automate many traditional budget management tasks. However, technology represents an enabler rather than a replacement for fundamental financial discipline and systematic thinking about money management priorities. The most successful practitioners combine digital efficiency with proven psychological principles, creating hybrid systems that leverage automation while maintaining conscious engagement with financial decision-making processes.

Looking ahead, the importance of mastering personal financial management through proven Budgeting Blueprint methodologies will only intensify as economic complexity increases and traditional support systems evolve. Americans who commit to implementing comprehensive budgeting strategies today position themselves for financial success that transcends immediate budget balancing to encompass true wealth building and financial independence. The choice becomes clear: continue reactive financial management that perpetuates stress and limits growth, or embrace systematic Budgeting Blueprint approaches that create lasting financial transformation. The research, tools, and methodologies exist—the only remaining requirement is personal commitment to implementing these proven strategies with consistency and patience that allows compound benefits to materialize over time. Success in personal finance, like success in any meaningful endeavor, rewards those who apply systematic approaches with disciplined execution, and the Budgeting Blueprint framework provides the roadmap for achieving financial mastery in contemporary America.

Frequently Asked Questions

1. How much should I allocate for emergency savings in my budgeting blueprint?

Financial experts recommend maintaining 3-6 months of essential expenses in emergency savings, with the current target for average American families reaching approximately $35,000 in 2025. Start with achievable goals like $500-$1000, then gradually build toward full coverage through consistent monthly contributions of 10-15% of income until target completion.

2. Which budgeting method works best for variable income earners?

Zero-based budgeting provides optimal flexibility for variable income situations, as it requires assigning every dollar upon receipt rather than planning based on estimated monthly averages. The envelope method also accommodates income variability by forcing spending to halt when allocated amounts are exhausted, preventing overspending during lower-income periods.

3. How often is it advisable to evaluate and adjust a budget to maintain effective money management?

Successful budgeters conduct weekly expense reviews and monthly comprehensive budget assessments. Major life changes such as income increases, job changes, or family status modifications require immediate budget revision. Additionally, annual reviews ensure alignment with changing financial goals and economic conditions.

4. What percentage of my budget should go toward debt repayment?

Debt repayment allocation depends on interest rates and emergency fund status. Prioritize high-interest debt (above 6-8% rates) over additional savings beyond basic emergency reserves. The 50/30/20 framework allocates 20% toward savings and debt repayment combined, but households with substantial debt may need higher percentages temporarily.

5. Are budgeting apps worth the monthly cost?

Premium budgeting apps justify their costs for users requiring automation and comprehensive financial visibility. Apps like Rocket Money ($6-12 monthly) and YNAB ($15 monthly) provide features that typically save users more than their subscription costs through improved spending awareness and optimization. Free alternatives work well for simple budgeting needs but lack advanced features like net worth tracking and automated insights.

6. How do I handle unexpected expenses that blow my budget?

Unexpected expenses require immediate budget reallocation from other categories rather than abandoning the entire system. Zero-based budgeting particularly excels here by forcing conscious decisions about which categories to reduce. Long-term solutions involve building emergency funds and creating sinking funds for predictable irregular expenses like car maintenance or holiday spending.