Advanced Forex Trading Strategies for 2025: Dominate EUR/USD, USD/JPY & GBP/USD

The year 2025 presents unprecedented opportunities and challenges for American forex traders navigating the complex landscape of currency markets. As global economic dynamics shift and central bank policies evolve, understanding sophisticated forex trading strategies becomes crucial for success in this $6 trillion daily market. The foreign exchange market has transformed dramatically, with technological advancements, changing monetary policies, and geopolitical tensions creating both volatility and opportunity for skilled traders.

For American traders specifically, the current market environment offers unique advantages. The Federal Reserve’s monetary policy decisions, the strength of the US dollar, and America’s economic resilience provide a strong foundation for implementing effective forex trading strategies. However, success requires more than just market knowledge—it demands disciplined execution, robust risk management, and deep understanding of currency pair dynamics.

Performance Comparison of Major Forex Trading Strategies for 2025

Understanding the 2025 Forex Market

Federal Reserve Policy Impact on Currency Markets

The Federal Reserve’s monetary policy decisions significantly influence global forex markets, creating ripple effects that American traders must understand to implement successful forex trading strategies. According to recent analysis from Goldman Sachs Research, the Fed is expected to cut rates by 75 basis points in 2025, with potential cuts beginning as early as September. This dovish stance represents a departure from the aggressive tightening cycle of 2022-2023, when rates were raised by 5 percentage points to combat inflation.

These policy shifts directly impact currency pair dynamics, particularly for USD-denominated pairs. When the Federal Reserve signals rate cuts, it typically weakens the dollar against other major currencies, creating opportunities for traders who understand these relationships. The current federal funds rate of 4.25%-4.50% remains elevated compared to historical norms, but the trajectory toward lower rates is becoming clearer.

Key Federal Reserve factors affecting forex trading strategies:

- Interest rate differential changes – Widening or narrowing spreads between US rates and other central banks

- Forward guidance communications – Fed Chair Jerome Powell’s rhetoric significantly impacts market sentiment

- Quantitative easing considerations – Asset purchase programs affecting long-term yields

- Economic data interpretation – How the Fed responds to employment, inflation, and GDP data

- Political pressure considerations – Potential influence from the Trump administration on Fed independence

Global Economic Environment and Currency Volatility

The global economic presents both challenges and opportunities for American forex traders implementing sophisticated forex trading strategies. Recent research from the European Central Bank indicates that cross-currency correlations have increased, making portfolio diversification more challenging but also creating new arbitrage opportunities.

Economic divergence between major economies creates the foundation for profitable currency trading. While the United States demonstrates economic resilience with moderate GDP growth projections, other major economies face varying challenges. The Eurozone continues recovering from energy crises and geopolitical tensions, Japan maintains ultra-accommodative monetary policy, and the United Kingdom navigates post-Brexit economic adjustments.

This economic divergence creates trending opportunities that trend-following forex trading strategies can exploit. When economic fundamentals clearly favor one currency over another, sustained directional moves often follow, providing multiple entry points for position traders and swing traders alike.

Technology and Market Structure Evolution

The forex market’s technological evolution continues accelerating in 2025, with artificial intelligence and machine learning increasingly integrated into trading platforms. Recent academic research published in the Journal of Advances in Mathematics and Computer Science demonstrates that hybrid deep learning models combining CNN-LSTM networks with Deep Q-Learning achieve superior performance compared to traditional approaches.

For American retail traders, this technological advancement democratizes access to sophisticated forex trading strategies previously available only to institutional players. Modern trading platforms now offer:

- Advanced algorithm integration – Retail traders can access institutional-grade trading algorithms

- Real-time sentiment analysis – Social media and news sentiment incorporated into trading decisions

- Multi-timeframe analysis tools – Gain deeper market insights by evaluating trends across short-, medium-, and long-term timeframes.

- Automated risk management – Simplify trading with AI-powered position sizing and dynamic stop-loss adjustments.

- Advanced backtesting features – Test and refine strategies using decades of historical market data to boost accuracy and performance

Major Currency Pair Analysis for 2025

EUR/USD: Navigating European Economic Recovery

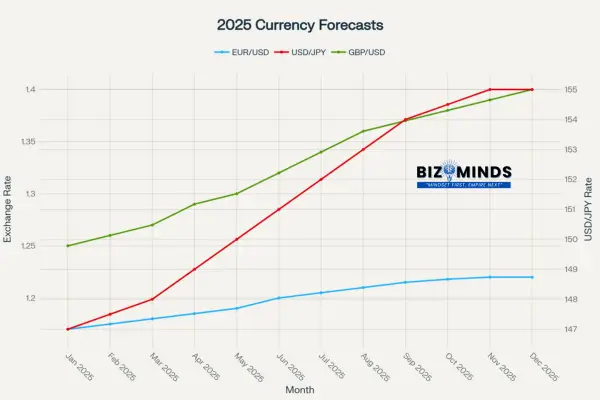

The EUR/USD currency pair, representing nearly 25% of global forex trading volume, remains the most liquid and widely traded pair globally. For American traders, EUR/USD offers unique advantages including tight spreads, abundant liquidity, and predictable responses to economic data releases. The pair’s behavior in 2025 reflects the fundamental divergence between Federal Reserve and European Central Bank policies.

Current EUR/USD market dynamics:

The European Central Bank’s monetary policy stance differs significantly from the Federal Reserve’s approach. While the Fed signals potential rate cuts, the ECB maintains a more cautious approach toward monetary easing. This policy divergence creates opportunities for carry trade forex trading strategies and interest rate differential plays.

Technical analysis reveals EUR/USD trading within a broader uptrend, with key resistance around 1.2200 and support near 1.1400. Recent price action suggests the pair is positioning for a potential breakout higher, supported by improving European economic fundamentals and expectations of US dollar weakness.

Fundamental factors driving EUR/USD in 2025:

- ECB monetary policy decisions – Slower rate cuts compared to the Federal Reserve

- European economic recovery – Gradual improvement in Eurozone GDP growth

- Energy security improvements – Reduced dependence on Russian energy supplies

- Political stability factors – European Union political cohesion and policy coordination

- Trade relationship dynamics – US-EU trade agreements and tariff considerations

Effective forex trading strategies for EUR/USD:

Trend Following Approach: EUR/USD tends to develop sustained trends lasting several months. American traders can implement trend-following forex trading strategies using moving average crossovers, with the 50-day and 200-day moving averages providing reliable signals. When the shorter moving average crosses above the longer one, it signals potential uptrend continuation.

Range Trading Tactics: During consolidation periods, EUR/USD often respects technical support and resistance levels. Range trading forex trading strategies work effectively when the pair trades sideways, allowing traders to buy near support and sell near resistance with tight stop-losses.

News Trading Opportunities: Major economic releases from both the US and Eurozone create short-term volatility perfect for news trading forex trading strategies. Key events include Federal Reserve meetings, ECB policy announcements, US Non-Farm Payrolls, and European inflation data.

USD/JPY: Capitalizing on Interest Rate Differentials

The USD/JPY currency pair presents compelling opportunities for American traders in 2025, driven primarily by the substantial interest rate differential between the United States and Japan. The Bank of Japan’s commitment to ultra-accommodative monetary policy contrasts sharply with the Federal Reserve’s higher rate environment, creating ideal conditions for carry trade forex trading strategies.

2025 Price Forecasts using Forex Trading Strategies for Major Currency Pairs: EUR/USD, USD/JPY, and GBP/USD

Interest rate differential dynamics:

Japan’s monetary policy remains the most accommodative among major developed economies, with the Bank of Japan maintaining rates near zero while the Federal Reserve keeps rates significantly higher. This differential creates positive carry for traders holding long USD/JPY positions, earning interest on the position while potentially benefiting from currency appreciation.

Recent USD/JPY market behavior:

The pair has demonstrated strong upward momentum throughout 2024 and early 2025, rising from approximately 146 yen per dollar to current levels around 148-150. Technical analysis suggests the pair could reach 155 or higher by year-end, supported by fundamental factors and technical momentum indicators.

Key factors influencing USD/JPY trading:

- Bank of Japan intervention risks – Potential currency intervention if yen weakens excessively

- US Treasury yield movements – Rising yields typically support USD/JPY appreciation

- Risk sentiment fluctuations – Safe-haven flows can strengthen yen during market stress

- Japanese economic data – GDP, inflation, and trade balance impacts

- Geopolitical tensions – Regional security concerns affecting yen demand

Optimal forex trading strategies for USD/JPY:

Carry Trade Strategy:

Long-term position holding to capture interest rate differentials while benefiting from potential currency appreciation. This approach requires careful risk management due to volatility risks and potential intervention.

Breakout Trading:

USD/JPY often experiences significant breakouts following key resistance levels. American traders can implement breakout forex trading strategies by identifying consolidation patterns and entering positions when price breaks above resistance with increased volume.

Momentum Trading:

The pair’s tendency to develop sustained momentum makes it ideal for momentum-based forex trading strategies. Using indicators like RSI divergence and MACD crossovers helps identify optimal entry and exit points.

GBP/USD: British Pound Recovery Prospects

The GBP/USD currency pair, commonly known as “Cable,” presents unique opportunities for American traders in 2025 as the British pound potentially recovers from years of Brexit-related uncertainty. Recent economic improvements in the UK and political stability provide a foundation for pound strength against the dollar.

UK economic fundamentals improving:

The UK economy demonstrates signs of stabilization and growth, with inflation moderating toward the Bank of England’s 2% target and employment remaining relatively stable. The Bank of England’s monetary policy approach differs from both the Federal Reserve and European Central Bank, creating unique trading opportunities.

Political and economic stability factors:

- Brexit implementation completion – Reduced uncertainty as new trade relationships stabilize

- Conservative government policies – Business-friendly economic policies supporting growth

- Energy security improvements – Diversified energy sources reducing supply risks

- Financial services competitiveness – London maintaining its role as a global financial center

- Trade relationship developments – New trade agreements outside the European Union

Technical analysis considerations:

GBP/USD demonstrates high volatility compared to other major pairs, creating opportunities for various forex trading strategies. The pair often experiences rapid moves during London trading hours, making it attractive for day traders and scalpers.

Recommended forex trading strategies for GBP/USD:

Swing Trading Approach: GBP/USD’s volatility makes it ideal for swing trading forex trading strategies that capture multi-day price movements. Using Fibonacci retracements and trend line analysis helps identify optimal entry and exit points.

Volatility Trading: High intraday volatility creates opportunities for volatility-based forex trading strategies. Options strategies and range trading during high volatility periods can be particularly effective.

Economic Calendar Trading: UK economic releases often create significant price movements. American traders can implement news trading forex trading strategies around key UK data releases like GDP, inflation, and Bank of England meetings.

Advanced Forex Trading Strategies for 2025

Technical Analysis-Based Approaches

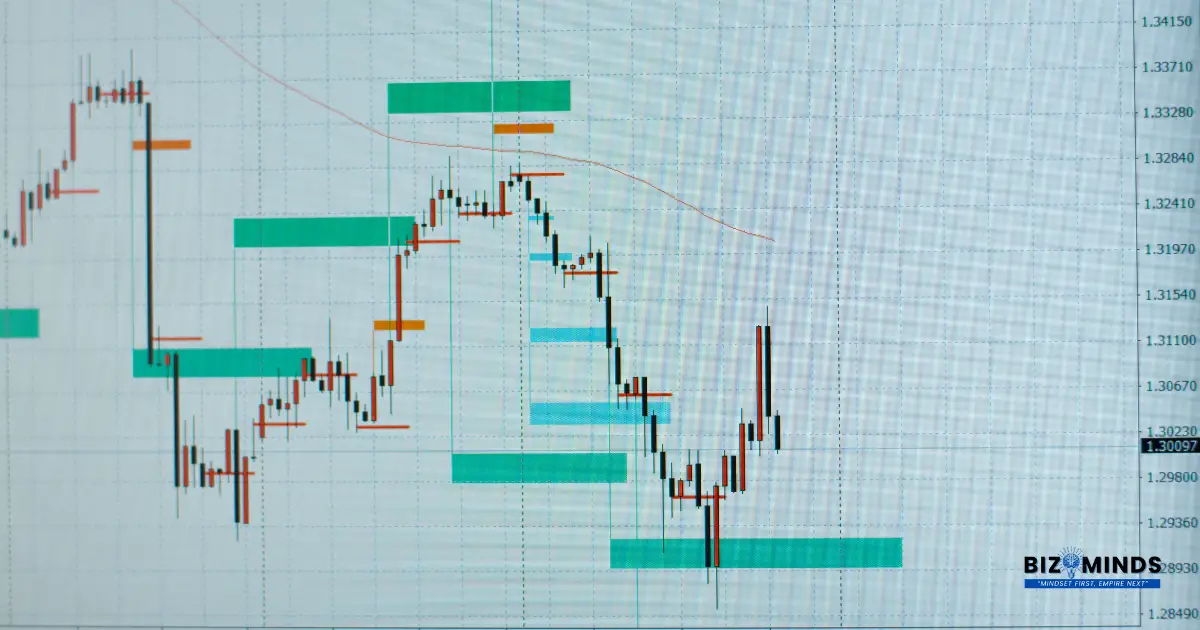

Technical analysis forms the backbone of many successful forex trading strategies, providing American traders with tools to analyze price patterns, identify trends, and time market entries and exits. Modern technical analysis incorporates traditional charting methods with advanced indicators and algorithmic analysis.

Essential technical indicators for forex trading:

- Moving Average Convergence Divergence (MACD) – Identifies trend changes and momentum shifts

- Relative Strength Index (RSI) – Determines overbought and oversold conditions

- Bollinger Bands – Track market volatility and spot possible price reversal zones.

- Fibonacci Retracements – Identify key support and resistance levels for smarter trade entries.

- Stochastic Oscillator – Validate trend momentum and optimize entry or exit timing.

Multi-timeframe analysis strategy:

Successful forex trading strategies often incorporate multiple timeframes to confirm trade signals and improve accuracy. American traders typically use:

- Weekly charts – Identify long-term trends and major support/resistance levels

- Daily charts – Determine intermediate-term direction and key levels

- 4-hour charts – Time entries and exits within the overall trend

- 1-hour charts – Fine-tune entry points and manage positions

Pattern recognition techniques:

Chart patterns provide powerful tools for implementing effective forex trading strategies. Key patterns include:

- Head and Shoulders – Reliable reversal pattern indicating trend changes

- Double Tops/Bottoms – Confirmation patterns for trend reversals

- Triangles and Wedges – Continuation patterns suggesting trend persistence

- Flags and Pennants – Short-term continuation patterns within larger trends

Fundamental Analysis Integration

Fundamental analysis examines economic indicators, central bank policies, and geopolitical events to determine currency values. Successful forex trading strategies integrate fundamental analysis with technical analysis for comprehensive market understanding.

Key economic indicators for forex trading:

- Gross Domestic Product (GDP) – Measures overall economic health and growth

- Consumer Price Index (CPI) – Inflation indicator affecting central bank policies

- Non-Farm Payrolls – US employment data significantly impacting USD pairs

- Interest Rate Decisions – Central bank policy directly affecting currency values

- Trade Balance – Import/export data influencing currency demand

Central bank policy analysis:

Understanding central bank communications and policy decisions is crucial for implementing effective forex trading strategies. American traders must monitor:

- Federal Reserve communications – FOMC meetings, Fed Chair speeches, and policy statements

- European Central Bank decisions – ECB policy meetings and President Lagarde’s communications

- Bank of Japan statements – BoJ policy decisions and intervention threats

- Bank of England actions – BoE rate decisions and forward guidance

Geopolitical risk assessment:

Geopolitical events significantly impact currency markets, creating opportunities for news trading forex trading strategies. Recent examples include:

- Trade tensions – US-China trade relations affecting safe-haven currencies

- Military conflicts – Regional instability driving flight-to-quality flows

- Election outcomes – Political changes influencing economic policies

- Brexit developments – Ongoing UK-EU relationship impacts

Risk Management Excellence

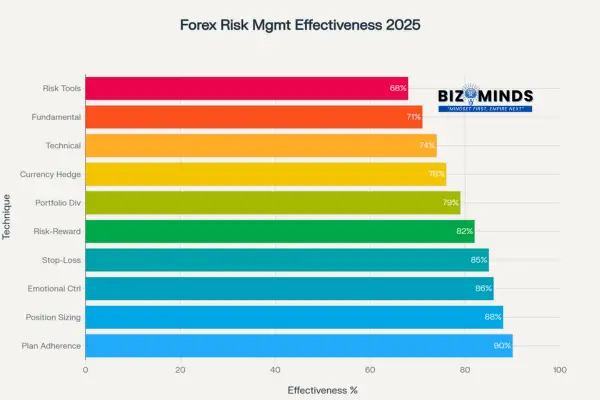

2025 Effectiveness of Forex Risk Management Strategies Used by US Traders

Risk management represents the most critical component of successful forex trading strategies, with studies showing that disciplined risk management often distinguishes profitable traders from those who experience losses. US traders should adopt robust risk management strategies that include proper position sizing, effective stop-loss orders, and diversified portfolios.

Position sizing methodologies:

Proper position sizing ensures that individual trades cannot catastrophically damage trading accounts. Effective forex trading strategies incorporate:

- Percentage risk rule – Never risk more than 1-2% of account equity per trade

- Volatility-adjusted sizing – Adjust position size based on currency pair volatility

- Correlation considerations – Reduce position sizes when trading correlated pairs

- Account growth scaling – Gradually increase position sizes as account equity grows

Stop-loss placement strategies:

Stop-losses protect against excessive losses while allowing profitable trades to develop. Advanced forex trading strategies use:

- Technical stop-losses – Placed beyond key support/resistance levels

- Volatility-based stops – Adjusted based on Average True Range (ATR)

- Time-based stops – Exiting positions after predetermined time periods

- Trailing stops – Moving stops to lock in profits as trades move favorably

Portfolio diversification principles:

Diversification reduces overall portfolio risk by spreading exposure across multiple currency pairs and trading strategies. Effective approaches include:

- Currency exposure management – Avoiding overexposure to single currencies

- Strategy diversification – Combining trend-following and mean-reversion approaches

- Timeframe diversification – Trading across multiple timeframes simultaneously

- Geographic diversification – Trade across major, minor, and exotic currency pairs to spread risk and capture global forex opportunities

USA-Specific Trading Advantages and Considerations

American Market Access and Regulation

American forex traders benefit from robust regulatory oversight and access to high-quality brokers, creating optimal conditions for implementing sophisticated forex trading strategies. The Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) provide comprehensive consumer protection while maintaining market integrity.

Regulatory advantages for US traders:

- Segregated customer funds – Client funds protected from broker insolvency

- Standardized leverage limits – Maximum 50:1 leverage on major pairs reducing excessive risk

- Transparent pricing – Regulated brokers must provide fair and transparent pricing

- Dispute resolution mechanisms – Formal processes for resolving trading disputes

- Educational requirements – Brokers must provide comprehensive educational resources

Access to institutional-grade platforms:

US traders now benefit from professional-grade trading platforms once exclusive to institutions, offering advanced tools that enable sophisticated forex strategies:

- Direct market access – Connection to interbank liquidity providers

- Advanced charting tools – Professional-grade technical analysis capabilities

- Algorithmic trading support – API access for automated trading strategies

- Risk management tools – Sophisticated position sizing and hedging capabilities

Tax Implications for American Forex Traders

Understanding tax implications is crucial for American traders implementing forex trading strategies, as tax efficiency can significantly impact overall profitability. The Internal Revenue Service treats forex trading gains and losses as ordinary income, subject to standard income tax rates.

Tax considerations for forex trading:

- Section 988 treatment – Forex gains taxed as ordinary income rather than capital gains

- Mark-to-market elections – Professional traders can elect mark-to-market accounting

- Business expense deductions – Educational costs, software, and data fees may be deductible

- Record keeping requirements – Detailed transaction records required for tax compliance

Strategies for tax efficiency:

Smart American traders implement tax-efficient forex trading strategies including:

- Timing of gains and losses – Strategic realization of gains and losses for tax optimization

- Entity structure optimization – Using appropriate business entities for tax advantages

- Professional trader status – Qualifying for favorable tax treatment through consistent trading

- International tax considerations – Understanding tax implications of offshore trading

Technology Infrastructure Advantages

The United States provides superior technology infrastructure supporting advanced forex trading strategies through high-speed internet connectivity, reliable power grids, and proximity to major financial centers. American traders benefit from:

Connectivity advantages:

- Low-latency connections – Ultra-fast fiber links to leading global trading hubs for quicker order execution

- Redundant internet providers – Multiple backup connections ensuring uptime

- Cloud-based access – Scalable computing power that accelerates backtesting, data analysis, and forex strategy development

- Mobile trading capabilities – Advanced mobile platforms for trading on-the-go

Data access and analysis:

American traders have access to comprehensive market data and analysis tools supporting sophisticated forex trading strategies:

- Real-time economic data – Instant access to market-moving news and live economic releases for informed trading decisions

- Historical data archives – Extensive historical data for backtesting strategies

- Research and analysis – Professional research from major financial institutions

- Social trading platforms – Community-driven analysis and signal sharing

Practical Implementation Guidelines

Setting Up a Professional Trading Environment

Creating an optimal trading environment is essential for implementing successful forex trading strategies. American traders must establish professional setups supporting focused analysis and disciplined execution.

Physical trading setup requirements:

- Multiple monitor configuration – At least two monitors for chart analysis and news monitoring

- Reliable internet connection – Backup connections ensuring uninterrupted trading

- Comfortable workspace – Ergonomic furniture supporting extended trading sessions

- Quiet environment – Minimizing distractions during analysis and trading

- Emergency power backup – UPS systems protecting against power outages

Software and platform selection:

Choosing appropriate trading platforms significantly impacts the effectiveness of forex trading strategies. Key considerations include:

- Platform reliability – Consistent uptime and stable execution

- Charting capabilities – Advanced technical analysis tools

- Order management – Sophisticated order types and risk management features

- Mobile compatibility – Seamless mobile trading capabilities

- Customer support – Responsive technical and trading support

Developing Personal Trading Plans

Successful forex trading strategies require comprehensive trading plans addressing goals, risk tolerance, and specific methodologies. American traders must develop written plans incorporating:

Goal setting and expectations:

- Realistic profit targets – Achievable monthly and annual return objectives

- Risk tolerance definition – Maximum acceptable drawdown and loss limits

- Time commitment – Hours dedicated to analysis and trading activities

- Capital allocation – Percentage of investment portfolio allocated to forex trading

Strategy selection and backtesting:

Choosing appropriate forex trading strategies requires thorough backtesting and forward testing:

- Historical performance analysis – Testing strategies on historical data

- Market condition adaptability – Strategy performance across different market environments

- Risk-adjusted returns – Evaluating strategies based on Sharpe ratios and maximum drawdown

- Implementation complexity – Matching strategy complexity to available time and resources

Performance monitoring and adjustment:

Continuous improvement is essential for maintaining effective forex trading strategies:

- Trade journaling – Detailed records of all trading decisions and outcomes

- Performance metrics tracking – Regular analysis of key performance indicators

- Strategy refinement – Ongoing optimization based on performance data

- Emotional control monitoring – Tracking psychological factors affecting trading decisions

Common Pitfalls and How to Avoid Them

Understanding common mistakes helps American traders implement more effective forex trading strategies while avoiding costly errors that derail trading careers.

Emotional trading mistakes:

- Fear of Missing Out (FOMO) – Entering trades based on emotional impulses rather than analysis

- Revenge trading – Attempting to recover losses through increasingly risky trades

- Overconfidence – Abandoning risk management after profitable periods

- Analysis paralysis – Overthinking trades and missing optimal entry opportunities

Technical implementation errors:

Common technical mistakes in forex trading strategies include:

- Overleveraging – Using excessive leverage relative to account size

- Poor timing – Entering trades without proper technical confirmation

- Inadequate risk management – Failing to implement stop-losses and position sizing

- Strategy jumping – Constantly changing strategies without adequate testing

Psychological preparation techniques:

Mental preparation is crucial for implementing disciplined forex trading strategies:

- Meditation and mindfulness – Developing emotional control and focus

- Stress management – Techniques for managing trading-related stress

- Realistic expectations – Accepting that trading involves both profits and inevitable losses as part of long-term success

- Continuous education – Ongoing learning and skill development

Risk Management Mastery for American Traders

Advanced Position Sizing Techniques

Position sizing represents the most critical aspect of successful forex trading strategies, with proper sizing often determining the difference between long-term success and failure. American traders must master sophisticated position sizing methodologies that account for volatility, correlation, and market conditions.

Volatility-adjusted position sizing:

Modern forex trading strategies incorporate volatility measurements to adjust position sizes dynamically. The Average True Range (ATR) indicator provides valuable insights into currency pair volatility, allowing traders to:

- Reduce position size during high volatility periods to maintain consistent risk levels

- Increase position size during low volatility environments when stops can be placed closer

- Adjust stop-loss distances based on current volatility measurements

- Calculate optimal entry timing when volatility conditions align with strategy requirements

Correlation-based risk management:

Understanding currency correlations is essential for implementing effective forex trading strategies that avoid overexposure to single economic factors. American traders must monitor:

- Positive correlations – Pairs moving in the same direction (EUR/USD and GBP/USD)

- Negative correlations – Currency pairs that typically move in opposite directions, such as EUR/USD and USD/JPY

- Changing correlations – How relationships evolve during market stress

- Portfolio heat – Total risk exposure across all correlated positions

Kelly Criterion application:

The Kelly Criterion provides mathematical optimization for position sizing in forex trading strategies. The formula calculates optimal position size based on:

Kelly Percentage Formula – Calculated as: ((Win Rate × Average Profit) – (Loss Rate × Average Loss)) ÷ Average Profit, used to optimize position sizing in trading

American traders can apply Kelly Criterion principles while maintaining conservative position sizes to account for model uncertainty and changing market conditions.

Hedging Strategies and Portfolio Protection

Advanced forex trading strategies often incorporate hedging techniques to protect portfolios against adverse market movements while maintaining profit potential. American traders have access to sophisticated hedging instruments through regulated brokers.

Direct hedging approaches:

- Perfect hedges – Taking opposite positions in the same currency pair

- Imperfect hedges – Using correlated pairs to offset directional risk

- Time-based hedging – Protecting positions during high-risk events

- Partial hedging – Hedging portions of positions while maintaining profit potential

Options-based protection:

Currency options provide flexible hedging for forex trading strategies requiring downside protection with unlimited upside potential:

- Protective puts – Buying put options to limit downside risk on long positions

- Covered calls – Selling call options against long positions for income generation

- Straddles and strangles – Volatility-based strategies for uncertain market direction

- Risk reversals – Combining puts and calls for cost-effective hedging

Stress Testing and Scenario Analysis

Robust forex trading strategies must withstand various market conditions, requiring comprehensive stress testing and scenario analysis. American traders should regularly evaluate strategy performance under extreme conditions.

Historical stress testing:

Testing strategies against historical market crises provides insights into potential weaknesses:

- 2008 Financial Crisis – Testing performance during liquidity crunches and flight-to-quality flows

- Swiss Franc event (2015) – Evaluating strategy resilience during sudden central bank policy changes

- COVID-19 pandemic – Evaluating trading performance amid extreme market volatility and unprecedented global disruption

- Flash crashes – Understanding strategy behavior during rapid market dislocations

Forward-looking scenario planning:

Developing scenarios for potential future events helps prepare forex trading strategies for unknown risks:

- Central bank policy divergence – Testing strategies under various monetary policy scenarios

- Geopolitical tensions – Evaluating performance during international conflicts

- Economic recessions – Understanding strategy behavior during economic downturns

- Technology disruptions – Preparing for market structure changes and algorithmic trading evolution

Performance Optimization and Continuous Improvement

Trade Analytics and Performance Measurement

Successful implementation of forex trading strategies requires comprehensive performance measurement and analysis. American traders must track key metrics to identify strengths, weaknesses, and optimization opportunities.

Essential performance metrics:

- Total return – Overall profitability over specific time periods

- Sharpe ratio – Risk-adjusted returns measuring efficiency

- Maximum Drawdown – The deepest decline in account value from a peak to a low point, showing downside risk exposure.

- Win Rate – The percentage of executed trades that result in profits.

- Average Risk-to-Reward Ratio – Compares typical gains against average losses to measure trade quality.

- Profit Factor – A performance ratio of total profits earned versus total losses incurred.

Advanced analytics techniques:

Modern forex trading strategies benefit from sophisticated analytics including:

- Monte Carlo simulations – Testing strategy robustness under various random scenarios

- Bootstrap analysis – Evaluating strategy stability through resampling techniques

- Walk-forward optimization – Testing strategies on rolling time periods

- Regime change detection – Identifying when market conditions shift and strategies may need adjustment

Trade timing analysis:

Understanding optimal trade timing improves forex trading strategies effectiveness:

- Session-based performance – Analyzing results during Asian, European, and American trading sessions

- Day-of-week effects – Identifying performance patterns across different weekdays

- Economic calendar correlation – Understanding how strategy performance relates to economic events

- Volatility regime performance – Comparing results during high and low volatility periods

Technology Integration and Automation

Modern forex trading strategies increasingly incorporate automation and artificial intelligence to improve execution and reduce emotional decision-making. American traders have access to sophisticated technological tools supporting strategy automation.

Algorithmic trading development:

Building automated forex trading strategies requires understanding of:

- Programming languages – Python, MQL4/5, or other platforms for strategy development

- Backtesting frameworks – Robust testing environments for strategy validation

- Execution algorithms – Optimizing trade execution to minimize slippage and market impact

- Risk management automation – Smart trading systems that automatically handle position sizing and stop-loss placement to minimize downside risk

Artificial intelligence applications:

AI enhances forex trading strategies through:

- Pattern recognition – Identifying complex market patterns beyond human capability

- Sentiment analysis – Processing news and social media for market sentiment insights

- Predictive modeling – Machine learning models for price prediction and timing

- Portfolio optimization – AI-driven position sizing and risk allocation

Continuous Education and Skill Development

The forex market continuously evolves, requiring ongoing education to maintain effective forex trading strategies. American traders must commit to lifelong learning and skill development.

Educational resources for forex traders:

- Academic research – Staying current with academic studies on market behavior and trading strategies

- Professional certifications – Pursuing relevant financial certifications (CFA, FRM, etc.)

- Industry conferences – Attending forex and financial trading conferences

- Online courses – Participating in specialized forex trading education programs

- Mentorship programs – Learning from experienced professional traders

Skill development areas:

Key areas for ongoing development in forex trading strategies include:

- Programming and automation – Learning to code and automate trading strategies

- Statistical analysis – Advanced statistics for strategy development and testing

- Risk Management – Advanced techniques and portfolio theory strategies designed to minimize losses and optimize returns

- Psychology and discipline – Mental skills for consistent strategy execution

- Market microstructure – Understanding how modern forex markets operate

Conclusion

The foreign exchange market in 2025 presents extraordinary opportunities for American traders who master sophisticated strategies and maintain disciplined execution. With the Federal Reserve signaling potential rate cuts and global economic dynamics creating significant currency movements, the three major pairs—EUR/USD, USD/JPY, and GBP/USD—offer compelling prospects for skilled participants. Success requires combining technical analysis with fundamental insight, implementing robust risk controls, and adapting approaches to evolving conditions. The integration of advanced technology and professional platforms provides unprecedented tools for precise, data-driven decision-making.

Effective risk management remains the cornerstone of long-term profitability, as position sizing, stop-loss placement, and diversification often determine outcomes more than any single trading technique. US traders benefit from strong regulatory oversight, reliable infrastructure, and access to educational resources that support disciplined practices. Equally important are psychological factors—emotional control, patience, and systematic execution—that reinforce consistent performance and prevent impulsive decisions during volatile periods.

Looking ahead, continuous learning and technological innovation will shape successful trading for years to come. American market participants possess unique advantages through regulatory protection and technological access that, when combined with proven methods and disciplined risk management, create a solid foundation for enduring success. Rather than chasing perfect predictions, the key lies in executing well-tested approaches consistently, staying adaptable, and continually refining one’s process.

Frequently Asked Questions About Forex Trading Strategies

1. What are the most effective forex trading strategies for beginners in 2025?

Beginners should use straightforward, rule-based approaches—trend following with moving averages, range trading between clear support/resistance, and long-term position trading—while never risking more than 1–2% per trade and focusing on highly liquid majors (EUR/USD, USD/JPY, GBP/USD).

2. How much capital is required to start forex trading effectively in the USA?

Effective U.S. forex trading typically requires at least $2,500–$5,000 to accommodate position sizing and U.S. leverage limits (50:1 majors, 20:1 minors), though professionals often recommend starting with $10,000 to balance risk management and growth potential.

3. Which currency pairs are best for American forex traders in 2025?

American traders benefit from focusing on currency pairs that offer optimal trading conditions and align with US market hours. The best pairs include:

Major Pairs (USD-based):

- EUR/USD – Highest liquidity, tightest spreads, predictable price action

- USD/JPY – Excellent for carry trades, responds well to US yield changes

- GBP/USD – High volatility providing numerous trading opportunities

- USD/CHF – Safe-haven characteristics useful during market stress

- USD/CAD – Strong correlation with oil prices and North American economics

Cross Pairs (Non-USD):

- EUR/JPY – Excellent volatility for swing trading strategies

- GBP/JPY – High volatility suitable for experienced traders

- EUR/GBP – Less USD correlation, good for diversification

The key is choosing pairs that match individual trading styles and available trading hours, with major USD pairs typically offering the best conditions for implementing various forex trading strategies.

4. How do Federal Reserve decisions impact forex trading strategies?

Fed policy drives dollar strength or weakness: rate hikes boost USD, cuts weaken it; forward guidance, QE/QT programs, and interpretation of employment, inflation, and GDP releases all inform positioning and timing in forex strategies.

5. What risk management techniques are essential for forex trading success?

Core risk controls include: position sizing at 1–2% of equity per trade, mandatory stop-loss orders with ≥1:2 risk-reward ratios, portfolio diversification across uncorrelated pairs, drawdown limits (10–20%), and monitoring correlations to avoid concentrated exposure.

6. How can American traders identify the best entry and exit points?

Optimal entries/exits combine technical triggers (moving average crossovers, breakouts, RSI/MACD signals, candlestick patterns) with fundamental confirmations (economic data, central bank statements, rate differentials, geopolitical events), plus profit targets, trailing stops, and time-based exits.

7. What role does economic calendar analysis play in forex trading strategies?

Tracking high-impact events (Non-Farm Payrolls, Fed/ECB/BoJ meetings, GDP, CPI, central bank speeches) is essential: traders position ahead of consensus, exploit volatility spikes for news trading, and adjust size or avoid markets during major releases.

8. How important is backtesting for forex trading strategy development?

Backtesting validates strategies by testing on extensive historical data, calculating risk metrics, optimizing parameters, and assessing performance across market regimes. Best practices include out-of-sample testing, walk-forward analysis, realistic cost/slippage assumptions, and multi-timeframe validation to prevent curve fitting.

9. What psychological factors most impact forex trading success?

Emotional factors (FOMO, revenge trading, overconfidence, analysis paralysis, loss aversion) heavily influence results. Techniques like mindfulness, visualization, stress management, realistic goal setting, and strict plan adherence foster discipline and minimize psychological errors.

10. How can American traders optimize their trading schedules around market sessions?

Trade smarter with session strategies – Adapt to Asian range setups, European breakouts, U.S. volatility trades, and overlap periods for high liquidity. Part-timers can focus on specific sessions, while full-timers may employ strategies across all periods.

11. What are the most common mistakes most forex traders make and how to avoid them?

Understanding common mistakes helps American traders implement more effective forex trading strategies while avoiding costly errors:

Trading Mistakes:

- Overleveraging – Using excessive position sizes relative to account equity

- No Trading Plan – Entering the market without clear rules, goals, or a structured strategy.

- Weak Risk Management – Misusing stop-losses and poor position sizing that expose traders to excessive losses.

- Strategy Hopping – Frequently switching methods without proper testing or long-term evaluation.

- Emotional Trading – Allowing fear, greed, or frustration to drive decisions instead of logic and data

Technical Errors:

- Ignoring correlations – Taking multiple correlated positions increasing risk

- Inadequate analysis – Entering trades without sufficient technical/fundamental confirmation

- Poor timing – Trading against trends or during low-liquidity periods

- News trading mistakes – Trading immediately around high-impact news without experience

Prevention Strategies:

- Education and preparation – Thoroughly learning forex trading strategies before implementation

- Demo trading – Practicing strategies without financial risk

- Gradual scaling – Starting with small positions and gradually increasing size

- Performance tracking – Maintaining detailed records for continuous improvement

- Professional development – Ongoing education and skill enhancement

Success in forex trading requires acknowledging that losses are inevitable while focusing on consistent execution of proven forex trading strategies.

12. How can traders adapt their forex strategies to changing market conditions?

Market conditions constantly evolve, requiring adaptive forex trading strategies that perform across different environments:

Market Regime Identification:

- Trending markets – Sustained directional movements favoring trend-following strategies

- Range-bound markets – Sideways price action suitable for range trading approaches

- Volatile markets – High volatility periods offering breakout opportunities

- Quiet markets – Low volatility environments requiring different risk management

Adaptive Strategy Techniques:

- Multi-strategy portfolios – Diversify performance by blending methods like trend-following, mean reversion, and breakout trading styles.

- Dynamic position sizing – Adapt trade sizes according to volatility levels and changing market conditions for improved risk control

- Strategy rotation – Emphasizing different approaches based on market regime

- Parameter optimization – Adjusting indicator settings for current conditions

Market Monitoring Systems:

Successful forex trading strategies incorporate systematic market condition assessment through volatility measurements, trend strength indicators, correlation analysis, and volume patterns.

Professional traders maintain flexibility while adhering to core risk management principles, adapting tactics rather than abandoning proven strategic frameworks. This requires ongoing market analysis, strategy performance monitoring, and willingness to modify approaches based on changing conditions.

Citations

- https://www.goldmansachs.com/insights/articles/why-the-fed-may-cut-rates-earlier-than-expected

- https://www.morningstar.com/markets/when-will-fed-start-cutting-interest-rates

- https://www.ecb.europa.eu/press/projections/html/ecb.projections202506_eurosystemstaff~16a68fbaf4.en.html

- https://journaljamcs.com/index.php/JAMCS/article/view/2028

- https://www.ebc.com/forex/most-profitable-forex-major-pairs-full-ranking

- https://www.fxstreet.com/currencies/usdjpy

- https://tradersunion.com/currencies/forecast/usd-jpy/long-term-forecast/

- https://naga.com/news-and-analysis/articles/british-pound-gbp-price-prediction

- https://www.quantifiedstrategies.com/forex-trading-strategies/

- https://virtusinterpress.org/IMG/pdf/jgrv11i1art9.pdf

- https://www.youtube.com/watch?v=Zk0E0tjc32o

- https://home.treasury.gov/system/files/136/June-2025-FX-Report.pdf

- https://quadcode.com/blog/top-15-most-popular-trading-strategies

- https://www.markets.com/education-centre/forex-market-analysis-yen-gains-usd-jpy-eur-jpy-gbp-jpy

- https://admiralmarkets.com/education/articles/forex-strategy/best-forex-trading-strategies-that-work

- https://www.youtube.com/watch?v=qS-2XGjaXUo

- https://www.fxstreet.com/analysis/trading-strategies-during-summer-eur-usd-eur-jpy-nzd-jpy-202508111444

- https://www.calpnetwork.org/wp-content/uploads/2025/08/mheu.pdf

- https://www.youtube.com/watch?v=G8Hp-lR7PBg

- https://acy.com/en/market-news/education/thumbnail-market-education-top-forex-pairs-after-big-5-j-o-20250807-094726/

- https://hmarkets.com/blog/5-best-trading-strategies-for-every-trader/

- https://www.investopedia.com/articles/forex/11/why-trade-forex.asp

- https://acy.com/en/market-news/education/8-steps-start-forex-day-trading-2025-03042025-085032/

- https://www.myfxbook.com/forex-market/correlation/USDJPY

- https://www.calpnetwork.org/wp-content/uploads/2025/09/y2oqw.pdf

- https://www.sciencedirect.com/science/article/pii/S1057521924002758/pdf

- https://sureshotfx.com/forex-trading-for-beginners/

- https://www.investopedia.com/top-6-most-tradable-currency-pairs-4773389

- https://www.youtube.com/watch?v=nk6r9whUJfA

- https://www.fxstreet.com/currencies/eurusd

- https://naga.com/en/news-and-analysis/articles/eurusd-price-prediction

- https://www.ebc.com/forex/gbp-to-usd-forecast-predictions-for–and-beyond

- https://capital.com/en-int/analysis/euro-forecast

- https://coincodex.com/forex/usd-jpy/forecast/

- https://www.sc.com/bw/market-outlook/global-market-outlook-20-6-2025

- https://in.tradingview.com/symbols/USDJPY/technicals/

- https://acy.com/en/market-news/market-analysis/market-analysis-gbpusd-forecast-post-cpi-fvg-breakout-2025-08-14-133153/

- https://tradingeconomics.com/euro-area/currency

- https://in.investing.com/currencies/usd-jpy-technical

- https://www.cnbc.com/2025/06/25/gbp-is-there-room-for-sterling-to-make-gains-against-the-dollar.html

- https://www.dukascopy.com/swiss/french/marketwatch/articles/euro-to-dollar-forecast/

- https://in.tradingview.com/symbols/USDJPY/

- https://www.argentex.com/resources/fundamental-drivers-for-gbp-usd-and-eur-in-2025/

- https://j2t.com/solutions/blogview/usdjpy-forecast/

- https://www.reuters.com/business/fed-rate-cuts-doubts-over-independence-keep-us-dollar-under-pressure-2025-09-03/

- https://www.oanda.com/us-en/trade-tap-blog/trading-knowledge/forex-traders-successful-habits/

- https://www.tastyfx.com/learn/how-to-trade-forex/

- https://www.calpnetwork.org/wp-content/uploads/2025/09/ua1u.pdf

- https://www.angelone.in/knowledge-center/online-share-trading/here-are-some-good-forex-trading-strategies

- https://www.calpnetwork.org/wp-content/uploads/2025/09/u3qi.pdf

- https://www.investopedia.com/articles/forex/08/successful-trader-traits.asp

- https://www.xs.com/en/blog/forex-risk-management/

- https://www.federalreserve.gov/monetarypolicy/fomcminutes20250730.htm

- https://www.sharekhan.com/financial-blog/blogs/best-forex-trading-strategies-and-techniques

- https://www.federalreserve.gov/releases/h15/

- https://www.investopedia.com/articles/investing/010616/impact-fed-interest-rate-hike.asp

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4979859

- https://www.abacademies.org/articles/performance-evaluation-of-a-forex-system-marketing-prospects-analysis-14259.html

- https://www.longdom.org/stock-forex-trading.html

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3995011

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5276088

- https://sist.sathyabama.ac.in/sist_naac/aqar_2022_2023/documents/1.3.4/mba-mba-batch%20no-248.pdf

- https://www.sciencedirect.com/science/article/abs/pii/S0378426613002549

- https://www.sciencedirect.com/science/article/pii/S2666827025000313

- https://www.iibf.org.in/documents/IIBF-Study-Final-03.06.18%20.pdf

- https://www.sciencedirect.com/science/article/pii/S1057521924003582

- https://www.calpnetwork.org/wp-content/uploads/2025/09/w8wav.pdf

- http://www.diva-portal.org/smash/get/diva2:230702/FULLTEXT01.pdf

- https://www.calpnetwork.org/wp-content/uploads/2025/08/y7vkt.pdf

- https://gscen.shikshamandal.org/wp-content/uploads/2024/07/51-Ruchita-Nandagawli.pdf

- https://www.sciencedirect.com/science/article/abs/pii/S0165011425001101

- https://www.sciencedirect.com/science/article/pii/S1057521924000838

- https://www.nature.com/articles/s41599-025-04605-5

- https://www.accaglobal.com/in/en/student/exam-support-resources/fundamentals-exams-study-resources/f9/technical-articles/forex.html