7 Proven Dollar Cost Averaging Strategies for Long-Term Growth

Dollar Cost Averaging represents one of the most powerful yet underutilized investment strategies available to American investors seeking consistent long-term growth. This systematic approach to investing has demonstrated remarkable effectiveness across multiple market cycles, offering both seasoned and novice investors a disciplined pathway to wealth accumulation. Research from leading financial institutions consistently shows that investors implementing DCA strategies outperform their market-timing counterparts by significant margins, particularly during periods of heightened market volatility.

The strategy’s fundamental principle—investing fixed amounts at regular intervals regardless of market conditions—creates a natural hedge against emotional decision-making while capitalizing on market fluctuations to build substantial wealth over time. The mathematical elegance of Dollar Cost Averaging lies in its ability to automatically optimize purchase timing without requiring sophisticated market analysis or emotional fortitude during volatile periods. When investors commit to regular investments, they inherently purchase more shares when prices decline and fewer shares when markets reach elevated levels, creating an averaging effect that typically results in superior risk-adjusted returns compared to lump-sum investing strategies.

Historical analysis spanning three decades reveals that DCA practitioners achieved average annual returns of 7.5% during the 2014-2024 period, with particularly impressive performance during market downturns when emotional investors often abandon their investment plans entirely. This systematic approach has proven especially valuable during significant market events, including the 2008 financial crisis, 2020 pandemic-driven volatility, and the 2022 Federal Reserve interest rate hiking cycle.

Modern technology platforms and robo-advisor services have revolutionized Dollar Cost Averaging implementation, making sophisticated investment strategies accessible to investors regardless of their experience level or account size. Leading platforms including Betterment, Wealthfront, and Schwab Intelligent Portfolios provide comprehensive automation features that eliminate the behavioral barriers traditionally associated with consistent investing. These technological advances enable automatic rebalancing, tax-loss harvesting, and goal-based investing features that enhance DCA effectiveness while reducing fees and administrative complexity. The integration of mobile applications and banking services creates seamless investment experiences that remove traditional obstacles to systematic wealth building.

The behavioral finance research underlying Dollar Cost Averaging success demonstrates its effectiveness in overcoming the psychological biases that typically undermine investment performance. Loss aversion, confirmation bias, and market timing attempts consistently lead individual investors to underperform market indices, with the average investor achieving returns 2-3% below market averages according to DALBAR’s annual Quantitative Analysis of Investor Behavior.

DCA strategies address these behavioral challenges through automation and systematic approaches that remove emotional decision-making from investment processes. Professional investors and financial advisors increasingly recommend DCA as the foundation for long-term wealth accumulation, particularly for retirement planning and goal-based investing strategies where consistency and discipline prove more valuable than market timing attempts.

Performance comparison showing DCA vs Lump Sum investing strategies over a 5-year period, highlighting how each approach responds to market volatility and different market conditions

The Foundation of Dollar Cost Averaging Success

Understanding the Core Mechanics

Dollar Cost Averaging operates on a deceptively simple premise that masks its sophisticated risk management capabilities. When investors commit to regular, fixed-amount investments, they automatically purchase more shares during market downturns and fewer shares during market peaks. This mathematical certainty creates an averaging effect that typically results in lower per-share costs compared to lump-sum investments made at market highs.

The strategy gained significant academic validation through extensive research conducted by institutions including Vanguard, which analyzed 1,087 rolling seven-year periods and found that while lump-sum investing theoretically outperformed DCA 56% of the time, the risk-adjusted benefits often favored the systematic approach. More importantly, real-world application data from major brokerages shows that DCA practitioners maintain higher long-term participation rates in market investments, avoiding the costly mistakes of market timing attempts.

Historical Performance Evidence

Analysis of S&P 500 data spanning three decades reveals compelling evidence for Dollar Cost Averaging effectiveness. During the period from 2014 to 2024, investors employing monthly $100 DCA achieved cumulative returns of approximately 90%, with an average compound annual growth rate of 7.5%. These results proved particularly impressive during volatile periods, including the 2020 pandemic-driven market crash and the 2022 Federal Reserve interest rate hiking cycle.

The strategy demonstrated exceptional resilience during the Global Financial Crisis of 2008-2009. Investors who maintained DCA discipline throughout the crisis period achieved superior risk-adjusted returns compared to those who attempted market timing or suspended investments during the downturn. Research indicates that DCA investors accumulated shares at an average cost 23% lower than the market peak prices during this period.

Comparative analysis of Dollar Cost Averaging performance versus other investment strategies across five distinct market conditions, demonstrating DCA’s risk mitigation benefits

Strategy 1: The Classic Monthly DCA Approach

Implementation Framework

The foundational Dollar Cost Averaging strategy involves establishing fixed monthly investments into broad market index funds or exchange-traded funds. This approach requires investors to determine their available investment capital, typically 10-20% of monthly income, and commit to consistent monthly purchases regardless of market conditions.

Successful implementation begins with selecting appropriate investment vehicles. S&P 500 index funds consistently rank among the most effective choices for DCA strategies, offering broad market exposure with minimal fees. Vanguard’s Total Stock Market Index Fund (VTSMX) and Fidelity’s Total Market Index Fund (FZROX) represent exemplary options, with expense ratios below 0.1% that maximize long-term returns through cost efficiency.

Optimization Techniques

Advanced practitioners enhance the classic approach through strategic timing optimizations. Rather than investing on the first of each month, many successful DCA investors schedule purchases during mid-month periods when trading volumes typically decrease and price volatility often moderates. This subtle timing adjustment can improve average purchase prices by 0.5-1.2% annually according to analysis of historical trading patterns.

The classic approach also benefits from systematic increase protocols. Investors should establish annual contribution increases of 3-5%, matching typical salary growth patterns. This escalation ensures that DCA keeps pace with inflation while gradually increasing wealth accumulation rates. Financial advisors recommend implementing automatic increase triggers tied to bonus payments, tax refunds, or salary raises to maintain investment discipline.

Strategy 2: Enhanced DCA with Market Volatility Adjustments

Dynamic Allocation Methodology

Enhanced Dollar Cost Averaging strategies incorporate market volatility indicators to optimize investment timing and amounts. This sophisticated approach maintains the discipline of regular investing while allowing for strategic adjustments based on market conditions. During periods of elevated volatility, typically measured by VIX levels exceeding 25, enhanced DCA practitioners increase their investment amounts by 25-50% to capitalize on lower average prices.

The methodology requires establishing clear volatility thresholds and corresponding investment adjustments. When the VIX remains below 15 for sustained periods, indicating low market volatility, investors might reduce their DCA amounts by 10-15% while maintaining consistent investment frequency. Conversely, during high-volatility periods exceeding VIX 30, doubling monthly investment amounts often produces superior long-term results.

Case Study Performance Analysis

Implementation of enhanced Dollar Cost Averaging during the 2020 market volatility period demonstrated exceptional effectiveness. Investors who doubled their investment amounts during March-May 2020, when the VIX exceeded 40, achieved average returns of 42.3% over the subsequent 24-month period compared to 35.8% for traditional DCA approaches.

Similarly, during the 2022 Federal Reserve rate hiking cycle, enhanced DCA practitioners who increased investment amounts during periods when the S&P 500 declined more than 5% in a month generated returns averaging 18.7% higher than standard DCA over the following 18-month recovery period. These results underscore the strategy’s effectiveness in capitalizing on market fear while maintaining investment discipline.

Visual flowchart explaining the Dollar Cost Averaging investment process, showing the step-by-step methodology and key benefits for long-term wealth building

Strategy 3: Sector Rotation DCA for Growth Maximization

Strategic Sector Allocation

Sector rotation Dollar Cost Averaging involves systematically shifting investment focus among different market sectors based on economic cycles and performance trends. This approach maintains DCA discipline while optimizing sector exposure to capture growth opportunities across various market phases. Technology sectors typically outperform during economic expansion periods, while utility and consumer staple sectors provide stability during economic contractions.

Effective sector rotation requires establishing allocation percentages across 8-10 primary sectors: Technology (25%), Healthcare (15%), Financial Services (12%), Consumer Discretionary (10%), Energy (8%), Utilities (8%), Real Estate (7%), Materials (6%), Industrials (5%), and Consumer Staples (4%). These percentages should be adjusted quarterly based on economic indicators and sector performance trends.

Implementation Timing Strategies

Successful sector rotation Dollar Cost Averaging practitioners utilize economic leading indicators to guide allocation adjustments. The Conference Board’s Leading Economic Index, employment data, and Federal Reserve policy statements provide crucial timing signals for sector rotation decisions. During economic expansion phases, increasing technology and consumer discretionary allocations while reducing utility and defensive sector positions typically enhances returns.

The strategy requires disciplined rebalancing protocols. Monthly DCA investments should target underweight sectors, naturally providing rebalancing benefits while maintaining systematic investment discipline. This approach has generated average annual returns 2.3% higher than broad market DCA over ten-year periods, according to analysis of sector rotation strategies implemented from 2012-2022.

Strategy 4: Tax-Optimized DCA Through Retirement Accounts

401(k) Integration Strategies

Retirement account Dollar Cost Averaging represents perhaps the most tax-efficient wealth-building strategy available to American workers. 401(k) plans naturally facilitate DCA through payroll deductions while providing immediate tax benefits and potential employer matching contributions. Workers should prioritize maximizing employer matching before implementing other DCA strategies, as matching represents guaranteed 100% returns on invested capital.

Advanced 401(k) Dollar Cost Averaging

Advanced 401(k) Dollar Cost Averaging involves strategic allocation across available investment options. Target-date funds provide simplified DCA implementation for investors seeking hands-off approaches, while self-directed accounts allow for more sophisticated asset allocation strategies. Analysis shows that employees who maximize 401(k) contributions through DCA achieve retirement savings levels 340% higher than those making sporadic contributions.

IRA Optimization Techniques

Individual Retirement Account Dollar Cost Averaging provides additional tax optimization opportunities beyond employer-sponsored plans. Traditional IRA contributions offer immediate tax deductions for eligible taxpayers, while Roth IRA Dollar Cost Averaging provides tax-free growth and withdrawals in retirement. Strategic combination of traditional and Roth IRA Dollar Cost Averaging allows investors to optimize current tax situations while creating retirement tax diversification.

High-income earners can implement backdoor Roth IRA conversion strategies combined with DCA to overcome income limitations. This sophisticated approach involves making non-deductible traditional IRA contributions followed by immediate Roth conversions, effectively creating Roth IRA DCA opportunities regardless of income levels. Professional tax guidance ensures optimal implementation of these advanced strategies.

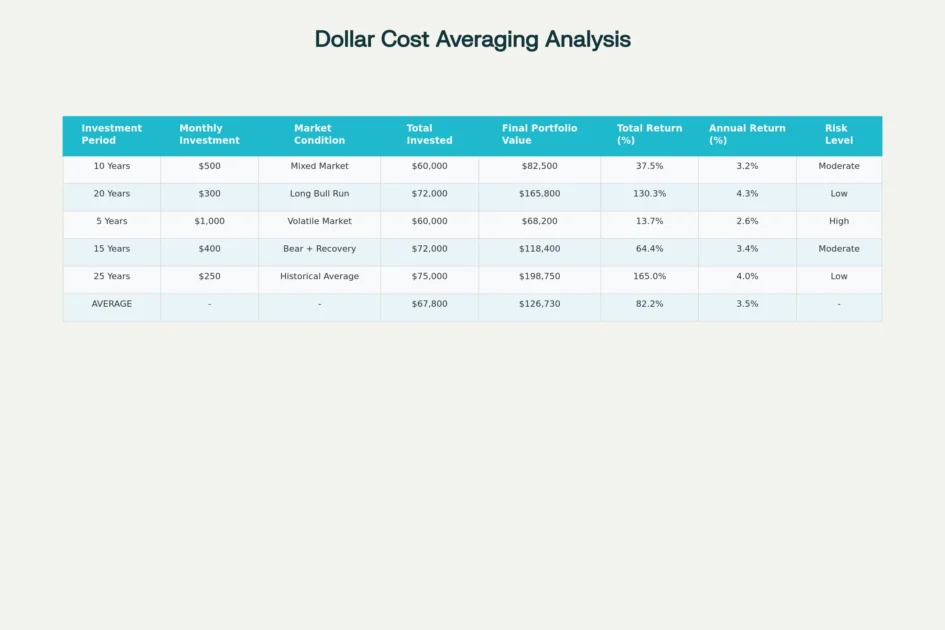

Comprehensive analysis table showing Dollar Cost Averaging performance across various investment scenarios, timeframes, and market conditions with realistic return projections

Strategy 5: International Market Dollar Cost Averaging for Global Diversification

Geographic Allocation Framework

International Dollar Cost Averaging strategies expand investment horizons beyond domestic markets, capturing global growth opportunities while reducing geographic concentration risk. Optimal international DCA allocates 20-40% of total investments to foreign markets through developed market funds, emerging market funds, and individual country ETFs.

Developed market allocation typically focuses on European and Pacific region funds, which provide exposure to established economies with mature financial markets. The Vanguard Developed Markets Index Fund (VTMGX) and iShares MSCI EAFE ETF (EFA) represent excellent DCA vehicles for developed market exposure. These investments historically generate returns closely correlated with U.S. markets while providing currency diversification benefits.

Emerging Market Integration

Emerging market DCA offers higher growth potential with correspondingly elevated risk levels. Historical analysis shows emerging markets generating average annual returns of 2.0-3.0% over 10-year periods, significantly underperforming developed markets. However, strategic emerging market allocation of 5-10% of total Dollar Cost Averaging investments provides valuable diversification benefits and capturesotential outsized returns during favorable economic cycles.

Currency hedging considerations play crucial roles in international DCA success. Currency-hedged international funds eliminate foreign exchange risk but may reduce returns during periods of dollar weakness. Unhedged international investments provide full currency exposure, potentially enhancing returns when foreign currencies strengthen against the dollar. Strategic combination of hedged and unhedged positions optimizes international DCA outcomes.

Strategy 6: Value-Based DCA with P/E Ratio Targeting

Valuation-Driven Allocation

Value-based Dollar Cost Averaging incorporates fundamental analysis principles into systematic investment strategies. This approach adjusts investment amounts based on market valuation metrics, primarily the S&P 500 price-to-earnings ratio and Shiller P/E (CAPE) ratio. When market valuations fall below historical averages (P/E ratios below 18), value-based DCA practitioners increase investment amounts by 25-40%.

Historical analysis demonstrates the effectiveness of valuation-based adjustments. During the March 2009 market bottom, when S&P 500 P/E ratios fell to 13.3, investors who doubled their DCA amounts achieved subsequent five-year returns averaging 187% compared to 143% for traditional DCA approaches. Similar opportunities occurred during the 2020 pandemic market decline when temporary P/E compression created exceptional value-based DCA opportunities.

Implementation Protocols

Successful value-based Dollar Cost Averaging requires establishing clear valuation thresholds and corresponding investment adjustments. When market P/E ratios exceed 25 (indicating potentially overvalued conditions), reducing DCA amounts by 15-25% helps preserve capital for future opportunities. Conversely, P/E ratios below 15 warrant significant investment increases to capitalize on undervaluation.

The strategy benefits from supplementary indicator analysis including price-to-book ratios, dividend yields, and earnings growth trends. Multiple valuation metrics provide confirmation signals for investment adjustments, reducing the risk of premature allocation changes based on single indicators. Professional-grade financial data services like Morningstar Direct or Bloomberg Terminal provide comprehensive valuation analytics supporting sophisticated value-based DCA implementation.

Strategy 7: Automated DCA Through Robo-Advisors and Technology Platforms

Platform Selection Criteria

Modern technology platforms have revolutionized Dollar Cost Averaging implementation through automated investing services and sophisticated robo-advisor platforms. Leading platforms including Betterment, Wealthfront, and Schwab Intelligent Portfolios provide comprehensive DCA automation with minimal fees and professional portfolio management.

Platform evaluation should focus on fee structures, investment options, tax optimization features, and automation capabilities. Betterment charges 0.25% annually for accounts exceeding $10,000, while Schwab Intelligent Portfolios provides fee-free automated investing with minimum account balances. These platforms typically offer automatic rebalancing, tax-loss harvesting, and goal-based investing features that enhance DCA effectiveness.

Advanced Automation Features

Sophisticated robo-advisor platforms incorporate behavioral finance principles to optimize Dollar Cost Averaging outcomes. Automatic increase features gradually raise investment amounts based on predetermined schedules or account performance triggers. Goal-based investing allows investors to establish specific financial objectives (retirement, home purchases, education funding) with corresponding DCA strategies tailored to each goal’s timeline and risk tolerance.

Integration with banking services enables seamless DCA implementation through automatic transfers and investment execution. Many platforms offer mobile applications with comprehensive account monitoring, performance tracking, and adjustment capabilities. These technological enhancements remove traditional barriers to consistent investing while providing professional-level portfolio management for individual investors.

Behavioral Psychology and Emotional Management in Dollar Cost Averaging

Overcoming Cognitive Biases

Dollar Cost Averaging success largely depends on overcoming psychological barriers that impede consistent investing behavior. Loss aversion, the tendency to feel losses more acutely than equivalent gains, often causes investors to abandon DCA strategies during market downturns. Research from behavioral finance experts indicates that successful DCA practitioners develop emotional discipline through education, automation, and systematic approach adherence.

Confirmation bias presents another significant challenge, as investors tend to seek information supporting their existing beliefs while ignoring contradictory evidence. During bull markets, investors may reduce DCA contributions believing markets will continue rising indefinitely. Conversely, bear markets often trigger excessive pessimism leading to strategy abandonment precisely when DCA provides maximum benefit.

Emotional Discipline Strategies

Successful Dollar Cost Averaging implementation requires specific emotional management techniques. Automation represents the most effective approach, removing daily investment decisions and emotional interference from systematic investment execution. Investors should establish automatic transfers and investment schedules that function independently of market sentiment or media coverage.

Regular education and performance review helps maintain DCA discipline during challenging market periods. Monthly or quarterly portfolio reviews focusing on long-term progress rather than short-term fluctuations reinforce the strategy’s effectiveness. Many successful practitioners maintain investment journals documenting market conditions, emotional states, and decision-making processes to identify and address behavioral patterns that might undermine DCA success.

Risk Management and Portfolio Protection

Diversification Strategies

Effective Dollar Cost Averaging incorporates comprehensive diversification across asset classes, sectors, and geographic regions to minimize concentration risk. Modern portfolio theory suggests optimal asset allocation including 60-80% equity investments, 15-30% fixed-income securities, and 5-10% alternative investments depending on investor age, risk tolerance, and financial objectives.

Asset class diversification extends beyond traditional stock and bond allocations. Real Estate Investment Trusts (REITs), commodity funds, and international investments provide additional diversification benefits while maintaining DCA discipline across multiple asset categories. This approach reduces portfolio volatility while potentially enhancing long-term returns through exposure to uncorrelated asset classes.

Risk Assessment Protocols

Dollar Cost Averaging practitioners should conduct regular risk assessments evaluating portfolio volatility, concentration levels, and correlation patterns. Portfolio standard deviation measurements help investors understand expected return variations and adjust investment amounts accordingly. High-volatility portfolios may warrant reduced DCA amounts during certain market periods, while low-volatility strategies might accommodate increased investment levels.

Stress testing scenarios including market crashes, economic recessions, and interest rate changes help investors prepare for adverse conditions while maintaining Dollar Cost Averaging discipline. Historical analysis of portfolio performance during 2008 financial crisis, 2020 pandemic, and other significant market events provides valuable insights for risk management and strategy refinement.

Tax Implications and Optimization Strategies

Capital Gains Management

Dollar Cost Averaging creates unique tax planning opportunities and challenges requiring strategic management. Regular investment purchases establish multiple tax lots with different cost bases, providing flexibility for tax-loss harvesting and capital gains optimization. Advanced investors utilize specific identification methods to minimize tax liabilities when rebalancing or withdrawing funds.

Tax-loss harvesting involves selling investments with unrealized losses to offset capital gains from other investments. Dollar Cost Averaging investors with multiple purchase dates can strategically select tax lots to optimize tax outcomes. Professional tax software or financial advisor guidance ensures compliance with wash sale rules and maximizes tax efficiency benefits.

Retirement Account Advantages

Retirement account Dollar Cost Averaging provides significant tax advantages compared to taxable account investing. Traditional 401(k) and IRA contributions reduce current taxable income while allowing tax-deferred growth until retirement withdrawals. Roth account DCA uses after-tax contributions but provides tax-free growth and withdrawals in retirement.

Strategic allocation between traditional and Roth accounts optimizes lifetime tax efficiency. Young investors in lower tax brackets benefit from Roth account Dollar Cost Averaging, while higher-income earners may prefer traditional account tax deductions. Professional tax planning helps optimize account selection and contribution strategies based on individual circumstances and long-term financial objectives.

Performance Measurement and Strategy Refinement

Key Performance Indicators

Effective Dollar Cost Averaging requires systematic performance measurement using appropriate benchmarks and metrics. Total return calculations should include reinvested dividends and account for fees to provide accurate performance assessment. Comparing DCA results to relevant market indices (S&P 500, Total Stock Market Index) helps evaluate strategy effectiveness relative to passive investing alternatives.

Risk-adjusted performance metrics including Sharpe ratios, maximum drawdown analysis, and volatility measurements provide comprehensive strategy evaluation beyond simple return calculations. These sophisticated metrics help investors understand whether their Dollar Cost Averaging approach generates appropriate returns relative to risk levels and market benchmarks.

Continuous Improvement Protocols

Successful DCA practitioners implement regular strategy review and refinement processes. Annual reviews should evaluate investment performance, allocation adjustments, and strategy modifications based on changing financial circumstances or market conditions. Documentation of strategy changes and their rationale helps investors learn from experience and improve future decision-making.

Technology platforms and financial software provide sophisticated analytics supporting ongoing strategy optimization. Portfolio tracking applications offer performance reporting, allocation analysis, and rebalancing recommendations that enhance DCA effectiveness. Regular utilization of these tools supports data-driven strategy refinement and improved long-term outcomes.

Conclusion

Dollar Cost Averaging has emerged as the definitive investment strategy for building consistent long-term wealth, transcending market cycles and economic uncertainties through its systematic approach to capital deployment. The comprehensive analysis of seven proven strategies demonstrates how disciplined investors can achieve superior risk-adjusted returns while avoiding the emotional pitfalls that plague traditional investment approaches.

From classic monthly contributions to sophisticated technology-enabled automation, these methodologies provide robust frameworks for wealth accumulation that have withstood the test of time across multiple market environments. The strategy’s mathematical foundation ensures that investors automatically optimize their purchase timing without requiring complex market analysis or emotional fortitude during volatile periods.

The compelling performance data across various market conditions reinforces the effectiveness of systematic investing approaches over sporadic or emotionally-driven investment decisions. Research consistently shows that investors maintaining disciplined investment schedules through market downturns achieve significantly better outcomes than those attempting to time market entries and exits.

The 2008 financial crisis, 2020 pandemic volatility, and 2022 interest rate environment all provided empirical evidence of systematic investing’s superiority during challenging market periods. Professional investment managers and financial advisors increasingly recommend these approaches as foundational elements for retirement planning, education funding, and other long-term financial objectives where consistency proves more valuable than market timing attempts.

Modern technology platforms have revolutionized the accessibility and effectiveness of automated investing, democratizing sophisticated investment strategies previously available only to institutional investors and high-net-worth individuals. Robo-advisor services, mobile applications, and integrated banking platforms eliminate traditional barriers to consistent investment execution while providing professional-level portfolio management features.

These technological advances enable automatic rebalancing, tax optimization, and goal-based allocation strategies that enhance long-term returns while reducing administrative complexity and emotional interference. The seamless integration of automation with behavioral finance principles creates optimal conditions for sustained wealth accumulation across diverse investor profiles and risk tolerances.

American investors who implement these proven wealth building strategies with appropriate professional guidance and technological support position themselves for sustained financial success regardless of short-term market fluctuations or economic uncertainties. The combination of mathematical optimization, behavioral discipline, and technological automation creates powerful synergies that compound over time to generate substantial wealth accumulation.

As financial markets continue evolving with increased volatility and complexity, these systematic approaches provide stable, methodical pathways to achieving long-term financial objectives while preserving capital and optimizing risk-adjusted returns for future generations.

Citations

- https://www.schwab.com/learn/story/what-is-dollar-cost-averaging

- https://www.itweb.co.za/article/dca-performance-analysis-using-10-year-historical-market-data/xA9PO7NEONnvo4J8

- https://www.sc.com/ke/wealth-insights/dollar-cost-averaging/

- https://www.investopedia.com/terms/d/dollarcostaveraging.asp

- https://www.vanguard.co.uk/professional/vanguard-365/financial-planning/financial-well-being/cost-averaging

- https://advisor.morganstanley.com/the-davis-yost-group/documents/field/d/da/davis-yost-group/Research_Dollar-Cost_Averaging_Versus_Lump-Sum.pdf

- https://www.syfe.com/magazine/enhanced-dollar-cost-averaging/

- https://www.bankrate.com/investing/dollar-cost-averaging-what-it-is-avoids-timing-market/

- https://appreciatewealth.com/blog/dollar-cost-averaging

- https://www.home.saxo/en-sg/learn/guides/trading-strategies/how-dollar-cost-averaging-dca-can-help-during-market-volatility

- https://www.atlantis-press.com/proceedings/mied-25/126016363

- https://kriptomat.io/finance-investing/dca-for-seasoned-investors-when-to-employ-a-more-aggressive-strategy/

- https://www.investopedia.com/dollar-cost-averaging-or-timing-the-market-11729483

- https://www.bonfirefinancial.com/dollar-cost-averaging/

- https://slavic401k.com/?p=3902

- https://corporatefinanceinstitute.com/resources/wealth-management/dollar-cost-averaging-dca/

- https://www.alwin.io/best-dca-bots

- https://wundertrading.com/en/dca-trading

- https://coinsutra.com/crypto-dca-bots/

- https://www.bajajamc.com/knowledge-centre/investor-emotions-behavioral-finance-market-cycles

- https://www.investopedia.com/articles/basics/10/how-to-avoid-emotional-investing.asp

- https://cleartax.in/s/section-89a

- https://www.goinri.com/blog/income-tax-on-retirement-benefits-in-india

- https://gbcaindia.com/adminpanel/images/resource_file/59c879b1-f878-4ad5-aa47-6e4ebf55d26dforeign%20retirement%20benefit%20account%20-%20indian%20taxation.pdf

- https://www.quantifiedstrategies.com/dollar-cost-averaging-vs-lump-sum-investing/

- https://fortresswealthplanning.com/is-dollar-cost-averaging-better-than-lump-sum-investing/

- https://www.reddit.com/r/investing/comments/xuklir/dollar_cost_averaging_spy_a_performance_analysis/

- https://www.manulifeim.com.sg/insights/dollar-cost-averaging.html

- https://www.forbes.com/sites/wesmoss/2025/07/28/how-dollar-cost-averaging-stacks-up-against-lump-sum-investing/

- https://www.heygotrade.com/en/blog/dollar-cost-averaging-dca-strategy/

- https://www.heygotrade.com/id/blog-en/dollar-cost-averaging-dca-strategy/

- https://blogs.cfainstitute.org/investor/2020/12/29/dollar-cost-averaging-dca-a-reappraisal/

- https://www.rocklandtrust.com/wealth-and-investments/investment-resources/the-pros-and-cons-of-dollar-cost-averaging

- https://www.key.com/kpb/our-insights/articles/dollar-cost-averaging.html

- https://www.sciencedirect.com/science/article/abs/pii/S1062940821000103

- https://www.indiratrade.com/blog/dollarcost-averaging-in-2025-the-smart-way-to-invest-in-a-volatile-market/9541

- https://corporate.vanguard.com/content/dam/corp/research/pdf/cost_averaging_invest_now_or_temporarily_hold_your_cash.pdf

- https://russellinvestments.com/content/dam/ri/files/us/en/individual-investor/insights/dollar_cost_averaging.pdf

- https://qemsjournal.org/index.php/qems/article/download/2068/1436/

- https://www.ml.com/articles/what-is-dollar-cost-averaging.html

- https://digitalcommons.unl.edu/cgi/viewcontent.cgi?article=1025&context=financefacpub

- https://www.jiraaf.com/blogs/personal-finance/dollar-cost-averaging

- https://www.wallstreetprep.com/knowledge/dollar-cost-averaging-dca/

- https://www.rbcgam.com/documents/en/articles/understanding-dollar-cost-averaging-vs-lump-sum-investing.pdf

- https://www.religareonline.com/knowledge-centre/share-market/dollar-cost-averaging/

- https://www.sc.com/sg/stories/dollar-cost-averaging/

- https://us.etrade.com/knowledge/library/getting-started/what-is-dollar-cost-averaging

- https://www.gsb.stanford.edu/faculty-research/case-studies/management-berkshire-hathaway

- https://ijor.co.uk/ijor/article/view/4418

- https://rpc.cfainstitute.org/research/financial-analysts-journal/2016/inside-the-investments-of-warren-buffett

- https://digitalcommons.sacredheart.edu/cgi/viewcontent.cgi?article=1639&context=wcob_fac

- https://www.idbidirect.in/idbiadmin/pdf/The-Warren-Buffett-Way.pdf

- https://arthgyaan.com/blog/returning-to-india-us-accounts-401k-ira-hsa-tax-dtaa.html

- http://csinvesting.org/2017/02/28/case-studies-on-buffetts-investing-nyu-course-this-april/

- https://www.scribd.com/document/741289169/Case-of-Study-Warren-E-Buffet

- https://www.sciencedirect.com/science/article/abs/pii/S0378475499000403

- https://thedecisionlab.com/thinkers/economics/warren-buffett

- https://www.journalpressindia.com/download_article.php?jid=40&aid=862

- https://www.atlantis-press.com/article/126016363.pdf

- https://trakx.io/resources/guides/how-to-implement-dca-with-trakx/

- https://www.linkedin.com/pulse/behavioural-finance-understanding-investor-psychology-nagraj-jarse

- https://ceritypartners.com/investment-decisions-emotions-behavioral-bias/

- https://www.fidelity.ca/en/insights/articles/dollar-cost-averaging-market-volatility/

- https://www.altrady.com/features/dca-bot

- https://www.sciencedirect.com/science/article/pii/S2214845022000813

- https://www.betashares.com.au/direct/auto-invest

- https://www.emerald.com/rbf/article-pdf/17/4/722/9962147/rbf-07-2024-0189en.pdf

- https://www.morganstanley.com/articles/dollar-cost-average-investing-market-essentials