How to Secure Funding for Startup: USA – Focused Guide

Every entrepreneurial dream begins with a spark of inspiration, but transforming that vision into a thriving enterprise requires more than passion alone. In today’s competitive business landscape, where approximately 90% of startups ultimately fail, securing the right funding for startup often becomes the crucial divider between ambitious ideas that remain forever on paper and breakthrough companies that reshape entire industries. The statistics paint a sobering picture: while first-time founders face an 18% success rate, those who successfully navigate the funding for startup journey dramatically increase their odds of long-term survival and growth. This stark reality underscores why understanding the intricacies of funding for startup acquisition has become an essential skill for every aspiring entrepreneur in America.

The emotional and psychological impact of fundraising is profound, with 72% of startup founders acknowledging that entrepreneurship has greatly affected their mental well-being, and 37% facing anxiety during their entrepreneurial journey. Yet paradoxically, despite these challenges, an overwhelming majority of entrepreneurs would embark on this path again, driven by the transformative potential of their vision and the deep satisfaction that comes from building something meaningful from nothing. The pursuit of funding for startup ventures represents more than just a financial transaction—it’s a validation of one’s business acumen, market insight, and ability to communicate complex ideas to sophisticated investors who evaluate hundreds of opportunities each year.

The American startup ecosystem presents both unprecedented opportunities and formidable challenges in 2025. While venture capital funding experienced a dramatic decline to $76 billion in Q1 2024—the lowest activity in nearly five years—this environment has also created opportunities for well-prepared entrepreneurs who can showcase well-defined value propositions and maintain viable, long-lasting business models. Success stories like Uber, which progressed from a $1.5 million seed round to multi-billion dollar valuations, and Airbnb, which overcame initial investor rejections to become a hospitality industry disruptor, illustrate that with proper preparation, persistence, and strategic thinking, entrepreneurs can still achieve remarkable outcomes even in challenging market conditions.

Data reveals compelling evidence about the correlation between funding success and startup survival rates. Research indicates that venture capital-backed startups demonstrate significantly higher success rates across all development stages, with 55% success in seed stage compared to just 25% for non-VC-backed companies. This advantage compounds through subsequent rounds, reaching 80% success rates for Series C and later-stage VC-backed startups versus 55% for their unfunded counterparts. These statistics highlight how securing appropriate funding for startup operations creates a virtuous cycle of growth, credibility, and access to additional resources that can accelerate market penetration and competitive positioning.

This comprehensive guide navigates every critical aspect of the American funding landscape, from understanding your precise funding for startup requirements and crafting compelling investor narratives to mastering term sheet negotiations and building lasting relationships with financial partners. Through real-world case studies, data-driven insights, and empathetic guidance that acknowledges both the exhilaration and exhaustion inherent in the entrepreneurial journey, you’ll gain the knowledge and confidence needed to transform your startup vision into a funded reality. Whether you’re bootstrapping your initial prototype, preparing for your first angel round, or scaling toward institutional venture capital, this roadmap provides the strategic framework and emotional support necessary to successfully secure the resources that will fuel your company’s growth and market impact.

Understanding Your Financial Needs for Funding for Startup: The Foundation of Smart Capital Acquisition

Before reaching out to potential investors or exploring any avenue for funding for startup operations, gaining crystal-clear insight into your precise financial requirements becomes absolutely critical for long-term success. This comprehensive financial analysis serves as the cornerstone of your entire fundraising strategy and directly influences every subsequent decision about funding for startup acquisition. Develop a meticulously detailed financial forecast that encompasses both immediate needs and future growth projections, ensuring you present investors with a credible, data-driven narrative about your capital requirements.

Breaking Down Your Complete Financial Landscape

One-Time Startup Costs: Building Your Foundation

Document every initial expense required to launch operations, including equipment purchases, legal incorporation fees, initial inventory, technology setup, permits and licenses, office deposits, and professional service fees. According to recent data from the Small Business Administration, the average startup requires between $10,000 and $50,000 in initial capital, though tech-enabled ventures often need significantly more for product development and market entry. Create a comprehensive spreadsheet categorizing these expenses as either essential for launch or desirable for enhanced operations, allowing you to prioritize spending based on available capital.

Monthly Burn Rate: Understanding Your Operating Reality

Calculate your precise monthly burn rate by analyzing all recurring expenses including rent, salaries and benefits, utilities, marketing and advertising spend, software subscriptions, insurance premiums, and operational costs. According to research by Stripe, 32% of founders are concerned about depleting their cash too fast, highlighting the importance of accurately calculating the burn rate for startup survival. Monitoring both gross burn rate (total monthly expenses) and net burn rate (expenses minus revenue) is crucial to gauge actual cash flow. For instance, if a startup has $80,000 in monthly expenses but earns $20,000 in revenue, the net burn rate amounts to $60,000.

Growth Milestones and Strategic Investment Areas

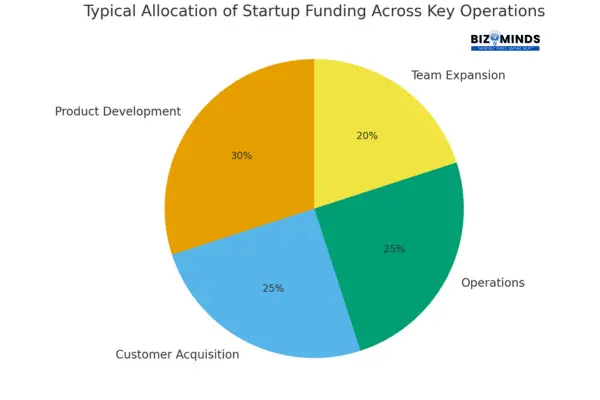

Identify specific funding requirements for product development phases, customer acquisition campaigns, team expansion plans, technology infrastructure scaling, and market expansion initiatives. Each milestone should tie directly to measurable business outcomes that justify the investment. Successful startups typically allocate 20-30% of their funding for startup growth toward customer acquisition, 25-35% toward product development, and 30-40% toward operational expenses and team building. Create timeline-based funding requirements that align with your business development roadmap.

Runway Calculation: Your Financial Lifeline

Determine how many months your startup can operate before requiring additional capital by dividing your current cash balance by your monthly net burn rate. Industry specialists recommend extending your startup runway to 24-36 months, up from the usual 18-24 months, in response to the more competitive fundraising climate in 2025. For instance, if you have $1.2 million in cash reserves and burn $60,000 monthly, you have a 20-month runway. However, factor in potential revenue growth and expense increases to create more accurate projections.

The Strategic Importance of Precision in Financial Planning

By basing the funding for startup request on carefully researched data instead of hopeful guesses, you showcase financial expertise and strategic insight that appeals to seasoned investors. This analytical approach helps you avoid two critical mistakes that derail many fundraising efforts: raising too little capital, which forces premature fundraising rounds and costly bridge financing, or raising excessive amounts, resulting in unnecessary dilution and unrealistic growth expectations. Data from Carta shows that founders typically experience 20% dilution in seed rounds and another 20% in Series A, making precise funding calculations essential for maintaining meaningful ownership stakes.

Professional investors evaluate hundreds of funding for startup requests monthly and immediately recognize founders who have thoroughly analyzed their capital requirements versus those making rough estimates. Create detailed scenario planning with best-case, expected-case, and worst-case financial projections to demonstrate your understanding of potential variables that could impact your funding needs. This comprehensive approach not only builds investor confidence but also provides you with strategic flexibility to navigate unexpected challenges while maintaining adequate runway for sustainable growth.

Remember that accurate financial planning extends beyond immediate funding needs to encompass your entire growth trajectory, helping you sequence funding rounds strategically and maintain optimal equity positions throughout your startup journey. This foundational work becomes the bedrock upon which all subsequent fundraising activities build, making the investment in detailed financial analysis one of the most valuable uses of your early-stage preparation time.

Explore the Full Spectrum of Funding for Startup Sources in the USA

Every stage of your startup journey calls for different funding for startup sources, each with distinct advantages, requirements, and strategic implications for your business trajectory. Understanding this comprehensive landscape empowers you to make informed decisions about funding for startup operations that align with your growth objectives, risk tolerance, and long-term vision. The American entrepreneurial ecosystem offers an unprecedented variety of financing options, from traditional self-funding approaches to cutting-edge crowdfunding platforms and government-backed innovation grants.

| Funding for Startup Sources | Overview | Equity Impact |

| Bootstrap (Personal) | Leverage savings, credit cards, or personal loans to get started. | Full control; high personal risk |

| Friends & Family | Early-stage backing from your circle in exchange for equity or debt. | Moderate dilution; informal terms |

| Angel Investors | Affluent individuals funding seed stages—often with mentorship. | Equity given; strategic support |

| Venture Capital (VC) | Firms investing larger sums in high-growth prospects. | Significant equity exchange |

| Crowdfunding | Pre-sell products or offer perks to backers via platforms like Kickstarter. | No equity loss; marketing boost |

| Bank Loans & Lines | SBA loans or commercial credit—repayable with interest. | No equity loss; requires collateral |

| Grants & Subsidies | Non-dilutive funding from government or nonprofits for qualifying ventures. | No equity loss; competitive |

Bootstrapping: The Foundation of Self-Reliance

Bootstrapping remains the most common initial approach to funding for startup operations, with approximately 77% of entrepreneurs using personal savings to launch their ventures. This self-funding strategy involves leveraging personal savings, credit cards, home equity, or asset liquidation to finance initial operations. The Small Business Administration data shows that entrepreneurs typically invest an average of $40,000 of personal funds during the startup phase. While bootstrapping maintains complete ownership control and forces disciplined spending habits, it also carries significant personal financial risk and may limit growth velocity compared to externally funded competitors.

Successful bootstrapping requires meticulous financial planning, lean operational strategies, and often a longer timeline to achieve market penetration. Companies like Mailchimp and Basecamp famously bootstrapped their way to billion-dollar valuations, demonstrating that self-funding can lead to substantial long-term success without external interference or equity dilution.

Angel Investors: Strategic Capital with Mentorship

Angel investors represent affluent individuals who invest personal capital in promising funding for startup, typically during seed or early-stage phases. In 2024, angel investors in the United States provided an average investment of $78,000 per deal, with successful startups raising between $25,000 and $100,000 from individual angels. When angels collaborate in groups or syndicates, total funding for startup can exceed $750,000. Beyond capital, angels often bring industry expertise, professional networks, and strategic guidance that can accelerate startup development and market entry.

The angel investment process tends to be less formal than venture capital, often relying on personal relationships and informal evaluation criteria. However, angels typically require 5-25% equity stakes and may seek board representation or advisory roles. Research indicates that angel-backed startups demonstrate higher success rates compared to bootstrapped ventures, with 55% achieving their next funding milestone versus 25% for non-angel-backed companies.

Venture Capital: Institutional Growth Capital

Venture capital firms represent professional funding for startup organizations that pool capital from institutional investors to fund high-growth startups. VC funding for startup in the United States averaged $7 million per deal in 2024, with firms typically investing $1 million to $100 million depending on the funding stage. VCs conduct extensive due diligence processes, requiring comprehensive business plans, financial projections, and market analysis before making investment decisions.

Venture capital funding comes with significant trade-offs: while providing substantial capital and strategic resources, VCs typically demand 20-50% equity stakes and often require board seats and operational control. VC-backed startups face pressure for rapid growth and eventual exit through acquisition or IPO. However, data shows that VC-backed companies achieve 80% success rates in later funding rounds compared to 55% for non-VC-backed startups.

Government Grants: Non-Dilutive Innovation Funding

Federal and state government grants provide non-dilutive funding for startup ventures focused on innovation, technology development, and economic growth. The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs, known as “America’s Seed Fund,” offer Phase I awards up to $300,000 and Phase II awards up to $1 million for qualifying technology startups. The National Science Foundation alone provides funding for startup over $200 million annually through these programs.

Government grants require no equity dilution and often validate startups’ technological credibility, making them attractive to future investors. However, the application process is highly competitive, with success rates typically below 15%, and grants often come with specific research requirements and reporting obligations. The Department of Energy, National Institutes of Health, and Department of Defense also offer substantial grant opportunities for startups in relevant sectors.

Crowdfunding: Community-Driven funding for startup Formation

Crowdfunding platforms enable startups to raise funding for startup from large numbers of individual contributors, either through reward-based campaigns (Kickstarter, Indiegogo) or equity-based offerings (StartEngine, Republic). Reward-based crowdfunding maintains the highest success rate at 39.6%, while equity crowdfunding achieves approximately 20% success. The average successful crowdfunding campaign raises funding for startup around $8,150, though technology and design projects average $15,000.

Crowdfunding offers unique advantages beyond capital: market validation, customer acquisition, and marketing exposure. Successful campaigns require compelling storytelling, strong visual content, and active community engagement. Research shows that campaigns raising 30% of their goal within the first week have a 75% chance of overall success, emphasizing the importance of early momentum and social proof.

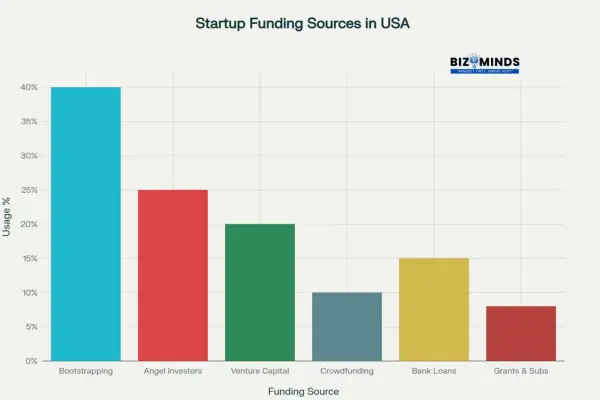

Common sources of Funding for Startup in the USA by Estimated Usage Percentage

This comprehensive capital landscape provides multiple pathways for entrepreneurs to secure funding for startup while maintaining strategic flexibility. The optimal approach often involves sequencing different funding for startup sources as your startup matures, beginning with bootstrapping or friends-and-family rounds, progressing through angel investment, and potentially culminating in venture capital or strategic partnerships. Understanding each option’s requirements, benefits, and limitations enables you to craft a funding strategy that supports sustainable growth while preserving founder control and equity ownership.

The key to successful funding for startup ventures lies in matching your specific needs, growth stage, and strategic objectives with the most appropriate funding for startup sources, often utilizing multiple options simultaneously or sequentially to optimize your financial foundation and competitive positioning.

Design an Engaging Pitch Deck to Secure Funding for Startup

Creating a compelling pitch deck represents one of the most critical components in securing funding for startup ventures, serving as your primary tool for communicating complex business concepts to potential investors in a concise, visually appealing format. Research from Silicon Valley Bank indicates that investors typically spend only 2-5 minutes initially reviewing pitch decks, making every slide’s design and content crucial for capturing and maintaining attention. Your pitch deck functions as both a standalone document for initial screening and a presentation guide for in-person meetings with potential investors.

The Essential 10-12 Slide Framework

Slide 1: Vision and Value Proposition

Open with a powerful one-sentence overview that clearly articulates what your company does and the value it provides to customers. Think of this as your “elevator pitch slide”—concise enough to fit in a tweet yet compelling enough to hook investors immediately. Successful examples like Airbnb’s opening slide (“Web 2.0 for everyone to rent space”) demonstrate how clarity and simplicity create immediate understanding and interest.

Slide 2: Problem Statement

Define the specific problem of your funding for startup solves using relatable storytelling and concrete data points. According to pitch deck analysis from Figma, the most successful presentations make problems feel personal and urgent. Include market statistics, customer pain points, and current solution inadequacies to establish the foundation for your value proposition. Avoid generic problems—focus on specific, well-researched challenges that resonate with your target audience.

Slide 3: Solution and Product Demo

Present your solution clearly, showing exactly how it addresses the identified problem. Include screenshots, product demos, or interactive prototypes that allow investors to experience your product firsthand. Figma’s research shows that embedded prototypes in pitch decks significantly increase investor engagement and comprehension. Visual demonstrations prove product viability better than lengthy explanations.

Slide 4: Market Size and Opportunity

Showcase the total addressable market (TAM), serviceable addressable market (SAM), and serviceable obtainable market (SOM) with reliable data sources and realistic market forecasts. Include market growth rates, customer demographics, and adoption trends that support your expansion strategy. Investors need to see both current market size and future growth potential to justify their investment thesis.

Slide 5: Traction and Customer Stories

Showcase concrete evidence of market validation through user metrics, revenue growth, customer testimonials, partnerships, or pilot programs. Buffer’s successful pitch deck emphasized transparent sharing of real numbers and growth metrics, which built credibility with investors. Include specific data points like monthly active users, revenue growth rates, customer acquisition costs, and retention metrics.

Slide 6: Business Model and Revenue Streams

Clearly explain how your startup generates revenue, pricing strategies, unit economics, and path to profitability. Include customer acquisition costs, lifetime value calculations, and gross margins to demonstrate financial viability. Investors want to understand not just how you’ll make money, but how you’ll scale revenue efficiently and sustainably.

Slide 7: Financial Forecasts and Projections

Present realistic financial projections covering the next 3-5 years, including revenue, expenses, and key performance indicators. Base projections on market research, comparable companies, and bottom-up analysis rather than optimistic assumptions. Include sensitivity analysis showing different growth scenarios to demonstrate thorough financial planning.

Slide 8: Competitive Landscape

Identify direct and indirect competitors, highlighting your unique differentiators and competitive advantages. Use comparison matrices or positioning maps to visually demonstrate your market position. Acknowledge competition honestly while clearly articulating why your approach is superior or addresses underserved market segments.

Slide 9: Go-to-Market Strategy

Outline your customer acquisition strategy, sales channels, marketing approach, and partnership plans. Include specific tactics, timeline, budget allocation, and success metrics. Demonstrate understanding of your target customers and how you’ll reach them cost-effectively at scale.

Slide 10: Team and Advisory Board

Introduce key team members, highlighting relevant experience, domain expertise, and track records. Include advisors, board members, or strategic partners that add credibility and support your execution capability. Investors often emphasize that they “invest in people, not just ideas,” making team slides critical for building confidence.

Slide 11: Funding Request and Use of Proceeds

Clearly state how much funding for startup you’re seeking and exactly how funds will be allocated across different business functions. Break down spending by categories like product development, marketing, hiring, operations, and working capital. Provide timeline for fund utilization and key milestones you’ll achieve with the investment.

Typical Allocation of Funding for Startup across Key Operational Areas

Slide 12: Next Steps and Contact Information

End with a clear call-to-action, next steps in the process, and comprehensive contact information. Include timeline for decision-making and any immediate follow-up requirements. Make it easy for interested investors to continue the conversation.

Design and Storytelling Best Practices

Visual clarity and emotional connection distinguish successful pitch decks from forgettable presentations. According to Toptal’s analysis, aesthetically polished decks that reflect company personality and align with brand identity create stronger first impressions. Use consistent color schemes (2-3 colors maximum), readable fonts, and professional layouts that support rather than distract from your content. Companies like Notion and Figma demonstrated how clean, purpose-driven design enhances message delivery and investor comprehension.

Storytelling transforms data into compelling narratives that create emotional connections with investors. Structure your presentation as a journey: establish the problem, introduce your team as heroes, present your solution as the transformation, and paint a vision of the successful outcome. Include customer success stories, founder motivations, and market impact to humanize your business beyond just financial metrics.

Understanding Valuation Dynamics: A Concise Overview

Early-stage funding for startup valuations in the U.S. usually fall between $3 million and $8 million pre-money, heavily influenced by market perception, the strength of the founding team, and growth prospects rather than conventional financial indicators. Key term-sheet elements to master include:

- Liquidation Preferences: Determine payout order and amount on exit, with 1× non-participating preferences returning investors’ capital first before founders share in remaining proceeds.

- Anti-Dilution Clauses: Protect investors in down rounds; full-ratchet provisions maximize investor security but heavily dilute founders, while weighted-average formulas offer a more balanced approach.

- Board Composition & Control Rights: Early rounds often grant investors board seats and veto powers over major decisions; negotiate to maintain strategic flexibility.

Effective negotiation focuses less on headline valuations and more on these protective terms. Founders secure stronger positions by demonstrating traction, fostering multiple investor interests, and engaging specialized legal counsel to ensure fair, founder-friendly agreements.

Cultivate Investor Relationships: Building Trust and Momentum to gain funding for startup

Establishing genuine connections with investors is as crucial as perfecting your pitch deck. Cultivating strong relationships lays the groundwork for ongoing support, strategic guidance, and smoother fundraising rounds of funding for startup.

Network Strategically

Immerse yourself in America’s vibrant entrepreneurial ecosystems by attending marquee startup hubs—Silicon Valley, Boston, and Austin—as well as industry-specific conferences like TechCrunch Disrupt or Fortune Brainstorm Tech. Engage with alumni associations from your alma mater, join specialized industry groups (e.g., FinTech Council, Clean Energy Entrepreneurs), and participate in local meetups or co-working space events. Authentic, face-to-face interactions build rapport far more effectively than cold outreach, and shared experiences often spark long-term partnerships.

Leverage Digital Platforms

Expand your reach beyond geographic constraints with online investor-founder marketplaces such as AngelList, Gust, and SeedInvest. Craft a compelling, data-driven profile highlighting your traction, team expertise, and market opportunity. Maintain transparent, regular updates—monthly newsletters or milestone announcements—to demonstrate progress and foster investor confidence. Early engagement on these platforms can generate warm intros, accelerate due diligence, and even spark competitive interest that strengthens your negotiating position.

Enter Accelerators & Pitch Competitions

Accelerator programs like Y Combinator, 500 Global, and Techstars provide more than just seed capital—they offer intense mentorship, structured curricula, and powerful demo-day platforms where dozens of top-tier VC firms converge. Similarly, sector-focused pitch contests (e.g., Clean Energy Challenge, FinTech Innovation Lab) offer validation, press exposure, and strategic introductions. Winning or placing in these programs enhances credibility, creates valuable referral networks, and often catalyzes downstream venture capital interest, setting the stage for larger funding rounds.

Showcase Traction and Momentum

Investors prioritize seeing clear progress and concrete achievements when considering funding for startup opportunities. To demonstrate traction and build confidence:

- Early Adopters & Pilot Users: Showcase key customers who have tested your product or service, sharing usage statistics and testimonials that validate market demand.

- Revenue Growth & Recurring Subscriptions: Highlight month-over-month or quarter-over-quarter revenue increases, recurring-revenue metrics such as monthly recurring revenue (MRR), and customer retention rates.

- Strategic Partnerships & Letters of Intent: Present formal agreements or LOIs with established companies that endorse your solution and signal future market access.

- Product Iterations from User Feedback: Detail how customer insights have driven feature enhancements, usability improvements, or pivots—underscoring your responsiveness and user-centric development.

Presenting concrete metrics—such as a 150% increase in MRR over six months or a 90% customer renewal rate—reduces investor uncertainty and fuels enthusiasm for further investment.

Master Term Sheet Negotiations

Term sheets define essential financial and governance conditions that influence your startup’s future success in securing funding for startup. Key components to scrutinize include:

- Pre-Money Valuation: Establishes your company’s worth before new capital—impacting investor stake and founder dilution.

- Equity Dilution: Defines the percentage of ownership exchanged for funding, directly affecting founder and employee equity pools.

- Liquidation Preference: Determines the order and amount investors receive on exit, ranging from a simple 1× non-participating preference to more complex participating structures.

- Board Seats & Governance: Allocates control rights, voting power, and consent thresholds for significant corporate actions.

Engage experienced legal counsel or seasoned mentors to interpret term sheet nuances, negotiate balanced protections, and ensure alignment with your long-term vision and growth strategy.

Leverage Government Programs and Grants

Federal and state grants offer non-dilutive funding for startup options that provide vital operational runway while preserving full ownership equity. Notable opportunities include:

- SBIR & STTR Programs: Administered by NSF, NIH, and other agencies, offering Phase I awards up to $300K and Phase II awards up to $1M for technology and research innovation.

- Departmental Grants: Agencies like the Department of Energy and Department of Defense fund clean energy, defense tech, and advanced manufacturing projects.

- State & Local Economic Development Grants: Available through state economic offices and regional innovation hubs, these grants support job creation and community impact initiatives.

While competition is fierce, successfully securing government grants validates your technology, enhances credibility, and extends your runway without equity dilution.

Mitigate Common Fundraising Challenges

Successfully securing funding for startup operations requires not only strategic planning but also resilience in overcoming common obstacles. Entrepreneurs must navigate investor rejections by treating them as valuable feedback opportunities—refining pitches, addressing concerns, and building social proof through customer validation and endorsements.

- Investor Rejections: Treat “no” as constructive feedback—refine your pitch, address concerns, and update your materials. Build social proof through customer testimonials, pilot results, and third-party endorsements.

- Equity Dilution Fears: Sequence funding rounds to achieve key milestones before raising large sums. Consider alternative structures like revenue-based financing or convertible notes to delay valuation and minimize early dilution.

- Emotional Toll: Fundraising is a marathon, not a sprint. Celebrate small victories—completed investor meetings, positive feedback, and incremental traction—to sustain morale. Cultivate a supportive network of peers, mentors, and founder communities for encouragement and guidance.

Growth-Stage Investments: Scaling Beyond Seed

As you progress into institutional rounds, funding expectations and due diligence intensify. U.S. startups in 2025 typically secure:

| Stage | Average Funding Amount |

| Seed | $1.2 million |

| Series A | $6.5 million |

| Series B | $15 million |

| Series C | $30 million |

Average Funding for Startup Amounts by Funding Round Stage in economics, sizable market share growth, and experienced leadership teams. Demonstrating strong governance, clear scaling strategies, and robust financial controls becomes critical to attract and close substantial growth-stage capital.

Conclusion

Securing the right funding for startup ventures is a vital step that significantly influences the trajectory and sustainability of any new business in the USA. The fundraising journey is a blend of preparation, strategic networking, financial acumen, and resilience. By thoroughly assessing financial needs, understanding diverse funding options, and mastering the art of pitching and negotiating, entrepreneurs gain the confidence and credibility needed to attract the right funding for startup sources. This comprehensive approach lays a strong foundation for translating innovative ideas into scalable, impactful businesses.

It is essential to remember that each funding for startup source—whether bootstrapping, angel investment, venture capital, crowdfunding, or government grants—comes with its unique advantages, challenges, and implications for control and growth. The best outcomes typically result from a well-sequenced, blended funding for startup sources strategy that evolves with your startup’s stage and goals. As demonstrated throughout this guide, maintaining clear financial discipline, showcasing measurable traction, and cultivating authentic investor relationships can multiply your chances of fundraising success while preserving founder equity and vision.

Navigating term sheet negotiations and understanding valuation dynamics are equally critical to safeguarding your startup’s long-term interests. Early-stage startups often face complex choices regarding equity dilution, liquidation preferences, and governance rights that profoundly shape future fundraising rounds and exits. Accessing expert advice and aligning investor expectations with your company mission empowers founders to make strategic decisions, balancing immediate funding for startup needs with sustainable growth.

Ultimately, the journey to secure funding for startup operations is as much about personal perseverance and learning as it is about financial resources. Embracing challenges, adapting to feedback, and leveraging both human connections and data-driven insights are foundational to transforming entrepreneurial aspirations into thriving enterprises that contribute meaningfully to the dynamic U.S. startup ecosystem.

Frequently Asked Questions

1. What’s the fastest way to fund a startup?

Bootstrapping and tapping friends and family often yield the quickest seed capital, but they carry personal risk. Crowdfunding can also deliver rapid initial funds if your concept resonates with the public.

2. Are U.S. government grants worth pursuing?

Yes—if you qualify. SBIR/STTR grants can provide significant, non-dilutive capital for tech and research innovations, though the application process is rigorous.

3. How do I find angel investors?

Connect with regional angel networks like Band of Angels, participate in pitch events, and actively engage on platforms such as AngelList. Personal introductions via mutual contacts also carry weight.

4. Should I seek venture capital before product-market fit?

Generally, no. VCs look for demonstration of product-market fit and traction. Early-stage rounds from angels or accelerators better suit pre-product-market fit startups.

5. Can I combine multiple funding sources?

Absolutely. Many startups bootstrap initially, secure angel investment next, and then pursue VC once they hit milestones. A blended approach optimizes equity and financing costs.

6. What documents do investors request?

Key items include your business plan, pitch deck, cap table, financial model, incorporation documents, and any patents or IP agreements.

7. How much equity is too much to give up?

Founders often aim to retain at least 50% equity post-Series A. Beyond 30–40% dilution in early rounds can hinder future fundraising and founder incentives.

8. Is location critical for funding?

While proximity to hubs helps, remote pitches and digital diligence have democratized access. A strong online presence and referrals can overcome geographic barriers.

9. What valuation can I expect at Seed?

In the USA, seed stage valuations generally range between $3 million and $8 million, influenced by factors such as industry sector, market traction, and the strength of the founding team..

10. How long does fundraising usually take?

Plan for 3–9 months from initial outreach to closing. Building relationships early can compress timelines.

11. What’s the role of accelerators?

They provide seed funding, mentorship, networks, and demo-day exposure—often catalyzing your first institutional investment.

12. How do I maintain investor relationships post-funding?

Communicate transparently through monthly or quarterly updates, share milestones, and proactively discuss challenges to build trust and support future rounds.