The Best Crypto Wallet for Beginners: A Comprehensive Guide for U.S. Readers

Choosing your first crypto wallet can feel like standing at a crossroads: one direction opens the door to seamless digital finance freedom, and the other leaves you at risk of losing access to your own funds forever. In the United States, cryptocurrency adoption has skyrocketed—driven by a wave of institutional investments, widespread media coverage, and the promise of decentralized finance reshaping traditional banking. Today, over 46 million Americans own some form of digital currency, signaling a seismic shift in how U.S. residents store value and conduct transactions.

A crypto wallet is more than just an app or device; it’s your personal vault in the digital realm. Whether you’re holding Bitcoin as a long-term store of value, trading altcoins on decentralized exchanges, or exploring NFTs on Ethereum, the wallet you choose determines how easily you can transact, how securely your private keys are stored, and how swiftly you can recover your assets if something goes awry.

This comprehensive guide will help you:

- Understand the distinctions among software wallets—like mobile apps and browser extensions—and hardware wallets that store keys offline.

- Compare the critical features for beginners, including private-key management, backup and recovery options, and cost considerations tailored to U.S. consumers.

- Follow a clear, step-by-step setup process that aligns with U.S. regulatory standards and best security practices.

- Implement ongoing security measures—from two-factor authentication to safe storage techniques—that protect your digital assets in an ever-evolving threat landscape.

By the end of this article, you’ll not only know how to pick the right crypto wallet but also feel confident that your digital holdings are secure, accessible, and ready to participate in America’s rapidly growing digital economy.

Key Criteria for Selecting a Beginner-Friendly Crypto Wallet

The ideal crypto wallet choice differs from person to person, depending on investment goals and security requirements. You need to balance convenience, security, and cost to find a solution that fits your comfort level and long-term goals. Below are the most critical factors to evaluate—each with deeper insights, U.S.-specific considerations, and a comparative table to help you decide.

Security Features of Crypto wallet

Your private key safeguards your financial future, which is why a non-custodial crypto wallet is the best option for complete ownership and security. Look for:

- Two-Factor Authentication (2FA): Adds a second verification step via SMS, authenticator app, or hardware token.

- Biometric Unlock: Fingerprint or face recognition on mobile wallets reduces reliance on PINs alone.

- Secure Element / Hardware Isolation: In hardware devices like Ledger or Trezor, private keys are stored in a tamper-resistant chip.

- Open-Source Code: Wallets with publicly auditable code (e.g., Trezor Model One) let security researchers inspect for vulnerabilities.

Ease of Use

A beginner-friendly crypto wallet should guide you through setup, recovery, and daily transactions without jargon overload. Key usability hallmarks include:

- An onboarding wizard: It should guide users step-by-step to securely back up their seed phrase and enable two-factor authentication, making the crypto wallet setup both safe and simple.

- Clear Transaction Flow: Explicit “Send” and “Receive” screens with QR-code scanning and fee customization.

- Customizable Alerts: Price or balance notifications that help U.S. investors monitor holdings and market moves.

Supported Cryptocurrencies

Even if you start with Bitcoin and Ethereum, you may expand into BNB, Solana, or USDC (a U.S.-backed stablecoin). Compare:

- Mobile wallets (Trust Wallet, Coinbase Wallet) often support 100+ tokens and U.S. stablecoins.

- Desktop wallets (Exodus) typically list 50–200 assets, plus integrated swap features.

- Hardware wallets (Ledger Nano S) claim compatibility with over 1,800 tokens but require companion software for each blockchain.

Backup & Recovery

Losing your recovery phrase means losing access permanently—no exceptions. Best practices:

- Seed phrases: They are typically 12 words long as a standard, while 24-word phrases offer increased entropy and stronger security.

- Encrypted Cloud Backup: Services like Brave Wallet offer optional cloud-encrypted phrase storage for U.S. users.

- Shamir’s Secret Sharing: Advanced wallets split your seed into multiple parts stored separately, reducing single-point failure risks.

Cost

While most software wallets are free, remember that “free” often means trade-offs in customer support or advanced features. Hardware wallets range from $50 for basic models (e.g., SafePal S1) to $200+ for top-tier devices with color screens and Bluetooth (e.g., Ledger Nano X). Balance cost against:

- The amount you plan to store (larger balances justify hardware expense).

- Frequency of transactions (active traders may prefer free mobile apps).

Customer Support & Community

A strong support network can save you time and money when issues arise. Look for wallets with:

- 24/7 Ticketing & Live Chat: Essential for U.S. users facing time-sensitive transfers.

- Extensive Knowledge Base: Video tutorials, FAQs, and troubleshooting guides.

- Active U.S. Forums & Social Channels: Reddit threads (r/Bitcoin, r/CryptoCurrency) and Telegram groups moderated by wallet teams.

Comparative Overview of Beginner Crypto Wallet Criteria

| Criteria | Mobile Wallets | Desktop Wallets | Hardware Wallets | Custodial (Exchange) Wallets |

| Security | 2FA, Biometric unlock | 2FA, Password protect | Secure element, PIN, passphrase | Platform-controlled keys, 2FA |

| Ease of Use | High (app stores, guided UI) | Moderate (install, updates) | Low–Moderate (initial setup manual) | Very high (web/app interface) |

| Supported Cryptocurrencies | 100+ tokens, U.S. stablecoins | 50–200 tokens | 1,800+ tokens (via companion app) | 50+ tokens, U.S. dollar wallets |

| Backup & Recovery | Seed phrase, optional cloud backup | Seed phrase | Seed phrase, Shamir’s Secret Sharing | Email/password recovery |

| Cost | Free | Free | $50–$200+ | Free |

| U.S. Customer Support | Varies, often app-based | Community forums, email | Ticketing, live chat (premium) | 24/7 support, FDIC-insured USD backup |

This table highlights how each crypto wallet category stacks up across the most important dimensions for U.S. beginners. By weighing these factors against your personal needs—whether you prioritize convenience, breadth of token support, or rock-solid security—you’ll be well on your way to selecting the ideal crypto wallet for your journey.

Types of Crypto Wallet

Understanding the different types of crypto wallets is crucial for beginners to select one that fits their security needs and lifestyle. Each wallet type carries distinct advantages and trade-offs—especially within the U.S. market, where regulatory compliance and user preferences shape available options.

Software Wallets

Software wallets are digital applications that allow you to store and manage cryptocurrencies directly on your device. These are generally free, easy to download, and perfect for beginners eager to jump into the market.

- Desktop Wallets

Desktop wallets such as Exodus are compatible with Windows and macOS operating systems, offering secure cryptocurrency management on both platforms. They offer a rich user experience with built-in portfolio tracking, one-click token swaps, and detailed transaction histories. Exodus supports over 200 cryptocurrencies and integrates U.S.-specific stablecoins such as USDC, making it suitable for American users. However, being connected to the internet means they are more vulnerable to hacking than hardware wallets, so securing your desktop environment is essential. - Mobile Wallets

Mobile wallets like Trust Wallet transform your smartphone into an all-in-one crypto hub, offering convenience for quick trades, payments, and token management on the go. Trust Wallet supports over 40 blockchains and thousands of tokens, including U.S.-regulated tokens, with biometric security features suited for busy U.S. users. These wallets often integrate with decentralized applications (DApps), enabling access to NFTs and DeFi platforms seamlessly. - Browser Extension Wallets

Browser wallets such as MetaMask operate as extensions on Chrome, Firefox, and other browsers. They are the go-to choice for interacting with the decentralized web—providing direct access to DeFi protocols, decentralized exchanges (DEXs), and NFT marketplaces without downloading heavy software. MetaMask is widely used in the U.S. crypto wallet community for its ease of use and strong network compatibility, offering control over private keys but requiring vigilance against phishing attacks.

Hardware Wallets

Hardware wallets physically store your private keys offline, making them immune to most online hacking attempts. Popular models like the Ledger Nano S and Trezor Model One cost between $79 and $149 in the U.S., representing a worthwhile investment for those holding significant amounts or planning to HODL long-term.

These wallets connect to your computer or smartphone only when signing transactions, keeping your keys isolated at all other times. Both devices support thousands of tokens and multiple blockchains, making them versatile for U.S. users who may diversify their holdings. Their screen and button confirmation also add manual verification layers that increase security.

Paper Wallets

A paper wallet is an offline cold storage method where the public and private keys are printed or handwritten on physical paper. They offer maximum security against online threats but demand extreme care—loss, damage, or theft of the paper means complete loss of funds. Due to their manual complexity and risk, paper wallets are generally not recommended for beginners unless you have experience with offline crypto security procedures.

Custodial Wallets (Exchange Wallets)

Cryptocurrency exchanges like Coinbase and Binance.US offer custodial wallets where the provider controls the private keys. Here, the platform controls the private keys on your behalf, simplifying the user experience and ensuring U.S. regulatory compliance. These wallets are excellent for newcomers who want quick access to trading and deposits without handling private keys. However, this convenience comes at the cost of privacy and control, as you must trust the platform’s security and policies.

For U.S. users, custodial wallets often come with features like FDIC insurance on USD holdings, customer support, and easy fiat onramps, further lowering the entry barrier into crypto wallet ownership.

Comparative Chart: Crypto Wallet Types Overview

| Wallet Type | Key Characteristics | Security Level | Best For | U.S. Regulatory Considerations |

| Software Wallets | Desktop/mobile/browser apps, free, internet-connected | Medium | Beginners, frequent traders | Supports U.S. tokens; varies by app |

| Hardware Wallets | Offline key storage devices, ~$79–$149 | High | Large holders, long-term investors | Fully compliant, sold by regulated vendors |

| Paper Wallets | Offline print of keys, manual handling required | Very High (but risky) | Advanced users with secure storage | No direct regulatory issues; physical custody |

| Custodial Wallets | Exchange-controlled keys, ease of use | Low–Medium | Newbies, casual users | U.S. exchanges regulated; customer protection policies |

Selecting the right type of crypto wallet tailored to your needs, whether prioritizing security or convenience, will empower your safe and confident participation in the growing U.S. cryptocurrency ecosystem.

Top Beginner Crypto Wallet Recommendations

When starting your cryptocurrency journey in the crypto wallet in the U.S.A, it’s important to choose a wallet that balances security, ease of use, and the ability to support the digital assets you plan to hold or trade. Below is a curated list of top beginner-friendly crypto wallets categorized by type, with details on pricing and key advantages relevant to U.S. users.

| Wallet Type | Name | U.S. Price | Key Advantage |

| Desktop/Mobile | Exodus | Free | Built-in exchange & portfolio tracking |

| Mobile | Trust Wallet | Free | Supports 40+ blockchains, including U.S. regulated tokens |

| Browser Extension (DeFi) | MetaMask | Free | Seamless integration with decentralized apps (DApps) |

| Hardware | Ledger Nano S | $79 (U.S.) | Highly secure offline storage with robust U.S. support |

| Hardware | Trezor Model One | $99 (U.S.) | Open-source firmware ensuring transparency and security |

| Exchange Custodial (U.S.) | Coinbase Wallet | Free | FDIC-insured USD wallet, U.S. regulatory compliant |

| Exchange Custodial (U.S.) | Binance US Wallet | Free | Offers low trading fees, ideal for active U.S. traders |

Comparative Overview of Beginner Crypto Wallet Criteria

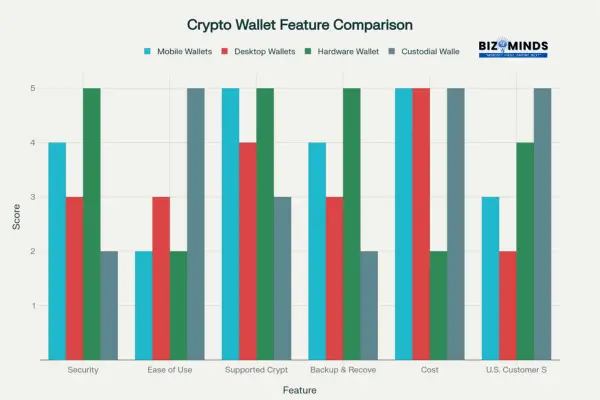

The “Comparative Overview of Beginner Crypto Wallet Criteria” is a clear summary of the essential factors beginners should consider when choosing a crypto wallet. It compares wallet categories—Mobile, Desktop, Hardware, and Custodial—across key dimensions such as security, ease of use, supported cryptocurrencies, backup and recovery options, cost, and customer support. This overview highlights the trade-offs each type presents, helping new users balance convenience, security, and regulatory compliance to find the best fit for their specific needs and goals in the U.S. crypto market.

Crypto wallet feature comparison

Highlights of These Wallets:

Exodus:

Well-suited for beginners who want a user-friendly interface on desktop or mobile devices. The wallet integrates a simple exchange feature and portfolio management tools for over 200 cryptocurrencies.

Trust Wallet:

Favored by mobile users, with support for a broad range of tokens and blockchains. Its biometric security features make it convenient and secure for everyday use across the U.S.

MetaMask:

The leading browser extension wallet in the U.S. for interacting with DeFi projects and NFTs. It provides users full control over private keys with a clean, straightforward interface.

Ledger Nano S:

A budget-friendly hardware wallet known for its strong and uncompromising security features. Its offline storage keeps your private keys away from internet vulnerabilities, making it ideal for long-term holders.

Trezor Model One:

The choice for transparency-focused users in the U.S., thanks to its open-source firmware. It supports multi-currency portfolios and provides a secure physical device to protect private keys.

Coinbase Wallet:

Perfect for U.S. beginners who prefer convenience and regulatory assurance. Its FDIC-insured USD holdings and customer support offer a safety net rarely found in purely non-custodial wallets.

Binance US Wallet:

Best for traders in the U.S. who want low fees and easy access to a wide range of cryptocurrencies on a highly liquid platform.

These wallets represent a spectrum of options tailored to different user profiles across the U.S.—from casual holders to active traders, and from those prioritizing convenience to those focused on security. Choosing the right wallet sets the foundation for a safer, more enjoyable crypto experience.## 4. Top Beginner Crypto Wallet Recommendations

When starting your cryptocurrency journey in the U.S., it’s important to choose a wallet that balances security, ease of use, and the ability to support the digital assets you plan to hold or trade. Below is a curated list of top beginner-friendly crypto wallets categorized by type, with details on pricing and key advantages relevant to U.S. users.

Step-by-Step Guide: Setting Up Your First Crypto Wallet

Starting with your first crypto wallet can be straightforward if you follow these carefully designed steps that emphasize security and usability—especially tailored for U.S. users navigating a fast-evolving regulatory and technological environment.

Step 1: Choose & Download

Begin by visiting the official website of your chosen wallet to avoid phishing scams— for instance, exodus.com for Exodus or trustwallet.com for Trust Wallet. Always verify you are on the legitimate U.S. domain before downloading. Download the app compatible with your device (desktop or mobile). When choosing a hardware wallet like the Ledger Nano S, always buy from authorized U.S. resellers or directly from the official Ledger website to avoid counterfeit products and ensure security.

Step 2: Create & Backup Your Seed Phrase

When you create your wallet, you will receive a 12- or 24-word recovery phrase (also known as a seed phrase). This recovery phrase functions as the master key; anyone with it can control and transfer your assets. Write this phrase down meticulously on paper or a durable medium—never store it digitally or online. Consider using a fireproof safe or a secure offline device designed for seed storage. For U.S. users, this practice aligns with best security standards endorsed by crypto security experts and industry bodies.

Step 3: Enable Security Features of crypto wallet

Once your wallet is set up, immediately activate all available security features:

- PIN or Password Protection: Prevents unauthorized app access.

- Biometric Unlock (Fingerprint or Face ID): Convenient yet secure mobile access for smartphones common in the U.S. market.

- Two-Factor Authentication (2FA): Adds a vital layer of protection during login or transaction approvals. Use authenticator apps like Google Authenticator or hardware tokens for more robust security than SMS codes.

Step 4: Conduct a Test Transaction

Before moving large sums in the crypto wallet, send a small test amount—say, $10 worth of Bitcoin—from your exchange account (e.g., Coinbase or Binance US) to your new wallet. Confirm the transaction’s arrival, then try sending a small amount back. This validates your wallet’s proper setup, your understanding of its interface, and your ability to manage transfers securely.

Best Practices for Crypto Wallet Security and Maintenance

Maintaining the security of your crypto wallet is a continuous process that protects against evolving threats. Here are time-tested best practices, particularly relevant for U.S. crypto holders facing frequent phishing attacks and regulatory guidelines:

- Store Recovery Phrases Securely: Use a fireproof safe or encrypted USB devices specifically designed for seed phrase storage. Avoid storing phrases in cloud storage, email, or photographs. Consider using steel seed storage products found on U.S. market platforms for added durability.

- Keep Software Up to Date: Enable automatic updates for your wallet app and any associated companion software (hardware wallet apps, for example). Keeping your software current helps protect against newly discovered vulnerabilities.

- Guard against Phishing and Scams: Always double-check URLs for wallet websites and exchanges before logging in. Use bookmark shortcuts for critical sites. Avoid clicking suspicious links or opening attachments from unverified senders to reduce phishing and malware risk. Educate yourself regularly about common scam tactics prevalent in the U.S. crypto space.

- Track Your Portfolio: Use portfolio tracking apps or wallet-integrated features to monitor your crypto balances monthly. This feature enables early detection of unauthorized transactions to help protect your funds. Popular U.S.-trusted portfolio trackers include Blockfolio and Delta, which support alerts and detailed transaction histories.

By following these guided steps and security practices, you’re not only safeguarding your crypto wallet but also building a foundational understanding that will empower you on your broader journey through the dynamic cryptocurrency ecosystem.

Conclusion

Selecting your first crypto wallet doesn’t have to be an overwhelming experience. By focusing on the key pillars of security, ease of use, and alignment with U.S. regulatory standards, you can confidently choose a wallet that fits your unique needs and risk tolerance. Whether you decide on the free convenience and accessibility of a mobile or desktop wallet, or invest in the robust, offline security of a hardware device, the foundational knowledge and best practices shared in this guide will empower you to safeguard your digital assets effectively.

Remember, your crypto wallet is not just a tool but your personal gateway to the broader world of cryptocurrency—one that requires continuous care, vigilance, and informed decision-making. By setting up strong recovery procedures, keeping your software up to date, and staying aware of evolving threats, you position yourself to navigate the dynamic U.S. crypto landscape with confidence and peace of mind. Embark on your crypto journey prepared, protected, and ready to seize the exciting opportunities ahead.

Frequently Asked Questions (FAQs)

- Q: What’s the difference between custodial and non-custodial wallets?

A: Custodial wallets hold the private keys on your behalf, meaning a third party controls access to your funds. Non-custodial wallets give you sole control over your private keys, offering greater security but requiring you to manage your own backup and recovery. - Q: How can I restore access to my crypto wallet if I lose the seed phrase?

A: No— Losing your seed phrase usually results in permanent loss of access to your cryptocurrency funds. It’s essential to back up your recovery phrase securely and never share it. - Q: Are hardware wallets worth it?

A: Yes, especially if you hold more than $500 in crypto or prioritize maximum security. Hardware wallets keep your keys offline, safeguarding them against online hacks and malware. - Q: How many wallets should a beginner have?

A: One non-custodial wallet combined with an exchange account usually offers a good balance between control and convenience. - Q: Can I use the same crypto wallet for multiple cryptocurrencies?

A: Most modern wallets support multiple cryptocurrencies, but it’s important to verify compatibility, especially for newer or less common tokens. - Q: Are there any fees associated with using crypto wallet?

A: While most wallets are free to download, transactions on blockchains usually incur network (mining) fees. Some wallets may also charge fees for built-in exchange services. - Q: Is it secure to store cryptocurrency in an exchange wallet?

A: While storing crypto in a custodial exchange wallet is convenient, it carries risks such as potential exchange hacks, insolvency, or loss of control over your assets. For long-term storage, a non-custodial wallet is recommended. - Q: What happens if my hardware wallet is lost or damaged?

A: As long as you have your recovery seed phrase, you can restore your funds on a new device. Without it, access is lost permanently. - Q: Is it safe or advisable to share access to my crypto wallet with family members?

A: Sharing wallet access can expose your funds to risk. Instead, consider using multi-signature wallets that require multiple approvals for transactions. - Q: What is the recommended backup schedule for a crypto wallet?

A: Backup your seed phrase securely once during setup, and update backup copies if the wallet offers new recovery phrases after software updates or upgrades. - Q: Are crypto wallets regulated in the U.S.?

A: Hardware and software wallets themselves are generally unregulated, but wallets operated by exchanges or custodians comply with U.S. regulations, including AML and KYC laws. - Q: Can I recover crypto if the wallet app is discontinued?

A: Yes, as long as you have your recovery phrase, you can restore your crypto on any compatible wallet that supports the same blockchain standards.