Startup Growth Fueled by Blockchain Technology: The Innovation Engine

The convergence of blockchain technology with entrepreneurial innovation represents one of the most transformative forces reshaping the global business environment. As venture capital flows surge and regulatory frameworks evolve, American startups are positioning themselves at the forefront of a revolution that promises to fundamentally alter how businesses operate, transact, and create value. This comprehensive analysis examines the pivotal role blockchain technology plays in startup innovation, exploring market dynamics, funding trends, regulatory developments, and the practical applications driving sustainable growth across industries.

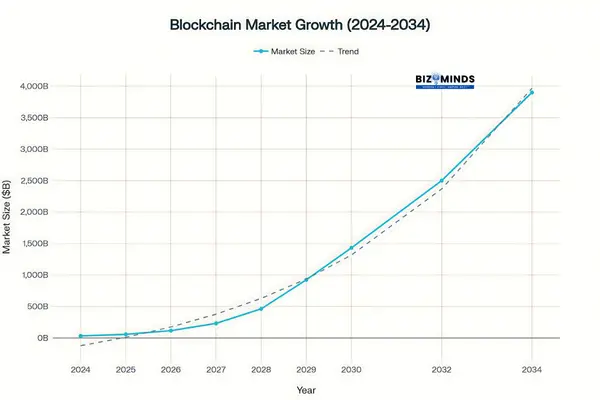

Global blockchain technology market growth projection showing exponential expansion from $31.28 billion in 2024 to an estimated $3.9 trillion by 2034

The global blockchain technology market demonstrates unprecedented momentum, with projections indicating growth from $57.72 billion in 2025 to an astounding $1.43 trillion by 2030. This exponential trajectory reflects not merely speculative interest but genuine enterprise adoption and technological maturation. For American entrepreneurs, these figures underscore a critical window of opportunity where early-stage ventures can establish market leadership in emerging sectors.

Market Dynamics and Investment Outlook

Funding Patterns and Capital Flow

The investment outlook for blockchain technology startups reveals fascinating patterns that illuminate both opportunities and challenges. In Q1 2025, venture capitalists invested $4.8 billion into crypto and blockchain-focused startups across 446 deals, representing a 54% quarter-over-quarter increase. However, this growth narrative requires nuanced interpretation, as 40% of this capital stemmed from a single $2 billion strategic investment by UAE’s MGX into Binance.

Distribution of blockchain startup funding across different investment stages, showing total funding amounts in millions of dollars for 2024-2025

The funding distribution across stages reveals strategic implications for entrepreneurs. Seed-stage funding commanded $1.31 billion, while Series A rounds attracted $1.15 billion, indicating robust early-stage investor confidence. Particularly noteworthy is the emergence of “Other” funding categories, totaling $2.21 billion, reflecting innovative financing mechanisms unique to blockchain technology ventures, including token sales, decentralized autonomous organization (DAO) funding, and strategic partnerships with established enterprises.

Key Investment Trends:

- Pre-seed blockchain startup transactions increased 50% in 2024

- From 2021 through 2024, bitcoin startups garnered nearly $1.2 billion in capital, underscoring a solid investment trend in this emerging market

- Crypto venture capital funding projected to exceed $18 billion in 2025

- United States maintains 38.6% of global blockchain startup deal count

Regional Market Leadership

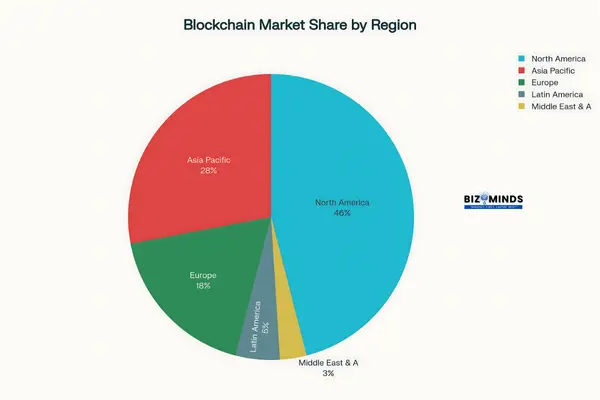

Regional distribution of the global blockchain technology market showing North America’s dominant position with 46% market share

North America’s dominance in the blockchain technology ecosystem extends beyond mere market share statistics. With 46% of global market revenue and projected growth at 33.9% CAGR through 2035, American companies benefit from unique advantages including regulatory clarity initiatives, extensive venture capital networks, and established technology infrastructure. The regional market’s $15.2 billion investment volume demonstrates sustained institutional confidence in blockchain innovation potential.

This geographic concentration creates network effects that benefit startup ecosystems. Silicon Valley, New York, and emerging hubs like Austin and Miami provide entrepreneurs access to technical talent, regulatory expertise, and sophisticated investors familiar with blockchain technology applications. The proximity to major financial institutions, healthcare systems, and Fortune 500 companies facilitates pilot programs and strategic partnerships essential for scaling blockchain solutions.

Regulatory Environment and Compliance Framework

Federal Policy Evolution

The regulatory background surrounding blockchain technology has experienced significant transformation under the current administration. President Trump’s January 2025 Executive Order on “Strengthening American Leadership in Digital Financial Technology” established foundational policy principles supporting blockchain innovation. This directive clearly upholds the right of both individuals and private businesses to access and lawfully use open public blockchain networks free from harassment or legal repercussions “.

This policy shift represents a paradigm change from previous regulatory uncertainty. The establishment of technology-neutral regulations and well-defined jurisdictional boundaries provides startups with operational clarity previously unavailable. Entrepreneurs can now develop blockchain technology solutions with greater confidence regarding compliance requirements and regulatory expectations.

Key Regulatory Developments:

- Formation of bicameral crypto committee prioritizing stablecoin legislation

- SEC crypto task force accelerating regulatory frameworks

- Department of Government Efficiency exploring blockchain for federal operations

- State-level regulatory sandboxes in Arizona, Wyoming, and Florida

Compliance Considerations for Startups

Successful blockchain technology startups must navigate complex compliance requirements spanning multiple regulatory domains. Financial applications face scrutiny from the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC), while healthcare applications must address HIPAA requirements and FDA guidelines. Supply chain solutions encounter regulatory frameworks from the Department of Agriculture and customs authorities.

The key to regulatory success lies in proactive compliance integration rather than retroactive adaptation. Leading startups embed compliance professionals within development teams, ensuring regulatory considerations influence architectural decisions from project inception. This approach prevents costly redesigns and accelerates market entry timelines.

Industry Applications and Use Case Development

Financial Services Innovation

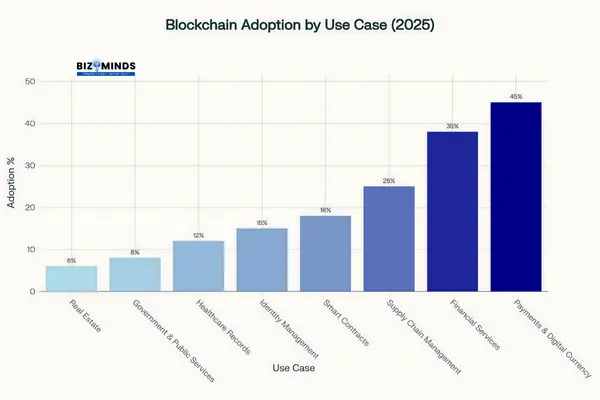

Blockchain technology adoption rates across various industry use cases, with payments and digital currency leading at 45% adoption

Blockchain technology applications in financial services continue driving the highest adoption rates, commanding 45% of total market implementation. American fintech startups leverage blockchain for diverse applications including payment processing, trade finance, identity verification, and smart contract automation. Companies like Ripple and Stellar demonstrate how blockchain infrastructure can reduce cross-border payment costs by up to 60% while improving settlement speeds from days to minutes.

Decentralized Finance (DeFi) platforms represent a particularly dynamic segment within financial blockchain technology applications. Protocols like Compound and Aave have achieved total value locked (TVL) exceeding $9 billion and $13 billion respectively, demonstrating market validation for blockchain-based lending, borrowing, and yield generation. These platforms eliminate traditional intermediaries, reducing costs while expanding access to financial services.

Financial Blockchain Applications:

- Cross-border payments and remittances

- Trade finance and supply chain financing

- Decentralized lending and borrowing

- Insurance claims processing automation

- Regulatory reporting and compliance monitoring

Healthcare System Transformation

Healthcare applications of blockchain technology address critical challenges including data interoperability, supply chain integrity, and patient privacy protection. With a market size of $4.04 billion in 2023, the healthcare blockchain industry is anticipated to grow to $11.33 billion in 2024, supported by a robust CAGR of 63.3%. American healthcare startups utilize blockchain for electronic health record management, pharmaceutical tracking, clinical trial data integrity, and medical device authentication.

SimplyVital Health’s Health Nexus platform exemplifies practical healthcare blockchain implementation, enabling hospitals to securely share patient information while maintaining HIPAA compliance. The platform addresses interoperability challenges that fragment patient care across multiple providers. Similarly, TraceRX applies blockchain principles to pharmaceutical supply chain tracking, preventing counterfeit medications from entering healthcare systems.

The integration of blockchain technology with Internet of Things (IoT) devices creates particularly compelling healthcare applications. Wearable sensors and remote monitoring devices can securely transmit patient data to blockchain networks, ensuring data integrity while enabling real-time health analytics. This combination supports precision medicine initiatives and population health management programs.

Supply Chain and Manufacturing Applications

Supply chain management represents the second-largest application area for blockchain applications, capturing 25% of market adoption. American manufacturing companies implement blockchain solutions to achieve end-to-end traceability, verify product authenticity, and automate compliance reporting. Walmart’s collaboration with IBM Food Trust demonstrates blockchain’s capability to trace contaminated products within seconds rather than days, potentially preventing foodborne illness outbreaks.

Blockchain applications provides substantial advantages to the pharmaceutical industry by improving supply chain visibility, ensuring product integrity, and streamlining regulatory compliance. Counterfeit medications cause significant patient safety risks and economic losses, making authentication crucial. Blockchain technology enables pharmaceutical companies to create immutable records tracking medications from manufacturing through patient delivery, ensuring authenticity while facilitating recall procedures when necessary.

Supply Chain Blockchain Benefits:

- Real-time inventory tracking and management

- Automated compliance and regulatory reporting

- Supplier verification and risk assessment

- Product authenticity and anti-counterfeiting measures

- Sustainability and ethical sourcing verification

Government and Public Sector Adoption

Federal Implementation Initiatives

Government adoption of blockchain technology extends beyond regulatory oversight to practical implementation across federal agencies. The Department of Government Efficiency (DOGE), led by Elon Musk, explores blockchain applications for federal spending tracking, payment automation, and data security. These initiatives potentially represent the largest government blockchain deployment globally, affecting trillions in federal expenditures.

The Joint Financial Management Improvement Program (JFMIP) has successfully piloted blockchain systems for federal grant management, achieving 35% reductions in administrative costs through automated compliance checks and real-time fund tracking. This prototype expanded across multiple agencies including Treasury, Commerce, and Health and Human Services, demonstrating scalability potential for broader federal adoption.

Government Blockchain Applications:

- Federal grant and contract management

- Identity verification and digital credentials

- Voting system security and transparency

- Intellectual property protection

- Public records and document authentication

State and Local Innovation

State governments increasingly recognize blockchain technology as a tool for improving public services and reducing administrative costs. Utah’s blockchain digital ID pilot program, launched in 2024, creates verifiable credentials for county permits and identification documents. The program addresses identity theft concerns while streamlining government services for citizens.

Several states have established regulatory sandboxes specifically designed to foster blockchain innovation. Arizona’s innovative framework permits blockchain startups to operate with up to 10,000 customers during a two-year test phase before needing full regulatory approval. This approach balances innovation promotion with consumer protection, creating favorable environments for blockchain technology startups.

Technical Challenges and Solutions

Scalability and Performance Optimization

Scalability remains a fundamental challenge for blockchain technology implementation, particularly for applications requiring high transaction throughput. In 2025, Bitcoin supports approximately 7 transactions per second, compared to Ethereum’s higher throughput of around 15 TPS. These limitations create bottlenecks for mainstream adoption, especially in payment processing and high-frequency trading applications.

Layer 2 scaling solutions address these limitations through various technological approaches. Zero-knowledge rollups, state channels, and sidechains enable higher transaction throughput while maintaining security properties of underlying blockchain networks. Polygon’s Layer 2 solution, for example, processes over 7,000 transactions per second while reducing costs by up to 100x compared to Ethereum mainnet transactions.

Scalability Solutions:

- Layer 2 protocols and state channels

- Sharding and parallel processing

- Hybrid blockchain architectures

- Off-chain computation with on-chain verification

- Consensus mechanism optimization

Interoperability and Integration Challenges

Interoperability between different blockchain networks presents significant technical and business challenges. Most blockchain networks operate as isolated systems, unable to directly communicate or transfer assets without complex bridging mechanisms. This fragmentation limits the potential for comprehensive blockchain technology solutions spanning multiple platforms.

Cross-chain protocols like Polkadot and Cosmos attempt to address interoperability challenges through standardized communication protocols and shared security models. These solutions enable developers to build applications that leverage multiple blockchain networks’ strengths while maintaining security and decentralization properties.

The interoperability market projects growth from $456.86 million in 2025 to $8.48 billion by 2037, reflecting increasing demand for connected blockchain ecosystems. Startups focusing on interoperability solutions may capture significant value as the blockchain ecosystem matures and consolidates.

Successful Case Studies and Implementation Examples

Enterprise Blockchain Adoption

Major American corporations demonstrate practical blockchain technology implementation across diverse use cases. Together, Microsoft and Goldman Sachs operate the Canton Network, handling $50 billion in daily transaction volumes via secure smart contract execution. This enterprise blockchain infrastructure supports interoperable solutions for finance, supply chain, and identity management applications.

VeChain’s partnership with Walmart China illustrates successful supply chain blockchain implementation. The platform tracks products across multiple industries including luxury goods, food safety, and pharmaceuticals, providing consumers with verified product authenticity information. VeChain’s VeThor Token (VET) creates economic incentives for network participation while enabling access to platform services.

Successful Implementation Factors:

- Clear business value proposition and ROI metrics

- Strategic partnerships with established enterprises

- Regulatory compliance integration from project inception

- Scalable technical architecture supporting growth

- User-friendly interfaces minimizing adoption barriers

Startup Success Stories

Several American blockchain technology startups demonstrate successful scaling strategies and market validation.

Anchorage Digital

Anchorage Digital, a cryptocurrency custody platform for institutional investors, raised $487 million in Series D funding. The company combines cold storage security with hot wallet accessibility, addressing institutional demand for secure digital asset management.

Stably

Stably, a Seattle-based fintech company, specializes in creating stablecoins and blockchain-based financial products. The company raised $7.7 million in Series A funding to develop USD-pegged stablecoins for international remittances and digital payments. Stably’s approach bridges traditional finance with cryptocurrencies, addressing regulatory concerns while providing practical utility.

Tenderly

Tenderly offers a blockchain development platform providing tools for building, testing, and monitoring smart contracts. In its Series B financing, the company obtained $58.6 million to support the growth of its Web3 development platform. Tenderly’s success demonstrates market demand for developer tools supporting blockchain technology application development.

Investment Strategies and Funding Approaches

Venture Capital Trends

Venture capital investment in blockchain technology startups reflects evolving investor sentiment and market maturation. Established venture capital firms are increasingly creating dedicated blockchain investment divisions, recognizing the technology’s capacity for enduring, non-speculative returns. Andreessen Horowitz (a16z), Sequoia Capital, and Bessemer Venture Partners have committed billions to blockchain-focused investment strategies.

The geographic distribution of blockchain venture capital demonstrates the United States’ competitive advantages. American startups captured 38.6% of global blockchain deal count despite representing a smaller percentage of total companies. This concentration reflects sophisticated investor ecosystems, regulatory clarity, and proximity to enterprise customers willing to adopt blockchain solutions.

Investment Considerations:

- Technology maturity and scalability potential

- Regulatory compliance and legal framework alignment

- Market size and adoption trajectory analysis

- Team expertise and execution capability assessment

- Competitive positioning and differentiation factors

Alternative Funding Mechanisms

Blockchain technology enables innovative funding mechanisms unavailable to traditional startups. Token sales, Initial Coin Offerings (ICOs), and Security Token Offerings (STOs) provide direct access to global capital markets. However, these mechanisms require careful regulatory compliance and sophisticated tokenomics design to ensure sustainable business models.

Decentralized Autonomous Organizations (DAOs) represent emerging funding models where communities collectively fund and govern blockchain projects. Protocol DAOs like MakerDAO and Compound DAO manage billions in assets through decentralized governance mechanisms. These models demonstrate alternative approaches to startup funding and governance that may become mainstream as regulatory frameworks evolve.

Future Trends and Market Predictions

Technological Evolution Trajectory

The future of blockchain technology innovation centers on several key technological developments. Modular blockchain architectures decouple core functions like consensus, execution, and data availability, enabling customizable networks tailored to specific use cases. Celestia’s modular data availability network and Polygon’s restructured framework demonstrate this architectural evolution.

Artificial intelligence integration with blockchain technology creates powerful combinations for automated contract execution, predictive analytics, and fraud detection. With an estimated value of $680.89 million in 2025, the blockchain AI market is anticipated to surge to $4.34 billion by 2034, fueled by the integration of these transformative technologies.

Emerging Technology Trends:

- Quantum-resistant cryptographic implementations

- AI-powered smart contract automation

- Environmental sustainability and carbon-neutral consensus

- Privacy-preserving technologies and zero-knowledge proofs

- Cross-chain interoperability protocols

Market Expansion Opportunities

Blockchain technology adoption will accelerate across industries currently underserved by existing solutions. Real estate tokenization enables fractional ownership and improved liquidity for previously illiquid assets. Educational credentialing benefits from tamper-proof certificate verification and lifelong learning records. Energy markets utilize blockchain for peer-to-peer renewable energy trading and carbon credit verification.

The integration of blockchain technology with Internet of Things (IoT) devices creates opportunities for automated machine-to-machine transactions and decentralized data marketplaces. As IoT device deployment expands globally, blockchain infrastructure becomes essential for secure, scalable device communication and micropayment processing.

Challenges and Risk Mitigation

Technical Implementation Risks

Blockchain technology startups face significant technical risks that can impact business viability and customer adoption. Smart contract vulnerabilities can result in substantial financial losses, as demonstrated by numerous DeFi protocol exploits. Thorough security auditing, formal verification methods, and bug bounty programs help mitigate these risks but require substantial investment and technical expertise.

Scalability limitations may constrain growth potential for applications requiring high transaction throughput. Startups must carefully evaluate technical architectures and scaling solutions during early development phases to avoid costly redesigns. Layer 2 solutions, sharding implementations, and hybrid architectures provide potential solutions but add complexity to system design and maintenance.

Risk Mitigation Strategies:

- Comprehensive security auditing and formal verification

- Modular architecture enabling future scalability improvements

- Regulatory compliance integration from project inception

- Diversified technical talent and advisory expertise

- Contingency planning for technology evolution scenarios

Market and Regulatory Uncertainties

Regulatory uncertainty remains a significant risk factor for blockchain technology startups, despite recent policy clarifications. Changes in political leadership, enforcement priorities, or international regulatory coordination can substantially impact business operations. Startups must maintain flexibility to adapt business models and technical implementations as regulatory frameworks evolve.

Market adoption rates may differ significantly from projected timelines, affecting revenue generation and funding requirements. Enterprise sales cycles for blockchain solutions often extend 12-18 months due to technical complexity and integration requirements. Startups require sufficient capital reserves and patient investors to navigate extended adoption periods.

Strategic Recommendations for Entrepreneurs

Market Entry Strategies

Successful blockchain technology startups typically focus on specific industry verticals rather than attempting broad horizontal solutions. Financial services, healthcare, and supply chain management offer established value propositions and willing customer bases. Entrepreneurs should identify specific pain points within these industries where blockchain provides demonstrable advantages over existing solutions.

Partnership strategies prove crucial for blockchain startup success. Engaging with reputable firms offers crucial benefits including customer acquisition, expert technical support, and a strong grasp of compliance regulations. Strategic partnerships with system integrators, consulting firms, and technology vendors can accelerate market entry and reduce customer acquisition costs.

Strategic Success Factors:

- Clear value proposition addressing specific customer pain points

- Regulatory compliance integration from business model inception

- Strategic partnerships with established industry players

- Technical architecture supporting long-term scalability requirements

- Experienced team combining blockchain expertise with industry knowledge

Technology Development Priorities

Blockchain startups need to prioritize user-friendly design and seamless integration over complex technical features to drive adoption. Many promising blockchain applications fail due to poor user interfaces and complex onboarding processes. Successful startups abstract blockchain complexity while providing familiar user experiences comparable to traditional software applications.

Security and compliance must be foundational considerations rather than afterthoughts. Implementing security best practices, regular auditing, and compliance frameworks from project inception prevents costly remediation and builds customer trust. Insurance coverage for smart contract vulnerabilities and professional liability provides additional protection for both startups and customers.

Conclusion: The Innovation Imperative

Blockchain technology represents a generational opportunity for American entrepreneurs to build transformative businesses addressing fundamental inefficiencies in traditional systems. The convergence of regulatory clarity, technical maturation, and enterprise adoption creates favorable conditions for sustainable blockchain startup growth. However, success requires careful navigation of technical challenges, regulatory requirements, and market dynamics unique to this emerging ecosystem.

The projected growth from $57.72 billion to $1.43 trillion by 2030 reflects not speculative hype but genuine transformation across industries ranging from finance to healthcare to government services. Entrepreneurs who combine blockchain expertise with deep industry knowledge, regulatory compliance awareness, and customer-focused execution strategies are positioned to capture significant value creation opportunities.

The next revolution in startup innovation will be defined not by blockchain technology itself, but by practical applications that solve real problems, create measurable value, and scale sustainably within existing regulatory frameworks. American entrepreneurs who embrace this pragmatic approach while maintaining technological innovation leadership will drive the next wave of transformative business model evolution.

Frequently Asked Questions

1. What makes blockchain technology particularly suitable for startup innovation compared to established technologies?

Blockchain technology offers unique advantages for startups including reduced infrastructure requirements, direct access to global markets, and novel business model possibilities. Unlike traditional software development requiring extensive server infrastructure and payment processing partnerships, blockchain enables startups to build decentralized applications with global reach from inception. The technology’s inherent transparency and immutability create trust without requiring established brand recognition, allowing new companies to compete effectively with established players.

The permissionless nature of public blockchains enables startups to access financial services, identity verification, and data storage capabilities without extensive partnerships or regulatory approvals. This democratization of infrastructure particularly benefits entrepreneurs in developing markets or those addressing underserved customer segments. Additionally, blockchain technology enables innovative funding mechanisms like token sales and DAO governance, providing startups with alternative capital sources beyond traditional venture capital.

2. How do regulatory compliance requirements impact blockchain startup development timelines and costs?

Regulatory compliance significantly influences blockchain technology startup development, typically adding 20-30% to overall project timelines and budgets. Compliance requirements vary substantially based on application domain, with financial services applications facing the most stringent requirements from SEC, CFTC, and FinCEN oversight. Healthcare applications must address HIPAA privacy requirements and FDA device regulations, while supply chain solutions encounter customs and agricultural regulatory frameworks.

Successful startups integrate compliance considerations during architectural design phases rather than addressing requirements post-development. This proactive approach prevents costly redesigns and accelerates market entry approval processes. Legal and compliance expertise costs range from $50,000-$200,000 annually for early-stage startups, depending on application complexity and regulatory scope. However, regulatory clarity improvements under the current administration have reduced uncertainty costs and accelerated approval timelines for many blockchain applications.

3. What technical scalability challenges should entrepreneurs anticipate when building blockchain-based solutions?

Scalability challenges represent the most significant technical hurdle for blockchain technology startups, with most networks processing 7-15 transactions per second compared to traditional payment systems handling thousands of transactions per second. Transaction costs increase substantially during network congestion periods, potentially making applications economically unviable during peak usage. Startups must carefully evaluate whether their use cases require high transaction throughput and plan scaling solutions accordingly.

Layer 2 scaling solutions like state channels, rollups, and sidechains address throughput limitations but add architectural complexity and user experience challenges. Hybrid blockchain architectures combining public and private networks offer scalability benefits while maintaining security properties, but require sophisticated technical expertise to implement effectively. Entrepreneurs should budget 15-25% of technical development resources for scalability optimization and plan gradual scaling approaches that grow with user adoption rather than attempting to solve scalability comprehensively at launch.

4. How can startups effectively evaluate market demand and customer willingness to adopt blockchain solutions?

Market validation for blockchain technology solutions requires careful distinction between technological interest and practical adoption willingness. Enterprises often express enthusiasm for blockchain concepts but hesitate when implementation requires significant process changes or integration complexity. Successful market validation focuses on specific pain points that blockchain solves rather than promoting the technology itself.

Pilot programs with enterprise customers provide valuable validation data while generating revenue and case studies for broader market expansion. These engagements typically require 3-6 months for implementation and validation, with successful pilots converting to full deployments at 60-70% rates. Customer willingness to pay premium pricing for blockchain solutions indicates genuine value perception rather than speculative interest. Startups should target customers already experiencing significant costs from problems blockchain addresses, such as supply chain fraud, data security breaches, or payment processing inefficiencies.

5. What funding strategies work best for blockchain technology startups, and how do they differ from traditional startup funding?

Blockchain technology startups benefit from diverse funding options including traditional venture capital, token sales, and DAO governance mechanisms. Traditional VC funding provides operational expertise and strategic guidance but may require longer investment cycles due to technical complexity and regulatory considerations. Blockchain-focused VCs offer industry expertise and regulatory knowledge valuable for navigating compliance requirements.

Token sales enable direct access to global capital markets but require sophisticated tokenomics design and regulatory compliance for securities laws. Successful token sales typically raise $2-10 million for early-stage startups, with funds released based on development milestones rather than equity dilution. DAO funding through grant programs like Ethereum Foundation grants provide $50,000-$500,000 for technical development without equity requirements. Hybrid funding strategies combining VC investment for operations with token sales for community building often provide optimal resource allocation for blockchain startups.

6. What role will artificial intelligence integration play in the future development of blockchain applications?

The convergence of artificial intelligence and blockchain technology creates powerful synergies for automated contract execution, predictive analytics, and fraud detection capabilities. AI-powered smart contracts can automatically adjust parameters based on real-world data, enabling dynamic pricing, risk assessment, and resource allocation without human intervention. This combination particularly benefits supply chain management, insurance claims processing, and financial services applications requiring complex decision-making logic.

The blockchain AI market projects growth from $680.89 million in 2025 to $4.34 billion by 2034, reflecting increasing enterprise adoption of integrated solutions. Machine learning algorithms can analyze blockchain transaction patterns to detect fraudulent activity, optimize network performance, and predict market trends. Privacy-preserving AI techniques like federated learning combined with blockchain data integrity create opportunities for collaborative analytics without exposing sensitive data. Startups combining AI expertise with blockchain development capabilities may capture significant competitive advantages as these technologies mature and converge.

Citations

- https://finance.yahoo.com/news/blockchain-technology-market-size-projected-084800457.html

- https://www.grandviewresearch.com/industry-analysis/blockchain-technology-market

- https://www.galaxy.com/insights/research/crypto-venture-capital-q1-2025

- https://pmc.ncbi.nlm.nih.gov/articles/PMC7004292/

- https://www.cvvc.com/blogs/where-vcs-are-investing-in-2025-blockchain-vs-ai-funding-trends

- https://crustlab.com/blog/what-is-the-future-of-blockchain/

- https://thecurrencyanalytics.com/altcoins/ripples-5-billion-bid-to-acquire-circle-rejected-as-stablecoin-battle-heats-up-186059

- https://finance.yahoo.com/news/circle-pursues-ipo-talks-coinbase-164710952.html

- https://www.unlock-bc.com/142736/circle-stuck-between-5b-ipo-and-acquisition-talks-with-ripple-and-coinbase/

- https://builtin.com/blockchain/blockchain-companies-roundup

- https://www.reveation.io/blog/successful-blockchain-startups

- https://research.aimultiple.com/blockchain-case-studies/

- https://ninjapromo.io/top-30-crypto-vc-investment-funds

- https://www.cnbc.com/2025/04/03/bitcoin-related-startup-deals-rose-in-2024-trammell-venture-partners.html

- https://www.coindesk.com/markets/2025/06/10/ripples-brad-garlinghouse-says-circle-ipo-signals-us-stablecoin-regulation-ahead

- https://journals.sagepub.com/doi/10.1177/21582440251367622

- https://webisoft.com/articles/disadvantages-of-blockchain/

- https://binariks.com/blog/emerging-blockchain-technology-trends/

- https://4irelabs.com/articles/top-23-billion-dollar-blockchain-ideas/

- https://101blockchains.com/companies-using-blockchain-technology/

- https://www.debutinfotech.com/blog/challenges-faced-by-enterprises-in-the-adoption-of-blockchain

- https://qubit.capital/blog/blockchain-startups-overcome-regulatory-challenges

- https://101blockchains.com/blockchain-trends/

- https://www.seedtable.com/best-blockchain-startups-in-united-states

- https://www.protokol.com/insights/overcoming-enterprise-blockchain-challenges/

- https://finlaw.in/blog/blockchain-project-ideas-for-startups-that-could-disrupt-industries-in-2025

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4067588

- https://qubit.capital/blog/build-winning-blockchain-business-plan-startups

- https://ijarsct.co.in/Paper4527.pdf

- https://www.cvvc.com

- https://www.21by72.com/blockchain-startups/

- https://www.alchemy.com/dapps/top/venture-capital-firms

- https://www.sciencedirect.com/science/article/pii/S1047831021000146

- https://hashlock.com/services/crypto-capital-venture-funding

- https://www.sciencedirect.com/journal/blockchain-research-and-applications

- https://www.rapidinnovation.io/post/top-blockchain-startups-to-watch

- https://www.galaxy.com/insights/research/crypto-blockchain-venture-capital-q2-2025

- https://digitalcommons.odu.edu/cgi/viewcontent.cgi?article=1079&context=itds_facpubs

- https://lnct.ac.in/future-of-blockchain-technology-by-2025/

- https://startupsavant.com/startups-to-watch/blockchain

- https://growthlist.co/blockchain-startups/

- https://www.grandviewresearch.com/horizon/outlook/blockchain-technology-market-size/global

- https://ec-europa-eu.libguides.com/blockchain/research/journals

- https://www.tekrevol.com/blogs/blockchain-statistics-facts/

- https://blockchain.ubc.ca/research/research-papers

- https://www.nextmsc.com/report/blockchain-market-bf3157

- https://www.sciencedirect.com/science/article/pii/S2444569X24001446

- https://www.fortunebusinessinsights.com/press-release/blockchain-technology-market-9046

- https://www.emerald.com/gkmc/article/74/1-2/128/1239566/Blockchain-innovations-and-the-contribution-of-the

- https://www.embroker.com/blog/startup-statistics/

- https://www.custommarketinsights.com/report/blockchain-technology-market/

- https://webisoft.com/articles/blockchain-crypto-statistics/

- https://www.marketsandmarkets.com/Market-Reports/blockchain-technology-market-90100890.html

- https://www.statista.com/topics/5122/blockchain/

- https://moldstud.com/articles/p-global-success-stories-in-remote-blockchain-development-inspiring-case-studies

- https://www.debutinfotech.com/blog/top-20-supply-chain-startups-using-blockchain-technology

- https://webisoft.com/articles/blockchain-development-company-in-north-america/

- https://accubits.com/blockchain-case-studies-and-success-stories/

- https://fortune.com/2025/05/19/circle-internet-coinbase-ripple-goldman-sachs-ipos-cryptocurrency-mergers-sp-500/

- https://www.linkedin.com/pulse/blockchain-case-studies-real-world-success-stories-build-my-dapp-oux5f

- https://www.investopedia.com/10-biggest-blockchain-companies-5213784

- https://www.solulab.com/case-studies/

- https://cybermagazine.com/articles/top-10-blockchain-companies

- https://www.thetokendispatch.com/p/coinbase-v-ripple-the-battle-for

- https://www.pragmaticcoders.com/success-stories/tag/blockchain

- https://www.solulab.com/fintech-startups-blockchain/

- https://iaeme.com/Home/journal/IJBT

- https://www.rapidinnovation.io/post/future-trends-in-blockchain-technology

- https://jisem-journal.com/index.php/journal/article/view/3046

- https://www.frontiersin.org/journals/blockchain/articles/10.3389/fbloc.2025.1491609/full

- https://www.precedenceresearch.com/blockchain-technology-market

- https://ietresearch.onlinelibrary.wiley.com/journal/26341573

- https://www.sciencedirect.com/science/article/pii/S2199853124001495

- https://www.emerald.com/jebde/article/doi/10.1108/JEBDE-08-2024-0023/1252008/Academic-exploration-of-blockchain-and-AI-in

- https://www.sciencedirect.com/science/article/pii/S0959652623009988