Tax loss harvesting tips have become increasingly valuable for American investors navigating volatile markets and seeking to maximize after-tax returns. This powerful tax strategy allows investors to systematically convert investment losses into meaningful tax savings, potentially adding 1-2% in annual after-tax returns while maintaining portfolio growth objectives.

As markets experience inevitable downturns, understanding how to implement tax loss harvesting tips effectively can transform temporary setbacks into long-term financial advantages. The strategy works by selling investments that have declined in value to realize capital losses, which can then offset capital gains from profitable investments or reduce ordinary income by up to $3,000 annually.

High-net-worth investors and those in elevated tax brackets stand to benefit most significantly, particularly when combining tax loss harvesting with sophisticated approaches like direct indexing or systematic year-round implementation. Recent research demonstrates that robo-advisors implementing automated tax-loss harvesting have generated over $1 billion in estimated tax savings for clients over the past decade, with some platforms reporting that 96% of participants have had their advisory fees completely covered by the tax benefits.

Whether managing individual stocks, exchange-traded funds, municipal bonds, or even cryptocurrency portfolios, mastering these tax loss harvesting tips can substantially reduce your tax burden while keeping your investment strategy on track.

Understanding the Fundamentals of Tax Loss Harvesting

Tax loss harvesting represents a cornerstone strategy for tax-efficient investing, allowing investors to strategically sell securities at a loss to offset taxable capital gains and reduce overall tax liability. The fundamental principle revolves around using the tax code to transform market downturns into valuable opportunities for tax reduction without disrupting long-term investment objectives. When properly executed, this approach enables investors to maintain their desired asset allocation while capturing immediate tax benefits that compound over time.

2025 Capital Gains Tax Rates comparison showing the significant tax advantages of long-term holdings versus short-term gains for single filers across different income brackets

The mechanics of tax loss harvesting begin with identifying investments trading below their original purchase price, known as the cost basis. Once identified, these underperforming securities are sold to realize a capital loss that can be applied against capital gains generated elsewhere in the portfolio. The proceeds from the sale are then reinvested into similar but not substantially identical securities, ensuring continued market exposure while adhering to IRS regulations. This process creates what investment professionals call “tax alpha”—additional returns generated through tax efficiency rather than market performance.

Tax-loss harvesting generates significant tax alpha, with municipal bonds and direct indexing strategies providing the highest after-tax excess returns for investors

Capital losses harvested through this strategy provide multiple avenues for tax reduction. First, they offset capital gains dollar-for-dollar, with no limit on the amount of gains that can be offset in a given year. Short-term losses initially offset short-term gains, while long-term losses offset long-term gains, though any excess losses from one category can then be applied to the other. This matching system proves particularly valuable for high-income investors subject to the 3.8% Net Investment Income Tax, as harvested losses reduce the income subject to this additional levy.

Beyond offsetting gains, tax-loss harvesting allows investors to deduct up to $3,000 of net capital losses against ordinary income annually, with the limit reduced to $1,500 for married individuals filing separately. This provision proves especially beneficial during years when an investor experiences net losses across their portfolio, providing immediate relief on the tax return. Any losses exceeding both capital gains and the $3,000 ordinary income limit can be carried forward indefinitely to future tax years, creating a valuable tax asset that continues providing benefits long after the original loss was harvested.

The distinction between short-term and long-term capital gains significantly impacts the value of tax loss harvesting tips. Short-term capital gains, generated from securities held for one year or less, face taxation at ordinary income rates ranging from 10% to 37% for 2025. Conversely, long-term capital gains benefit from preferential rates of 0%, 15%, or 20%, depending on income level. Harvesting losses to offset short-term gains provides substantially greater tax savings, as each dollar of loss offsets income that would otherwise be taxed at rates potentially exceeding 40% when including the Net Investment Income Tax.

Research conducted at MIT examining historical U.S. market data from 1926 to 2018 found that tax loss harvesting generated an average geometric tax alpha of 1.10% annually, with results ranging from 0.57% to 2.29% per year depending on market conditions. This variability underscores the importance of implementing tax-loss harvesting systematically throughout the year rather than waiting for year-end, as market volatility creates the most abundant harvesting opportunities. The study also noted that tax loss harvesting proves most valuable when investors have other gains to offset, though the ability to carry losses forward maintains the strategy’s relevance even during periods when losses exceed gains.

Navigating the Wash Sale Rule Successfully

The wash sale rule represents the most critical compliance consideration when implementing tax loss harvesting tips, and violating this regulation can completely negate the intended tax benefits. Established to prevent taxpayers from claiming artificial losses while maintaining identical investment positions, the wash sale rule disallows capital loss deductions when an investor purchases the same or a substantially identical security within 30 days before or after the sale date. This creates a 61-day window—spanning 30 days prior, the sale date itself, and 30 days following during which repurchasing the sold security or its equivalent triggers the rule.

Wash Sale Rule 61-day timeline showing prohibited purchase periods before and after selling securities at a loss

Understanding what constitutes a “substantially identical” security proves essential for successful tax loss harvesting implementation. The Internal Revenue Service has deliberately avoided providing precise definitions, creating interpretive challenges for investors and advisors.

However, general principles have emerged through IRS guidance and tax practitioner consensus. Selling shares of one company and purchasing shares of a different company, even within the same industry, generally avoids wash sale violations. Similarly, selling an exchange-traded fund tracking one index and purchasing an ETF tracking a different index typically satisfies the requirement, even when the two funds have substantial overlap.

Common examples of substantially identical securities include stocks and warrants from the same corporation, bonds from the same issuer with similar maturity dates and interest rates, and mutual fund shares from different share classes of the identical fund.

Conversely, securities generally not considered substantially identical include common stock versus preferred stock from the same company, bonds with different maturity dates or interest rates from the same issuer, and stocks from different companies even when operating in the same sector. The S&P 500 ETF from one provider and the total stock market ETF from another provider would not be considered substantially identical despite both tracking U.S. equity markets.

The wash sale rule extends beyond simple repurchases in the same account where the loss occurred. Purchases of substantially identical securities in any account controlled by the taxpayer or their spouse trigger the rule, including tax-deferred retirement accounts like traditional IRAs, Roth IRAs, and 401(k) plans.

This cross-account application creates particular complexity for investors managing multiple portfolios, as purchasing replacement shares in an IRA to avoid wash sale implications actually triggers the rule while providing no offsetting benefit since retirement account losses aren’t deductible. Financial advisors must coordinate across all household accounts to prevent inadvertent violations.

When a wash sale occurs, the disallowed loss doesn’t disappear entirely but rather gets added to the cost basis of the replacement security. This adjustment preserves the economic benefit of the loss by reducing future gains when the replacement security is eventually sold, effectively deferring rather than eliminating the tax benefit.

Additionally, the holding period of the original security transfers to the replacement shares, potentially converting what would have been a short-term gain into a long-term gain eligible for preferential rates. While this mitigation softens the impact of wash sale violations, investors still lose the ability to offset current-year gains or income, which represents the primary value of tax loss harvesting.

Strategic approaches exist for avoiding wash sale violations while maintaining desired market exposure. The most straightforward method involves waiting 31 days after the loss sale before repurchasing the same security, though this approach creates risk if the security rebounds during the waiting period. A more sophisticated technique employs “tax loss harvesting with similar assets,” where investors immediately purchase a different but highly correlated security.

For example, selling the Vanguard Total Stock Market ETF (VTI) at a loss and immediately buying the SPDR Portfolio Total Stock Market ETF (SPTM) maintains total U.S. stock market exposure while avoiding wash sale issues since the funds track different indexes. This approach has become standard practice among robo-advisors and professional wealth managers implementing systematic tax loss harvesting.

Alternative strategies for managing wash sale risk include the “double-up” method, where investors purchase additional shares of the position they wish to harvest, wait 31 days, then sell the original tax lot at a loss.

This technique maintains continuous market exposure but requires deploying additional capital and creates concentration risk during the 31-day holding period. Another approach involves selling the entire position, immediately investing in a sector ETF or related investment, waiting 31 days, then rotating back to the original holding. Each strategy presents tradeoffs between tax efficiency, tracking error versus the desired investment, and implementation complexity.

For cryptocurrency investors, the wash sale rule currently presents a unique opportunity. Because the IRS classifies cryptocurrency as property rather than securities, the wash sale rule does not apply to digital assets under current regulations.

This means investors can sell Bitcoin or other cryptocurrencies at a loss and immediately repurchase the identical asset without any waiting period, capturing the tax loss while maintaining their position. However, legislative proposals have sought to close this loophole, and investors should monitor potential rule changes that could extend wash sale provisions to cryptocurrency transactions.

Implementing Tax Loss Harvesting Tips Across Investment Types

Tax loss harvesting tips apply differently across various investment vehicles, with each offering distinct advantages and implementation considerations based on structure, liquidity, and tax characteristics. Understanding these nuances enables investors to maximize tax efficiency while maintaining their strategic asset allocation across stocks, bonds, funds, and alternative investments. The vehicle selected for tax loss harvesting significantly impacts both the frequency of opportunities and the magnitude of potential tax benefits.

Direct indexing through separately managed accounts (SMAs) has emerged as the gold standard for systematic tax loss harvesting implementation. Unlike mutual funds or exchange-traded funds where investors own a single security, direct indexing allows investors to own the individual stocks comprising a benchmark index.

This structure creates exponentially more tax loss harvesting opportunities since losses can be realized at the individual security level rather than only when the entire fund declines. Technology platforms can monitor these positions continuously, executing trades daily or even multiple times daily to capture losses as they emerge.

Research comparing daily versus monthly tax loss harvesting in direct indexing strategies found that the continuous daily approach generated approximately 30 basis points of additional annual tax savings compared to monthly reviews. Investment managers like Wealthfront report that their automated direct indexing platforms have harvested over $145 million in losses annually, translating to nearly $50 million in estimated tax benefits for clients.

For the third quarter of 2025 alone, Parametric sold more than $13 billion in securities across fixed income separately managed accounts, realizing $330 million in net losses and delivering over $119 million in potential tax benefits. These figures demonstrate the substantial value direct indexing brings to high-net-worth investors seeking to maximize tax efficiency.

Exchange-traded funds represent the most accessible vehicle for implementing tax loss harvesting tips for most investors. ETFs offer substantial liquidity, tight bid-ask spreads, and the ability to easily identify similar but not substantially identical replacement funds when harvesting losses.

For example, an investor holding the SPDR S&P 500 ETF (SPY) that has declined can sell the position and immediately purchase the Vanguard S&P 500 ETF (VOO) or the iShares Core S&P 500 ETF (IVV) without violating wash sale rules, as these represent different securities despite tracking the same index. This flexibility has made ETF-based tax loss harvesting the foundation of robo-advisor platforms, which have democratized the strategy for investors with relatively modest account sizes.

Robo-advisors like Betterment and Wealthfront have integrated automated tax loss harvesting as a core service, with Betterment estimating the strategy adds 0.77% in additional annual returns for typical investors and Wealthfront projecting benefits ranging from 1.11% to 1.98% depending on the investor’s tax burden.

These platforms employ algorithms that monitor portfolios continuously, automatically executing harvesting trades when losses exceed predetermined thresholds and immediately reinvesting proceeds into predetermined replacement ETFs. The automation eliminates the manual effort traditionally required while ensuring systematic implementation throughout the year rather than only during year-end tax planning.

Individual stock positions present robust opportunities for tax loss harvesting, particularly within diversified portfolios where some holdings invariably underperform even during bull markets. Investors can sell losing stock positions and either rotate into stocks from different companies within the same sector or invest in sector-specific ETFs to maintain similar market exposure.

For concentrated stock positions with substantial embedded gains, combining tax loss harvesting from a diversified direct indexing portfolio with gradual liquidation of the appreciated shares creates a tax-efficient transition strategy. Over a three-to-five-year period, realized losses from the indexed portfolio offset gains from reducing the concentrated position, minimizing the tax impact of diversification.

Municipal bonds offer particularly attractive tax loss harvesting opportunities for high-income investors due to the unique characteristics of fixed-income securities. Unlike perpetual securities like stocks, bonds have finite lives and mature at par value.

When investors sell municipal bonds at a loss and reinvest the proceeds in similar bonds purchased at a premium to par, the harvested loss provides immediate tax benefits while the replacement bond generates no additional capital gain upon maturity. This structure potentially eliminates capital gains tax liabilities rather than merely deferring them, making municipal bond tax loss harvesting especially powerful.

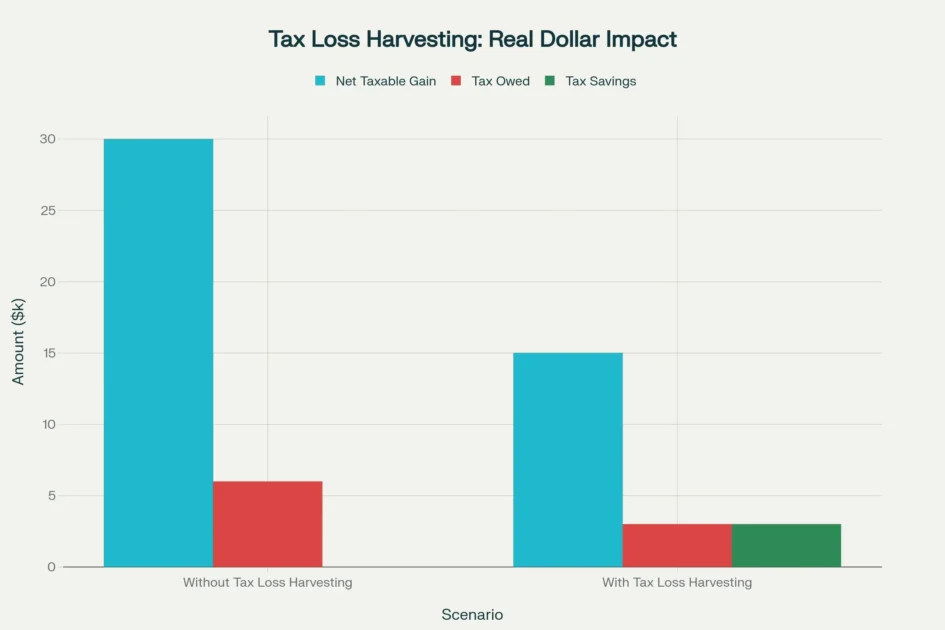

Tax-loss harvesting can reduce tax liability by 50% in this example, saving $3,000 by offsetting $30,000 in capital gains with $15,000 in harvested losses

The municipal bond market’s depth and diversity facilitate effective tax loss harvesting implementation. With thousands of issuers and substantial daily trading volume, investors can easily identify replacement bonds that avoid wash sale issues while maintaining similar credit quality, duration, and yield characteristics.

PIMCO and other fixed-income managers employ technology-driven approaches to identify harvesting opportunities across eligible municipal bond accounts, aggregate trades for improved execution, and ensure compliance with wash sale regulations. During 2025’s volatile interest rate environment, firms implementing systematic municipal bond tax loss harvesting captured significant value for clients as rising yields created temporary losses in existing holdings.

Corporate bonds and other taxable fixed-income securities similarly benefit from tax loss harvesting, though the potential tax alpha proves lower than municipal bonds due to different tax dynamics. Investment-grade corporate bond portfolios managed with systematic loss harvesting can add approximately 0.3% in annual after-tax returns according to third-party research. The strategy proves particularly effective during periods of rising interest rates, when existing bond holdings experience price declines that create harvesting opportunities before the bonds mature and return to par value.

Cryptocurrency represents a unique asset class for tax loss harvesting due to its extreme volatility and current exemption from wash sale rules. Digital asset investors can sell cryptocurrencies like Bitcoin or Ethereum at a loss, immediately repurchase the identical asset, and claim the capital loss for tax purposes without any waiting period.

This creates unlimited opportunities to harvest losses while maintaining desired exposure to specific cryptocurrencies. Investors must report crypto losses on Form 8949 and can use them to offset capital gains from any source—stocks, real estate, or other crypto sales—plus up to $3,000 of ordinary income annually. While legislative proposals may eventually close this loophole by extending wash sale rules to digital assets, under current 2025 regulations, cryptocurrency offers the most flexible tax loss harvesting opportunities available.

Strategic Timing Throughout the Tax Year

Timing represents a critical yet frequently overlooked dimension of effective tax loss harvesting tips, with research and market history demonstrating that year-round systematic implementation substantially outperforms traditional year-end approaches.

The conventional practice of concentrating tax loss harvesting in November and December—driven by year-end tax planning deadlines—often proves suboptimal due to reduced market volatility during these months, crowded trades, and administrative bottlenecks. Historical analysis of S&P 500 returns since 1950 reveals that November and December typically rank among the best-performing months for equities, with average gains of 1.8% and 1.6% respectively, making these periods among the worst times to find abundant harvesting opportunities.

Systematic tax loss harvesting throughout the year allows investors to accumulate substantially larger amounts of harvested losses by capturing opportunities as market volatility creates them. When losses are harvested early in the year, investors have the remainder of the tax year to potentially use those losses to offset gains from portfolio rebalancing, year-end mutual fund distributions, or unexpected taxable events.

For example, investors who sold a business or investment property in January and immediately established a direct indexing portfolio could spend the next eleven months systematically harvesting losses to offset the realized gain, potentially reducing their tax liability by tens or hundreds of thousands of dollars.

Market data supports the year-round approach’s superiority. Analysis examining monthly S&P 500 returns found that August, September, February, and June historically present more abundant tax loss harvesting opportunities than November or December, with August showing an average return of -0.1% and September averaging -0.5%. Investors implementing monthly or quarterly portfolio reviews for tax-loss harvesting capture these mid-year opportunities before market rebounds eliminate them.

Russell Investments research comparing various review frequencies found that daily monitoring and harvesting generated the highest tax alpha, followed by weekly, monthly, and quarterly approaches, with year-end-only implementation producing the lowest benefits.

The deadline for completing tax loss harvesting transactions typically falls on the last business day of December for the current tax year, though specific dates vary when December 31 falls on a weekend. However, settlement timing creates an additional consideration that many investors overlook.

Securities transactions in U.S. markets generally settle two business days after the trade date (T+2), so trades executed late in December must account for settlement timeframes to ensure they count for the current tax year. Financial advisors recommend completing year-end tax loss harvesting trades by mid-December to avoid settlement complications and ensure sufficient time for proper execution.

Strategic investors can optimize timing by coordinating tax loss harvesting with portfolio rebalancing activities. When periodic rebalancing indicates a need to reduce exposure to certain asset classes or sectors, reviewing these positions for unrealized losses before selling creates opportunities to capture tax benefits while achieving allocation objectives.

This integrated approach to portfolio management and tax efficiency ensures that rebalancing activities contribute to tax alpha rather than creating unnecessary tax liabilities. Research examining the combination of rebalancing and tax loss harvesting found that investors who systematically implemented both strategies achieved better after-tax returns than those who treated the activities separately.

Market volatility spikes present particularly valuable windows for aggressive tax loss harvesting implementation. During periods like the 2020 pandemic-driven market decline, the 2022 bear market, or the 2025 first-quarter volatility, systematic tax-loss harvesting programs captured exceptional value as widespread price declines created abundant opportunities.

High-net-worth investors working with wealth managers often establish “volatility response” protocols that automatically trigger increased harvesting activity when market swings exceed certain thresholds. This opportunistic approach supplements regular systematic reviews by capturing outsized losses during unusual market conditions.

For investors planning major life transitions or anticipating significant taxable events, proactive tax loss harvesting in advance creates valuable offsets. Those expecting to sell a business, exercise stock options, or liquidate highly appreciated real estate within the next one to three years benefit from establishing direct indexing portfolios immediately and beginning systematic loss harvesting.

The accumulated losses can then be strategically deployed to offset the anticipated gains, potentially saving hundreds of thousands or even millions in taxes depending on the transaction size. Financial planners increasingly incorporate multi-year tax loss harvesting strategies into comprehensive wealth management plans for clients anticipating substantial taxable events.

Maximizing Tax Efficiency for High-Income Investors

High-income investors face disproportionately large tax burdens that make tax loss harvesting tips especially valuable, with the strategy potentially generating significantly greater benefits than for investors in lower tax brackets.

Multiple factors converge to amplify the value of tax-loss harvesting for affluent taxpayers, including higher marginal ordinary income tax rates reaching 37% for 2025, long-term capital gains rates of 20% for high earners, the 3.8% Net Investment Income Tax applying to investment income above certain thresholds, and state income taxes that further increase the effective tax rate on investment gains.

The Net Investment Income Tax warrants particular attention when evaluating tax loss harvesting benefits for wealthy investors. This 3.8% surtax applies to the lesser of net investment income or modified adjusted gross income exceeding $200,000 for single filers or $250,000 for married couples filing jointly.

When combined with the top 20% long-term capital gains rate, the effective federal tax on investment gains reaches 23.8% before considering state taxes. In high-tax states like California, New York, or New Jersey, the combined federal and state effective rate can approach or exceed 30% on long-term gains and 50% on short-term gains. Harvesting losses to offset these highly-taxed gains creates substantial dollar savings.

Advanced tax loss harvesting techniques tailored for ultra-high-net-worth individuals involve sophisticated strategies beyond basic implementation. Asset location optimization places tax-inefficient investments like taxable bonds and REITs in tax-deferred accounts while maintaining tax-efficient equity holdings in taxable accounts where losses can be harvested.

Cross-asset-class harvesting systematically reviews all investment categories—domestic equities, international stocks, fixed income, alternatives—to identify loss opportunities across the entire portfolio rather than examining each sleeve in isolation. This comprehensive approach maximizes the total losses captured while maintaining desired overall asset allocation.

Direct indexing at scale provides high-net-worth investors with unparalleled tax loss harvesting capabilities unavailable through traditional fund structures. By owning hundreds or thousands of individual securities across multiple separately managed accounts, affluent investors create exponentially more tax lots that can be selectively harvested.

Sophisticated wealth management firms employ technology platforms that monitor these positions continuously, executing trades automatically when losses exceed predetermined thresholds while maintaining tight tracking to benchmark indexes. Cerulli Associates projects that direct indexing assets will surpass $800 billion by 2026, driven primarily by high-net-worth demand for superior tax management.

Institutional-quality implementation combines direct indexing with customization overlays that reflect investor preferences while enhancing tax efficiency. Environmental, social, and governance screens can be applied to exclude certain industries or companies while the underlying tax loss harvesting algorithms continue operating. Sector tilts or factor exposures can be incorporated to express investment views without sacrificing tax optimization.

Some ultra-wealthy families employ multiple direct indexing strategies across different market segments—large cap, mid cap, small cap, international—each operating independently to generate tax losses while collectively providing comprehensive market exposure.

The compounding effect of reinvested tax savings amplifies long-term wealth accumulation for high-income investors implementing systematic tax loss harvesting. When tax savings generated from harvested losses are immediately reinvested into the portfolio rather than spent, these funds benefit from years or decades of additional compound growth.

Financial planning analyses modeling this effect over 20-30 year time horizons demonstrate that the accumulated value of reinvested tax savings can reach millions of dollars for high-net-worth portfolios, substantially exceeding the sum of individual annual tax benefits. This multiplicative effect makes tax loss harvesting one of the most powerful wealth accumulation tools available to affluent investors.

Professional tax and legal guidance proves essential for high-net-worth investors implementing sophisticated tax loss harvesting strategies. Complex situations involving multiple entity structures, trust accounts, concentrated stock positions, or cross-border tax considerations require coordinated planning with CPAs, tax attorneys, and wealth advisors.

State-specific tax rules add another layer of complexity, as not all states allow loss carryforwards or apply the same $3,000 ordinary income offset limit. Comprehensive wealth management firms increasingly offer integrated tax advisory services or maintain close partnerships with tax professionals to ensure tax loss harvesting implementation aligns with broader estate planning, business succession, and multi-generational wealth transfer strategies.

Avoiding Critical Tax Loss Harvesting Mistakes

Implementing tax loss harvesting tips successfully requires vigilance in avoiding common pitfalls that can negate intended benefits or create unintended tax consequences. The most prevalent error involves violating the wash sale rule, which completely disallows the harvested loss when investors repurchase substantially identical securities within the 61-day window.

This mistake often occurs through inadvertent purchases in different accounts, automated dividend reinvestment programs that acquire additional shares of the sold security, or spouse accounts that independently purchase the same holding. Preventing wash sale violations requires comprehensive oversight across all household accounts and coordination of trading activity to ensure no prohibited purchases occur.

Attempting tax loss harvesting within retirement accounts ranks among the most fundamental errors investors make, yet it remains surprisingly common. Traditional IRAs, Roth IRAs, 401(k) plans, and other tax-advantaged accounts do not generate taxable capital gains, so capital losses within these accounts provide no tax benefit whatsoever. Selling positions at a loss within retirement accounts simply locks in investment losses without any offsetting tax deduction. The only appropriate time to realize losses in these accounts occurs when rebalancing or replacing an investment for legitimate portfolio management reasons unrelated to tax considerations.

Selling quality long-term investments solely to capture tax losses represents a strategic mistake that prioritizes short-term tax savings over long-term wealth building. While harvesting losses provides immediate tax benefits, parting with fundamentally sound investments that temporarily declined in value can result in missing subsequent recovery and appreciation.

The most effective implementations of tax loss harvesting tips involve selling underperforming investments that no longer align with the portfolio strategy while immediately reinvesting proceeds in similar securities to maintain market exposure. Investors should evaluate whether they would still want to own the security if purchasing it today at current prices; if the answer is yes, using similar replacement securities preserves the investment thesis while capturing the tax loss.

Neglecting to account for transaction costs and advisory fees when implementing tax loss harvesting can erode or eliminate the net benefit of the strategy. Frequent trading generates commission costs, bid-ask spreads reduce execution prices, and some investment platforms charge fees based on trading activity. Before executing a tax-loss harvesting trade, investors should calculate whether the expected tax savings exceed the all-in transaction costs.

For smaller accounts or modest loss amounts, the math may not support harvesting every available loss. This consideration particularly applies to individual investors managing their own tax loss harvesting rather than using zero-commission platforms or professional advisors who have negotiated institutional trading costs.

Forgetting to track and apply capital loss carryforwards in subsequent years wastes valuable tax assets that took deliberate effort to create. When annual losses exceed both capital gains and the $3,000 ordinary income deduction limit, the excess carries forward indefinitely to offset future gains or income.

However, taxpayers must actively track these carryforward amounts and remember to apply them on future tax returns, as the IRS does not automatically calculate or prompt for their use. Maintaining detailed records of harvested losses, the year they occurred, and the amounts carried forward to subsequent years ensures no tax benefits are inadvertently abandoned.

Triggering short-term capital gains while harvesting losses requires careful consideration of the tax-rate differential. Short-term gains face taxation at ordinary income rates as high as 37%, while long-term gains benefit from preferential rates typically capped at 20%.

When rebalancing portfolios or replacing securities after loss harvesting, inadvertently selling positions held less than one year can generate short-term gains that face much higher tax rates than the long-term gains being offset. Strategic tax lot selection—choosing which specific shares to sell based on their acquisition date and cost basis—helps avoid converting long-term holdings into short-term gains.

Overlooking mutual fund and ETF distribution timing presents another subtle but consequential error. Most mutual funds and many ETFs distribute capital gains to shareholders annually, typically in December. Investors who purchase fund shares shortly before the distribution date receive taxable capital gains attributed to appreciation that occurred before they owned the investment.

When combined with tax loss harvesting, purchasing replacement funds immediately before their distribution dates can partially negate the benefits of the harvested loss by creating unexpected taxable gains. Reviewing upcoming distribution schedules before executing replacement trades helps avoid this timing issue.

Failing to consider the impact of future tax rate changes represents a sophisticated planning error that affects long-term tax efficiency. Tax-loss harvesting provides the greatest benefit when losses are harvested during high-income years and offset gains realized during lower-income years.

For example, surgeons or corporate executives in their peak earning years facing the top 37% marginal rate who harvest losses and carry them forward into retirement when their rate drops to 24% or lower may have been better served realizing gains at the lower rate during retirement rather than during high-earning years. While predicting future tax rates involves uncertainty, incorporating lifetime income projections and potential tax law changes into tax loss harvesting strategies optimizes the timing of loss realization relative to gain recognition.

Leveraging Technology and Professional Guidance

The evolution of tax loss harvesting tips from manual year-end exercises to sophisticated automated strategies reflects dramatic technological advances in wealth management platforms. Modern investment technology enables continuous portfolio monitoring, instantaneous loss identification, automatic trade execution, and wash sale avoidance tracking that would be impossible through manual processes.

Robo-advisors pioneered the democratization of automated tax loss harvesting, bringing strategies previously available only to ultra-wealthy clients to investors with account minimums as low as $500 to $5,000.

Leading robo-advisor platforms employ algorithms that monitor client portfolios constantly, executing tax-loss harvesting trades whenever positions decline below predetermined thresholds. Betterment, Wealthfront, and other automated platforms maintain lists of primary ETFs and corresponding replacement securities that provide similar market exposure without violating wash sale rules.

When a position in the primary ETF declines sufficiently to generate meaningful tax savings, the system automatically sells the position and immediately purchases the replacement ETF, then reverses the trade 31 days later if desired. This systematic automation captures far more tax loss harvesting opportunities than investors manually reviewing portfolios quarterly or annually.

Performance data from robo-advisors demonstrates the substantial value of automated implementation. Wealthfront reports harvesting over $145 million in losses during 2024 alone, generating an estimated $49.83 million in tax benefits for clients. Over the past decade, the platform estimates it has delivered more than $1 billion in cumulative tax savings to investors.

Notably, approximately 96% of Wealthfront clients who have used tax-loss harvesting for at least one year have had their annual advisory fees completely covered by the estimated tax benefits, with average tax savings reaching 7.6 times the 0.25% annual fee. These results illustrate how effective automated tax loss harvesting can make professional investment management essentially free on an after-tax basis.

Direct indexing platforms from firms like Parametric, Charles Schwab, BlackRock, and Vanguard represent the institutional-grade evolution of automated tax loss harvesting for high-net-worth investors. These separately managed account platforms own hundreds or thousands of individual securities rather than ETFs, creating exponentially more tax lots and harvesting opportunities.

Sophisticated algorithms monitor positions at the individual security level, comparing each holding’s current price to its cost basis and executing harvesting trades whenever losses exceed predefined thresholds. The systems simultaneously manage wash sale compliance, index tracking error, and transaction cost minimization across thousands of client accounts.

Daily monitoring and trading in direct indexing strategies generates approximately 30 basis points of additional annual tax savings compared to monthly review frequencies, according to analysis by J.P. Morgan Asset Management.

The continuous approach captures losses quickly during market volatility before positions recover, maximizing the total losses harvested throughout the year. Russell Investments employs a trading desk staffed 24 hours daily with traders averaging over 15 years of experience who systematically search for harvesting opportunities while balancing risk and benchmark tracking. This professional implementation substantially exceeds the results achievable through manual processes or infrequent reviews.

Integration of tax loss harvesting technology with comprehensive financial planning software creates synergies that optimize overall wealth management strategies. Advanced platforms incorporate tax projections, estate planning considerations, and multi-year income modeling to identify optimal timing for gain realization and loss harvesting.

For example, the technology can identify years when clients should intentionally realize gains to utilize lower tax brackets or harvest maximum losses to offset anticipated large gains from business sales or real estate transactions. This forward-looking integration transforms tax-loss harvesting from a reactive year-end exercise into a proactive multi-year wealth optimization strategy.

Professional guidance from certified financial planners, certified public accountants, and tax attorneys remains essential despite technological advances, particularly for high-net-worth individuals with complex situations. Tax professionals provide personalized analysis considering client-specific factors including state tax implications, alternative minimum tax exposure, estate tax planning integration, and charitable giving strategies that interact with capital gain and loss recognition.

CPAs ensure proper reporting of harvested losses on Schedule D and Form 8949, accurate tracking of loss carryforwards, and compliance with evolving IRS regulations. Estate planning attorneys coordinate tax loss harvesting with wealth transfer strategies, trust administration, and multigenerational tax planning.

The combination of sophisticated technology implementation and professional advisory oversight delivers optimal results for investors across wealth levels. Robo-advisors serve mass-affluent clients seeking low-cost automated solutions, while hybrid models combining automated platforms with human financial advisor access appeal to investors wanting both efficiency and personalized guidance.

Ultra-high-net-worth families typically engage dedicated wealth management teams coordinating direct indexing implementation, comprehensive tax planning, estate design, and family office services. Regardless of wealth level, successful tax loss harvesting implementation requires either robust technology tools, professional expertise, or ideally both working in coordination to maximize after-tax returns over investment lifetimes.

Building a Year-Round Tax Loss Harvesting Strategy

Developing a systematic year-round approach to tax loss harvesting tips transforms the strategy from an occasional tax-saving tactic into a comprehensive wealth optimization discipline. Successful implementation begins with establishing clear guidelines for when and how to harvest losses, defining replacement security selections, and integrating tax-loss harvesting seamlessly with overall portfolio management activities. The framework should balance maximizing tax benefits against minimizing trading costs, tracking error, and disruption to long-term investment objectives.

Setting specific loss thresholds creates objective criteria for executing tax-loss harvesting trades rather than relying on subjective judgment or sporadic reviews. Common threshold approaches include harvesting any loss exceeding $1,000 in absolute terms, losses representing more than 5-10% decline from cost basis, or losses that would generate tax savings exceeding trading costs by a defined multiple.

More sophisticated strategies employ tiered thresholds, harvesting smaller losses during high-volatility periods when abundant opportunities exist but maintaining higher bars during stable markets when losses appear less frequently. Direct indexing platforms typically set thresholds between $50 and $500 per position depending on account size and transaction costs.

Establishing a regular review calendar ensures consistent monitoring and timely action when opportunities arise. Quarterly reviews represent a practical minimum frequency for most individual investors managing their own tax-loss harvesting, allowing sufficient time for positions to develop meaningful losses while capturing opportunities before year-end.

Monthly reviews increase the likelihood of identifying and acting on losses before market recoveries eliminate them. Investors using automated platforms or working with active wealth managers should employ daily or weekly monitoring to maximize opportunities captured throughout market cycles. The review process should examine all taxable accounts holistically, identifying total losses available and prioritizing the most tax-efficient positions to harvest first.

Pre-approved replacement securities streamline implementation by eliminating delays in identifying appropriate investments after selling loss positions. For equity ETF portfolios, maintaining a matrix matching each primary holding with one or two acceptable replacements that provide similar exposure without wash sale concerns enables immediate reinvestment.

For example, pairing the Vanguard S&P 500 ETF (VOO) with the SPDR S&P 500 ETF (SPY) and the iShares Core S&P 500 ETF (IVV) provides multiple replacement options depending on which position needs harvesting. Similar mappings should exist for international equity, bond, and sector-specific holdings across the portfolio. Direct indexing strategies maintain databases of thousands of replacement securities for individual stock positions, enabling automated selection of appropriate swaps when losses are harvested.

Coordinating tax loss harvesting with portfolio rebalancing activities enhances tax efficiency while maintaining strategic asset allocation targets. When periodic rebalancing indicates reducing exposure to an overweight asset class, reviewing those positions for unrealized losses before selling captures tax benefits that would otherwise be lost.

Conversely, identifying underweight asset classes that require additional purchases provides natural opportunities to deploy proceeds from tax loss harvesting sales, ensuring the strategy supports rather than conflicts with allocation objectives. This integrated approach treats tax-loss harvesting as a component of comprehensive portfolio management rather than an isolated tax tactic.

Maintaining meticulous records of all tax-loss harvesting transactions proves essential for accurate tax reporting and maximizing the long-term benefits of the strategy. Documentation should include the date and price of each security sold at a loss, the amount of the realized loss, replacement securities purchased, verification that wash sale rules were not violated, and tracking of any loss carryforwards to subsequent years.

Investment platforms and tax software typically provide year-end Form 1099-B reporting realized gains and losses, but relying solely on these forms without independent tracking can result in errors or missed opportunities to apply carryforward losses. Establishing a spreadsheet or database that logs all tax loss harvesting activity throughout the year facilitates accurate tax preparation and provides historical reference for evaluating the strategy’s effectiveness.

Measuring and evaluating tax-loss harvesting performance helps optimize the strategy over time and demonstrates its value relative to costs incurred. Key metrics include total losses harvested annually, estimated tax savings based on marginal rates, tax alpha as a percentage of portfolio value, and the ratio of tax savings to advisory fees or transaction costs.

Comparing these results across different market environments, investment vehicles, and implementation approaches identifies which elements deliver the greatest benefits and deserve emphasis in future years. Regular performance assessment also helps set realistic expectations and justify ongoing costs for professional implementation or technology platforms.

Integrating Tax Loss Harvesting with Broader Financial Planning

Tax loss harvesting tips deliver maximum value when integrated within comprehensive financial planning strategies that consider the full spectrum of a client’s financial life. Isolated tax-loss harvesting optimization without regard to income projections, retirement timing, charitable intentions, estate planning, and major life events can result in suboptimal outcomes despite technically proficient execution. Sophisticated wealth management incorporates tax loss harvesting as one component of coordinated strategies designed to minimize lifetime tax burdens while achieving personal financial goals.

Strategic gain realization planning works in concert with loss harvesting to optimize the timing of both gains and losses across the client’s lifetime. During low-income years such as early retirement before required minimum distributions begin or years between employment transitions, intentionally realizing capital gains up to the top of the 0% or 15% long-term capital gains brackets minimizes lifetime taxes.

Harvested losses accumulated during high-income working years can be partially utilized during these strategic gain-realization years, with remaining losses preserved to offset future high-bracket gains. This dynamic approach treats the pool of harvested losses as a valuable asset to be strategically deployed when it provides maximum benefit rather than mechanically applying losses against the first available gains each year.

Charitable giving strategies enhance tax efficiency when coordinated with capital gain and loss management. Donating appreciated securities directly to qualified charities before selling allows donors to deduct the full fair market value of the gift while avoiding capital gains taxes entirely. Conversely, investors should never donate securities with unrealized losses, as doing so forfeits the ability to claim the loss deduction without generating any offsetting tax benefit.

The optimal approach involves donating appreciated shares from the portfolio and separately selling depreciated shares to harvest losses, maximizing total tax savings from both activities. Donor-advised funds facilitate this strategy by accepting donated securities and allowing donors to direct grants to charities over multiple years while taking immediate tax deductions.

Estate planning considerations significantly impact optimal tax loss harvesting strategies, particularly for older or ultra-wealthy clients. Securities held until death receive a step-up in cost basis to fair market value, eliminating all embedded capital gains. For positions with large unrealized gains, holding until death and passing to heirs often proves more tax-efficient than selling during lifetime and paying capital gains taxes.

This consideration affects which positions should be candidates for strategic harvesting versus patient holding. Conversely, harvested losses that remain unused at death generally disappear without providing any benefit, creating incentives to strategically realize some gains during high-income years rather than carrying losses indefinitely.

Retirement account withdrawal strategies interact with taxable account tax-loss harvesting in important ways. Required minimum distributions from traditional IRAs and 401(k) plans create taxable ordinary income that cannot be offset by capital losses, making years with large RMDs less attractive for realizing capital gains in taxable accounts. However, accumulated capital loss carryforwards can be strategically used to offset gains from portfolio transitions, concentrated stock liquidation, or real estate sales that occur during high-RMD years.

Comprehensive planning models these interactions across decades to identify optimal sequencing of retirement account withdrawals, Social Security claiming, Roth conversions, and taxable account realization patterns.

Business owners and entrepreneurs require specialized tax loss harvesting strategies coordinated with business exit planning, equity compensation, and business succession. Owners anticipating business sales in the next three to five years benefit from establishing direct indexing portfolios immediately and systematically harvesting losses to offset the anticipated gain from the transaction.

Similarly, executives receiving substantial restricted stock units or exercising large option grants can use accumulated harvested losses to offset the ordinary income or capital gains generated by these events. Professional practices, family businesses, and middle-market company owners should coordinate tax loss harvesting implementation with M&A advisors, business attorneys, and transaction tax specialists to optimize the overall tax efficiency of business transitions.

Conclusion: Transforming Investment Volatility into Tax Advantages

Tax loss harvesting tips represent one of the most powerful yet underutilized strategies available to American investors seeking to minimize tax burdens and maximize after-tax wealth accumulation. The fundamental principle of strategically selling securities at losses to offset taxable gains transforms inevitable market volatility from a source of stress into a valuable opportunity for enhancing long-term financial outcomes.

Research spanning decades of market history demonstrates that systematic tax loss harvesting implementation can add 1-2% in annual after-tax returns for equity portfolios and even higher benefits for fixed-income and direct indexing strategies.

The evolution of tax loss harvesting from manual year-end exercises requiring substantial advisor time into automated year-round strategies powered by sophisticated technology has democratized access to these benefits. Robo-advisors now provide systematic tax-loss harvesting to investors with modest account balances, while direct indexing platforms deliver institutional-quality implementation for high-net-worth individuals managing millions in investable assets.

This technological transformation has fundamentally altered the value proposition of professional investment management, with many investors finding that tax savings alone exceed advisory fees by substantial multiples. Successful implementation of tax-loss harvesting tips requires attention to critical details including wash sale rule compliance, strategic timing throughout market cycles, appropriate selection of investment vehicles, and integration with comprehensive financial planning.

The strategy delivers greatest benefits to high-income investors facing elevated marginal tax rates, those managing substantial taxable portfolios outside retirement accounts, and individuals anticipating major taxable events like business sales or concentrated stock liquidation. However, investors across wealth and income levels can capture meaningful tax savings through disciplined execution of these principles.

Looking forward, tax loss harvesting will likely become an expected standard service rather than a premium offering as technology continues advancing and investor awareness grows. Cerulli Associates research indicates that customized tax management has transitioned from optional to expected among wealth management clients, driving rapid growth in direct indexing and tax-optimized separately managed accounts.

Legislative changes may eventually extend wash sale rules to cryptocurrency and potentially impose new restrictions on tax loss harvesting practices, making it imperative for investors to capitalize on current opportunities while regulations remain favorable. The integration of artificial intelligence and machine learning into tax-loss harvesting platforms promises further enhancements in coming years, with algorithms potentially identifying complex multi-security harvesting opportunities, predicting optimal replacement security selections, and coordinating tax strategies across multiple household members and entity structures.

As these capabilities mature, the gap between basic do-it-yourself tax loss harvesting and professional implementation will likely widen, rewarding investors who embrace sophisticated approaches. Whether implementing tax-loss harvesting through robo-advisors, professional wealth managers, or self-directed strategies, the key to success lies in systematic execution, vigilant wash sale compliance, year-round opportunity monitoring, and integration with broader financial planning objectives.

Market volatility, while uncomfortable in the moment, creates the losses that power tax savings—transforming temporary portfolio declines into lasting wealth advantages. By mastering these tax loss harvesting tips and implementing them consistently, investors can substantially reduce lifetime tax burdens, keeping more wealth invested and compounding toward their financial goals.

Begin by evaluating your current investment situation, identifying accounts eligible for tax-loss harvesting, and selecting an implementation approach appropriate for your wealth level and complexity. For accounts under $100,000, robo-advisors offer excellent automated solutions at minimal cost. Investors with $250,000 to $1 million might consider hybrid approaches combining automated platforms with periodic financial advisor consultations.

High-net-worth individuals managing multi-million dollar portfolios should explore direct indexing through separately managed accounts, coordinated with comprehensive tax and estate planning. Regardless of the path chosen, taking action to implement systematic tax loss harvesting today begins compounding tax savings that will accumulate into substantial value over investment lifetimes.

Citations

- https://dspace.mit.edu/bitstream/handle/1721.1/135992/SSRN-id3351382.pdf

- https://www.wealthfront.com/blog/tax-loss-harvesting-results-2024/

- https://www.morganstanley.com/articles/tax-loss-harvesting

- https://www.ameriprise.com/financial-goals-priorities/taxes/tax-harvesting

- https://www.commonsllc.com/insights/tax-loss-harvesting-strategies

- https://www.wealthformula.com/blog/advanced-tax-loss-harvesting-techniques/

- https://www.schwab.com/learn/story/how-to-cut-your-tax-bill-with-tax-loss-harvesting

- https://cooksonpeirce.com/iq-journal/the-ultimate-guide-to-tax-loss-harvesting/

- https://investor.vanguard.com/investor-resources-education/taxes/offset-gains-loss-harvesting

- https://www.fidelity.com/viewpoints/personal-finance/tax-loss-harvesting

- https://www.parametricportfolio.com/solutions/wealth-managers/custom-separately-managed-accounts/tax-management/tax-loss-harvesting

- https://alpinemar.com/blog/crypto-tax-loss-harvesting/

- https://www.investopedia.com/articles/financial-advisors/121914/pros-and-cons-annual-taxloss-harvesting.asp

- https://corporate.vanguard.com/content/dam/corp/research/pdf/tax_loss_harvesting_why_a_personalized_approach_is_important.pdf

- https://www.thetaxadviser.com/issues/2023/sep/the-economics-of-tax-loss-harvesting/

- https://www.bankrate.com/taxes/short-term-capital-gains-tax-rates-and-how-to-reduce-your-taxes/

- https://www.nerdwallet.com/article/taxes/capital-gains-tax-rates

- https://www.fidelity.com/learning-center/smart-money/capital-gains-tax-rates

- https://www.feltonandpeel.com/tax-loss-harvesting-timing-matters/

- https://www.alliedintegratedwealth.com/blog/tax-loss-harvesting-isnt-just-for-december-a-year-round-guide/

- https://www.reddit.com/r/fidelityinvestments/comments/1dzoi5x/why_does_wash_sale_rule_exist_and_how_is_tax_loss/

- https://privatebank.jpmorgan.com/nam/en/insights/wealth-planning/for-your-year-end-tax-planning-beware-the-wash-sale-rule

- https://turbotax.intuit.com/tax-tips/investments-and-taxes/wash-sale-rule-what-is-it-how-does-it-work-and-more/c5ANd7xnJ

- https://www.nisivoccia.com/mind-the-wash-sale-rule-when-harvesting-tax-losses/

- https://www.schwab.com/learn/story/primer-on-wash-sales

- https://www.blackrock.com/us/individual/literature/brochure/loss-harvesting-and-wash-sale-rule-considerations-en-us.pdf

- https://www.investopedia.com/terms/s/substantiallyidenticalsecurity.asp

- https://www.firstrade.com/resources/tax-center/wash-sales

- https://apps.irs.gov/app/vita/content/10s/10_04_011.jsp?level=

- https://www.fidelity.com/learning-center/personal-finance/wash-sales-rules-tax

- https://www.realized1031.com/blog/can-you-tax-loss-harvest-in-an-ira

- https://www.whitecoatinvestor.com/screw-up-when-tax-loss-harvesting/

- https://ygacpa.com/blog/common-tax-loss-harvesting-mistakes-investors-should-avoid/

- https://www.physiciantaxsolutions.com/tax-tips/biggest-pitfalls-tax-loss-harvesting/

- https://www.investopedia.com/terms/r/robo-tax-loss-harvesting.asp

- https://www.americancentury.com/insights/tax-loss-harvesting/

- https://onlinetaxman.com/crypto-tax-loss-harvesting/

- https://www.harness.co/articles/investment-trends-2025-tax-loss-harvesting-crypto/

- https://www.whitecoatinvestor.com/tax-loss-harvest-bitcoin/

- https://advisors.vanguard.com/investments/personalized-indexing/direct-indexing-and-tax-loss-harvesting

- https://russellinvestments.com/content/ri/us/en/insights/russell-research/2025/01/direct-indexing_-an-easy-way-to-tax-loss-harvest-all-year-round.html

- https://am.jpmorgan.com/us/en/asset-management/adv/investment-strategies/separately-managed-accounts/tax-managed-solutions/continuous-tax-loss-harvesting-yields-more-potential-for-tax-savings/

- https://www.bny.com/pershing/us/en/insights/direct-indexing-tax-management.html

- https://www.parametricportfolio.com/blog/tax-loss-harvesting-fixed-income-q3-2025

- https://moneyfortherestofus.com/robo-advisors/

- https://www.invesco.com/us/en/insights/tax-loss-harvesting-could-lower-your-tax-bill.html

- https://towerpointwealth.com/tax-loss-harvesting/

- https://www.pimco.com/us/en/resources/education/easing-the-pain-of-gains

- https://www.parametricportfolio.com/blog/tax-loss-harvesting-fixed-income

- https://www.hartfordfunds.com/practice-management/client-conversations/financial-planning/tax-loss-harvesting-boon-for-bond-investors.html

- https://www.alliancebernstein.com/content/dam/global/insights/insights-whitepapers/the-next-generation-of-fixed-income-tax-loss-harvesting.pdf

- https://russellinvestments.com/us/blog/tax-loss-harvesting-frequency-matters

- https://tradewiththepros.com/tax-loss-harvesting-in-december/

- https://www.columbiathreadneedleus.com/insights/latest-insights/it-may-be-time-to-reschedule-your-tax-loss-harvesting

- https://www.wedbush.com/leveraging-tax-loss-harvesting/

- https://www.edelmanfinancialengines.com/education/tax/the-benefits-of-tax-loss-harvesting/

- https://www.adamsbrowncpa.com/blog/understanding-the-importance-of-rebalancing-an-investment-portfolio/

- https://pressbooks.pub/nonelectivefinance/chapter/rebalancing-and-tax-loss-harvesting/

- https://turbotax.intuit.com/tax-tips/investments-and-taxes/guide-to-short-term-vs-long-term-capital-gains-taxes-brokerage-accounts-etc/L7KCu9etn

- https://www.irs.gov/taxtopics/tc409

- https://www.cerebraltaxadvisors.com/blog/tax-loss-harvesting/

- https://bentoakcapital.com/avoid-these-common-tax-loss-harvesting-mistakes/

- https://www.nerdwallet.com/best/investing/robo-advisors

- https://www.ameriprise.com/financial-goals-priorities/taxes/common-tax-mistakes-for-investors-to-avoid

- https://www.im.natixis.com/en-us/insights/tax-management/2025/tax-loss-harvesting-what-it-is-how-to-explain-to-clients

- https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/ideas-and-insights/heres-how-to-make-your-tax-loss-harvesting-strategy-do-more-for-you

- https://turbotax.intuit.com/tax-tips/investments-and-taxes/5-situations-to-consider-tax-loss-harvesting/L06jlQWfl

- https://brighttax.com/blog/tax-loss-harvesting-for-us-expats/

- https://www.financialplanningassociation.org/learning/publications/journal/AUG24-customer-trust-and-satisfaction-robo-adviser-technology-OPEN

- https://economics.yale.edu/sites/default/files/2023-01/Jonathan_Lam_Senior%20Essay%20Revised.pdf

- https://www.reddit.com/r/investing/comments/v5hlf3/wash_sale_rule_who_determines_if_the_securities/

- https://am.gs.com/en-us/institutions/campaign/tax-loss-harvesting-strategies-how-they-work

- https://www.morningstar.com/financial-advisors/wash-sale-challenge-what-is-substantially-identical

- https://smartasset.com/investing/short-term-capital-gains-tax

- https://www.sciencedirect.com/science/article/pii/S0165410123000319

- https://bipartisanpolicy.org/explainer/2025-federal-income-tax-brackets-and-other-2025-tax-rules/

- https://insognacpa.com/blog/how-can-you-harvest-investment-and-crypto-losses-without-triggering-tax-trouble

- https://frontierasset.com/top-five-tax-loss-harvesting-mistakes-to-avoid/

- https://www.breckinridge.com/insights/details/tax-loss-harvesting-in-fixed-income-portfolios/

- https://www.reddit.com/r/Bogleheads/comments/16py1la/how_much_value_in_activelymanaged_sma_doing_tax/

- https://www.nuveen.com/en-us/insights/fixed-income/tax-loss-harvesting

- https://www.morganstanley.com/articles/what-is-direct-indexing-benefits