What to Do When a Debt Collector Calls: Your Rights and Best Responses

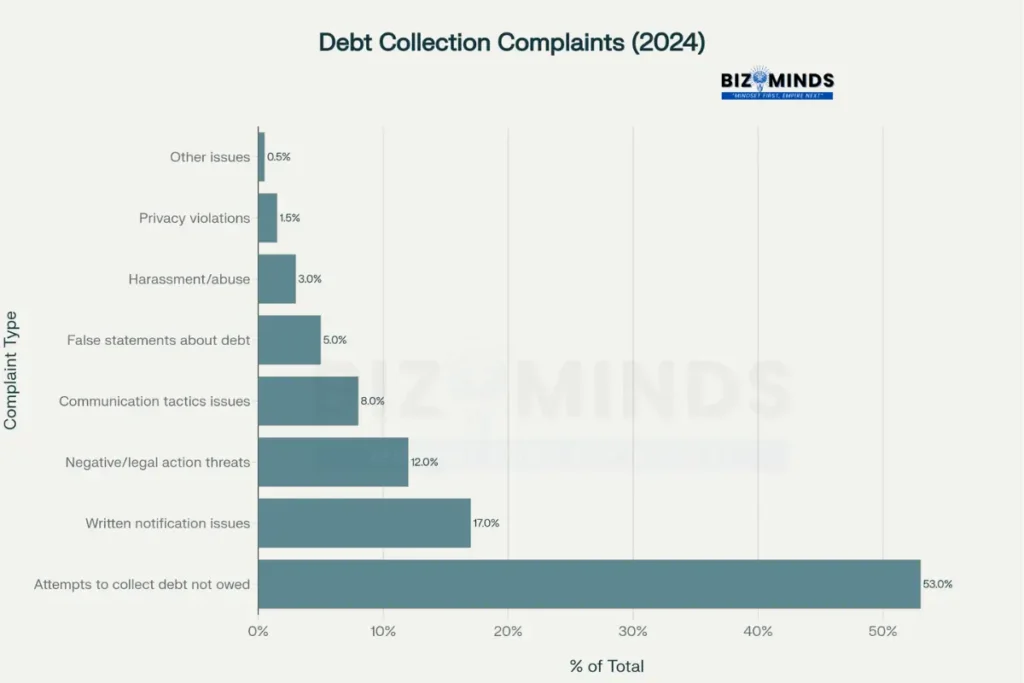

When a debt collector contacts someone for the first time, the experience often triggers immediate anxiety and confusion. The sudden phone call or unexpected letter transforms a typical day into one filled with stress, fear, and uncertainty about financial obligations and legal consequences. Research from the Consumer Financial Protection Bureau reveals that over 109,000 debt collection complaints were filed in 2023 alone, with 53% involving attempts to collect debts not actually owed. This staggering statistic demonstrates how frequently consumers face collection efforts for debts they may not legitimately owe, adding layers of frustration and bewilderment to an already challenging situation.

The psychological impact of debt collection extends far beyond financial concerns, creating a cascade of emotional and physical health consequences that can persist long after the initial contact. Studies indicate that 69% of individuals behind on consumer credit payments report feeling anxious, while over half describe feeling unable to cope with their circumstances. The emotional toll manifests through sleep disturbances, concentration difficulties, and heightened stress levels that can trigger depression and anxiety disorders.

Young adults facing debt collection pressure show significantly increased psychological distress, with more severe consequences among low-income individuals who often lack resources to address these challenges effectively. The stigma associated with debt problems compounds these effects, as many consumers internalize messages about financial irresponsibility and view themselves as failures for struggling with repayment obligations.

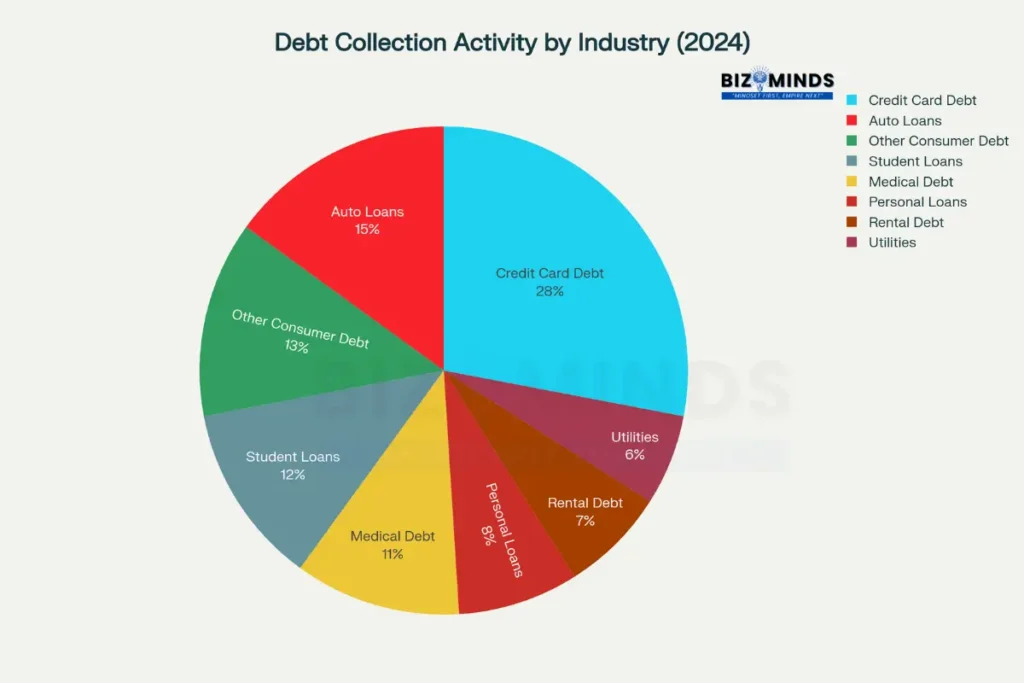

Understanding proper responses and legal protections becomes critical for millions of Americans navigating this challenging financial situations. The debt collection industry represents a significant economic force, with companies recovering billions in outstanding consumer obligations annually across various debt categories. Credit card obligations comprise 28% of all collection activity, followed by auto loans at 15%, student loans at 12%, and medical debt at 11%. These statistics reflect the widespread nature of debt collection, affecting consumers across all demographic groups and economic circumstances. The average amounts vary dramatically, from utility bills averaging $450 to student loans averaging $32,000, demonstrating how collection efforts can involve both modest household expenses and life-changing financial obligations.

This comprehensive analysis examines the essential rights, strategic responses, and protective measures available to consumers facing debt collection efforts in the United States. The framework includes understanding federal protections under the Fair Debt Collection Practices Act, navigating state-specific consumer laws, implementing effective communication strategies, and recognizing when professional legal assistance becomes necessary.

By understanding these protections and response strategies, consumers can transform what often feels like a powerless situation into an opportunity to assert their rights, resolve legitimate obligations appropriately, and protect themselves from abusive or illegal collection practices that violate federal and state consumer protection laws.

Understanding the Debt Collector Industry and Your Rights

The Industry Overview

The debt collection industry represents a significant economic force, with companies recovering billions in outstanding consumer obligations annually. The market encompasses various types of debt, with credit card obligations comprising 28% of all collection activity, followed by auto loans at 15%, student loans at 12%, and medical debt at 11%. The average amounts vary dramatically across categories, from utility bills averaging $450 to student loans averaging $32,000.

Most Common Debt Collector Complaints: CFPB Data Shows 53% Involve Invalid Debts

First-party debt collectors operate as the original creditors attempting to recover their own outstanding accounts, while third-party debt collectors work on behalf of creditors for contingency fees or purchase debts outright for pennies on the dollar. This distinction proves crucial because federal protections under the Fair Debt Collection Practices Act (FDCPA) primarily apply to third-party collectors rather than original creditors.

Current Market Dynamics

Total household debt in the United States reached $17.57 trillion in 2024, representing a 2.4% increase from the previous year. Credit card debt experienced particularly sharp growth at 8.6%, while student loan balances declined by 16.8% due to federal forgiveness programs. These fluctuations directly impact collection activity, as higher debt levels typically correlate with increased delinquencies and subsequent collection efforts.

Debt Collector Activity by Industry: Credit Cards Lead at 28% of All Collections

The debt collection services market was valued at approximately $4.88 billion in 2024 and is projected to reach $7.96 billion by 2029. This growth reflects increasing consumer reliance on credit, persistent inflation pressures, and evolving collection technologies that enable more sophisticated debt recovery strategies.

Federal Debt Collector Laws and Consumer Protection Rights

The Fair Debt Collection Practices Act Foundation

Enacted in 1977, the FDCPA established the primary federal framework governing debt collection practices. The statute aims to eliminate abusive collection practices, promote fair debt collection, and provide consumers with mechanisms to dispute and validate debt information. These protections apply specifically to personal, family, and household debts, including credit cards, medical bills, personal loans, and mortgages.

Prohibited practices under the FDCPA include harassment through threats of violence, obscene language, or repeated calls intended to annoy or abuse consumers. Debt collectors cannot make false statements about debt amounts, misrepresent their legal authority, or threaten actions they cannot legally take. The law also prohibits unfair practices such as collecting unauthorized fees or depositing post-dated checks early.

Debt Collector Communication Rules and Time Restrictions

The FDCPA establishes strict parameters governing when and how debt collectors may contact consumers. Collection calls are generally restricted to hours between 8:00 AM and 9:00 PM in the consumer’s local time zone. Collectors cannot contact consumers at inconvenient locations, particularly workplaces where employers prohibit such communications.

Recent regulatory updates through the CFPB’s Regulation F have clarified communication frequency limits, establishing a presumption of harassment when debt collectors call more than seven times within seven consecutive days or contact consumers within seven days after having a conversation about the debt. These rules apply regardless of whether consumers answer the calls, recognizing that repeated ringing phones can constitute harassment.

Debt Validation Rights and Procedures

Within five days of initial contact, debt collectors must provide written validation notices containing specific information about the debt and consumer rights. This validation notice must include the debt amount, the original creditor’s name, and statements explaining the consumer’s right to dispute the debt within 30 days.

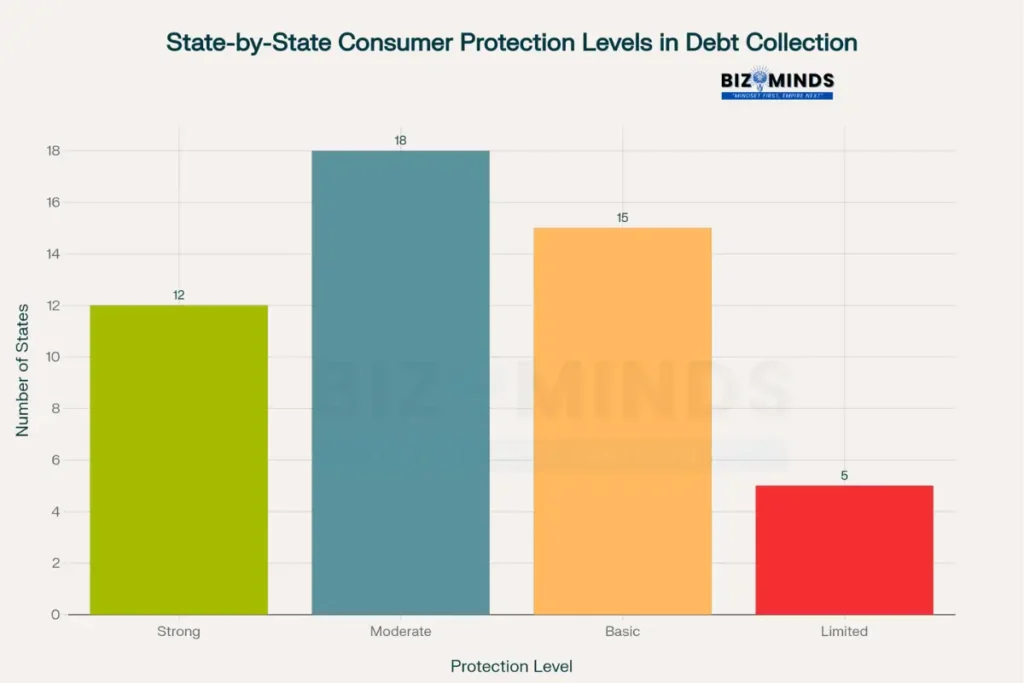

State Debt Collector Protection Laws: 30 States Exceed Federal Requirements

The validation process serves as a critical consumer protection mechanism, particularly given that 53% of debt collection complaints involve attempts to collect debts not actually owed. Common reasons include identity theft (32% of such complaints), debts already paid (14%), or debts discharged in bankruptcy (3%).

State-Level Protections and Variations

Enhanced State Consumer Protections

While the FDCPA provides baseline federal protections, many states have enacted additional laws that extend consumer protections beyond federal requirements. Research indicates that 12 states provide strong consumer protection that extends FDCPA coverage to original creditors and includes additional licensing requirements. Another 18 states offer moderate protection with state-specific enhancements, while 15 states maintain basic federal standards.

States with enhanced protections including California, Colorado, Florida, Illinois, North Carolina, Oklahoma, Texas, and Wisconsin extend fair debt collection protections to cover original creditor communications. These jurisdictions recognize that consumers may experience similar harms whether contacted by third-party collectors or original creditors using aggressive tactics.

Licensing and Regulatory Requirements

Many states require debt collectors to obtain licenses and comply with additional regulations beyond federal requirements. These licensing provisions often include bonding requirements, fee restrictions, and enhanced disclosure obligations. Consumers should verify whether debt collectors contacting them possess required state licenses, as operating without proper authorization may constitute a violation of state law.

Medical Debt Collection Considerations

Unique Challenges in Medical Debt

Medical debt presents particularly complex collection issues, accounting for approximately 11% of all collection activity with average amounts of $2,850. The CFPB received over 7,400 medical debt collection complaints in 2023, representing 11% of all debt collection complaints sent to companies for review.

Common problems include attempts to collect medical bills that insurance should have covered, bills that hospitals’ financial assistance programs have already addressed, and poor communication between healthcare providers, insurance companies, and debt collectors. Consumers frequently report receiving conflicting information from different entities about the same medical debt.

Financial Assistance Program Issues

Federal law requires non-profit hospitals to provide financial assistance or “charity care” to eligible patients to maintain tax-exempt status. However, consumers regularly report debt collectors pursuing bills that financial assistance programs have already covered. This occurs due to poor information sharing between hospitals and debt collectors, with consumers bearing the burden of proving they received charity care.

Research indicates that 77% of non-profit hospitals spent less on charity care and community investment than the value of their tax exemptions, suggesting widespread underutilization of required assistance programs. When hospitals partner with financial institutions for medical payment products, patients may face collection practices that IRS regulations would prohibit hospitals from using directly.

Strategic Response Approaches

Initial Contact Protocol

When debt collectors make initial contact, consumers should remain calm and focus on gathering information rather than making immediate commitments. Request the debt collector’s name, company, address, and phone number, along with basic information about the alleged debt. Avoid acknowledging the debt or making payment commitments during this first conversation.

Document all interactions with debt collectors, including dates, times, caller names, and conversation summaries. This documentation proves essential if violations occur and legal action becomes necessary. Consider recording conversations where legally permitted, as recordings provide powerful evidence of harassment or other violations.

How to Request Debt Collector Validation and Documentation

Send a written debt validation letter within 30 days of initial contact to exercise full rights under the FDCPA. This letter should request comprehensive information including the original creditor’s name and address, account numbers, proof of debt ownership, detailed payment history, and verification that the debt collector is licensed in your state.

Essential validation requests should include documentation showing legal obligation to pay the debt, such as original signed agreements, complete accounting of all charges and payments, confirmation that the debt remains within applicable statutes of limitations, and evidence of proper debt ownership transfer if the debt has been sold.

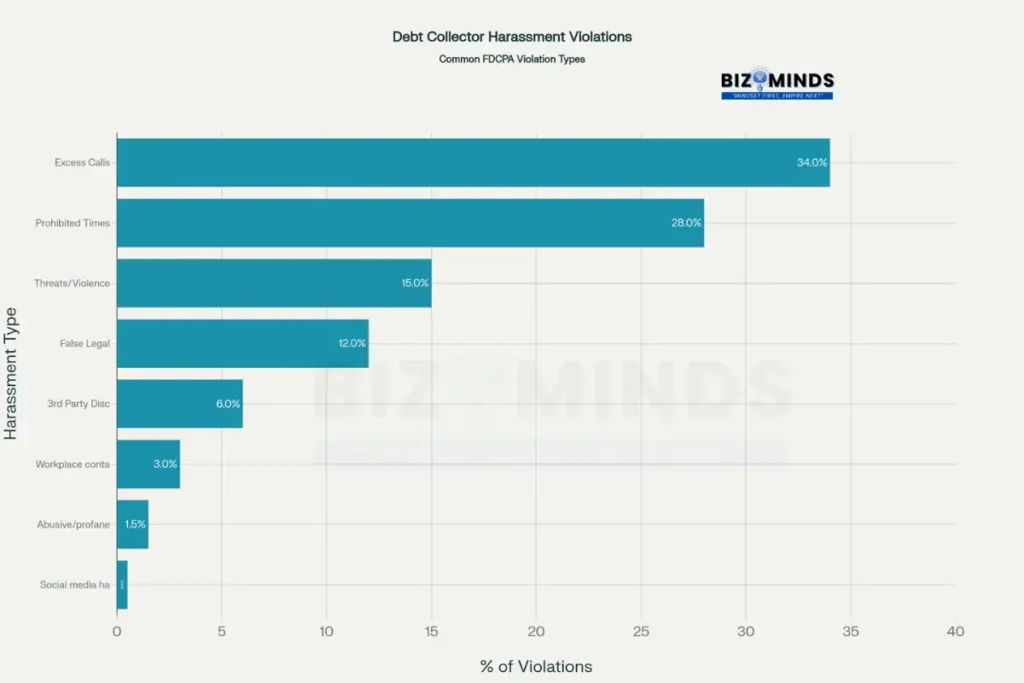

Debt Collector Harassment Statistics: Excessive Calls Account for 34% of Violations

Communication Management

Consumers may request that debt collectors cease all communication by sending written cease and desist letters. However, this stops collection calls but does not eliminate the underlying debt or prevent potential lawsuits. Collectors may still contact consumers to confirm they will cease communication or notify them of specific legal actions.

Alternative approaches include requesting that collectors only communicate in writing or only through legal counsel if represented by an attorney. This strategy maintains some communication while limiting harassment potential through repeated phone calls.

Time-Barred Debt Protections

Statute of Limitations Framework

Each state establishes statutes of limitations that limit the time period during which creditors and debt collectors may file lawsuits to recover debts. These periods typically range from three to six years for most consumer debts, though some states extend limitations to 10 years. The statute begins running from the date of first missed payment or last payment made on the account.

Time-barred debt cannot be legally collected through court action, though the debt itself continues to exist. Debt collectors may still attempt collection through phone calls and letters, but cannot successfully sue to recover time-barred debts. Consumers must affirmatively raise statute of limitations as a defense in court proceedings.

How Debt Collectors Can Revive Time-Barred Debts

Consumers must exercise extreme caution when dealing with potentially time-barred debts, as certain actions can restart the limitations period. Making partial payments, acknowledging the debt in writing, or agreeing to payment plans may revive collection rights even on time-barred debts. Before responding to collection efforts on old debts, consumers should research their state’s statute of limitations and consult legal counsel if uncertain.

Legal Remedies and Enforcement

FDCPA Violation Claims

Consumers may sue debt collectors for FDCPA violations in state or federal court within one year of the violation. Successful claims can result in actual damages for losses suffered, statutory damages up to $1,000 per debt collector (not per violation), and recovery of court costs and attorney fees.

Common violations leading to successful lawsuits include harassment through excessive calls (34% of harassment complaints), calling at prohibited times (28%), threatening language or violence (15%), and making false legal threats (12%). The availability of attorney fee awards makes FDCPA cases attractive for consumer attorneys, increasing access to legal representation.

Documentation and Evidence

Building strong FDCPA violation cases requires comprehensive documentation of collector communications and violations. Phone records showing call frequency and timing provide crucial evidence, particularly for harassment claims. Recorded conversations, where legally permitted, offer powerful evidence of abusive language, false statements, or other violations.

State recording laws vary significantly, with some states requiring consent from all parties while others permit recording by any party to the conversation. Consumers should research their state’s recording requirements before attempting to document collection calls.

Practical Response Strategies

Immediate Action Steps

When debt collectors call, implement a systematic response protocol to protect your interests while gathering necessary information. First, request that the caller identify themselves, their company, and the purpose of their call. Ask for their mailing address and phone number, as legitimate collectors will readily provide this information.

Avoid providing personal information such as Social Security numbers, bank account details, or employment information during initial calls. Scam artists often pose as debt collectors to gather personal information for identity theft, making verification essential before sharing sensitive data.

Request all communications in writing, as verbal agreements or admissions may not provide adequate protection if disputes arise. Written communications create permanent records and trigger specific legal protections under the FDCPA.

Settlement and Payment Considerations

If the debt is legitimate and you decide to resolve it, negotiate settlement terms carefully and obtain written agreements before making payments. Many debt collectors will accept significantly reduced amounts, particularly on older accounts where recovery prospects are uncertain.

Settlement negotiations should address the total amount to be paid, payment schedule if applicable, agreement that the settlement resolves the entire debt, and commitment to remove negative credit reporting. Obtain these terms in writing before making any payments, as verbal agreements provide insufficient protection.

Consider the tax implications of settled debts, as forgiven amounts exceeding $600 may constitute taxable income requiring IRS Form 1099-C reporting. Consult tax professionals regarding potential liability before agreeing to significant debt settlements.

Technology and Modern Collection Practices

Digital Communication Channels

Recent regulatory updates permit debt collectors to contact consumers through social media platforms and text messaging, subject to specific restrictions. Social media contacts must be private and hidden from other connections, with collectors required to identify themselves and provide opt-out mechanisms. Text messaging follows similar privacy requirements while respecting frequency limitations.

Electronic communications offer consumers both opportunities and risks in debt collection interactions. While these channels may provide more convenient communication options, they also create new avenues for potential harassment or privacy violations. Consumers should understand their rights regarding electronic communications and document any violations.

Automated Collection Systems

Many debt collectors utilize automated calling systems and predictive dialers to increase contact efficiency. While these technologies remain subject to FDCPA requirements, they may increase the likelihood of calls at inappropriate times or excessive contact frequency. Consumers experiencing automated calls should track their frequency and timing to identify potential violations.

Industry-Specific Considerations

Rental Debt Collection

The CFPB began accepting rental debt collection complaints in August 2023, receiving over 1,700 complaints within the first five months. Rental debt often involves disputes over security deposit deductions, damage assessments, and fees that may not be legitimate under state law.

Common rental debt issues include landlords charging tenants for normal wear and tear, which typically violates state warranty of habitability requirements. Debt collectors pursuing rental debts inflated by improper charges may violate the FDCPA even if they lack knowledge of the improper fees.

Student Loan Collections

Federal student loans generally lack statutes of limitations, making them permanently collectible unless discharged through specific programs. However, private student loans may be subject to state limitation periods depending on their terms and applicable law. Borrowers should distinguish between federal and private loans when responding to collection efforts.

Recent federal student loan forgiveness programs have reduced total outstanding balances by 16.8% in 2024, but may create confusion regarding which loans remain collectible. Borrowers receiving collection notices should verify current loan status through official servicer communications before responding to third-party collectors.

Resources and Support Systems

Legal Aid and Consumer Assistance

Federal Legal Aid for Debt Collector Issues

Consumers facing debt collection issues have access to various free and low-cost legal resources through established federal programs. The Legal Services Corporation (LSC), an independent nonprofit established by Congress, provides financial support for civil legal aid to low-income Americans through 134 independent nonprofit legal aid organizations across all 50 states, the District of Columbia, and U.S. territories. LSC-funded programs serve individuals and families who meet income eligibility requirements, generally at 125% or below federal poverty guidelines.

Key legal aid resources include:

- LawHelp.org – Provides free legal aid connections and answers to legal questions for people with low to moderate incomes

- Law Help Interactive – Offers free legal form assistance for identity theft, landlord/tenant disputes, and uncontested divorce cases

- American Bar Association Free Legal Answers – Online platform where low-income individuals can ask questions and receive attorney responses

- Directory of Law School Pro Bono Programs – State-specific listings of law school legal clinics

State and Local Legal Assistance Programs

Many states operate specialized debt collection defense programs beyond federal offerings. Cook County Legal Aid for Housing and Debt (CCLAHD) exemplifies comprehensive local assistance, serving over 75,000 Cook County residents since 2020 with free legal help for tenants facing eviction, homeowners dealing with foreclosure, and individuals confronting consumer debt issues. The program operates dedicated helplines for eviction and consumer debt assistance as well as mortgage foreclosure mediation.

State-specific legal aid features:

- Legal Services NYC – Provides free assistance for identity theft victims, abusive debt collection practices, and consumer debt lawsuit defense

- Pro Se Assistance Programs – Many jurisdictions offer free legal clinics like St. Louis’s bankruptcy assistance program providing 30-minute attorney consultations

- Consumer Law Practice Groups – Specialized units within legal aid organizations handling bankruptcy, foreclosure, payday loans, and vehicle repossession cases

National Consumer Advocacy Organizations

The National Association of Consumer Advocates (NACA) serves as a premier resource for both consumer education and attorney referrals. NACA maintains extensive video education series covering debt collector violations, lawsuit defense strategies, and proper service procedures. The National Consumer Law Center (NCLC) provides comprehensive debt collection resources, including the leading treatise on the Fair Debt Collection Practices Act with access to over 15,000 FDCPA case summaries.

Advocacy organization services:

- Attorney referral databases organized by geographic location and consumer law specialty areas

- Educational webinars on debt collection rights and defense strategies

- Amicus brief submissions supporting consumer protection in significant court cases

- Research and policy advocacy for enhanced consumer protection legislation

Consumer Protection Agencies and Complaint Systems

Federal Agency Resources

The Consumer Financial Protection Bureau (CFPB) maintains the most comprehensive federal debt collection resource center, accepting over 109,000 debt collection complaints annually. The bureau provides extensive guidance on the Debt Collection Rule, model validation notices in multiple languages, and small entity compliance guides for industry participants. Consumers can submit complaints online that are forwarded to companies with typical response requirements within 15 days.

CFPB debt collection resources include:

- Interactive complaint database allowing consumers to track complaint trends and company responses

- Model validation notice templates available in English and Spanish

- Educational materials explaining consumer rights under the FDCPA and Regulation F

- “Ask CFPB” database with answers to hundreds of financial questions including debt collection issues

The Federal Trade Commission (FTC) operates parallel complaint systems and educational programs, particularly focusing on identity theft, credit reporting, and unfair collection practices. The FTC’s consumer education materials complement CFPB resources with practical guidance on credit reports, debt management, and recognizing collection scams.

State Attorney General Offices

State attorneys general maintain consumer protection divisions with specialized debt collection complaint programs and enforcement capabilities. Many states operate dedicated consumer hotlines staffed during business hours to provide guidance and complaint assistance.

State attorney general resources:

- Massachusetts Consumer Protection Division – Operates consumer hotlines staffed during business hours Monday through Friday

- Maryland Consumer Protection Division – Maintains dedicated hotlines with email complaint options

- New York Consumer Frauds Bureau – Provides consumer helplines for debt management and consumer protection assistance

- Washington State Consumer Protection – Offers online filing with specialized categories for debt collection violations

Most state offices investigate patterns of abuse and may pursue enforcement actions against violating companies, providing benefits beyond individual complaint resolution.

Financial Counseling and Education

Nonprofit Credit Counseling Through NFCC

The National Foundation for Credit Counseling (NFCC), founded in 1951, represents the gold standard in nonprofit financial counseling with member agencies in every state and U.S. territory. NFCC member organizations must maintain 501(c)(3) tax-exempt status, Council on Accreditation (COA) accreditation, and compliance with strict quality standards.

NFCC certification requirements ensure counselors can:

- Establish financial goals and create actionable achievement plans

- Develop working budgets adaptable during financial crises

- Negotiate with creditors for debt management alternatives

- Evaluate housing affordability and homeownership requirements

- Navigate student loan repayment processes and forgiveness programs

- Understand consumer rights and identify community resource referrals

- Develop strategies for financial difficulty recovery and future planning

NFCC counselors undergo initial certification and mandatory recertification every two years for credit counseling, annually for housing and student loan counseling. The certification exam covers basic counseling principles, budgeting, credit, collections and debt management, consumer rights, and bankruptcy.

Debt Management Plan Services

Certified credit counselors can establish debt management plans (DMPs) allowing consumers to make single monthly payments to counseling agencies that distribute funds to creditors. DMPs typically involve negotiated interest rate reductions and waived late fees rather than principal balance reductions. The Consumer Financial Protection Bureau distinguishes legitimate credit counseling from for-profit debt settlement companies that charge upfront fees for services consumers can perform independently.

Key differences between counseling types:

- Credit Counseling (Nonprofit) – Educational focus, minimal fees, debt management plans, consumer protection orientation

- Debt Settlement (For-Profit) – Principal reduction promises, substantial upfront fees, potential tax consequences, limited success rates

- Debt Consolidation (Commercial) – New loan products, credit requirements, interest rate variations, additional debt risk

Educational Resources and Financial Literacy

The CFPB maintains extensive adult financial education resources including guides for major financial decisions, budgeting tools, and topic-specific educational materials. These resources support both individual consumers and financial practitioners working with debt-burdened clients.

Comprehensive educational offerings include:

- Building blocks of financial capability for children and youth programs

- Financial well-being assessment tools providing personalized guidance without requiring account information

- Comparison shopping tools for credit cards and financial products

- Research on coaching best practices for financial professionals

- Webinar series covering money management and debt resolution strategies

State consumer protection agencies supplement federal resources with localized information addressing state-specific laws and procedures. Many agencies partner with legal aid organizations and nonprofit counseling services to provide comprehensive consumer support networks.

Specialized Support Programs

Medical Debt Assistance

Given the complexity of medical debt collection, specialized resources address insurance disputes, financial assistance program navigation, and charity care applications. The CFPB began accepting rental debt complaints in August 2023, recognizing the growing need for specialized assistance in this area.

Student Loan Support

The Student Loan Borrower Assistance program provides specialized guidance for federal and private student loan collection issues, including consolidation, rehabilitation, and forgiveness program navigation. The National Association of Consumer Bankruptcy Attorneys offers additional resources for borrowers facing complex student loan collection situations.

Technology and Accessibility

Modern consumer protection agencies increasingly offer multilingual resources, online complaint systems, and mobile-accessible educational materials to serve diverse populations. Many agencies provide materials in Spanish and other languages reflecting community demographics.

Digital accessibility features:

- Online complaint portals with case tracking capabilities

- Mobile-responsive educational materials accessible across device types

- Multilingual resources including Spanish model validation notices

- Audio recordings of educational content for accessibility compliance

- Interactive tools requiring no registration or personal information disclosure

These comprehensive support systems provide multiple pathways for consumers facing debt collection challenges, from immediate legal assistance through ongoing financial education and counseling services. Understanding available resources enables consumers to make informed decisions about addressing collection issues while building long-term financial stability.

Conclusion

Successfully navigating debt collection requires understanding both your legal rights and practical response strategies. The FDCPA and state consumer protection laws provide significant safeguards against abusive collection practices, but these protections only help consumers who understand and exercise their rights appropriately. Given that 53% of debt collection complaints involve attempts to collect debts not actually owed, proper verification and validation procedures prove essential for all consumers contacted by debt collectors.

The debt collection continues evolving with new technologies, regulatory updates, and market dynamics. Consumers benefit from staying informed about their rights, maintaining detailed documentation of all collection interactions, and seeking professional assistance when facing complex situations. Whether dealing with legitimate debts requiring resolution or improper collection attempts that violate federal law, informed consumers can protect their interests while navigating these challenging financial circumstances effectively.

Remember that ignoring debt collection efforts rarely proves beneficial, but hasty responses without understanding your rights may create worse outcomes. Take time to understand your situation, research your options, and seek appropriate guidance before making decisions that could impact your financial future for years to come.

Frequently Asked Questions

Can debt collectors call me at work?

Debt collectors may initially call your workplace, but must stop if you tell them your employer prohibits such calls or if you request they cease workplace contact. The FDCPA prohibits contact at inconvenient places, including workplaces where such communication is not allowed.

How many times can a debt collector legally call me?

Under CFPB Regulation F, debt collectors may not call more than seven times within seven consecutive days. They also cannot contact you within seven days after having a phone conversation about the debt. These rules create a presumption of harassment if violated.

What happens if I can’t pay the debt?

If you cannot pay, you have several options including requesting payment plans, negotiating settlements for reduced amounts, or exploring whether the debt is time-barred. Ignoring the debt completely may lead to lawsuits and judgments. Consider consulting with a consumer attorney or non-profit credit counselor to explore your options.

Can debt collectors garnish my wages without going to court?

No, debt collectors cannot garnish wages without first obtaining a court judgment in most cases. Federal taxes and student loans are exceptions that permit administrative garnishment. For other debts, collectors must file lawsuits and obtain judgments before pursuing wage garnishment.

What should I do if I think the debt isn’t mine?

Send a written debt validation letter within 30 days of first contact requesting proof that you owe the debt. Include requests for original creditor information, account statements, and documentation showing your legal obligation to pay. If you believe the debt results from identity theft, file reports with police and the Federal Trade Commission.

Can debt collectors contact my family members about my debt?

Debt collectors may only discuss your debt with your spouse, attorney, or (if you’re a minor) your parents or guardian. They cannot tell other family members, friends, neighbors, or employers about your debt. They may contact others only to locate you, but cannot mention the debt or that they’re debt collectors.