Best Pitch Deck Examples for Startups in the USA

In the fast-paced and highly competitive arena of startup fundraising, your pitch deck is often the first and most critical point of contact with potential investors. It is not merely a presentation but a strategic storytelling tool designed to convey the essence of your startup—your vision, the problem you aim to solve, the solution you offer, and your market opportunity. In the United States, where startups compete for the attention of discerning venture capitalists and angel investors who sift through thousands of pitches every year, crafting a compelling and clear pitch deck is essential. It acts as your gateway to securing crucial meetings and ultimately, investment capital.

A pitch deck functions as a concise, visual snapshot of your business, summarizing your unique value proposition and growth potential in a compelling way. Investors may spend just a few minutes or even seconds on your deck before deciding whether to engage further. This reality underscores the importance of clarity, simplicity, and narrative flow. A well-structured pitch deck tells a story that hooks the investor, showing not only the business opportunity but also demonstrating your team’s preparedness, strategic thinking, and understanding of the market dynamics. For startups in the USA, meeting these expectations is a key differentiator in a crowded and sophisticated investment ecosystem.

Beyond just securing funds, your pitch deck serves multiple strategic purposes. It communicates your startup’s mission to partners, attracts top talent by clearly outlining the company’s vision, and can even become a reference tool to align your team internally. A thoughtful, data-driven approach paired with authentic storytelling can build investor confidence and foster trust, which are foundational to forming long-term partnerships. This is especially critical in the USA, where venture capitalists value transparency, scalability, and evidence of real market traction before committing funds.

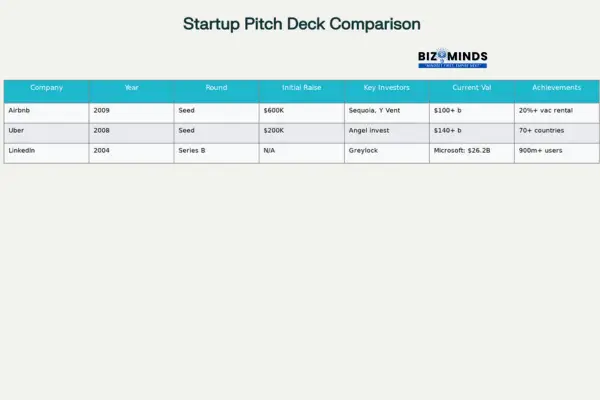

This article explores some of the most successful pitch deck examples from iconic American startups, such as Airbnb, Uber, and LinkedIn, to break down what made their decks stand out in a sea of competitors. Through detailed analysis of their structure, content, and design, you will gain practical insights and actionable lessons to apply to your own pitch deck creation. Whether seeking seed funding or Series A investment, understanding how to craft a compelling, data-backed, and emotionally engaging pitch presentation can dramatically increase your chances of attracting the right investors and accelerating your startup’s growth trajectory.

By delving into these proven examples and best practices, this guide aims to empower you to create a pitch deck that not only captures attention but also opens doors, builds meaningful connections, and paves the way for future success within the dynamic American startup ecosystem.

Here is a “Free Pitch Deck Template” for you in PPT format. If you want you can download it and use it as you wish to.

Here is a “Free Sample Pitch Deck for Tech Startup“. This template is not editable but for you to understand the design and concept of a Pitch Deck.

What Makes a Great Pitch Deck?

A stellar pitch deck flawlessly blends clarity, brevity, and engaging storytelling—three critical elements that, when skillfully combined, elevate a straightforward presentation into a compelling fundraising asset optimized to capture investor interest and drive funding success. At its core, an effective pitch deck must instantly communicate the problem your startup solves, articulate how your solution stands apart from existing alternatives, and convincingly demonstrate why your business has the potential to grow exponentially and generate substantial returns for investors.

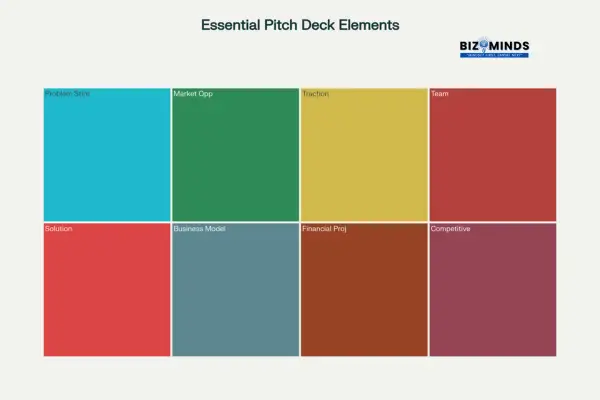

The foundation of any exceptional pitch deck lies in its essential structural elements, each serving a specific purpose in building investor confidence. A clear and relatable problem statement establishes the market need and creates emotional resonance with your audience. This should be followed by a well-articulated solution that showcases your unique value proposition and demonstrates how your product or service addresses the identified pain points more effectively than existing options. Your pitch deck must also present a realistic yet compelling market opportunity, supported by credible data that illustrates both market size and growth potential.

Beyond these foundational components, successful pitch deck incorporates several critical business elements that investors scrutinize carefully. Your business model should clearly outline revenue streams, pricing strategies, and scalability potential, showing investors exactly how you plan to monetize your solution. Proof of traction serves as validation that your concept resonates with real customers—whether through user metrics, revenue growth, partnerships, or customer testimonials. Additionally, introducing your capable team with relevant expertise and track record helps build confidence in your ability to execute the vision you’re presenting.

Importance of Storytelling in Pitch Decks

Storytelling goes beyond mere data presentation; it is a powerful method to communicate vision, make complex ideas simple, and inspire investor action by creating emotional engagement. The significance of storytelling in a pitch deck is paramount for capturing and sustaining investor interest, serving as a critical tool to engage and connect with investors on a deeper level. Rather than simply presenting data points and business metrics, your pitch deck should follow a narrative arc that takes investors on a journey from problem identification through solution presentation to impact demonstration. This storytelling approach simplifies complex ideas, highlights your value proposition clearly, and differentiates your solution from competitors while creating an emotional connection with potential investors.

How Storytelling Engages Investors

An effective narrative in a pitch deck:

- Forges emotional bonds by showcasing tangible effects and authentic customer experiences.

- Simplifies complex business concepts into relatable stories.

- Clearly highlights the problem, solution, and potential impact in a structured way.

However, even the most innovative startups can undermine their fundraising efforts through common pitch deck pitfalls that immediately signal inexperience to seasoned investors. Avoid overwhelming potential investors with excessive jargon, cluttered slides, or an overabundance of data that obscures your core message. Vague problem definitions, lack of financial clarity, and completely ignoring competitive analysis are red flags that suggest insufficient market understanding. Instead, aim for a narrative that flows logically, uses visuals effectively, and maintains focus on the most compelling aspects of your business opportunity while being transparent about challenges and realistic about projections.

Essential elements that make a great pitch deck with their purposes and best practices

The most effective pitch decks expertly balance presenting credible proof that builds investor trust with sparking excitement through a bold, yet realistic, vision for the company’s future growth. This balance requires presenting data-driven insights while maintaining emotional engagement, showing both current traction and future potential, and demonstrating thorough market understanding while keeping the presentation accessible and engaging. When these elements come together effectively, your pitch deck transforms from a simple business presentation into a compelling investment opportunity that investors cannot ignore.

Criteria for Selecting the Best Pitch Deck Examples

The most impactful startup pitch decks showcase simplicity combined with meaningful influence, striking a perfect balance that appeals to discerning investors. These examples feature visually clean designs that prioritize clarity over complexity, employing strategic white space and consistent branding to guide attention seamlessly through the narrative. They masterfully use storytelling techniques to transform business data into engaging narratives, forging emotional connections while maintaining professional credibility.

Outstanding presentations incorporate comprehensive, data-driven insights about market dynamics and performance, presenting quantitative evidence through well-designed visuals that make complex information instantly digestible. They reveal clear go-to-market strategies, detailing customer acquisition channels, target profiles, and scalable growth plans. Rather than stating intentions, these decks showcase concrete pathways for market penetration and competitive positioning, instilling confidence in investors about execution capabilities.

For startups in the United States, relevance to local venture capital norms is a critical differentiator. Investors expect detailed financial projections, accurate market-sizing approaches, and clear traction metrics. The strongest decks meet these standards by including solid revenue models, credible total addressable market calculations, and competitive analyses grounded in real data.

Visual design trends in 2025 favor minimal aesthetics with strategic use of gradients, asymmetrical layouts, and dynamic elements that add interest without distracting from core messages. Adhering to the “6-6 rule”—no more than six bullet points or six words per line—ensures information remains digestible and memorable. These principles support rather than overshadow the strategic messaging, resulting in presentations that feel both innovative and professional.

The selected case studies in this review were evaluated against these precise criteria, focusing on clarity of problem definition, visual appeal through purposeful design choices, and strategic messaging that demonstrates deep market understanding. Each example provides a blueprint for founders looking to craft compelling investor narratives in today’s competitive startup ecosystem.

Top Pitch Deck Examples from Successful American Startups

Airbnb Pitch Deck (2009): The Blueprint for Disruption

Airbnb’s legendary presentation stands as perhaps the most referenced startup document in fundraising history, demonstrating how simplicity and clarity can secure transformative investment. This concise 10-slide masterpiece helped the then-struggling startup secure $600,000 in seed funding from Sequoia Capital and Y Ventures, laying the foundation for what would become a $100+ billion hospitality empire. The lasting impact of the deck comes from its expert use of a problem-solution structure that precisely highlighted the challenges of costly, impersonal hotel stays while presenting Airbnb as the budget-friendly, genuine alternative.

The presentation’s strength lies in its strategic narrative construction, beginning with a relatable problem statement about high accommodation costs and limited availability, then seamlessly transitioning into their innovative solution of connecting travelers with local hosts. What made this particularly compelling was their detailed market opportunity analysis, which identified the $21 billion budget travel accommodation market and demonstrated clear understanding of their addressable audience. The deck also showcased their ingenious user acquisition strategy, including the now-famous Craigslist cross-posting technique that leveraged existing user bases to drive early growth without significant marketing spend.

Financial projections were presented with realistic optimism, showing a clear path to profitability through their 10% commission model while projecting potential annual revenue of $2.1 billion. The competitive analysis slide acknowledged existing players while clearly differentiating Airbnb’s unique value propositions: lower prices, larger selection, and user-friendly platform design. This transparency about competition, rather than claiming no competitors existed, demonstrated market sophistication that investors valued highly.

Uber Pitch Deck (2008): Redefining Urban Mobility

Originally conceived as “UberCab,” Uber’s foundational presentation targeted a luxury market segment with surgical precision, positioning itself as the “NetJets of car services” for urban professionalsThis 25-slide pitch deck, crafted by founders Garrett Camp and Travis Kalanick, successfully raised $200,000 in seed capital by tackling key inefficiencies in traditional taxi services, including lengthy wait times, absence of GPS integration, and unreliable dispatch systems. The presentation emphasized technology-driven solutions with features like one-click hailing, GPS auto-dispatch, and members-only access that created an exclusive, premium transportation experience.

The deck’s strategic market analysis revealed sophisticated understanding of transportation economics, particularly addressing the medallion system’s limitations that artificially constrained taxi supply and inflated costs. By targeting the 80% of non-airport taxi trips for retail and business use, Uber demonstrated strategic market positioning that avoided direct competition with airports’ established taxi systems while pursuing the largest addressable segment. This approach showed investors a clear path to market dominance without necessarily disrupting every aspect of existing transportation infrastructure simultaneously.

What distinguished Uber’s presentation was its detailed operating principles and scalable business model that outlined expansion strategies across major American cities. The phased rollout plan demonstrated how capturing just the top 10 markets would address 50% of the entire U.S. transportation market, showing massive scalability potential with relatively focused execution. Interestingly, the deck also touched on ride-sharing concepts that wouldn’t be implemented until 2014 with UberPool, demonstrating forward-thinking vision that extended beyond their immediate luxury service offering.

LinkedIn Pitch Deck (Series B, 2004): Network-Driven Professional Growth

LinkedIn’s Series B presentation broke conventional formatting by immediately identifying its user base and monetization strategies rather than opening with traditional problem statements. This strategic deviation reflected the company’s more mature stage, where proving traction and scalability took precedence over problem validation. The deck effectively positioned LinkedIn as the evolution of professional networking by comparing outdated job search methods to their trust-based, connection-driven alternative.

The presentation’s genius lay in its emphasis on verified connections and endorsement systems that created credibility and engagement far beyond static professional directories. By highlighting three distinct revenue streams—targeted advertising, job listings and recruitment services, and premium subscription services—LinkedIn demonstrated multiple pathways to monetization that reduced investment risk while showing substantial growth potential. The deck drew compelling parallels to eBay’s evolution from classified listings to reputation-based marketplace, illustrating how network effects could transform professional interactions.

Reid Hoffman’s strategic presentation emphasized proven traction and scalable business models crucial for later-stage investment rounds. Unlike seed-stage presentations focused on vision and potential, this Series B deck provided concrete evidence of user engagement, network growth metrics, and clear paths to profitability. The straightforward presentation of financial projections and team credentials built investor confidence in execution capability while demonstrating the platform’s potential for global professional networking dominance.

Funding outcomes and current status of companies that used pitch deck

Strategic Analysis: What Made each Pitch Deck Exceptional

These three iconic presentations share common elements that transcended their individual market contexts and funding stages. Each deck demonstrated deep market understanding through comprehensive competitive analysis while clearly articulating unique value propositions that differentiated their solutions. They balanced ambitious vision with realistic execution plans, showing investors both transformative potential and achievable milestones.

Visual storytelling played crucial roles in each presentation’s success, with clean design supporting rather than overwhelming their strategic narratives. All three companies presented scalable business models with multiple revenue streams and clear paths to profitability, addressing investor concerns about long-term sustainability. Most importantly, they demonstrated authentic understanding of their target customers’ pain points while providing compelling evidence that their solutions created genuine value in large, addressable markets.

Key Takeaways from Each Pitch Deck Example

Airbnb’s success teaches the importance of differentiating through relatable value propositions combined with creative, cost-effective user acquisition strategies that maximize limited resources. Their approach demonstrates how startups can leverage existing platforms and networks to accelerate growth without substantial marketing budgets, while maintaining clear focus on authentic customer experiences.

Uber’s deck underscores the power of addressing well-established problems through innovative technology solutions that create entirely new market categories. Their strategic market segmentation and phased expansion approach showed investors how focused execution in key markets could lead to rapid scalability and market dominance.

LinkedIn’s presentation exemplifies how later-stage companies should emphasize proven traction, network effects, and multiple monetization strategies to reduce investment risk while demonstrating substantial growth potential. Their approach shows the effectiveness of positioning growth and profitability evidence as primary investment drivers rather than relying solely on market opportunity projections.

Across all examples, success stemmed from combining compelling storytelling with data-driven insights, maintaining design clarity that supported strategic messaging, and demonstrating thorough understanding of both market dynamics and competitive landscapes while presenting realistic yet ambitious growth trajectories

How to Create Your Own Winning Pitch Deck

Creating a compelling fundraising presentation requires systematic planning, strategic thinking, and meticulous attention to both content and design elements that resonate with investors. The process begins with comprehensive market research and content preparation, followed by iterative storytelling refinement, visual design optimization, and continuous improvement based on investor feedback. Understanding this holistic approach ensures your presentation effectively communicates your startup’s value proposition while building investor confidence in your team’s execution capabilities.

Content Development and Strategic Framework

Begin your creation process by conducting thorough research and clearly identifying the core problem your startup addresses, ensuring you can articulate this challenge with specific, relatable examples and supporting data. Your unique solution should demonstrate clear differentiation from existing alternatives while showcasing genuine market validation through customer testimonials, usage metrics, or early revenue indicators. Develop a concise narrative that flows logically from problem identification through solution presentation to market opportunity demonstration, avoiding the temptation to lead with product features rather than customer pain points.

Structure your content using proven frameworks like Guy Kawasaki’s 10-slide template or Sequoia Capital’s approach, which emphasize problem-solution fit, market timing, business model clarity, competitive analysis, team credentials, and realistic financial projections. Create multiple story versions during your preparation phase, writing at least three different narrative approaches before settling on your final structure to ensure you’ve explored various positioning angles. This iterative content development process helps identify the most compelling value proposition while ensuring your presentation remains focused and digestible for time-constrained investors.

Visual Design and Professional Presentation of Pitch Deck

Maintain visual simplicity and professional consistency throughout your presentation, using clean layouts with strategic white space that guides investor attention without overwhelming them with information. Apply the “6-6 rule” by restricting each slide to six bullet points, each containing no more than six words, to keep your content clear, memorable, and powerful during concise investor presentations. Choose a consistent color scheme and font family that reflects your brand identity while maintaining readability across different presentation formats and screen sizes.

Incorporate compelling visuals, charts, and infographics that support rather than replace your narrative, using data visualization to make complex market information immediately understandable. When presenting financial projections, focus on 2-3 key performance indicators that demonstrate traction and growth potential, avoiding overwhelming investors with excessive metrics that dilute your core message. Ensure all visual elements serve a specific purpose in advancing your story, removing decorative graphics that don’t contribute to investor understanding of your business opportunity.

Financial Projections and Business Metrics

Develop realistic financial projections spanning 3-5 years that demonstrate clear paths to profitability while acknowledging the assumptions underlying your forecasts. Include essential financial statements such as profit and loss projections, cash flow analysis, and revenue forecasts that align consistently with your business model and market opportunity. Present unit economics that show individual customer or product profitability, providing investors with insights into your business’s fundamental financial viability and scalability potential.

Connect your financial projections directly to your funding requirements, clearly articulating how investment capital will drive specific growth milestones and business outcomes. Benchmark your projections against industry standards and comparable companies, demonstrating thorough market understanding while providing investors with context for evaluating your performance potential. Address your sales cycle length and its impact on cash flow, ensuring investors understand the timing dynamics that affect your revenue recognition and working capital requirements.

Team Presentation and Credibility Building

Introduce key team members with emphasis on relevant industry experience, domain expertise, and previous startup successes that directly relate to executing your business vision. Highlight complementary skills across your leadership team, showing investors you’ve assembled a balanced organization capable of addressing technical, business, and operational challenges. Include advisory board members or strategic partners who bring credibility, industry connections, or specialized knowledge that enhances your startup’s competitive positioning.

Demonstrate your team’s deep understanding of the market through detailed competitive analysis that acknowledges existing players while clearly articulating your differentiation strategy. Present evidence of customer validation, market traction, or strategic partnerships that validate both your solution’s market fit and your team’s ability to execute effectively. This credibility-building approach helps investors envision your team successfully navigating the challenges inherent in scaling a startup business.

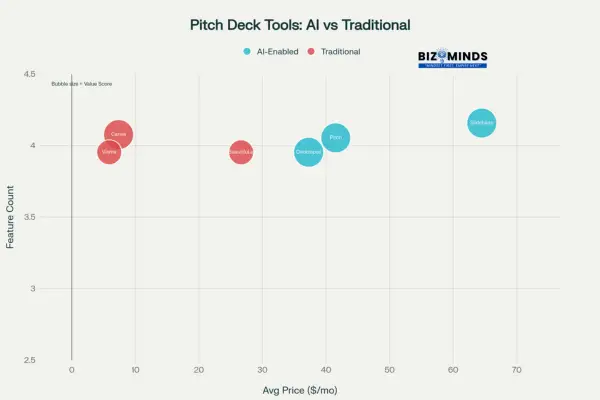

Comparison of top pitch deck creation tools with features, pricing, and best use cases

Tools and Resources for Pitch Deck Creation

Choose presentation creation tools that match your design skills, budget constraints, and collaboration needs, with options ranging from AI-powered platforms like Slidebean and Beautiful.ai to more flexible design tools like Canva and Pitch. AI-powered tools excel at generating professional layouts and maintaining design consistency, while traditional design platforms offer greater customization flexibility for founders with specific visual requirements. Consider tools with collaboration features if multiple team members will contribute to content development, and prioritize platforms that export to standard formats for easy sharing with investors.

Leverage advanced features like data visualization widgets, interactive elements, and real-time analytics tracking to enhance your presentation’s impact and gather insights about investor engagement. Tools like Visme offer extensive chart creation capabilities for data-heavy presentations, while platforms like Pitch provide engagement analytics that help you understand which slides capture investor attention most effectively. Balance feature richness with ease of use, ensuring your chosen tool enables rather than hinders your content development and design process.

Practice, Feedback, and Continuous Improvement

Enhance your presentation skills by rehearsing regularly with trusted advisors, mentors, or fellow entrepreneurs who offer candid feedback on content clarity and persuasiveness. Record yourself presenting to identify areas where your delivery could be more confident, passionate, or clear, ensuring you can convey deep knowledge and enthusiasm about your business opportunity. Practice handling common investor questions about market size, competitive threats, customer acquisition costs, and scalability challenges to build confidence during actual investor meetings.

Treat your presentation as a living document that evolves based on investor feedback, market changes, and business development milestones, updating content regularly to reflect current traction and refined strategic positioning. Gather specific feedback after each investor meeting about which slides were most compelling, what questions arose, and where clarification was needed to improve future presentations. This iterative improvement process ensures your presentation becomes increasingly effective at communicating your value proposition and generating investor interest over time.

Remember that your presentation serves as both a fundraising tool and a strategic communication asset for partnerships, customer presentations, and internal team alignment, making the investment in quality content and design valuable beyond immediate fundraising needs. The most successful presentations balance ambitious vision with realistic execution plans, demonstrating both transformative market opportunity and achievable near-term milestones that build investor confidence in your startup’s potential for sustainable growth.

Conclusion and Next Steps for Your Pitch Deck Journey

Crafting an exceptional pitch deck is both an art and a science, requiring you to blend compelling storytelling with rigorous data analysis. Throughout this exploration of iconic American startups like Airbnb, Uber, and LinkedIn, the common thread has been a clear narrative structure that guides investors from the problem statement through your unique solution and onto concrete evidence of market traction. By studying these examples, you gain valuable blueprints for articulating your vision, demonstrating market understanding, and showcasing the growth potential that investors seek.

A well-designed pitch deck transcends mere information delivery—it creates an emotional connection with your audience by humanizing the challenges and showcasing authentic customer experiences. Visual simplicity, consistent branding, and thoughtfully curated data visualizations ensure that your narrative remains engaging without overwhelming investors. The emphasis on storytelling, reinforced by clear go-to-market strategies and realistic financial projections, positions your startup as a credible, high-potential investment opportunity within the competitive U.S. venture capital landscape.

Moreover, the evolution of pitch deck creation tools and best practices underscores the importance of continuous improvement. Whether leveraging AI-driven design platforms or collaborative feedback sessions, your fundraising presentation should be dynamic, reflecting the latest traction milestones, strategic pivots, and refined market insights. Regularly updating and rehearsing your deck based on investor reactions not only sharpens your message but also builds the confidence and command of the material necessary for persuasive delivery.

In conclusion, your pitch deck is far more than a fundraising slide deck—it is the embodiment of your startup’s journey, mission, and potential. By combining structured content development, professional design principles, and iterative refinement, you can create a powerful investment narrative that resonates deeply with U.S. investors. Armed with the lessons from successful American startups and the tools to craft compelling presentations, you are well-equipped to transform your pitch deck into a gateway for the funding and partnerships that will drive your startup’s next phase of growth.

FAQs About Pitch Deck for Startups in the USA

- What is the ideal slide count for an effective pitch deck?

Aim for 10–12 focused slides that cover your core narrative without overwhelming investors. - How do I balance storytelling and data in my presentation?

Use a narrative arc—problem, solution, market, traction—supported by concise charts and visuals to illustrate key metrics. - Should I tailor my pitch deck for different investor audiences?

Yes. Customize market sizing, financial projections, and competitive analysis to align with each investor’s focus and portfolio interests. - How detailed should financial projections be?

Include 3–5 years of forecasts with key metrics (revenue, EBITDA, cash flow) and underlying assumptions, but avoid excessive line-item detail. - Is it necessary to include a competitive analysis slide?

Absolutely. Honest assessment of competitors and your differentiation strategy demonstrates market understanding and credibility. - How much emphasis should I place on team credentials?

Highlight relevant domain expertise, track records, and complementary skills—investors bet as much on founders as on ideas. - What design principles enhance slide readability?

Use the “6-6 rule” (maximum six bullet points per slide, six words per line), maintain consistent branding, and incorporate strategic white space to ensure clear and effective communication. - When should I update my deck?

Regularly revise after major milestones—funding rounds, product launches, partnerships—or incorporate investor feedback after pitch meetings. - Can I use AI tools for slide creation?

Yes. Platforms like Slidebean and Beautiful.ai streamline design, but always review layouts to ensure messaging precision and brand consistency. - How do I demonstrate traction if I have limited revenue?

Showcase user growth metrics, pilot partnerships, customer testimonials, or proof-of-concept pilots to validate demand and market fit. - Should I practice my pitch delivery?

Practice extensively with mentors and peers, record sessions for self-review, and prepare concise responses to common investor questions about market size, go-to-market strategy, and unit economics. - What follow-up materials complement a pitch deck?

Prepare an executive summary, detailed financial model, and one-page product roadmap to share with interested investors after the initial presentation.