Student Loans in 2025: Smart Strategies to Lower Debt

Picture this: You’re 22 years old, walking across the graduation stage with a diploma in one hand and dreams in your heart. But lurking in the shadows of your celebration is an invisible companion that will follow you for years to come—student loans debt. Within 72 hours of graduation, the congratulations end and reality hits with a jarring email: “Your student loans are now due.”

This isn’t just a financial story—it’s an emotional one that millions of Americans know all too well. If you’re one of the 42.5 million borrowers carrying $1.814 trillion in collective student debt, you’re not just numbers on a spreadsheet—you’re real people with real dreams that feel increasingly out of reach.

Morgan from Rhode Island knows this feeling intimately. After earning her degree in 2023, she discovered to her dismay that minimum payments weren’t reducing her original balance, while accruing interest secretly added $3,000 to what she owed. “I cried thinking I’d be in debt forever and would never be able to go on vacations or buy a new car,” she recalls. Her story isn’t unique—it’s happening in dormitories, graduation ceremonies, and family dinner tables across America right now.

The statistics paint a sobering picture of a generation under siege. An alarming 54% of borrowers report that their mental health struggles are directly linked to their student loans. One out of every eight earners making less than $50,000 annually has faced suicidal thoughts due to their financial obligations. When financial stress becomes a matter of life and death, it’s clear we’re facing more than just a policy problem—we’re confronting a human crisis.

But here’s what the headlines don’t tell you: smart, strategic borrowers are still finding ways to not just survive their student loans, but to thrive despite them. John Doe paid off his entire MBA student loan within three years of graduation while simultaneously launching a successful fintech company. Others on Reddit share stories of conquering six-figure debt loads without eating “rice and beans for five years”. These aren’t lottery winners or trust fund babies—they’re strategic thinkers who understood their options and executed consistently.

2025 has brought both unprecedented challenges and hidden opportunities for student loans borrowers. While the suspension of the SAVE plan left 7.84 million borrowers in limbo, and delinquency rates have reached historic highs, those who understand the new landscape can still dramatically reduce their debt burden.

The question isn’t whether student debt is overwhelming—it is. The real question is: What are you going to do about it?

This isn’t another article filled with generic advice about eating ramen noodles and skipping coffee. This is a comprehensive battle plan for 2025, built on real data, current policies, and strategies that actual borrowers are using right now to reclaim their financial futures. Whether you owe $15,000 or $150,000, whether you’re a recent graduate or a seasoned professional still carrying your educational investment, the tools for transformation are within your reach.

The weight of student loans debt feels heavier than ever. If you’re one of the 42.5 million Americans carrying the burden of $1.814 trillion in total student debt, you’re not alone in feeling overwhelmed. With the average federal loan balance sitting at $39,075 per borrower, many graduates find themselves questioning whether their degree was worth the financial strain that follows those years after graduation.

But here’s the reality check you need: 2025 has brought both challenges and opportunities for student loans borrowers. While recent policy changes have created uncertainty, smart borrowers who act strategically can still dramatically reduce their debt burden. This isn’t just about surviving your student loans—it’s about thriving despite them.

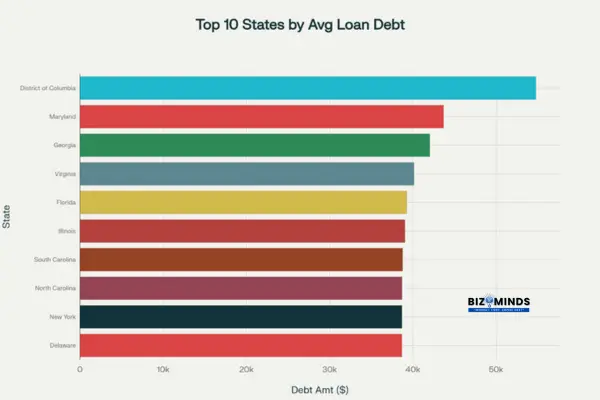

Top 10 States with Highest Average Federal Student Loan Debt (2025)

The Current Student Debt Landscape: A Crisis in Numbers

The numbers paint a sobering picture of America’s student debt crisis. Washington D.C. leads the nation with borrowers carrying an average debt of $54,795, while even the “lowest” states on the top-10 list still see average debts exceeding $38,000. But what’s truly alarming is what’s happening to borrowers right now.

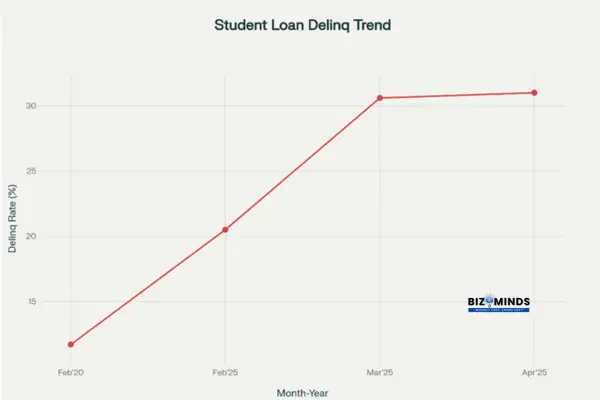

Student Loan Delinquency Crisis: 90+ Days Past Due Rates (2020-2025)

The delinquency crisis has reached unprecedented levels. Roughly 5.8 million federal student loans borrowers, or nearly one in three, are 90 days or more delinquent on student loans. This represents the highest delinquency rate ever recorded, jumping from just 11.7% in February 2020 to 31.0% by April 2025. Even more concerning, experts project that 1.8 million borrowers could enter default status by July 2025, with another million following in August.

The human cost extends beyond statistics. When borrowers become delinquent, their credit scores plummet by an average of 60 points, creating a domino effect that impacts their ability to secure housing, purchase vehicles, or access other forms of credit for years to come.

Policy Upheaval: Navigating the SAVE Plan Suspension

The halt of the SAVE (Saving on a Valuable Education) program has stranded about 7.84 million borrowers. What was once the most generous repayment option—allowing payments as low as 5% of discretionary income—has been blocked by federal courts, forcing borrowers into an administrative forbearance.

Here’s what this means for affected borrowers:

The Good News: You’re not required to make payments while in SAVE forbearance, and until August 1, 2025, no interest was accruing.

The Challenging Reality on Student Loans:

Starting August 1, 2025, interest resumed on SAVE student loans plans. For the average borrower, this translates to approximately $219 per month in interest charges alone. Over a full year, borrowers could face an additional $3,500 in interest costs.

The Strategic Response:

Borrowers in SAVE forbearance have been encouraged to transition to Income-Based Repayment (IBR) plans, which calculate payments at 10% of discretionary income—double the SAVE plan rate, but still more manageable than standard repayment for many borrowers.

Smart Repayment Strategies: Your Options Decoded

Understanding your repayment options has never been more critical. Each strategy serves different financial situations, and choosing the wrong one could cost you thousands of dollars over the life of student loans.

| Strategy | Monthly Payment Calculation | Forgiveness After | Interest Rate | Best For | Potential Savings/Benefits |

| Standard 10-Year Plan | Fixed payment over 10 years | No forgiveness | Federal rate (6.53% avg) | Stable income, want to pay off quickly | Lowest total interest paid |

| Income-Based Repayment (IBR) | 10% of discretionary income | 25 years | Federal rate (6.53% avg) | Lower income, need payment flexibility | Lower payments, eventual forgiveness |

| Pay As You Earn (PAYE) | 10% of discretionary income | 20 years | Federal rate (6.53% avg) | Lower income, newer borrowers | Lower payments, faster forgiveness |

| Revised Pay As You Earn (REPAYE/SAVE) | 5% of discretionary income (SUSPENDED) | 20-25 years (SUSPENDED) | Federal rate (SUSPENDED) | Very low income (currently unavailable) | Lowest payments (currently suspended) |

| Income-Contingent Repayment (ICR) | 20% of discretionary income or 12-year fixed | 25 years | Federal rate (6.53% avg) | Inconsistent income | Payment flexibility |

| Private Refinancing | Varies by lender and credit | No forgiveness | 3-8% (credit dependent) | High income, excellent credit | Up to 2-3% interest savings |

| Biweekly Payments | Half monthly payment every 2 weeks | No forgiveness | Federal rate (6.53% avg) | Stable income, want to save interest | Pay off ~1 year earlier |

| Extra Principal Payments | Regular payment + extra amount | No forgiveness | Federal rate (6.53% avg) | Extra cash available monthly | Significant interest savings |

Federal Repayment Plans: Finding Your Best Fit

Standard 10-Year Repayment remains the gold standard for borrowers who can afford higher monthly payments. While it offers no forgiveness, it minimizes total interest paid and gets you debt-free fastest. This works best for borrowers with stable, higher incomes who want to eliminate debt quickly.

Income-Driven Repayment (IDR) plans provide flexibility but require strategic thinking:

- Income-Based Repayment (IBR): Now the primary option for former SAVE borrowers, IBR caps payments at 10% of discretionary income with forgiveness after 25 years. The Department of Education reopened IDR applications in March 2025, making this accessible again.

- Pay As You Earn (PAYE): Offers the same 10% payment calculation but with faster forgiveness (20 years) for borrowers who qualify based on when they first borrowed.

- Income-Contingent Repayment (ICR): The highest payment option at 20% of discretionary income, but also the most flexible for borrowers with irregular income.

Acceleration Tactics That Actually Work to lower student loans

With a biweekly plan—half of your monthly bill paid every two weeks—you end up with 26 payments each year, the same as making 13 monthly payments. This simple switch can shave approximately one year off your repayment timeline and save thousands in interest on student loans.

Extra Principal Payments:

Even an additional $50 per month toward principal can dramatically reduce your total interest. The key is ensuring extra payments are applied to principal, not your next month’s payment.

Autopay Discounts:

By signing up for automatic payments, borrowers can receive a 0.25% interest rate cut from most federal student loans. While modest, this compounds over time and requires zero effort once set up.

Student Loans Consolidation vs. Refinancing: Making the Right Choice

The decision between federal consolidation and private refinancing can save—or cost—you tens of thousands of dollars.

Federal Direct Consolidation

When It Makes Sense:

- You have multiple federal loans with different servicers

- You want to access PSLF but have non-Direct loans

- You’re in default and need rehabilitation options

The Trade-offs:

- Your new interest rate will be the weighted average of existing rates, rounded up

- You risk forfeiting credit for payments you’ve already applied to forgiveness programs

- You maintain access to federal protections and forgiveness programs

Private Refinancing

The Sweet Spot:

High-income borrowers with excellent credit can potentially secure rates 2-3 percentage points lower than federal rates. With federal rates averaging 6.53%, securing a 4% private rate could save $10,000+ over a 10-year term on a $50,000 loan.

The Risk:

You permanently lose federal protections, including access to income-driven repayment, forbearance options, and forgiveness programs. In an uncertain economy, this trade-off requires careful consideration.

Budgeting and Financial Management: Building Your Defense

Successful student loans management starts with a bulletproof budget that prioritizes loan payments while building financial resilience.

The 50/30/20 Student Loans Adaptation

Budgeters often follow a rule of thumb: 50% of income on must-haves, 30% on lifestyle choices, and 20% toward savings and debt obligations. For student loans borrowers, consider the 50/20/20/10 rule:

- 50% for essential needs (housing, food, transportation, minimum loan payments)

- 20% for aggressive debt repayment (extra principal payments)

- 20% for wants (entertainment, dining out)

- 10% for emergency fund building

Emergency Fund Strategy for Borrowers

Start Small, Think Smart:

Even $500 can prevent you from missing loan payments during unexpected expenses. Automate $25-50 weekly transfers to a separate savings account. Once you hit $1,000, you’ll have breathing room for most emergencies.

The Student Loans Payment Buffer:

Consider keeping one month’s worth of loan payments in a separate account. This buffer ensures you never miss payments due to timing issues with paychecks or unexpected expenses.

Income Enhancement: Turning Side Hustles Into Debt Freedom

The gig economy offers unprecedented opportunities to accelerate debt payoff, but success requires strategy, not just hustle.

High-Impact Side Hustles for 2025

Skill Monetization:

Your education didn’t just create debt—it built valuable skills. Tutoring, freelance writing, graphic design, or consulting in your field can generate $500-2,000 monthly. Platforms like Upwork, Fiverr, and Wyzant make client acquisition easier than ever.

The $200 Rule:

Targeting just $200 extra monthly income can cut 2-3 years off a 10-year repayment timeline. This might mean:

- Teaching two tutoring sessions weekly ($100-200/month)

- Freelance writing two articles monthly ($200-400/month)

- Weekend delivery driving ($300-600/month)

Success Story Approach:

One Etsy seller documented paying off $15,000 in student loans by building a custom jewelry business that generated $800 monthly in profit. The key was treating the side hustle like a business, reinvesting profits into growth until income exceeded expenses.

Forgiveness and Relief Programs: Maximizing Your Opportunities

Despite policy uncertainty, substantial forgiveness programs remain available for borrowers who meet specific criteria.

Public Service Loan Forgiveness (PSLF): The Gold Standard

PSLF remains the most powerful forgiveness program available, offering complete loan forgiveness after 120 qualifying payments (10 years) for public service workers. This includes:

- Government employees at federal, state, and local levels

- 501(c)(3) nonprofit employees

- Peace Corps and AmeriCorps volunteers

- Public school teachers and university staff

- Public hospital and health clinic workers

Qualifying Payment Requirements:

- Must be made under an income-driven repayment plan

- Must be made while working full-time (30+ hours) for a qualifying employer

- Must be made on Direct Loans (other federal loans require consolidation)

Success Strategy:

File your Employment Certification Forms each year to monitor your status and address any problems promptly. The PSLF Help Tool at StudentAid.gov provides real-time feedback on payment eligibility.

Professional-Specific Programs

Teacher Loan Forgiveness:

Offers up to $17,500 in forgiveness for highly qualified math, science, and special education teachers who serve five consecutive years in low-income schools. The program requires student loans originated after October 1, 1998, and applies only to Direct and Stafford loans.

Nurse Corps Loan Repayment Program:

Provides up to 85% loan repayment for nurses who commit to working in Health Professional Shortage Areas. Despite intense competition, approved applicants can earn $25,000–$50,000 in loan repayment benefits over a two- to three-year timeframe.

State Programs:

Many states offer loan repayment assistance for healthcare professionals, teachers, lawyers, and other in-demand professions. For example, West Virginia offers up to $90,000 over four years for nurses serving in rural areas.

Employer Assistance Programs: The Hidden Benefit

A growing number of employers now offer student loans repayment assistance, and the benefit remains tax-free through December 31, 2025. Under current law, employers can contribute up to $5,250 annually toward employee student loans without the amount counting as taxable income.

Recent Legislative Update: The Budget Reconciliation Bill signed in July 2025 made this benefit permanent and included inflation adjustments starting in 2027. This means the $5,250 limit will increase over time, making employer assistance even more valuable.

Negotiation Strategy: If your employer doesn’t offer student loans benefits, propose it during performance reviews or when negotiating job offers. For employers, the tax advantages make this benefit cost-effective compared to salary increases.

Tax Optimization: Every Dollar Counts

Strategic tax planning can reduce your loan burden while building long-term wealth.

Student Loans Interest Deduction

The student loans interest deduction lets you subtract up to $2,500 in annual interest payments from your taxable income. Single taxpayers see the benefit phase out from $80,000 to $95,000 MAGI, and joint filers from $165,000 to $195,000. It covers federal and private loans, requires no itemization, and you’ll receive Form 1098-E if your interest payments exceed $600.

Education Tax Credits

American Opportunity Tax Credit (AOTC): Worth up to $2,500 per student per year for the first four years of college. Unlike deductions, this is a dollar-for-dollar reduction in taxes owed.

Lifetime Learning Credit: Provides up to $2,000 annually for any post-secondary education, with no limit on years claimed. Perfect for graduate students or professionals pursuing continuing education.

Emergency Preparedness: Protecting Your Progress

Life happens, and smart borrowers prepare for disruptions before they occur.

Hardship Options

Deferment and Forbearance: Federal loans offer several hardship options:

- Economic hardship deferment: Accessible to those facing unemployment or significant financial hardship.

- General forbearance: Discretionary relief for temporary financial difficulties

- Mandatory forbearance: Required by law for specific situations like medical residency

Payment Reduction Strategies: Before stopping payments entirely, explore:

- Switching to income-driven repayment for lower payments

- Requesting temporary payment reductions through your servicer

- Negotiating modified payment schedules during hardship

Default Prevention

If you’re struggling to make payments, contact your servicer immediately. Options include:

- Loan rehabilitation: Make 9 consecutive, on-time payments to remove default status

- Full payment: Pay the entire loan balance to resolve default

- Consolidation: Combine defaulted loans into a new Direct Consolidation Loan

Building Long-Term Wealth Despite Student Loans

The goal isn’t just debt elimination—it’s building financial security while managing loans strategically.

The Investment vs. Debt Payoff Decision

When to prioritize investing:

- Your loan interest rates are below 4-5%

- Your employer offers 401(k) matching (free money always wins)

- You have stable emergency savings

- You’re on track for loan forgiveness through PSLF or IDR

When to prioritize debt payoff:

- Your loan interest rates exceed 6-7%

- You have high-interest private loans

- The psychological burden of debt outweighs investment returns

- You’re close to paying off loans (within 2-3 years)

Home Buying Considerations

Debt-to-Income Impact: Most lenders prefer total debt payments (including student loans) below 36-43% of gross monthly income. However, some loan programs offer flexibility for borrowers with student debt.

Down Payment Strategy: Instead of delaying homeownership until loans are paid off, consider:

- FHA loans with 3.5% down payments

- Conventional loans with 3% down payment options

- State and local first-time buyer programs offering down payment assistance

Your 30-Day Action Plan

Transform knowledge into results with immediate, actionable steps:

Week 1: Assessment and Documentation

- Log into StudentAid.gov to review all federal loans and servicers

- Download and review your loan history and payment records

- Calculate your debt-to-income ratio and current monthly obligations

- Research your employer’s student loans benefits policy

Week 2: Strategy Selection

- Compare repayment options using StudentAid.gov calculators

- When in SAVE forbearance, research the process for filing an IBR application

- Investigate PSLF eligibility if you work in public service

- Get quotes for private refinancing if you have excellent credit

Week 3: Implementation

- Submit applications for optimal repayment plans

- Set up automatic payments for interest rate discounts

- Open a dedicated emergency fund savings account

- Create a side hustle action plan based on your skills

Week 4: Optimization

- Implement biweekly payment strategy if beneficial

- Apply for relevant forgiveness programs

- Schedule annual review dates for reassessing strategy

- Begin emergency fund contributions, even if just $25 weekly

Conclusion: Your Debt-Free Future Starts Today

The student debt crisis is real—with 42.5 million Americans carrying $1.814 trillion in collective debt and 31% of borrowers now seriously delinquent—but your power to transcend it is equally real. Ordinary borrowers like Morgan, who went from crying over growing debt to complete freedom, and Vishnu, who turned his MBA loans into entrepreneurial success, prove that strategic action transforms financial futures. The difference between drowning in debt and achieving freedom isn’t luck or exceptional circumstances—it’s knowledge, strategy, and the courage to act.

The tools for transformation exist right now: Income-driven repayment plans offer genuine relief, Public Service Loan Forgiveness remains the most powerful wealth-building program available, employer assistance programs are expanding with permanent tax benefits, and strategic approaches from refinancing to side hustles continue delivering real results for committed borrowers. But knowledge without action is worthless. Every month you delay is another month of interest accumulation and another month further from the financial freedom that should be your birthright as an educated American.

Your student loans funded your education—now let that education fund your strategy to eliminate them. You are part of the most educated generation in history with access to more tools and opportunities than any previous generation of borrowers. Financial freedom isn’t just about numbers in a bank account; it’s about reclaiming your dreams, buying that house, starting that family, and proving to yourself that you are more powerful than your circumstances. Your debt-free future starts today. Take the first step.