Fastest Growing Startup Markets in the USA: Disrupting Traditional Businesses or Not ?

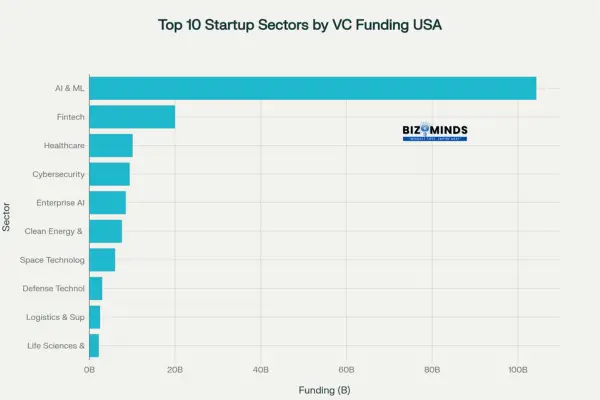

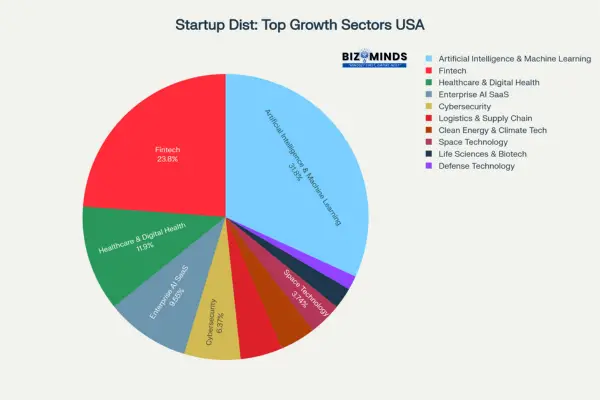

The American startup ecosystem is experiencing a revolutionary transformation that’s reshaping the entire business industry. As we navigate through 2025, venture capitalists are pouring unprecedented amounts of capital into sectors that promise not just profitability, but genuine societal impact. The data reveals a compelling story: the Fastest Growing Startup sectors are collectively attracting over $173.6 billion in annual funding, with growth rates that would make any traditional industry envious.

| Sector | Funding 2024 billions | Growth rate cagr | Market size 2025 billions | Number of startups | Key examples |

| Artificial Intelligence & Machine Learning | 104.3 | 28.46 | 73.98 | 40000 | [‘OpenAI’, ‘Anthropic’, ‘Scale AI’, ‘Databricks’] |

| Fintech | 20.0 | 11.2 | 4100.0 | 29955 | [‘Stripe’, ‘Robinhood’, ‘Chime’, ‘Klarna’] |

| Healthcare & Digital Health | 10.1 | 6.7 | 837.0 | 15000 | [‘Devoted Health’, ‘Teladoc’, ‘Abridge’] |

| Cybersecurity | 9.4 | 12.9 | 245.6 | 8000 | [‘Crowdstrike’, ‘SentinelOne’, ‘Okta’] |

| Enterprise AI SaaS | 8.5 | 16.17 | 150.0 | 12000 | [‘Databricks’, ‘Snowflake’, ‘Palantir’] |

| Clean Energy & Climate Tech | 7.6 | 17.2 | 240.0 | 5000 | [‘Tesla Energy’, ‘Rivian’, ‘QuantumScape’] |

| Space Technology | 6.0 | 15.6 | 250.0 | 4700 | [‘SpaceX’, ‘Relativity Space’, ‘Astranis’] |

This surge isn’t just about numbers—it’s about dreams becoming reality, entrepreneurs solving humanity’s greatest challenges, and investors recognizing that the next wave of unicorns will emerge from sectors that blend cutting-edge technology with practical solutions. From artificial intelligence startups that are redefining human-machine interaction to fintech companies democratizing financial services, the American startup has never been more dynamic or promising.

Modern open-plan startup office with entrepreneurs working at desks and natural light streaming in

Fastest growing startup Sector: AI & Machine Learning Leading $104B Investment Surge

The AI Revolution Takes Center Stage

The artificial intelligence sector stands as the undisputed leader among Fastest Growing Startup categories, attracting a staggering $104.3 billion in venture capital funding during 2024 alone. Nearly 65% of U.S. venture capital funding is directed toward AI, reflecting strong investor belief in its game-changing capabilities.

Top 10 Fastest Growing Startup sectors in the USA ranked by venture capital funding received in 2024

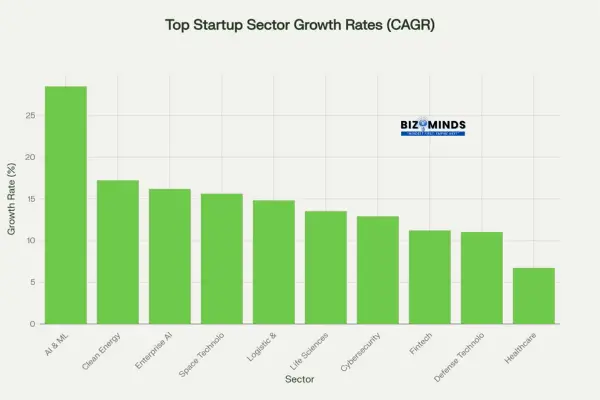

What makes this sector particularly compelling is its compound annual growth rate of 28.46%, far exceeding traditional technology sectors. The U.S. AI market, valued at approximately $73.98 billion in 2025, is projected to maintain this aggressive growth trajectory through 2031.

Key Players Driving Innovation

The sector is dominated by household names that have become synonymous with artificial intelligence:

- OpenAI – Leading with its groundbreaking ChatGPT and GPT-4 models, the company raised $40 billion in a historic funding round led by SoftBank

- Anthropic – Securing over $7.7 billion in funding for its Claude AI assistant, positioning itself as OpenAI’s primary competitor

- Scale AI – Attracting a remarkable $14.3 billion investment from Meta, highlighting the strategic importance of AI infrastructure

- Databricks – Raising significant rounds to power enterprise AI applications

Market Dynamics and Growth Drivers

The AI sector’s growth is fueled by several critical factors that extend far beyond mere technological novelty. Enterprise adoption has accelerated dramatically, with companies across industries recognizing AI as essential infrastructure rather than optional enhancement. The democratization of AI tools has created opportunities for startups to build specialized applications serving niche markets, while the infrastructure layer continues to expand with companies providing computing power, data management, and model deployment services.

The sector’s resilience is particularly noteworthy. Even as other technology sectors experienced funding contractions, AI startups maintained their momentum, with seed-stage AI funding increasing by 226% in 2024. This early-stage activity signals a robust pipeline of innovation that will drive future growth.

Fintech: USA’s Second Fastest growing startup Industry Worth $4.1 Trillion

ow Fintech Fastest growing startup Companies Are Disrupting Traditional Banking

The financial technology sector represents one of the most mature yet rapidly evolving Fastest Growing Startup ecosystems in America. Across the world, over 29,955 fintech startups have emerged, and the United States commands the greatest funding, highlighting the industry’s resilience and inventive spirit.

A customer making a digital payment using a smartphone and card reader showcasing FinTech’s digital wallet technology

In 2024, the U.S. fintech sector was valued at an impressive $4.10 trillion and is expected to soar to $11.85 trillion by 2034, growing at a CAGR of 11.20%. This represents not just incremental improvement, but fundamental transformation of how Americans interact with money.

Sector Breakdown and Innovation Areas

The fintech encompasses diverse sub-sectors, each addressing specific pain points in traditional financial services:

Digital Payments and Mobile Banking:

- Leading firms such as Stripe and Square have transformed how businesses handle payment transactions

- Mobile-first banks such as Chime and Ally Bank are attracting millions of customers with superior user experiences

- Cryptocurrency platforms including Coinbase and Kraken are democratizing digital asset access

Buy Now, Pay Later (BNPL) Services:

- Affirm and Afterpay attract younger consumers by offering adaptable and flexible payment solutions

- These platforms are reshaping consumer purchasing behavior and merchant relationships

Investment and Wealth Management:

- Robinhood has democratized stock trading with commission-free transactions

- Robo-advisors are making sophisticated investment strategies accessible to retail investors

Investment Trends and Market Dynamics

Despite global fintech investment challenges, the U.S. market demonstrated remarkable resilience, attracting over $20 billion in venture capital funding in 2024. The sector’s strength lies in its ability to address fundamental human needs around financial security, accessibility, and empowerment.

The regulatory environment continues evolving to balance innovation with consumer protection, particularly in areas like cryptocurrency, data privacy, and lending practices. This regulatory clarity is attracting institutional investors who previously viewed fintech as too risky.

Healthcare & Digital Health: The Fastest growing startup Sector Saving Lives and Billions

How Fintech Fastest growing startup Companies Are Disrupting Traditional Banking

Healthcare technology has emerged as a crucial Fastest Growing Startup sector, driven by aging demographics, chronic disease prevalence, and technological breakthroughs that make personalized medicine accessible. The sector attracted $10.1 billion across 497 deals in 2024, with venture capital investment increasing 30.4% in Q1 2025.

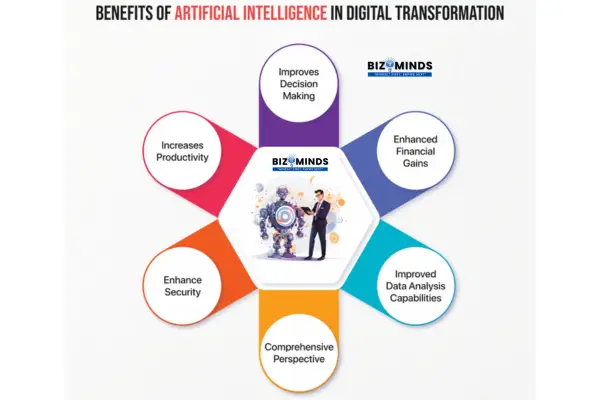

Key benefits of artificial intelligence in digital transformation include improved decision making, enhanced financial gains, and increased productivity

The American healthcare market’s profit pools are projected to grow from $605 billion in 2022 to $837 billion by 2027, representing a 6.7% CAGR that reflects both opportunity and necessity. This growth is particularly meaningful because it directly impacts human welfare and quality of life.

Innovation Areas Driving Growth

Telemedicine and Virtual Care:

The pandemic accelerated telemedicine adoption, but the trend has sustained as patients and providers recognize the convenience and efficiency benefits. Companies like Teladoc and Amwell have established benchmarks, while specialized startups focus on mental health, chronic care management, and remote diagnostics.

AI-Powered Healthcare Solutions:

- Diagnostic AI companies are developing tools that can identify diseases earlier and more accurately than traditional methods

- Clinical documentation platforms like Abridge are using voice recognition and language summarization to reduce physician administrative burden

- Predictive analytics tools are helping healthcare systems optimize resource allocation and patient outcomes

Personalized Medicine and Biotechnology:

- Companies are leveraging genetic data to develop targeted therapies

- These platforms provide digital, evidence-backed therapies designed to treat diverse health conditions effectively

- Wearable technology integration is enabling continuous health monitoring

Investment Patterns and Growth Catalysts

Healthcare AI startups captured 60% of all digital health funding in Q1 2025, totaling $3.2 billion. This concentration reflects investor confidence in AI’s potential to solve healthcare’s most pressing challenges, from physician burnout to diagnostic accuracy.

The sector benefits from several tailwinds including demographic trends, regulatory support for digital health solutions, and increasing consumer comfort with technology-mediated healthcare. The COVID-19 pandemic served as an unexpected catalyst, accelerating adoption timelines by years rather than decades.

Cybersecurity: Why This Fastest growing startup Sector Attracts $9.4B Annually

The Cybersecurity Imperative

As digital transformation accelerates across all industries, cybersecurity has evolved from a technical necessity to a business imperative, making it one of the most critical Fastest Growing Startup sectors. The global cybersecurity market reached $245.62 billion in 2024 and is projected to grow at a robust 12.9% CAGR, reaching $500.70 billion by 2030.

A professional interacting with a holographic cybersecurity interface highlighting data protection and network security concepts

The sector’s growth is driven by an increasingly sophisticated threat that includes AI-powered attacks, cloud infrastructure vulnerabilities, and complex digital supply chain risks. High-profile cyber incidents have made advanced cybersecurity a non-discretionary expenditure for enterprises of all sizes.

Market Dynamics and Investment Trends

Cybersecurity venture capital funding demonstrated remarkable resilience, reaching $9.4 billion globally in the first half of 2025, marking a three-year high. U.S. companies captured approximately 57% of global cybersecurity startup funding, reinforcing America’s leadership in security innovation.

Key Growth Areas:

- AI-Driven Security Operations – Automating threat detection and response

- Cloud-Native Application Protection Platforms (CNAPP) – Securing cloud infrastructure

- The Zero-Trust Architecture security approach enforces strict verification by operating under a “never trust, always authenticate” principle

- Data Privacy and Compliance – Addressing regulatory requirements and data protection

Innovation and Market Leadership

The sector is characterized by rapid innovation cycles as security companies race to stay ahead of evolving threats. Startups specializing in AI-driven security operations, cloud security, and identity access management are commanding premium valuations, with Enterprise Value-to-Revenue multiples ranging from 15x to 30x.

Notable funding rounds include companies like Safe Security ($70 million Series C), Wallarm ($55 million Series C), and Zero Networks ($55 million Series C). These investments reflect the market’s confidence in cybersecurity as an essential infrastructure layer for the digital economy.

Enterprise AI SaaS: The Fastest growing startup Category Transforming Business

Transforming Business Operations

Enterprise AI Software-as-a-Service represents a specialized subset of the broader AI trend, focusing specifically on business applications that automate operations, enhance decision-making, and drive efficiency. This Fastest Growing Startup sector is attracting significant investment as companies recognize AI’s potential to revolutionize traditional business processes.

The sector benefits from IBM’s $500 million Enterprise AI Venture Fund, launched in late 2023 to accelerate startups developing AI tools for real-world enterprise applications. This institutional support signals the sector’s strategic importance and growth potential.

Market Applications and Use Cases

Core Application Areas:

- Customer Service Automation – AI-powered chatbots and support systems

- Sales Enablement – Predictive analytics and lead scoring

- Optimizing operations by improving supply chain processes and effectively managing resource distribution

- Financial Analysis – Automated reporting and risk assessment

The sector’s appeal lies in its ability to deliver measurable ROI through efficiency gains and cost reduction. According to Rob Bearden, Founder and CEO of Sema4.ai, AI-driven automation will allow large companies valued in billions to operate efficiently with fewer than 100 staff members.

Investment Patterns and Growth Trajectory

Enterprise AI SaaS companies are attracting substantial venture capital as businesses across industries seek to implement AI solutions. The sector’s growth is supported by increasing enterprise comfort with cloud-based solutions and growing recognition of AI’s competitive advantages.

Companies in this space often achieve rapid scaling by addressing specific industry pain points while maintaining platform flexibility for broader applications. The B2B focus provides natural advantages including higher customer lifetime values, recurring revenue models, and strong defensibility through integration depth.

Compound Annual Growth Rate (CAGR) percentages for the top 10 Fastest Growing Startup sectors in the USA

Clean Energy & Climate Tech: The Fastest growing startup Sector Driving America’s Green Revolution

The Green Revolution in Startups

Clean energy and climate technology represent one of the most compelling Fastest Growing Startup sectors, driven by both environmental necessity and economic opportunity. The sector attracted $7.6 billion in U.S. venture capital funding in 2024, representing a 15% year-over-year increase.

The Inflation Reduction Act and CHIPS and Science Act have provided substantial tailwinds for the sector, offering incentives for clean technology development and deployment. Since 2021, public and private investments in cleantech have surged over 70%, hitting $240 billion by 2023, highlighting strong growth in the sector.

Technology Focus Areas and Innovation

Renewable Energy Infrastructure:

- Advanced solar panel technology with improved efficiency rates

- Next-generation battery storage systems for grid-scale applications

- Wind energy innovations including offshore and floating platforms

Transportation Electrification:

- Electric vehicle technology and charging infrastructure

- Sustainable aviation fuel development

- Autonomous electric vehicle systems

Industrial Decarbonization:

- Carbon capture and utilization technologies

- Clean hydrogen production and applications

- Sustainable manufacturing processes

Investment Trends and Policy Impact

The sector’s growth trajectory is supported by multiple factors including declining technology costs, supportive government policies, and increasing corporate sustainability commitments. However, recent political changes have introduced some uncertainty, with industrial cleantech investments declining 3% in Q1 2025.

Despite short-term volatility, long-term fundamentals remain strong. The global push toward net-zero emissions, coupled with the economic competitiveness of renewable energy, creates sustained demand for innovative solutions. Early-stage activity remains particularly robust, with 75% of deals in 2024 involving seed and Series-A companies.

Space Technology: USA’s Most Exciting Fastest growing startup Frontier

Commercial Space Revolution

Space technology has evolved from government-dominated endeavors to a thriving Fastest Growing Startup ecosystem, attracting $6.0 billion in U.S. funding during 2024. The sector benefits from dramatic cost reductions in launch capabilities, with SpaceX’s Falcon 9 offering launch prices around $2,720 per kg to LEO versus approximately $54,500 per kg during the Space Shuttle era.

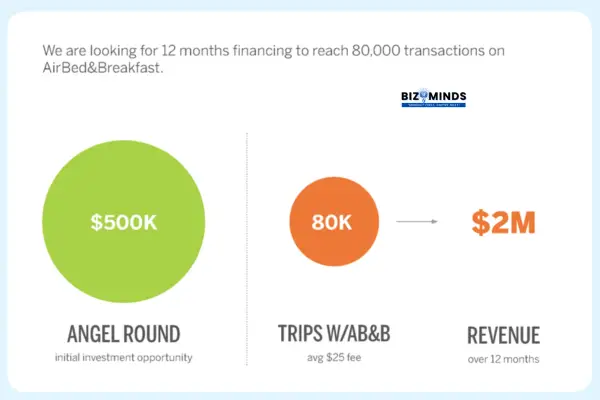

Example of a startup pitch deck slide showing a $500K angel round funding aiming to generate $2M revenue through 80,000 transactions within 12 months on AirBed&Breakfast

The U.S. space market, valued at over $250 billion, presents immense potential for startups with clear commercial applications. The industry is projected to grow from $630 billion in 2023 to $1.8 trillion by 2035, representing extraordinary expansion opportunities.

Innovation Areas and Market Opportunities

Launch Services and Infrastructure:

- Reusable rocket technology development

- Small satellite deployment systems

- Orbital debris cleanup platforms

Satellite Applications:

- Earth imaging and data analytics

- Communications and internet connectivity

- GPS and positioning services

Space Manufacturing and Habitats:

- In-space manufacturing capabilities

- Commercial space station development

- Space tourism infrastructure

Investment Dynamics and Growth Catalysts

Space technology funding demonstrated remarkable resilience, with U.S. companies capturing 70% of global space tech funding in Q2 2025. Investment in U.S. space ventures has already exceeded 2024’s full-year total, highlighting accelerating momentum.

Venture capital firms account for 77% of 2025 space funding, compared to 54% in 2024, indicating growing institutional confidence. The sector benefits from dual-use applications that serve both commercial and defense markets, providing multiple revenue streams and risk mitigation.

Notable companies include Relativity Space (raised over $1.3 billion for 3D-printed rockets), Astranis ($200 million for micro-geostationary satellites), and Sierra Space ($1.4 billion Series A for spaceplane development).

Defense Technology: National Security Meets Innovation

Defense Technology: Most Strategic Fastest Growing Startup Category

Defense technology has emerged as a critical Fastest Growing Startup sector, attracting $3.0 billion in venture capital funding in 2024, representing an 11% year-over-year increase. This growth reflects increasing recognition of national security challenges and the need for innovative solutions that leverage cutting-edge technology.

The sector benefits from government support through programs like the Defense Innovation Unit (DIU) and In-Q-Tel, which help bridge the gap between startup innovation and defense requirements. Additionally, geopolitical tensions and evolving threat are driving sustained demand for advanced defense solutions.

Key Innovation Areas

Autonomous Systems:

- Unmanned aerial vehicles (UAVs) and drones

- Autonomous ground vehicles and robotics

- AI-powered surveillance and reconnaissance systems

Cybersecurity and Information Warfare:

- Advanced threat detection and response systems

- Secure communication platforms

- Data protection and encryption technologies

Dual-Use Technologies:

- AI and machine learning applications

- Advanced materials and manufacturing

- Space-based systems and satellite technology

Investment Patterns and Market Leaders

Defense tech startups often pursue dual-use strategies, developing technologies that serve both military and commercial markets. This approach reduces dependence on government contracts while expanding addressable market opportunities.

Companies like Shield AI exemplify this approach, raising $200 million to scale AI pilot software for military aircraft while achieving a $2.7 billion valuation. Anduril has attracted over $2.8 billion in funding for autonomous defense systems that incorporate advanced AI capabilities.

The sector’s growth is supported by increasing defense budgets, modernization initiatives, and recognition that traditional defense contractors must partner with innovative startups to maintain technological superiority.

Regional Innovation Hubs: Beyond Silicon Valley

Geographic Distribution of Growth

While Silicon Valley remains the dominant hub for Fastest Growing Startup activity, the American startup ecosystem is experiencing significant geographic diversification. Cities like Miami, Austin, Atlanta, and Denver are emerging as major startup centers, driven by lower costs, supportive policies, and improved access to talent and capital.

Emerging Startup Hubs:

Miami: Leading in fintech and cryptocurrency startups, benefiting from proximity to Latin American markets and favorable regulatory environment

Austin: Attracting technology companies with supportive policies, lower operating costs, and strong talent pipeline from local universities

Atlanta: Becoming a logistics and supply chain technology center, leveraging its transportation infrastructure and corporate presence

Denver: Emerging as a cleantech and energy technology hub, supported by natural resources and environmental focus

Factors Driving Geographic Diversification

The decentralization of startup activity reflects several important trends including remote work adoption, rising costs in traditional tech centers, and improved access to venture capital in secondary markets. State and local governments are actively competing for startup activity through tax incentives, regulatory support, and infrastructure investments.

This geographic distribution creates opportunities for entrepreneurs outside traditional tech centers while providing investors with access to diverse talent pools and market opportunities. The trend also reflects the maturing of the startup ecosystem, where success is no longer geographically constrained.

Investment Trends and Market Dynamics

Venture Capital Flow Patterns

The Fastest Growing Startup sectors are attracting unprecedented levels of venture capital, with total U.S. startup funding surging 75.6% in the first half of 2025. This growth is primarily driven by AI and technology sectors, but extends across multiple industries as investors seek diversification and growth opportunities.

Key Investment Trends:

- Mega-rounds ($100+ million) are becoming more common, with 11 mega-rounds capturing 46% of all digital health funding in Q1 2025

- Early-stage activity remains robust across sectors, indicating healthy pipeline development

- Corporate venture capital participation is increasing as large companies seek strategic investments

- International capital continues flowing into U.S. startups, reflecting global confidence in American innovation

Market Maturation and Evolution

The startup ecosystem is demonstrating increasing sophistication in both company development and investor evaluation. Valuations are becoming more closely tied to revenue metrics and sustainable business models, while investors are emphasizing companies with clear paths to profitability.

This maturation is evident in longer funding cycles, higher due diligence standards, and increased focus on unit economics and market defensibility. Companies that demonstrate strong fundamentals and sustainable growth are commanding premium valuations, while those relying solely on growth-at-all-costs strategies face increased scrutiny.

Distribution of startup companies across the top 10 fastest growing startup sectors in the USA by number of companies

Future Outlook: Which Fastest-Growing Startup Sectors Will Dominate?

Technology Convergence and New Frontiers

The most promising opportunities in Fastest Growing Startup sectors often emerge at the intersection of multiple technologies. Artificial intelligence is increasingly being integrated into healthcare, cybersecurity, fintech, and other sectors, creating compound value propositions that address complex challenges.

Emerging Convergence Areas:

- AI + Healthcare: Personalized medicine, drug discovery, and diagnostic tools

- AI-powered cybersecurity solutions enable automated detection and response to cyber threats in real time

- AI + Clean Energy: Smart grid optimization and renewable energy management

- Blockchain + Finance: Decentralized finance and digital asset infrastructure

Regulatory Evolution and Market Impact

Regulatory frameworks continue evolving to balance innovation with consumer protection and national security. The development of clear, supportive regulations in areas like AI governance, data privacy, and financial services will significantly impact startup growth trajectories.

Companies that proactively engage with regulatory processes and build compliance into their core operations will have competitive advantages as markets mature and regulation becomes more comprehensive.

Global Competition and Market Positioning

American startups face increasing competition from international markets, particularly in areas like AI, clean energy, and advanced manufacturing. However, the U.S. maintains significant advantages including access to capital, talent depth, market size, and institutional support for innovation.

The continued success of Fastest Growing Startup sectors will depend on maintaining these competitive advantages while addressing challenges like talent acquisition, regulatory uncertainty, and international competition.

Conclusion: The USA Startup Revolution Continues

Fastest Growing Startup sectors in the USA represents more than statistical trends, it embodies the American spirit of innovation, risk-taking, and problem-solving that has driven economic progress for generations. From AI companies pushing the boundaries of human-machine collaboration to space startups making the cosmos accessible, these sectors are writing the next chapter of American economic leadership.

The $173.6 billion in annual funding across the top ten sectors reflects not just investor confidence, but recognition that these companies are building the infrastructure for tomorrow’s economy.

Each sector addresses fundamental human needs: AI enhances our cognitive capabilities, fintech democratizes financial access, healthcare technology improves quality of life, and cybersecurity protects our digital society.

What makes this moment particularly exciting is the convergence of favorable conditions: abundant capital, breakthrough technologies, supportive policies, and global market opportunities. The entrepreneurs building companies in these sectors aren’t just creating businesses—they’re solving problems that matter, generating employment, and contributing to American technological leadership on the global stage.

The geographic diversification beyond traditional tech centers means that innovation is becoming more accessible and inclusive, while the sector diversity provides resilience against economic cycles and market volatility. Whether driven by environmental necessity, demographic trends, or technological breakthroughs, these Fastest Growing Startup sectors are positioned for sustained expansion.

For entrepreneurs, investors, and policymakers, the message is clear: the future belongs to those who embrace innovation, support entrepreneurship, and recognize that today’s startups are tomorrow’s industry leaders. The American startup revolution continues, and its impact will shape not just the economy, but society itself.

Frequently Asked Questions (FAQs)

1. What makes AI and machine learning the Fastest Growing Startup sector in the USA?

AI and machine learning lead Fastest Growing Startup sectors due to their $104.3 billion in 2024 funding and 28.46% annual growth rate. The sector benefits from broad enterprise adoption, government support, and breakthrough technologies that solve real-world problems across industries. Companies like OpenAI and Anthropic have demonstrated massive commercial potential, attracting unprecedented investor interest and validating the sector’s transformative impact.

2. How has the fintech sector maintained its growth despite regulatory challenges?

The fintech sector remains a dominant Fastest Growing Startup category by focusing on genuine user needs and regulatory compliance. With over 29,955 startups globally and $4.10 trillion U.S. market value, fintech companies succeed by offering superior user experiences, lower costs, and innovative services. Regulatory clarity in areas like digital payments and cryptocurrency is actually accelerating institutional adoption and investment.

3. What role does government policy play in clean energy startup growth?

Government policy significantly impacts Fastest Growing Startup success in clean energy through legislation like the Inflation Reduction Act, which provided nearly $400 billion in subsidies and incentives. However, policy changes can create uncertainty, as seen in the recent 3% decline in industrial cleantech investments. Long-term growth depends on sustained policy support and private sector recognition of clean energy’s economic competitiveness.

4. Why are cybersecurity startups attracting record venture capital investment?

Cybersecurity represents a critical Fastest Growing Startup sector because digital transformation creates expanding attack surfaces that require sophisticated defense solutions. The sector has secured $9.4 billion in worldwide funding and is growing annually at 12.9%, driven by essential enterprise investments in security solutions. AI-powered attacks and cloud vulnerabilities are driving demand for innovative security solutions that traditional vendors cannot adequately address.

5. How do space technology startups achieve billion-dollar valuations?

Space technology Fastest Growing Startup companies achieve high valuations by leveraging dramatically reduced launch costs and identifying commercial applications for space-based services. Companies like Relativity Space ($4.2 billion valuation) and Sierra Space ($4.5 billion) demonstrate that reusable rockets, satellite constellations, and space infrastructure can generate substantial revenue streams beyond traditional government contracts.

6. What advantages do healthcare AI startups have over traditional healthcare companies?

Healthcare AI represents a Fastest Growing Startup sector because these companies can move faster than established healthcare organizations while leveraging data and technology to improve patient outcomes. With 60% of digital health funding going to AI companies, startups can address specific problems like physician burnout, diagnostic accuracy, and administrative efficiency without legacy system constraints.

7. Are enterprise AI SaaS companies sustainable beyond the current AI hype cycle?

Enterprise AI SaaS Fastest Growing Startup companies demonstrate sustainability through measurable ROI, recurring revenue models, and deep customer integrations. Unlike consumer AI applications, enterprise solutions solve specific business problems and provide quantifiable value through efficiency gains and cost reduction. IBM’s $500 million venture fund specifically targeting this sector validates long-term commercial potential.

8. How do regional startup hubs compete with Silicon Valley for talent and capital?

Regional hubs attract Fastest Growing Startup companies by offering lower operating costs, supportive government policies, and quality of life advantages. Cities like Miami (fintech), Austin (general tech), and Atlanta (logistics) develop specialized expertise while providing access to local talent and markets. Remote work trends and venture capital geographic diversification are reducing Silicon Valley’s monopoly on startup success.

9. What metrics should investors use to evaluate Fastest Growing Startup opportunities?

Investors evaluating Fastest Growing Startup companies should focus on total addressable market size, revenue growth rates, customer acquisition costs, and path to profitability. Market timing, regulatory environment, competitive positioning, and team experience are equally important. Sectors demonstrating sustained growth, like AI (28.46% CAGR) and clean energy (17.2% CAGR), offer more predictable returns than purely speculative investments.

10. How do defense technology startups navigate government contracting requirements?

Defense technology Fastest Growing Startup companies succeed by developing dual-use technologies that serve both military and commercial markets, reducing dependence on government contracts. Companies like Shield AI and Anduril leverage venture capital to fund initial development while pursuing government partnerships through programs like Defense Innovation Unit. This approach provides multiple revenue streams and reduces regulatory risks.

11. What challenges do fintech startups face in achieving profitability?

Fintech Fastest Growing Startup companies face challenges including customer acquisition costs, regulatory compliance expenses, and competition from established financial institutions. However, successful companies like Stripe and Robinhood demonstrate that superior user experiences, innovative products, and efficient operations can achieve sustainable profitability. The key is focusing on specific market segments and building defensible competitive advantages.

12. How will artificial intelligence integration affect other startup sectors?

AI integration will transform virtually all Fastest Growing Startup sectors by enhancing existing capabilities and creating new market opportunities. Healthcare startups are already using AI for diagnostics and drug discovery, while cybersecurity companies leverage AI for threat detection. This convergence creates compound value propositions but also increases technical complexity and competitive requirements for startup success.

Citations

- https://synergytop.com/blog/top-10-fastest-growing-industries-in-the-usa-in-2025-trends-opportunities/

- https://www.reuters.com/business/us-ai-startups-see-funding-surge-while-more-vc-funds-struggle-raise-data-shows-2025-07-15/

- https://www.cnbc.com/2025/07/22/ai-startups-raised-104-billion-in-first-half-exits-different-story.html

- https://thunderbit.com/blog/ai-startup-stats

- https://techcrunch.com/2025/08/27/here-are-the-33-us-ai-startups-that-have-raised-100m-or-more-in-2025/

- https://explodingtopics.com/blog/ai-statistics

- https://www.forbes.com/lists/ai50/

- https://skywork.ai/skypage/en/Analyzing-the-Growth-of-US-Cybersecurity-Startups:-Funding,-Threats,-and-Innovation-in-2025/1947907346579406848

- https://www.ventureatlanta.org/top-startup-industries-2025/

- https://www.expertmarketresearch.com/reports/united-states-fintech-market

- https://www.statista.com/topics/12515/fintech-in-the-us/

- https://www.marketdataforecast.com/market-reports/north-america-fintech-market

- https://www.fiercehealthcare.com/special-reports/fastest-growing-health-tech-startups-funding-look-2024-and-past-decade

- https://rockhealth.com/insights/2024-year-end-market-overview-davids-and-goliaths/

- https://www.aha.org/aha-center-health-innovation-market-scan/2025-05-27-digital-health-funding-surges-q1-ai-leading-way

- https://www.bitcot.com/fastest-growing-industries/

- https://growthlist.co/cyber-security-startups/

- https://www.startus-insights.com/innovators-guide/cybersecurity-report/

- https://www.statista.com/topics/11716/cleantech-in-the-us/

- https://www.ciphernews.com/articles/after-years-of-historic-growth-industrial-cleantech-investments-falter/

- https://www.svb.com/trends-insights/reports/future-of-climate-tech/

- https://storm4.com/resources/industry-insights/us-cleantech-statistics/

- https://www.cnbc.com/2025/07/18/investing-in-space-the-markets-taking-off.html

- https://www.kennox.ai/industry-news/space-venture-capital-deep-dive-2025

- https://www.phoenixstrategy.group/blog/how-space-tech-startups-attract-vc-funding

- https://www.plugandplaytechcenter.com/insights/spacetech-startups-break-into-usa-market

- https://successknocks.com/american-venture-capital-investment-trends/

- https://explodingtopics.com/blog/startup-stats

- https://startupgenome.com/report/gser2025/state-of-the-global-startup-economy

- https://www.alpha-sense.com/blog/trends/venture-capital-trends/

- https://www.embroker.com/blog/startup-statistics/

- https://govclab.com/2025/04/08/q2-2025-venture-trends-results/

- https://www.hubspot.com/startups/reports/hypergrowth-startups/fastest-growing-industries

- https://www.startupblink.com/startup-ecosystem/united-states

- https://www.bain.com/insights/global-venture-capital-outlook-latest-trends-snap-chart/

- https://explodingtopics.com/blog/fast-growing-companies

- https://www.statista.com/topics/4734/startups-in-north-america/

- https://www.ey.com/en_us/insights/growth/venture-capital-investment-trends

- https://startupsavant.com/startups-to-watch

- https://topstartups.io/?hq_location=Usa

- https://wise.com/gb/blog/venture-capital-trends

- https://www.forbes.com/sites/amyfeldman/2025/08/12/next-billion-dollar-startups-2025/

- https://dealroom.co/guides/global

- https://bdmtglobal.com/7-how-to-attract-u-s-investors-to-your-healthcare-startup-business/

- https://www.mordorintelligence.com/industry-reports/us-fintech-market

- https://www.precedenceresearch.com/fintech-as-a-service-market

- https://www.delveinsight.com/blog/ai-healthcare-startups-funding-trends

- https://www.zionmarketresearch.com/report/fintech-market

- https://www.svb.com/trends-insights/reports/healthcare-investments-and-exits/

- https://www.dealmaker.tech/content/the-essential-ai-startup-funding-guide-2025-strategies-for-success

- https://bluetree.digital/fintech-market-growth-statistics/

- https://topstartups.io/?industries=Cybersecurity

- https://globalventuring.com/corporate/energy-and-natural-resources/corporate-funding-for-us-cleantech-startups-slumps/

- https://www.startus-insights.com/innovators-guide/space-industry-outlook/

- https://explodingtopics.com/blog/cybersecurity-startups

- https://www.statista.com/topics/10756/space-startups/

- https://www.crn.com/news/security/2025/the-10-hottest-cybersecurity-startups-of-2025-so-far

- https://www.oliverwyman.com/our-expertise/insights/2023/may/investment-in-clean-energy-startups-is-booming.html

- https://www.ycombinator.com/companies/industry/security

- https://www.startus-insights.com/innovators-guide/cleantech-report/