How to Create a Family Budget That Actually Works: Complete 2025 Guide for US Families

Creating and maintaining a family budget represents one of the most critical financial skills American households can develop. Recent Federal Reserve research indicates that 55% of US adults maintain emergency savings covering three months of expenses, while the median household income reached $83,730 in 2024. Yet despite these encouraging statistics, many families struggle with effective budgeting, often due to unrealistic expectations, inadequate tracking systems, or failure to account for irregular expenses. This comprehensive guide provides evidence-based strategies, real-world examples, and practical tools to help the USA families establish sustainable budgeting practices that adapt to their unique circumstances and financial goals.

Couple planning their family budget together at the kitchen table with documents, calculator, and laptop

Understanding the Modern USA Family Budget Outlook

Current Household Financial Realities

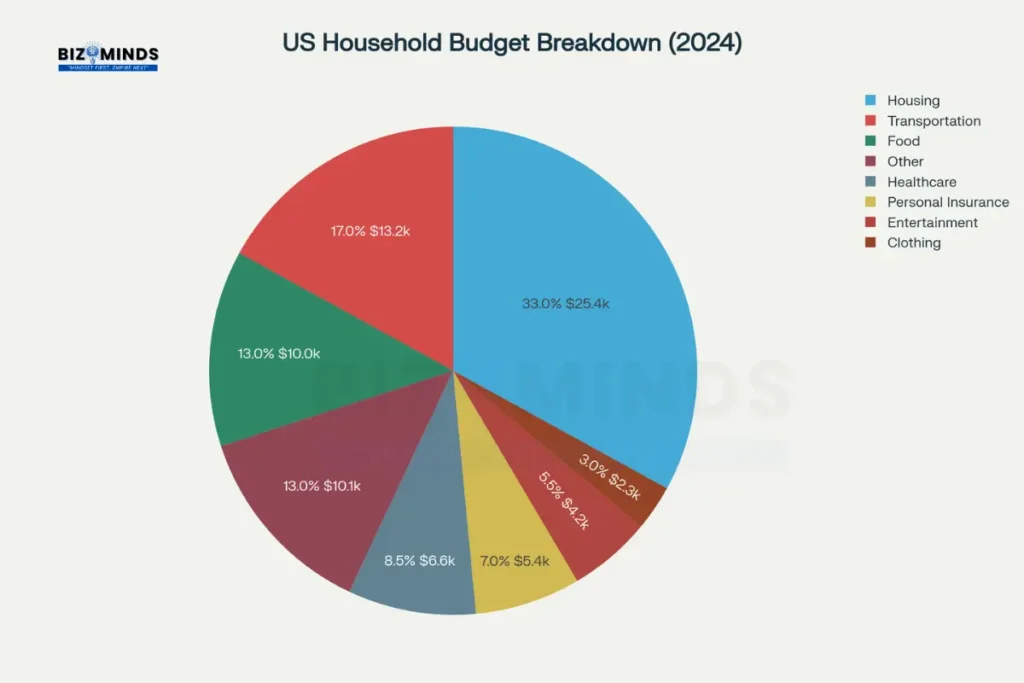

The average US household spent $77,280 in 2023, representing a 5.9% increase from the previous year. Housing continues to dominate family budgets, consuming approximately 33% of total expenses, followed by transportation at 17% and food at 13%. These proportions vary significantly across income levels, with lower-income households dedicating larger percentages of their income to essential expenses.

Breakdown of average US household spending by major expense categories in 2024

Research from the Economic Policy Institute reveals substantial geographic variations in family budget requirements. For instance, a basic family budget for a two-parent, two-child household ranges from $79,191 in Rockingham County, North Carolina, to $211,473 in San Francisco. This dramatic difference underscores the importance of localizing budget strategies rather than relying on national averages.

Income Distribution and Spending Patterns

The 2024 Census data shows that 19% of adults maintain family incomes below $25,000, while 39% earn $100,000 or more. These income disparities significantly impact budgeting approaches and emergency preparedness. Higher-income households demonstrate superior emergency fund readiness, with 74% of families earning over $100,000 maintaining three months of emergency savings, compared to only 24% of those earning under $25,000.

Transportation costs particularly burden lower-income families, consuming nearly 32% of pre-tax income for households earning $28,261 or less, compared to just 9.6% for those earning above $148,682. Rural households face additional challenges, spending an average of $14,295 annually on transportation, exceeding urban household expenditures by nearly $1,400.

Core Principles of Effective Family Budget Planning

The Foundation: Accurate Income and Expense Tracking

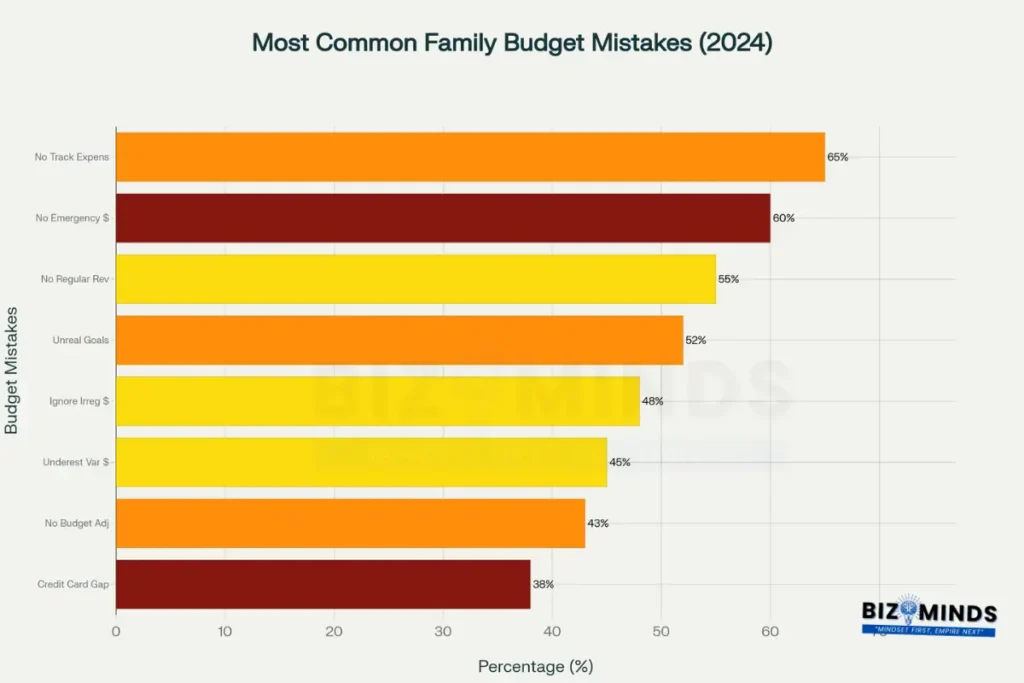

Successful family budgeting begins with comprehensive tracking of all income sources and expenditures. Research indicates that 65% of families fail to track expenses adequately, representing the most common budgeting mistake. Modern families typically receive income from multiple sources: 66% report wages or self-employment income, while 55% receive non-labor income including investment returns, Social Security, or pension benefits.

A family budget management app displayed on a smartphone amidst traditional office tools like papers, a laptop, and a calculator

Effective tracking requires documenting both regular and irregular income streams. Families should account for bonuses, tax refunds, and seasonal income variations rather than averaging these amounts across months. Similarly, expense tracking must capture both fixed costs like mortgage payments and variable expenses such as groceries, utilities, and entertainment.

Establishing Realistic Budget Categories

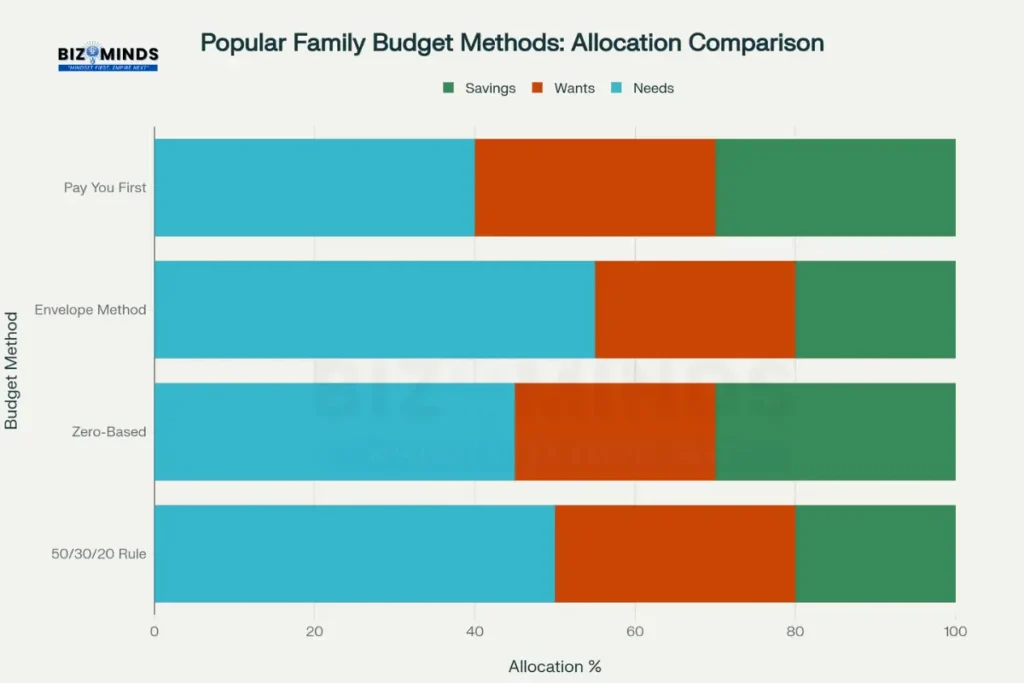

Professional financial advisors recommend organizing family budgets into three primary categories: needs, wants, and savings. However, the optimal allocation varies based on family circumstances, income level, and financial goals. The popular 50/30/20 rule suggests dedicating 50% to needs, 30% to wants, and 20% to savings, but this framework may require adjustment for families with higher housing costs or significant debt obligations.

Comparison of allocation percentages across popular family budgeting methods

Alternative budgeting approaches include:

- Zero-based budgeting: Allocating every dollar to specific categories, ensuring income minus expenses equals zero

- Envelope method: Designating cash amounts for specific spending categories

- Pay yourself first: Prioritizing savings and debt payments before discretionary spending

The Critical Role of Emergency Funds

Emergency fund establishment represents a non-negotiable component of family budget planning. Recent analysis suggests families should maintain approximately $35,000 in emergency savings, equivalent to six months of expenses for the average American household. This figure reflects 40% of median annual household income and accounts for essential expenses including housing, utilities, food, healthcare, and transportation.

Saving coins in an emergency fund jar to prepare for unexpected financial costs and build personal financial safety

Current statistics reveal concerning gaps in emergency preparedness. Only 46% of American adults maintain sufficient emergency savings to cover three months of expenses, while 24% have no emergency savings whatsoever. The disparity becomes more pronounced across income levels, with lower-income families facing particular vulnerability to financial shocks.

Implementing Popular Family Budget Methods

The 50/30/20 Budget Framework

The 50/30/20 budgeting method provides a simplified approach suitable for families seeking straightforward allocation guidelines. This framework divides after-tax income into three categories: 50% for essential needs, 30% for discretionary wants, and 20% for savings and debt repayment.

Essential needs encompass housing payments, utilities, groceries, transportation, insurance premiums, and minimum debt payments. The wants category includes dining out, entertainment, subscriptions, and non-essential shopping. The savings portion covers emergency fund contributions, retirement investments, and additional debt payments beyond minimums.

Families in high-cost areas may need to adjust these percentages, potentially allocating 60% to needs and reducing wants to 20%. Similarly, families with significant debt might temporarily increase the savings/debt repayment percentage to 30% while reducing discretionary spending.

Zero-Based Budgeting for Maximum Control

Zero-based budgeting requires assigning every dollar of income to specific categories, leaving no unallocated funds. This method promotes intentional spending decisions and prevents inadvertent overspending. Families following this approach begin each month by listing all income sources, then allocating funds to essential expenses, discretionary spending, and savings goals until reaching a zero balance.

This methodology works particularly well for families with irregular income or those working to eliminate debt. The detailed tracking requirement helps identify spending patterns and opportunities for optimization. However, zero-based budgeting demands significant time commitment and may feel restrictive for families preferring flexibility.

Envelope Budgeting for Spending Control

The envelope method involves allocating cash amounts to specific spending categories, either physically using envelopes or digitally through banking apps. Once an envelope’s funds are exhausted, no additional spending occurs in that category until the next budgeting period. This approach provides tangible spending limits and reduces reliance on credit cards.

Modern digital versions of envelope budgeting use separate checking accounts or budgeting apps to track category spending. Families can benefit from the envelope method’s spending discipline while maintaining the convenience of electronic payments. This approach works exceptionally well for variable expenses like groceries, entertainment, and clothing.

Managing Major Family Budget Categories

Housing: The Dominant Expense

Housing costs represent the largest component of family budgets, averaging 33% of total household expenditures. For many families, this percentage exceeds financial advisors’ recommended 25-30% threshold, particularly in high-cost metropolitan areas. Housing expenses extend beyond mortgage or rent payments to include utilities, maintenance, insurance, and property taxes.

Families struggling with housing costs should evaluate refinancing opportunities, consider downsizing, or explore alternative living arrangements. In some markets, purchasing may cost less than renting, while other areas favor rental arrangements. Geographic relocation can dramatically impact housing affordability, though families must weigh these savings against employment opportunities and family considerations.

Transportation: The Second-Largest Expense

Transportation expenses claim 17% of the average family budget, totaling approximately $13,174 annually. These costs include vehicle purchases, insurance, fuel, maintenance, and public transportation. Rural households face particular challenges, spending $1,400 more annually than urban counterparts due to limited public transportation options and longer commuting distances.

Families can reduce transportation costs through several strategies:

- Vehicle optimization: Choosing reliable, fuel-efficient vehicles and avoiding excessive loans

- Alternative transportation: Utilizing public transit, carpooling, or ridesharing when feasible

- Location decisions: Considering proximity to work and essential services when choosing housing

- Maintenance planning: Performing regular vehicle maintenance to prevent costly repairs

Food and Healthcare: Essential Variable Expenses

Food expenses consumed 10.6% of disposable personal income in 2024, with 5.0% allocated to groceries and 5.6% to dining out. These percentages have remained relatively stable, though absolute amounts continue rising due to inflation. Families can optimize food spending through meal planning, bulk purchasing, seasonal shopping, and limiting restaurant visits.

Healthcare costs average 8.5% of family budgets but vary significantly based on insurance coverage, family health status, and geographic location. Families should maximize preventive care benefits, utilize Health Savings Accounts when available, and research healthcare providers to ensure cost-effective treatment options.

Addressing Common Family Budget Pitfalls

The Most Frequent Budgeting Mistakes

Research identifies eight primary budgeting mistakes that derail family financial plans. Not tracking expenses affects 65% of families, while 60% fail to establish adequate emergency funds. Additional common mistakes include setting unrealistic goals (52%), irregular expense oversight (48%), and inadequate budget adjustments (43%).

Most common budgeting mistakes made by US families and their financial impact levels

These mistakes compound over time, leading to financial stress, increased debt, and delayed financial goals. Families can avoid these pitfalls through systematic tracking, regular budget reviews, and realistic expectation setting. Professional financial counseling may benefit families struggling to establish effective budgeting habits.

Handling Irregular and Unexpected Expenses

Many families underestimate irregular expenses such as annual insurance premiums, holiday gifts, vehicle maintenance, and medical costs. These expenses can derail monthly budgets if not properly anticipated. Financial experts recommend establishing separate savings categories for known irregular expenses, setting aside monthly amounts to cover these costs when they arise.

Unexpected expenses differ from irregular expenses because they cannot be anticipated. Job loss, major medical expenses, and emergency home repairs fall into this category. Emergency funds specifically address these situations, providing financial cushioning without disrupting ongoing budget categories.

Managing Variable Income Challenges

Families with irregular income from seasonal work, commission-based employment, or freelance activities face unique budgeting challenges. These households should base budgets on conservative income estimates, using excess earnings during high-income periods to build emergency reserves and advance financial goals.

Strategies for variable income families include:

- Income averaging: Using previous year’s earnings to estimate monthly income

- Priority-based budgeting: Ensuring essential expenses receive funding first

- Flexible spending categories: Adjusting discretionary spending based on monthly income

- Extended emergency funds: Maintaining larger cash reserves to smooth income volatility

Technology Tools and Resources for Modern Family Budget

Digital Budgeting Applications

Modern families benefit from numerous digital tools designed to simplify budget management. Popular applications include YNAB (You Need a Budget) for zero-based budgeting, Mint for expense tracking, and EveryDollar for simplified allocation. These tools offer automatic transaction categorization, bill reminders, and progress tracking toward financial goals.

Using digital tools like smartphones and laptops to visualize financial data for effective family budget planning

When selecting budgeting software, families should consider:

- Bank integration: Automatic transaction downloading and categorization

- User interface: Intuitive design suitable for all family members

- Goal tracking: Progress monitoring for savings and debt reduction objectives

- Reporting capabilities: Detailed analysis of spending patterns and trends

- Cost structure: Free versus premium features and ongoing subscription costs

Automation Strategies

Automated financial systems reduce the manual effort required for effective budgeting while ensuring consistent execution of financial plans. Families can automate savings transfers, bill payments, and investment contributions, reducing the likelihood of missed payments or delayed savings.

Recommended automation includes:

- Emergency fund contributions: Automatic transfers following each paycheck

- Bill payments: Scheduled payments for fixed expenses like utilities and insurance

- Savings goals: Regular transfers to designated savings accounts

- Investment contributions: Automated retirement and education savings

Education and Children in Family Budget Planning

Planning for Education Expenses

Education costs represent a significant long-term financial commitment for American families. Parents typically spend over $18,000-20,000 raising a child through high school graduation, with annual expenses reaching $94,000 for some families by 2011. College expenses add substantial additional costs, with private universities averaging $50,900 annually and public institutions costing $25,290.

Effective education planning requires early initiation, consistent contributions, and tax-advantaged savings vehicles. The 529 education savings plans offer tax-free growth and withdrawals for qualified education expenses. Parents can also claim tax deductions up to $1,500 under Section 80C for children’s tuition fees.

Teaching Children About Family Budget

Involving children in age-appropriate budget discussions provides valuable financial education while building family cooperation around spending decisions. Families can assign children specific responsibilities such as tracking grocery expenses, comparing prices, or managing small personal budgets.

Educational strategies include:

- Savings matching: Parents matching children’s education savings contributions

- Budget transparency: Explaining family financial decisions and trade-offs

- Goal setting: Helping children establish and work toward financial objectives

- Spending discussions: Involving children in family purchasing decisions

Real-World Family Budget Examples and Case Studies

Case Studies:

The Desper & Bibbus Family

The Desper & Bibbus family from Pennsylvania spent $7,953 monthly, demonstrating typical middle-income budgeting challenges. Their largest expenses included $1,553 for groceries, $899 for restaurants, and $739 for pet care. Credit card payments totaled $1,134, suggesting potential debt management issues.

This family’s budget illustrates common allocation patterns: high food costs due to family size, significant pet-related expenses, and credit card dependency. Their mortgage payment of $584 represents good housing cost control, though utility costs of $224 suggest potential efficiency improvements.

The Tran Family

The Tran family in California allocated $11,269 monthly, with substantial income and correspondingly higher expenses. Notable allocations included $1,952 for law school debt payments, $971 for retirement contributions, and $1,275 for charitable donations. Their housing costs totaled $3,984 combining rent and mortgage payments.

This family demonstrates advanced financial planning through significant retirement contributions and debt repayment prioritization. Their charitable giving reflects values-based budgeting, while professional development investments support long-term income growth.

The Campbell Family

The Campbell family managed a $5,705 monthly budget emphasizing debt reduction and medical expenses. They allocated $300 for debt settlement and faced $2,503 in medical/dental costs. Their housing costs remained controlled at $839 monthly rent.

This family’s experience highlights the impact of healthcare expenses on family budgets and the importance of emergency fund preparation. Their debt settlement strategy demonstrates proactive debt management, though medical expenses continue challenging their financial stability.

Advanced Budgeting Strategies and Optimization

Periodic Budget Reviews and Adjustments

Successful family budgets require regular evaluation and modification to reflect changing circumstances. Financial experts recommend monthly budget reviews to assess spending patterns, quarterly evaluations for category adjustments, and annual comprehensive reviews for goal modification.

Review processes should examine:

- Category performance: Comparing actual spending to budgeted amounts

- Goal progress: Assessing advancement toward savings and debt reduction objectives

- Life changes: Adjusting budgets for income changes, family additions, or major expenses

- Optimization opportunities: Identifying areas for spending reduction or reallocation

Advanced Optimization Techniques

Experienced budgeting families can implement sophisticated strategies to maximize financial efficiency. These techniques include tax optimization through strategic spending timing, cashback credit card utilization for routine expenses, and bulk purchasing for non-perishable goods.

Additional optimization strategies encompass:

- Seasonal adjustments: Modifying budgets for predictable seasonal expense variations

- Income tax planning: Coordinating deductions and credits with spending decisions

- Insurance optimization: Regular review of coverage levels and premium costs

- Investment coordination: Aligning budget surplus with investment opportunities

Geographic and Lifestyle Considerations

Family budget strategies must account for geographic cost variations and lifestyle preferences. Urban families may emphasize public transportation and entertainment options, while rural families focus on vehicle reliability and home maintenance. Regional cost differences affect housing, transportation, and food expenses significantly.

Climate considerations influence utility costs, seasonal employment opportunities, and recreational expenses. Families relocating should research comprehensive cost-of-living differences rather than focusing solely on housing or income variations.

Long-Term Financial Planning Integration

Connecting Budgets to Financial Goals

Effective family budgets serve as tools for achieving broader financial objectives rather than mere expense tracking mechanisms. Families should align budget categories with specific goals such as homeownership, retirement security, debt elimination, or education funding. This connection provides motivation for budget adherence and guides spending decisions.

Goal integration strategies include:

- Timeline establishment: Setting specific target dates for major financial objectives

- Progress tracking: Regular assessment of advancement toward goals

- Priority balancing: Managing competing financial objectives within budget constraints

- Flexibility planning: Maintaining adaptability for goal modification or timeline adjustment

Retirement and Investment Considerations

Family budgets should incorporate retirement planning from the earliest possible age, taking advantage of compound growth and employer matching contributions. The median family’s retirement preparedness varies significantly by income level and education, with higher-income families demonstrating superior retirement savings rates.

Investment allocation within family budgets typically begins with emergency fund establishment, followed by retirement contributions, and finally additional investment goals. Tax-advantaged accounts such as 401(k) plans and IRAs should receive priority funding before taxable investment accounts.

Estate Planning and Insurance Integration

Comprehensive family financial planning extends beyond budgeting to include estate planning and insurance coverage. Life insurance, disability insurance, and estate planning documents ensure family financial security regardless of unforeseen circumstances. These protections should align with family budget priorities and income levels.

Insurance planning considerations include:

- Coverage adequacy: Ensuring sufficient protection for family income and expenses

- Cost optimization: Balancing coverage levels with premium affordability

- Policy integration: Coordinating insurance with overall financial planning

- Regular review: Updating coverage for changing family circumstances

Conclusion

Creating a family budget that actually works requires combining evidence-based strategies with personalized approaches that reflect individual family circumstances, values, and goals. The data clearly demonstrates that successful budgeting extends far beyond simple expense tracking to encompass emergency preparedness, goal alignment, and continuous optimization. American families face unique challenges including geographic cost variations, irregular income patterns, and competing financial priorities, but systematic budgeting approaches can address these complexities effectively.

The most successful family budgets integrate multiple components: realistic income and expense tracking, appropriate emergency fund establishment, strategic category allocation, regular review processes, and long-term goal alignment. Technology tools enhance these traditional approaches while maintaining the personal discipline and commitment required for sustained success. Families must remain flexible, adjusting their budgeting methods as circumstances change while maintaining focus on core financial principles.

Ultimately, the family budget that actually works is one that reflects genuine family priorities, accommodates real-world constraints, and evolves with changing circumstances. By avoiding common pitfalls, utilizing appropriate tools, and maintaining consistent execution, American families can achieve financial stability and progress toward their most important goals. The investment in developing these budgeting skills pays dividends through reduced financial stress, improved goal achievement, and enhanced long-term financial security.

Frequently Asked Questions

What percentage of income should go to housing in a family budget?

Financial experts typically recommend limiting housing costs to 25-30% of gross income, though the average American family spends 33% on housing. In high-cost areas, this percentage may need to increase, but families should seek to minimize housing costs through location choices, downsizing, or refinancing when possible.

How much should families save for emergencies?

Families should maintain approximately $35,000 in emergency savings, equivalent to six months of essential expenses for the average American household. This amount represents about 40% of median household income and covers housing, utilities, food, healthcare, and transportation during financial emergencies.

Which budgeting method works best for families with irregular income?

Families with variable income benefit most from zero-based budgeting or the envelope method, combined with conservative income estimates and extended emergency funds. These approaches provide spending discipline while accommodating income fluctuations through flexible category adjustments.

How often should families review and adjust their budgets?

Successful families conduct monthly budget reviews to track spending performance, quarterly evaluations for category adjustments, and annual comprehensive reviews for goal modification. Budget adjustments should occur whenever significant life changes affect income or expenses.

What are the most common family budgeting mistakes to avoid?

The most frequent mistakes include not tracking expenses (65% of families), inadequate emergency fund establishment (60%), setting unrealistic goals (52%), and failing to account for irregular expenses (48%). These pitfalls can be avoided through systematic tracking, regular reviews, and realistic expectation setting.

How can families reduce their largest budget categories like housing and transportation?

Housing costs can be reduced through refinancing, downsizing, or relocating to lower-cost areas. Transportation expenses decrease through vehicle optimization, alternative transportation usage, strategic location choices, and regular maintenance planning. These categories offer the greatest potential for budget optimization due to their significant size.

Citations

- https://www.census.gov/newsroom/press-releases/2025/income-poverty-health-insurance-coverage.html

- https://www.federalreserve.gov/publications/2025-economic-well-being-of-us-households-in-2024-income-and-expenses.htm

- https://www.federalreserve.gov/consumerscommunities/sheddataviz/emergency-savings-table.html

- https://www.bls.gov/cex/

- https://coloradosun.com/2025/04/28/is-transportation-a-top-household-expense-in-the-us/

- https://www.epi.org/press/new-family-budget-calculator-data-show-cost-of-living-in-every-county-and-metropolitan-area-in-2024/

- https://www.bankrate.com/banking/savings/emergency-savings-report/

- https://www.smartcitiesdive.com/news/transportation-costs-household-statistics/735040/

- https://www.bts.gov/data-spotlight/transportation-cost-burden-falls-significantly-second-lowest-no-other-income-group

- https://www.linkedin.com/pulse/10-mistakes-youre-making-when-budgeting-your-personal-alfred-mathu-y2utf

- https://www.sofi.com/learn/content/common-budgeting-mistakes-that-people-often-make/

- https://www.cnb.com/personal-banking/insights/making-a-budget.html

- https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/creating-a-budget

- https://www.investopedia.com/your-emergency-fund-should-be-usd35-000-here-s-why-11725755

- https://www.mmbb.org/resources/e-newsletter/2024/july-august/zero-based-budgeting-and-the-50-30-20-rule

- https://www.experian.com/blogs/ask-experian/types-of-budget-plans/

- https://www.thrivent.com/insights/budgeting-saving/types-of-budgets-5-most-popular-methods-examples-who-theyre-best-for

- https://goodbudget.com

- https://www.incharge.org/financial-literacy/budgeting-saving/average-monthly-expenses/

- http://www.ers.usda.gov/data-products/chart-gallery/chart-detail?chartId=76967

- https://www.professionals.com.au/2024/10/03/are-you-making-one-of-these-7-common-budget-mistakes/

- https://www.homecredit.co.in/en/paise-ki-paathshala/detail/7-budgeting-pitfalls-that-can-push-your-finances-off-track

- https://www.personalfn.com/dwl/Financial-Planning/11-common-mistakes-to-avoid-when-managing-your-finances-in-2025

- https://dianapps.com/blog/top-10-personal-finance-software-for-2025/

- https://www.pcmag.com/picks/the-best-personal-finance-services

- https://www.dilzer.net/financial-health/how-much-should-i-save-for-my-child-s-education-needs

- https://www.fscb.com/blog/5-strategies-to-save-for-your-childs-education

- https://cleartax.in/s/tuition-fees-deduction-under-section-80c

- https://www.hdfcbank.com/personal/resources/learning-centre/save/tax-benefits-on-child-education-allowance

- https://www.nytimes.com/interactive/2021/05/18/magazine/money-diaries.html

- https://files.epi.org/page/-/old/briefingpapers/165/bp165.pdf

- https://www.epi.org/resources/budget/budget-factsheets/

- https://srfs.upenn.edu/financial-wellness/browse-topics/budgeting/popular-budgeting-strategies

- https://en.wikipedia.org/wiki/Household_income_in_the_United_States

- https://www.federalreserve.gov/publications/2025-economic-well-being-of-us-households-in-2024-savings-and-investments.htm

- https://povertycenter.columbia.edu/sites/povertycenter.columbia.edu/files/content/Publications/Joint-Report/Family-Budget-Consumer-Guide-CPSP-IECOHD-2025.pdf

- https://www.census.gov/topics/income-poverty/income/data/tables.html

- https://www.whitehouse.gov/wp-content/uploads/2024/03/budget_fy2025.pdf

- https://www.epi.org/resources/budget/

- https://neontra.com/personal-finance/topic/50-30-20-budget/

- https://www.cbo.gov/publication/61172

- https://www.citizensbank.com/learning/budgeting-strategies.aspx

- https://www.olyv.co.in/blog/top-10-best-budgeting-apps-for-indians-in-2025/

- https://www.youtube.com/watch?v=DiIr6Njt5zI

- https://www.youtube.com/watch?v=siW9K2yDFNw

- https://www.thegazette.com/staff-columnists/my-mother-the-family-budget-expert/

- https://www.morganstanley.com/articles/how-to-build-an-emergency-fund

- https://moneyview.in/insights/best-personal-finance-management-apps-in-india

- https://www.ifhe.org/fileadmin/user_upload/IJHE-Vol-17-Iss-1-A5-Nakagawa.pdf

- https://www.stlouisfed.org/publications/page-one-economics/2025/sep/when-unexpected-happens-be-ready-with-emergency-fund

- https://www.forbes.com/advisor/banking/best-budgeting-apps/

- https://www.australianunity.com.au/wealth/case-study/learning-to-budget

- https://www.cnbc.com/2024/06/27/how-much-money-you-actually-need-in-an-emergency-fund.html

- https://itdp.org/2024/01/24/high-cost-transportation-united-states/

- https://recipe.finology.in/goal-calculators/child-education

- https://www.bajajfinserv.in/investments/common-budget-mistakes

- https://www.finideas.com/how-to-plan-for-a-childs-education-expenses/

- https://www.westsiderag.com/2024/10/04/proven-strategies-to-avoid-common-budgeting-mistakes

- https://www.indiafirstlife.com/knowledge-center/child-insurance/children-education-allowance