Dividend Reinvestment Plans: This Strategy Turned $5,000 Into $127,000 Without Effort

In an era where achieving financial independence seems increasingly challenging, Dividend Reinvestment Plans emerge as a proven pathway that has transformed ordinary investors into millionaires through the power of systematic wealth accumulation. These programs represent more than just an investment strategy—they embody a mathematical certainty that has enabled countless Americans to build substantial fortunes from modest beginnings.

Historical market data spanning nearly a century demonstrates that investors who consistently reinvest their dividend payments achieve returns that dwarf traditional investment approaches, with some cases showing portfolio growth exceeding 2,400% over multi-decade periods. The beauty of this approach lies not in complex financial maneuvers or market timing expertise, but in harnessing the fundamental mathematical principle that Albert Einstein allegedly called the eighth wonder of the world.

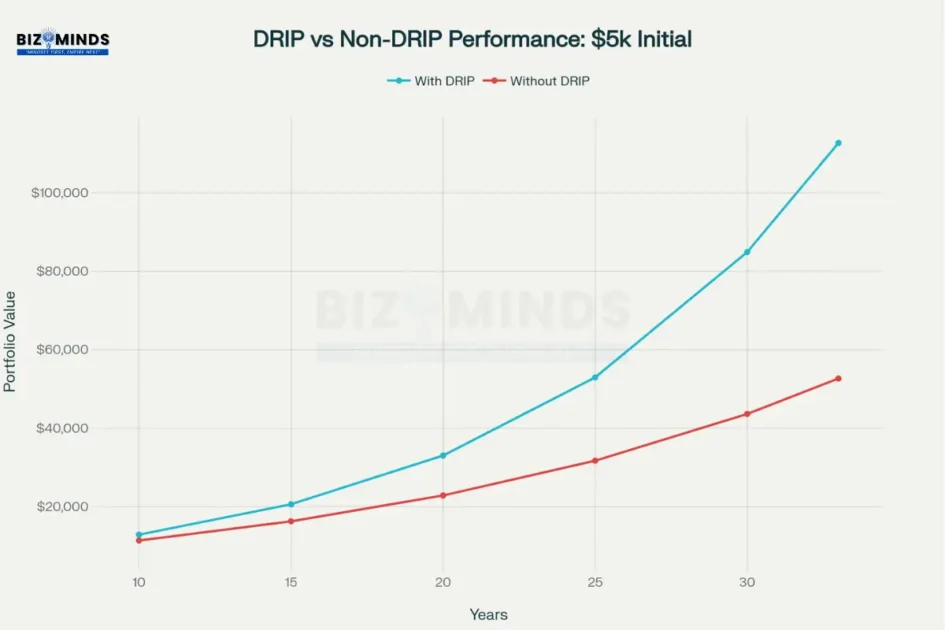

The transformation from a $5,000 initial investment to $127,000 represents more than impressive numbers—it illustrates the compound growth phenomenon that occurs when dividend payments are systematically reinvested rather than spent. Real-world success stories reinforce this potential, including investors who started with nothing and built dividend portfolios generating $4,800 monthly in passive income, achieving seven-figure net worth through consistent reinvestment discipline over 10-15 year periods.

This exponential growth pattern occurs because each reinvested dividend purchases additional shares, which generate their own dividends in subsequent periods, creating an accelerating cycle of wealth accumulation that becomes increasingly powerful with time. The mathematical beauty emerges from the fact that later-year dividend payments are calculated not just on the original investment, but on decades of accumulated reinvestment, resulting in dramatically larger annual income streams.

What distinguishes successful Dividend Reinvestment Plan (DRIP) investors from traditional dividend collectors extends beyond simple reinvestment mechanics to encompass a fundamental shift in investment psychology and strategy implementation. Research examining dividend-focused portfolios reveals that reinvestment participants achieve superior long-term returns compared to investors who collect dividends as cash, with the difference often exceeding $400,000 over 30-year periods when calculated on identical initial investments.

These investors understand that each dividend payment represents an opportunity to acquire additional ownership in quality companies at current market prices, effectively implementing dollar-cost averaging principles without additional out-of-pocket expenses. The automatic nature of dividend reinvestment eliminates emotional decision-making and market timing concerns, ensuring consistent wealth-building behavior regardless of short-term market volatility or economic uncertainty.

The accessibility and simplicity of dividend reinvestment strategies make this approach particularly attractive for investors seeking long-term wealth building without requiring extensive financial expertise or active portfolio management. Modern brokerage platforms have democratized access to dividend reinvestment programs, offering commission-free automatic reinvestment services across thousands of dividend-paying stocks and exchange-traded funds.

This technological advancement means that any investor, regardless of account size or investment experience, can implement the same wealth-building strategies that have created millionaires throughout market history. Unlike complex investment schemes requiring constant monitoring or specialized knowledge, dividend reinvestment programs operate automatically in the background, allowing participants to focus on their careers and personal lives while their investments compound steadily toward financial independence.

Dividend Reinvestment Plan (DRIP) vs Non-DRIP Performance Comparison: $5,000 Initial Investment Over Time

Understanding Dividend Reinvestment Plans

Dividend Reinvestment Plans represent a sophisticated yet accessible investment approach that automatically channels dividend payments into purchasing additional shares of the same company rather than distributing cash to shareholders. These programs, commonly abbreviated as DRIPs, operate on the fundamental principle that reinvested earnings generate their own returns, creating a compounding effect that accelerates wealth accumulation over extended periods.

The mechanics of Dividend Reinvestment Plans are elegantly straightforward. When a company declares a dividend, participants in the Dividend Reinvestment Plan (DRIP) receive additional shares equivalent to their dividend payment amount rather than cash. These newly acquired shares then generate their own dividends in subsequent periods, which are similarly reinvested, creating an exponential growth pattern that becomes increasingly powerful over time.

The Mathematical Foundation of Compound Growth

The transformative power of Dividend Reinvestment Plans stems from compound mathematics rather than market speculation. Research from Welch & Forbes demonstrates this principle through three distinct investment scenarios using S&P 500 data spanning from 1928 to 2021. In the first scenario, stocks without dividend payments would have grown $1,000 to $258,383 over 94 years, representing a 6.1% annual return from price appreciation alone.

The second scenario incorporates dividends but assumes investors deposit these payments in bank accounts rather than reinvesting them. This approach increases the final portfolio value to $380,250, achieving a 6.5% annual return. However, the third scenario reveals the true power of dividend reinvestment, where the same $1,000 investment grows to $7,008,076 over the identical timeframe, representing a 9.9% annual return.

This dramatic difference illustrates that while price appreciation contributed $258,383 to the final value, dividend reinvestment and the subsequent appreciation of dividend-purchased shares accounted for $6,749,693 of the total portfolio. These figures underscore how Dividend Reinvestment Plans can transform modest initial investments into substantial wealth through patient, systematic reinvestment rather than speculative trading.

The Evolution and Mechanics of Dividend Reinvestment Plan (DRIP) Programs

Dividend Reinvestment Plans emerged as companies sought to maintain strong shareholder bases while providing investors with cost-effective methods to accumulate ownership stakes. Today’s programs typically operate through three primary structures: company-sponsored plans administered directly by corporations or their transfer agents, brokerage-based reinvestment services offered through financial institutions, and third-party platforms that consolidate multiple DRIPs under unified management systems.

Company-sponsored Dividend Reinvestment Plans often provide the most attractive terms, frequently eliminating transaction fees entirely and sometimes offering share purchase discounts ranging from 1% to 5%. These programs commonly allow participants to make optional cash investments alongside dividend reinvestment, with annual contribution limits sometimes reaching $150,000 for established plans. Fractional share purchases represent another significant advantage, ensuring that every dividend dollar contributes to ownership accumulation regardless of current share prices.

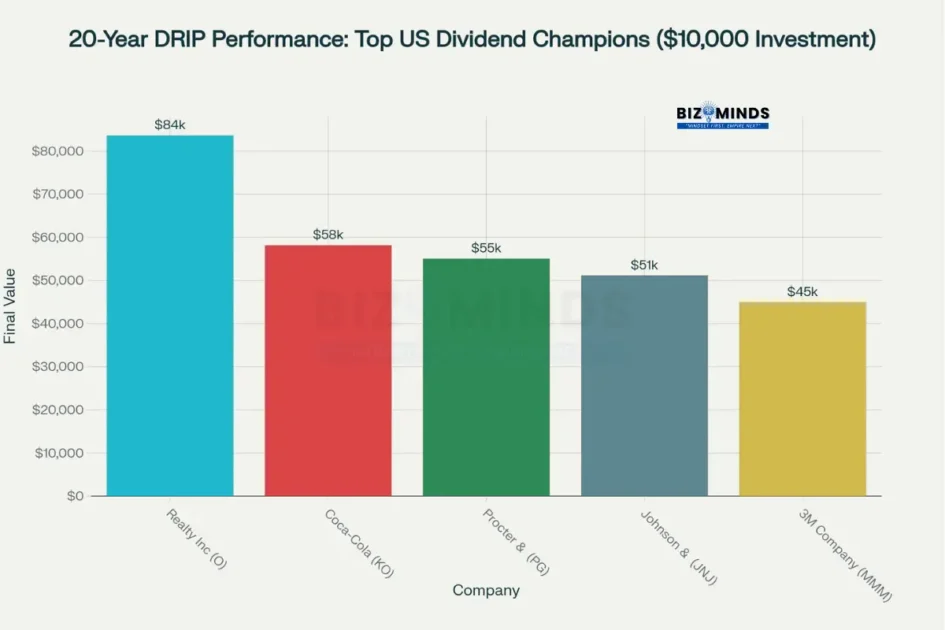

20-Year Dividend Reinvestment Plan (DRIP) Performance Comparison Across Top US Dividend Champions

Implementation Through Modern Brokerages

Contemporary brokerage platforms have revolutionized access to dividend reinvestment through automated services that mirror traditional Dividend Reinvestment Plan (DRIP) benefits while offering enhanced convenience and portfolio integration. Major brokerages including Charles Schwab, Fidelity, and TD Ameritrade provide automatic dividend reinvestment services for most dividend-paying stocks and exchange-traded funds without additional fees.

These brokerage-based systems excel in record-keeping and tax reporting, automatically tracking cost basis adjustments and providing consolidated statements that simplify annual tax preparation. While they may not offer the purchase discounts available through some company-sponsored plans, they provide superior flexibility for portfolio diversification and management across multiple holdings.

Performance Analysis and Real-World Applications

The practical impact of Dividend Reinvestment Plans becomes apparent through analysis of actual market performance and specific company examples. Among dividend-paying stocks, companies with consistent dividend growth records have demonstrated superior long-term performance compared to non-dividend-paying entities. Research from Hartford Funds indicates that dividend-growing companies achieved average annual returns of 10.24% compared to 4.31% for non-dividend-paying stocks over the period from 1973 to 2024.

Case Studies of Established Dividend Reinvestment Plan (DRIP) Companies

Johnson & Johnson exemplifies the potential of long-term dividend reinvestment, having increased its dividend for 62 consecutive years while maintaining a current yield of approximately 3.1%. The company’s Dividend Reinvestment Plan (DRIP) program offers commission-free reinvestment with fractional share capabilities and optional cash purchases, making it accessible to investors across various income levels. Its diversified healthcare portfolio and stable cash flows provide fundamental support for continued dividend growth.

Drip Case Studies

| Company | Ticker | Industry | Dividend History | Current Yield | DRIP Features | Investment Thesis | Risk Factors |

| Johnson & Johnson | JNJ | Healthcare/Pharmaceuticals | 62 consecutive years of increases | 3.1% | Commission-free, fractional shares, optional cash purchases | Stable healthcare demand, diverse product portfolio, strong cash flow | Regulatory changes, patent expirations, litigation risks |

| Coca-Cola | KO | Consumer Beverages | 62 consecutive years of increases | 3.0% | No fees, automatic reinvestment, dividend growth focus | Global brand recognition, recession-resistant demand, expanding markets | Health trends, currency fluctuations, competition |

| Realty Income | O | Real Estate Investment Trust | 32 consecutive years of increases, monthly payments | 5.8% | Monthly reinvestment, no fees, high yield | Monthly income, inflation protection, diversified real estate | Interest rate sensitivity, tenant risk, real estate cycles |

| 3M Company | MMM | Industrial/Technology | 65 consecutive years of increases | 6.5% | Commission-free, optional cash investments up to $150,000 annually | Innovation culture, diverse product lines, global presence | Industrial cyclicality, environmental liabilities, competition |

Realty Income Corporation, known as “The Monthly Dividend Company,” presents a unique DRIP opportunity with monthly rather than quarterly dividend payments. With a current yield of 5.8% and 32 consecutive years of dividend increases, the company’s Dividend Reinvestment Plan (DRIP) enables more frequent compounding through monthly reinvestment cycles. This accelerated compounding frequency can enhance long-term returns compared to traditional quarterly dividend schedules.

Monthly Drip Data

| Years | Total Invested | Final Value | Earnings | Return Multiple |

| 1 | 6000 | 6279.877702371104 | 279.8777023711036 | 1.0466462837285173 |

| 2 | 12000 | 13210.463660028376 | 1210.4636600283757 | 1.1008719716690314 |

| 3 | 18000 | 20859.18294931331 | 2859.182949313308 | 1.1588434971840726 |

| 4 | 24000 | 29300.44709692009 | 5300.447096920088 | 1.2208519623716703 |

| 5 | 30000 | 38616.37800178315 | 8616.378001783152 | 1.2872126000594384 |

| 6 | 36000 | 48897.606868289826 | 12897.606868289826 | 1.3582668574524952 |

| 7 | 42000 | 60244.15592334038 | 18244.155923340382 | 1.4343846648414378 |

| 8 | 48000 | 72766.4114951505 | 24766.411495150503 | 1.515966906148969 |

| 9 | 54000 | 86586.19792051586 | 32586.197920515857 | 1.6034481096391826 |

| 10 | 60000 | 101837.96272818024 | 41837.96272818024 | 1.697299378803004 |

| 11 | 66000 | 118670.08462851272 | 52670.08462851272 | 1.7980315852804958 |

| 12 | 72000 | 137246.3170344358 | 65246.31703443581 | 1.9061988477004974 |

| 13 | 78000 | 157747.3811570792 | 79747.38115707919 | 2.022402322526656 |

| 14 | 84000 | 180372.72417479055 | 96372.72417479055 | 2.1472943354141734 |

| 15 | 90000 | 205342.45958007147 | 115342.45958007147 | 2.2815828842230164 |

| 16 | 96000 | 232899.50858134698 | 136899.50858134698 | 2.426036547722364 |

| 17 | 102000 | 263311.9633924656 | 161311.9633924656 | 2.5814898371810355 |

| 18 | 108000 | 296875.69540148904 | 188875.69540148904 | 2.748849031495269 |

| 19 | 114000 | 333917.2335926676 | 219917.23359266762 | 2.929098540286558 |

| 20 | 120000 | 374796.9412246933 | 254796.94122469332 | 3.123307843539111 |

| 21 | 126000 | 419912.5216699429 | 293912.5216699429 | 3.3326390608725625 |

| 22 | 132000 | 469702.8875217087 | 337702.8875217087 | 3.558355208497793 |

| 23 | 138000 | 524652.4306105135 | 386652.43061051355 | 3.801829207322562 |

| 24 | 144000 | 585295.7344708998 | 441295.7344708998 | 4.0645537116034705 |

| 25 | 150000 | 652222.7751045167 | 502222.77510451665 | 4.348151834030111 |

| 26 | 156000 | 726084.6606357859 | 570084.6606357859 | 4.654388850229397 |

| 27 | 162000 | 807599.9656991028 | 645599.9656991028 | 4.985184973451252 |

| 28 | 168000 | 897561.72218246 | 729561.72218246 | 5.342629298705119 |

| 29 | 174000 | 996845.1343378158 | 822845.1343378158 | 5.728995024929976 |

| 30 | 180000 | 1106416.0933156323 | 926416.0933156323 | 6.146756073975735 |

Monthly Dividend Reinvestment Plan (DRIP) Investment Growth: The Power of Dollar-Cost Averaging with Dividend Reinvestment

The Coca-Cola Company represents another compelling DRIP candidate, combining brand recognition with consistent dividend growth spanning 62 years. Despite facing challenges from changing consumer preferences, the company’s global distribution network and brand value continue supporting dividend sustainability. Its Dividend Reinvestment Plan (DRIP) program operates without fees while providing automatic reinvestment capabilities that have benefited long-term shareholders through multiple economic cycles.

Tax Implications and Strategic Considerations

Understanding the tax treatment of Dividend Reinvestment Plans is crucial for optimizing after-tax returns and avoiding common misconceptions about reinvestment taxation. Reinvested dividends remain fully taxable in the year they are paid, identical to cash dividend payments. This means Dividend Reinvestment Plan (DRIP) participants must report dividend income on their tax returns even though they receive no cash to pay the associated taxes.

2025 Tax Framework for Dividend Reinvestment

The 2025 tax year maintains the preferential treatment for qualified dividends, with rates of 0%, 15%, or 20% depending on taxable income levels. Single filers enjoy 0% taxation on qualified dividends with taxable income up to $48,350, while married couples filing jointly receive the same treatment up to $96,700. These favorable rates apply to most U.S. corporation dividends and many foreign corporation dividends, making Dividend Reinvestment Plans particularly tax-efficient for long-term investors.

The reinvestment of dividends creates important cost basis adjustments that benefit investors during eventual share sales. Each dividend reinvestment establishes a new tax lot with its own purchase date and price, increasing the overall cost basis and potentially reducing future capital gains taxes. Modern brokerage platforms automatically track these adjustments, simplifying tax reporting and ensuring accurate calculations during share sales.

Dividend Reinvestment Plan (DRIP) FAQs

| Question | Answer |

| Are dividends from DRIPs taxed even though I don’t receive cash? | Yes, reinvested dividends are taxable in the year they are paid, just like cash dividends. You must report them as income on your tax return even though you don’t receive cash. However, these reinvested dividends increase your cost basis, reducing future capital gains taxes when you sell. |

| Can I participate in DRIPs through my brokerage account? | Most major brokerages offer automatic dividend reinvestment services for stocks and ETFs in your account. While not technically company-sponsored DRIPs, these provide similar benefits including fractional share purchases and automated reinvestment, often without additional fees. |

| What happens to my Dividend Reinvestment Plan (DRIP) shares if the company stops paying dividends? | You retain ownership of all shares purchased through the DRIP. If dividend payments stop, automatic reinvestment ceases, but your accumulated shares remain in your account. You can continue holding or sell them just like any other stock shares. |

| How do I track my cost basis with multiple DRIP purchases over time? | Each dividend reinvestment creates a separate tax lot with its own purchase date and price. Most brokerages and DRIP administrators provide detailed records. For tax purposes, you can typically use average cost basis or specific identification methods when selling shares. |

| Should I choose DRIPs for all my dividend stocks? | Dividend Reinvestment Plan (DRIP) suitability depends on your investment goals and financial situation. They work best for long-term growth-focused investors who don’t need current income. If you need regular income or want to diversify across different investments, taking cash dividends might be better. |

Advanced Strategies and Optimization Techniques

Sophisticated investors can enhance Dividend Reinvestment Plan (DRIP) effectiveness through strategic implementation approaches that maximize compound growth while managing risk factors. Dollar-cost averaging through regular additional investments amplifies the benefits of automatic dividend reinvestment by purchasing shares across various market conditions. Monthly contributions of $500, combined with dividend reinvestment achieving 9.9% annual returns, could potentially grow to over $1.1 million after 30 years.

Portfolio Integration and Diversification

While individual company DRIPs provide powerful compounding benefits, prudent investors often integrate multiple DRIPs within diversified portfolios to manage concentration risk. Combining dividend-focused equity positions with growth stocks, international holdings, and fixed-income securities creates balanced portfolios that benefit from DRIP compounding while maintaining appropriate risk levels.

Exchange-traded funds focused on dividend growth can provide DRIP benefits across diversified portfolios of dividend-paying stocks. Popular dividend ETFs like Vanguard Dividend Appreciation ETF (VIG) and SPDR S&P Dividend ETF (SDY) enable investors to access dividend reinvestment across hundreds of companies simultaneously, reducing single-company concentration while maintaining compound growth potential.

Impact of Dividend Yield on Long-Term Investment Returns

Risk Management and Potential Drawbacks

Dividend Reinvestment Plans, despite their compelling advantages, present certain limitations and risks that investors must carefully evaluate. Concentration risk represents the primary concern, as DRIPs naturally increase exposure to individual companies over time rather than promoting diversification. Investors participating in multiple company DRIPs may inadvertently create sector concentration if they favor similar industries or market segments.

Drip Comparison Table

| Aspect | DRIP Advantage | Traditional Dividend Collection |

| Transaction Costs | Often commission-free or low-cost | Standard brokerage fees apply |

| Fractional Shares | Can purchase fractional shares | Must buy whole shares only |

| Automation | Fully automated reinvestment | Manual reinvestment decisions |

| Compound Growth | Maximizes compounding effect | Depends on reinvestment discipline |

| Tax Implications | Deferred capital gains (until sale) | Dividends taxed annually regardless |

| Liquidity | Reduces immediate liquidity | Maintains cash flexibility |

| Diversification | Concentrates holdings in same stock | Allows portfolio diversification |

| Market Timing | Eliminates timing decisions | Requires active timing decisions |

| Income Stream | No immediate income generation | Provides regular income stream |

| Administrative Burden | Minimal maintenance required | Requires active management |

Liquidity considerations also merit attention, particularly for investors who may need access to their investments during market downturns. Dividend Reinvestment Plan (DRIP) participants effectively commit their dividend income to additional share purchases, reducing the cash available for other opportunities or emergency needs. This automatic reinvestment can prove disadvantageous during market peaks when share prices are elevated, as investors continue purchasing shares regardless of valuation levels.

Market Cycle Considerations

The effectiveness of Dividend Reinvestment Plans varies across different market environments and economic cycles. During extended bear markets, Dividend Reinvestment Plan (DRIP) participants benefit from purchasing additional shares at depressed prices, positioning portfolios for enhanced returns during subsequent recoveries. Conversely, during prolonged bull markets, automatic reinvestment may result in purchasing shares at elevated valuations, potentially reducing long-term returns.

Interest rate sensitivity affects dividend-paying stocks differently across sectors, with utilities and real estate investment trusts typically experiencing greater volatility during rate changes. DRIP participants in interest-sensitive sectors should understand these dynamics and consider diversification strategies that include rate-insensitive dividend payers.

Implementation Guide and Best Practices

Successful implementation of Dividend Reinvestment Plans requires careful planning and systematic execution aligned with individual financial objectives and risk tolerance. Investors should begin by evaluating their investment timeline, income needs, and diversification requirements before selecting appropriate DRIP candidates.

Selection Criteria for Dividend Reinvestment Plan (DRIP) Investments

Quality dividend-paying companies typically exhibit several key characteristics that support sustainable dividend growth over extended periods. Strong free cash flow generation, conservative payout ratios below 60-70% of earnings, and consistent earnings growth provide fundamental support for dividend sustainability. Companies with 25 or more consecutive years of dividend increases, known as Dividend Champions, have demonstrated the discipline and financial strength necessary for long-term Dividend Reinvestment Plan (DRIP) success.

Geographic diversification within DRIP portfolios can provide additional risk management benefits while maintaining dividend growth focus. International dividend-paying companies, accessible through American Depositary Receipts or international ETFs with DRIP capabilities, can provide exposure to different economic cycles and currency movements.

Creating a comprehensive data table showing the comparison between Dividend Reinvestment Plan (DRIP) and traditional dividend strategies:

| Aspect | Dividend Reinvestment Plan (DRIP) | Traditional Dividend Collection |

| Transaction Costs | Often commission-free or low-cost | Standard brokerage fees apply |

| Fractional Shares | Can purchase fractional shares | Must buy whole shares only |

| Automation | Fully automated reinvestment | Manual reinvestment decisions |

| Compound Growth | Maximizes compounding effect | Depends on reinvestment discipline |

| Tax Implications | Deferred capital gains (until sale) | Dividends taxed annually regardless |

| Liquidity | Reduces immediate liquidity | Maintains cash flexibility |

| Diversification | Concentrates holdings in same stock | Allows portfolio diversification |

| Market Timing | Eliminates timing decisions | Requires active timing decisions |

| Income Stream | No immediate income generation | Provides regular income stream |

| Administrative Burden | Minimal maintenance required | Requires active management |

Conclusion: Strategic DRIP Recommendations

Dividend Reinvestment Plans represent far more than a simple investment strategy—they embody a mathematical certainty that has consistently transformed patient investors into millionaires across multiple generations of market cycles. The compelling evidence demonstrates that investors who harness the systematic power of dividend reinvestment achieve returns that dramatically surpass traditional investment approaches, with historical data showing reinvestment participants generating 620% returns compared to 388% for those collecting cash dividends over identical timeframes.

This remarkable 50% performance advantage, translating to approximately $450,000 in additional wealth over three decades, occurs not through complex trading strategies or market timing expertise, but through the disciplined application of compound mathematics that Einstein reportedly called the most powerful force in the universe. Real-world success stories reinforce this potential, including investors who built seven-figure portfolios generating $4,800 monthly in passive income through consistent reinvestment discipline over 10-15 year periods.

The foundation of Dividend Reinvestment Plan success rests upon selecting quality dividend-paying companies with sustainable business models, consistent earnings growth, and conservative payout ratios that support long-term dividend increases spanning multiple decades. Research analyzing dividend-focused portfolios reveals that companies with 25 or more consecutive years of dividend increases, known as Dividend Champions, demonstrate the financial discipline and operational excellence necessary for sustained wealth creation through reinvestment programs.

Modern analysis shows that 85% of the S&P 500’s cumulative total returns since 1960 can be attributed to reinvested dividends rather than price appreciation alone, underscoring how systematic reinvestment transforms modest periodic payments into substantial portfolio growth. Combining individual company DRIPs with diversified dividend-focused exchange-traded funds provides optimal balance between compound growth potential and risk management, ensuring investors capture reinvestment benefits while maintaining appropriate portfolio diversification across various market conditions.

For investors with long-term investment horizons and minimal current income requirements, Dividend Reinvestment Plans offer an elegant solution for systematic wealth accumulation that operates independently of market timing or emotional decision-making. The automation inherent in DRIP programs eliminates the behavioral challenges that plague many investors, ensuring consistent reinvestment discipline during both market peaks and downturns when human psychology typically drives counterproductive decisions.

Recent analysis of VTI performance demonstrates this principle clearly, showing that dividend reinvestment over 20 years generated compound annual growth rates of 10.21% compared to 8.16% for investors who collected cash dividends, representing a 2% annual performance advantage that compounds dramatically over extended periods. This systematic approach proves particularly valuable during market volatility, as automatic reinvestment enables investors to purchase additional shares at depressed prices during downturns, positioning portfolios for enhanced returns during subsequent recoveries.

Understanding tax implications and implementing proper risk management strategies remain crucial components of successful dividend reinvestment implementation, ensuring investors maximize after-tax returns while maintaining appropriate portfolio balance. The 2025 tax framework maintains preferential treatment for qualified dividends, with rates of 0%, 15%, or 20% depending on income levels, making DRIPs particularly tax-efficient for long-term investors who benefit from deferred capital gains recognition until share sales occur.

Each dividend reinvestment creates important cost basis adjustments that reduce future capital gains taxes, with modern brokerage platforms automatically tracking these adjustments to simplify tax reporting and ensure accurate calculations during eventual share sales. Sophisticated investors enhance DRIP effectiveness through dollar-cost averaging with regular additional investments, potentially growing monthly $500 contributions combined with 9.9% annual returns into portfolios exceeding $1.1 million after 30 years.

The transformative power of compound dividend growth becomes most apparent when investors maintain unwavering discipline across multiple market cycles, allowing the mathematical certainty of exponential growth to overcome short-term volatility and market uncertainty. Historical analysis demonstrates that patient investors who consistently reinvest dividends for 40 years can transform $1,000 initial investments into holdings worth over $75,000, with more than $50,000 of that growth attributable entirely to dividend reinvestment rather than price appreciation.

This remarkable wealth creation occurs through the systematic accumulation of additional income-generating shares, creating an accelerating cycle where later-year dividend payments are calculated not just on original investments, but on decades of accumulated reinvestment. By understanding these principles, managing concentration risk through diversification, and selecting appropriate investments aligned with personal financial objectives, investors can harness this time-tested strategy to achieve long-term financial independence through the mathematical power of compound growth.

Frequently Asked Questions

1. Are dividends from DRIPs taxed even though I don’t receive cash?

Yes, reinvested dividends are taxable in the year they are paid, just like cash dividends. You must report them as income on your tax return even though you don’t receive cash. However, these reinvested dividends increase your cost basis, reducing future capital gains taxes when you sell.

2. Can I participate in DRIPs through my brokerage account?

Most major brokerages offer automatic dividend reinvestment services for stocks and ETFs in your account. While not technically company-sponsored DRIPs, these provide similar benefits including fractional share purchases and automated reinvestment, often without additional fees.

3. What happens to my DRIP shares if the company stops paying dividends?

You retain ownership of all shares purchased through the DRIP. If dividend payments stop, automatic reinvestment ceases, but your accumulated shares remain in your account. You can continue holding or sell them just like any other stock shares.

4. How do I track my cost basis with multiple DRIP purchases over time?

Each dividend reinvestment creates a separate tax lot with its own purchase date and price. Most brokerages and DRIP administrators provide detailed records. For tax purposes, you can typically use average cost basis or specific identification methods when selling shares.

5. Should I choose DRIPs for all my dividend stocks?

DRIP suitability depends on your investment goals and financial situation. They work best for long-term growth-focused investors who don’t need current income. If you need regular income or want to diversify across different investments, taking cash dividends might be better.

6. What’s the difference between company-sponsored DRIPs and brokerage dividend reinvestment?

Company-sponsored DRIPs are administered directly by the company or their transfer agent, often offering purchase discounts and lower fees. Brokerage reinvestment programs offer more convenience and easier record-keeping but may not include discounts. Both provide automatic reinvestment and fractional share benefits.

Citations

- https://tdwealth.net/best-free-retirement-planning-software-for-2024/

- https://humaninterest.com/learn/articles/retirement-planning-tools/

- https://choosefi.com/podcast-episode/are-we-there-yet-retire-early-case-study-ep-473

- https://www.worldfinance.com/strategy/playing-with-fire-how-some-millennials-are-retiring-before-the-age-of-40

- https://www.hrlineup.com/personal-capital-retirement-planner/

- https://www.financialsamurai.com/best-retirement-calculator/

- https://www.youtube.com/watch?v=Ta3s61BJk1w

- https://robberger.com/best-retirement-calculators/

- https://play.google.com/store/apps/details?id=com.personalcapital.pcapandroid&hl=en_IN

- https://moldstud.com/articles/p-leading-financial-planning-apps-for-real-time-monitoring

- https://viasocket.com/discovery/blog/7rtojn/Accounting/top-personal-finance-management-tools-to-transform-your-money-habits

- https://www.pnbmetlife.com/articles/retirement/fire-independence-retire-early-in-india.html

- https://www.kotaklife.com/insurance-guide/retirement/financial-independence-and-early-retirement

- https://mint.intuit.com/retirement

- https://www.iibf.org.in/documents/BankQuest/October-December%202024/12.pdf

- https://www.businessinsider.com/planned-retirement-until-discovered-fire-2024-04

- https://www.cnbc.com/2024/12/03/millennial-retired-early-with-half-a-million-dollars.html

- https://www.etmoney.com/learn/personal-finance/f-i-r-e-method-what-is-it-how-to-secure-retirement/

- https://www.hdfclife.com/insurance-knowledge-centre/retirement-planning/what-is-fire-and-how-does-it-work

- https://www.listenmoneymatters.com/personal-capital-vs-mint-vs-quicken-vs-ynab/

- https://www.bankrate.com/investing/financial-advisors/best-financial-planning-software/

- https://www.reddit.com/r/retirement/comments/1e9y32n/does_anyone_use_diy_retirement_financial_planning/

- https://www.youtube.com/watch?v=Gue3HO923Ks

- https://www.reddit.com/r/ChubbyFIRE/comments/15pf90u/newretirement_projectionlab_or_something_else/

- https://money.usnews.com/money/retirement/401ks/articles/best-retirement-planning-tools-and-software

- https://www.annuity.org/personal-takes/retired-at-42-how-a-plan-devised-as-a-teenager-resulted-in-a-successful-early-retirement/

- https://www.pcmag.com/picks/the-best-personal-finance-services

- https://www.nerdwallet.com/article/finance/best-budget-apps

- https://kaylalyon.com/personal-capital-and-mint-reviews/

- https://www.reddit.com/r/Fire/comments/zodt43/what_tools_do_you_use_to_save_and_plan_you/

- https://knowledge.insead.edu/career/fulfilment-and-fire-movement-realities-life-after-early-retirement

- https://www.investgrape.com/post/2024-guide-choosing-retirement-planning-software

- https://superagi.com/budgeting-smackdown-comparing-top-ai-planning-tools-like-you-need-a-budget-ynab-and-personal-capital/

- https://play.google.com/store/apps/details?id=com.nationwide.myretirement&hl=en

- https://fello.in/blogs/what-are-the-best-personal-finance-apps-for-you/

- https://www.nasdaq.com/articles/10-top-financial-planning-tools-and-apps-2024

- https://www.investopedia.com/articles/personal-finance/011916/best-retirementplanning-apps.asp

- https://www.reddit.com/r/ChubbyFIRE/comments/1i0mqef/best_app_for_personal_finance_and_retirement/

- https://dashdevs.com/blog/top-10-apps-for-your-personal-finance-management-become-thrifty-with-us/

- https://www.johnmarshallbank.com/resources/personal-finance/personal-finance-apps/

- https://www.forbes.com/advisor/banking/best-budgeting-apps/

- https://www.investopedia.com/terms/f/financial-independence-retire-early-fire.asp

- https://www.youtube.com/watch?v=P4cJdRuEHTk

- https://play.google.com/store/apps/details?id=com.realbyteapps.moneymanagerfree&hl=en_IN

- https://www.finnovate.in/fire-calculator

- https://www.homecredit.co.in/en/blog/personal-finance/top-5-free-and-paid-financial-planning-software

- https://mint.intuit.com

- https://www.nerdwallet.com/article/investing/financial-independence-retire-early

- https://smartasset.com/financial-advisor/mint-review

- https://www.investopedia.com/ynab-vs-mint-5179966

- https://www.empower.com/financial-calculators

- https://www.cnet.com/personal-finance/banking/mint-is-long-gone-try-this-awesome-budgeting-app-instead/

- https://www.personalcapital.com

- https://www.investor.gov/free-financial-planning-tools

- https://play.google.com/store/apps/details?id=com.iw.mint.app&hl=en

- https://www.usa.gov/retirement-planning-tools

- https://www.reddit.com/r/PersonalCapital/comments/13rhbli/personal_capitalempower_retirement_planner_big/

- https://www.reddit.com/r/financialindependence/comments/18fwsit/detailed_case_study_from_an_active_rfi/

- https://podcasts.apple.com/lu/podcast/43-fi-case-studies-retiring-now-investing-with-kids/id1684883300?i=1000717998482

- https://economictimes.com/news/new-updates/when-fire-backfires-he-lived-on-bare-minimum-to-save-440000-now-retiree-regrets-if-money-was-worth-sacrificing-lifes-joy/articleshow/124225977.cms

- https://www.empower.com/the-currency/work/sparks-fly-the-fire-movement-trend-is-fueling-early-retirement-news

- https://www.valueresearchonline.com/stories/225516/the-true-fire-story-beyond-viral-reels-and-early-exits/

- https://www.investopedia.com/articles/professionals/080615/top-5-software-programs-used-financial-advisors.asp

- https://www.bogleheads.org/forum/viewtopic.php?t=456248

- https://www.mikekasberg.com/blog/2022/07/05/mint-ynab-personal-capital-and-lunch-money-a-comparison.html

- https://www.youtube.com/watch?v=hxfnHV0kUnk

- https://www.whitecoatinvestor.com/best-retirement-calculators-2025/

- https://goodbudget.com