Master Tax Efficient Investing: Lower Your Capital Gains Tax in 2025

As we navigate 2025’s, the importance of tax efficient investing has never been more critical for American investors. With capital gains tax rates ranging from 0% to 20% plus potential additional taxes, strategic investment planning can save thousands of dollars annually while accelerating wealth building. Tax efficient investing isn’t just about choosing the right investments, it’s about creating a comprehensive strategy that minimizes tax drag while maximizing after-tax returns.

The modern tax system presents a dynamic balance of risks and openings, demanding proactive management and strategic insight. For the tax year 2025, long-term capital gains are taxed at rates of 0%, 15%, or 20%, where single taxpayers with taxable income up to $48,350 qualify for a 0% rate. However, individuals with high incomes face a supplemental 3.8% Net Investment Income Tax that can push their overall tax rate up to 23.8%. Understanding these nuances is crucial for implementing effective tax efficient investing strategies that can significantly impact your long-term wealth accumulation.

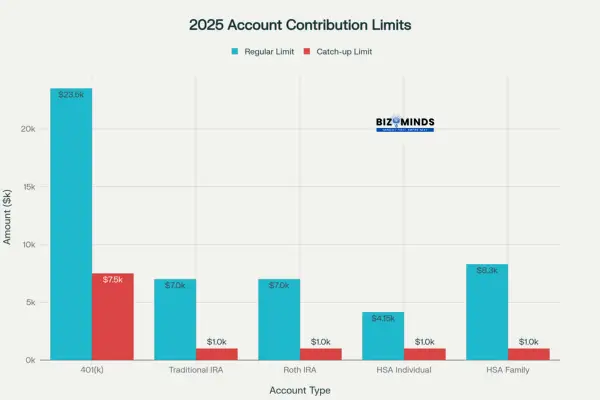

2025 Investment Account Contribution Limits for Tax Efficient Investing

Understanding the 2025 Tax Efficient Investing for Investors

The foundation of successful tax efficient investing begins with understanding how different types of investment income are taxed. The 2025 tax year brings specific brackets that every investor should memorize. For single filers, the 0% long-term capital gains rate applies to taxable incomes up to $48,350, the 15% rate covers incomes from $48,351 to $533,400, and the 20% rate kicks in above $533,400. Married couples filing jointly enjoy doubled thresholds, with the 0% rate extending to $96,700 and the 15% rate reaching $600,050.

Distribution of American Investment Assets by Account Type

Short-term capital gains face a harsher reality, taxed as ordinary income at rates reaching 37% for high earners. This stark difference between short-term and long-term rates makes holding period strategy a cornerstone of tax efficient investing. The additional 3.8% Net Investment Income Tax applies to investment income when modified adjusted gross income exceeds $200,000 for singles or $250,000 for married couples filing jointly.

Short-Term vs Long-Term Capital Gains Tax Rates Comparison

State taxes add another layer of complexity to tax efficient investing strategies. While municipal bond interest typically escapes federal taxation, state treatment varies significantly. California residents might face combined federal and state rates exceeding 30%, while residents of tax-free states like Texas or Florida enjoy more favorable treatment. This geographic variation makes location-specific tax efficient investing strategies essential for optimizing after-tax returns.

Capital Gains Tax Brackets and Planning Strategies for Tax Efficient Investing

The progressive nature of capital gains taxation creates opportunities for tax efficient investing through income management. Investors approaching the $48,350 threshold for singles or $96,700 for married couples might consider timing asset sales to remain in the 0% bracket. This strategy, known as “gain harvesting,” allows investors to realize gains without tax consequences while resetting their cost basis for future appreciation.

The dramatic jump from 15% to 20% at higher income levels creates additional planning opportunities. High-income investors might benefit from spreading large asset sales across multiple years to avoid crossing into the 20% bracket. Tax efficient investing principles suggest that timing large transactions around retirement, business sale years, or other income fluctuations can yield substantial savings.

Understanding the interaction between different types of income proves crucial for tax efficient investing success. Capital gains, qualified dividends, ordinary income, and tax-exempt interest all receive different treatment, creating opportunities for sophisticated investors to optimize their overall tax burden. This complexity underscores why tax efficient investing requires ongoing attention rather than set-and-forget approaches.

Strategic Asset Location for Maximum Tax Efficient Investing

Asset location represents one of the most powerful yet underutilized aspects of tax efficient investing. This strategy involves placing specific investments in accounts that provide the most favorable tax treatment, potentially increasing returns by 0.05% to 0.30% annually—a significant boost that compounds over decades. The core strategy centers on placing tax-inefficient investments within tax-advantaged accounts, while keeping tax-efficient investments in taxable accounts.

Studies from top financial institutions reveal that strategic asset location can substantially lower tax drag. High-net-worth individuals achieve nearly 90% of their tax savings by investing in municipal bonds in taxable accounts, alongside positioning passive stock funds in taxable accounts and active management funds in tax-advantaged plans. These strategic moves form the foundation of sophisticated tax efficient investing approaches.

Asset Location Strategy for Tax Efficient Investing

| Asset Type | Best Account Type | Tax Efficiency Reason |

| Municipal Bonds | Taxable | Tax-exempt interest |

| Treasury Bonds | Taxable | State/local tax exempt |

| Stock Index Funds | Taxable | Low turnover, qualified dividends |

| Tax-Managed Funds | Taxable | Designed for tax efficiency |

| Individual Stocks (>1 year) | Taxable | Long-term capital gains rates |

| Corporate Bonds | Tax-Deferred | High ordinary income tax rates |

| REITs | Tax-Deferred | High dividend distributions |

| High-Turnover Funds | Tax-Deferred | Frequent taxable distributions |

| High-Yield Bonds | Tax-Deferred | High interest income |

| International Bonds | Tax-Deferred | Interest taxed as ordinary income |

The asset location framework categorizes investments based on their tax characteristics. Tax-inefficient assets generating regular taxable events—such as corporate bonds, REITs, high-turnover mutual funds, and short-term holdings—belong in tax-deferred or tax-exempt accounts. Conversely, tax-efficient assets like municipal bonds, index funds, ETFs, and stocks held for long-term gains work well in taxable accounts where their favorable tax treatment can be fully utilized.

Optimizing Account Types for Different Assets

Tax-deferred accounts like traditional 401(k)s and IRAs excel at sheltering high-income generating assets from current taxation. Corporate bonds throwing off interest taxed at ordinary income rates benefit significantly from tax-deferred treatment. Similarly, REITs distributing substantial dividends and actively managed funds generating frequent capital gains distributions find their natural home in these accounts.

Roth accounts present unique opportunities for tax efficient investing, particularly for growth-oriented assets with substantial appreciation potential. Small-cap stocks, emerging market funds, and other high-growth investments can benefit from decades of tax-free compounding in Roth accounts. The absence of required minimum distributions makes Roth accounts ideal for assets intended for long-term growth or wealth transfer to heirs.

Taxable accounts deserve the most tax-efficient investments available. Municipal bonds providing tax-exempt interest income, broad-market index funds with minimal turnover, and individual stocks held for long-term capital gains treatment all thrive in taxable environments. Tax-managed funds specifically designed to minimize taxable distributions offer another excellent option for taxable account holdings, often achieving tax efficiency rivaling ETFs.

HSA: The Ultimate Tax Efficient Investing

Health Savings Accounts represent the pinnacle of tax efficient investing, offering unprecedented triple tax advantages that no other account type can match. HSA contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses avoid taxation entirely. For 2025, individuals can contribute $4,150 while families can contribute $8,300, with an additional $1,000 catch-up contribution for those 50 and older.

The investment potential of HSAs makes them powerful retirement vehicles beyond their healthcare purpose. Health Savings Accounts (HSAs) stand out by having no required minimum distributions, enabling unlimited growth potential over time. After age 65, HSAs function similarly to traditional IRAs for non-medical withdrawals, making them incredibly versatile tools for tax efficient investing strategies.

Strategic HSA management involves maintaining sufficient cash for near-term medical expenses while investing excess contributions for long-term growth. Many HSA providers offer investment options similar to 401(k) plans, enabling sophisticated asset allocation within the tax-free environment. Given that healthcare costs in retirement can exceed $300,000 for couples, HSAs provide both tax efficient investing opportunities and essential financial protection.

Tax Loss Harvesting: Converting Losses into Opportunities

Tax loss harvesting transforms investment setbacks into tax savings opportunities through strategic realization of losses to offset gains. This cornerstone of tax efficient investing can reduce tax liabilities by thousands of dollars annually while maintaining desired market exposure. The strategy works by selling underperforming investments to realize losses, then using those losses to offset capital gains from other investments or up to $3,000 of ordinary income annually.

Tax Loss Harvesting Process and Benefits Example

The mechanics of tax loss harvesting require careful attention to IRS rules, particularly the wash sale rule prohibiting the repurchase of substantially identical securities within 30 days. Successful tax efficient investing through loss harvesting involves selling losing positions and immediately reinvesting in similar but not identical assets, maintaining market exposure while capturing tax benefits. Taxpayers can carry forward unused losses indefinitely, leveraging these losses to shield income and minimize tax liabilities in future years.

Sophisticated investors employ year-round tax loss harvesting rather than waiting for year-end. Volatile markets create regular opportunities to harvest losses while maintaining portfolio balance through rebalancing activities. This proactive approach to tax efficient investing can generate substantial benefits, with some high-net-worth investors saving tens of thousands annually through systematic loss harvesting strategies.

Advanced Loss Harvesting Techniques

Direct indexing represents the evolution of tax loss harvesting, allowing investors to own individual stocks within an index while harvesting losses on specific holdings. This approach to tax efficient investing can generate significantly more tax alpha than traditional index fund investing, particularly for high-net-worth investors in elevated tax brackets. The ability to harvest losses on individual securities while maintaining broad market exposure creates powerful optimization opportunities.

Tax loss harvesting benefits multiply when combined with asset location strategies. Harvesting losses in taxable accounts while holding high-growth assets in Roth accounts creates synergistic effects that enhance overall tax efficient investing outcomes. This coordination requires sophisticated planning but can yield substantial improvements in after-tax returns over extended periods.

The timing of loss harvesting requires balancing tax benefits against transaction costs and market exposure considerations. High-frequency harvesting might generate more tax savings but could increase costs and complexity. Most successful tax efficient investing strategies employ systematic approaches that harvest significant losses while avoiding excessive turnover and associated costs.

Municipal Bonds: Tax-Free Income for High Earners

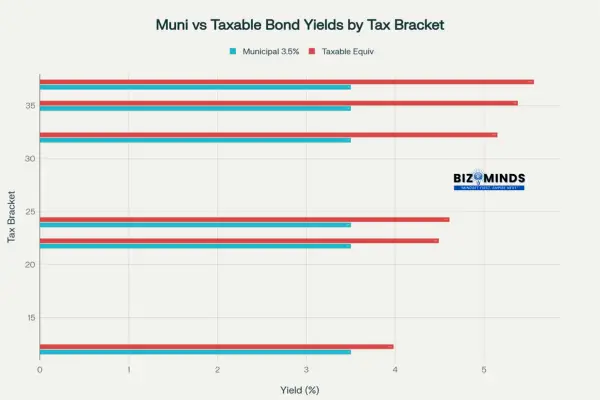

Municipal bonds occupy a special place in tax efficient investing strategies, offering federally tax-exempt interest income that becomes increasingly attractive as tax brackets rise. For investors in the 35% federal tax bracket, a 3% municipal bond yields the equivalent of a 4.62% taxable bond, demonstrating the power of tax-equivalent yield calculations. This tax advantage becomes even more pronounced when state and local tax exemptions apply to in-state municipal issues.

The safety profile of municipal bonds makes them attractive beyond their tax benefits. Historical default rates of just 0.04% between 1970 and 2000 compare favorably to corporate bonds’ 9.83% default rate over the same period. This combination of safety and tax efficiency makes municipal bonds cornerstone holdings for conservative portions of tax efficient investing portfolios, particularly for high-income investors seeking predictable tax-free income.

Tax-Equivalent Yield Comparison: 3.5% Municipal Bond vs Taxable Bonds

Municipal bond strategies require careful consideration of the tax-equivalent yield relative to taxable alternatives. The break-even tax rate where municipal bonds become attractive varies with current interest rates and credit spreads. Tax efficient investing principles suggest that investors in tax brackets of 22% or higher typically benefit from municipal bond inclusion, while lower-bracket investors might prefer taxable bonds with higher nominal yields.

Strategic Municipal Bond Implementation

Building a municipal bond ladder generates consistent tax-exempt income while effectively controlling interest rate risk. This tax efficient investing approach involves purchasing bonds with staggered maturity dates, providing regular principal returns for reinvestment while maintaining portfolio duration targets. The predictable cash flows from municipal bond ladders help retirees manage tax-efficient withdrawal strategies.

State-specific considerations significantly impact municipal bond tax efficiency. Residents of high-tax states like California, New York, or New Jersey benefit tremendously from in-state municipal bonds that escape federal, state, and local taxation. These “triple tax-free” bonds can provide after-tax yields exceeding many taxable alternatives, even when nominal rates appear modest.

Credit analysis remains important despite municipal bonds’ generally strong safety record. Rating agencies provide guidance, but understanding the underlying revenue sources and economic fundamentals of municipal issuers enhances tax efficient investing outcomes. General obligation bonds backed by taxing authority typically offer greater security than revenue bonds dependent on specific project cash flows.

Index Funds and ETFs: The Tax Efficiency Champions

Index funds and ETFs represent the gold standard for tax efficient investing in taxable accounts, combining broad diversification with minimal tax drag. Their passive management approach generates fewer taxable events than actively managed funds, while their structure allows for sophisticated tax management techniques. Exchange-traded funds add another layer of tax efficiency through their unique creation and redemption mechanism that rarely triggers capital gains distributions.

The tax efficiency of index investments stems from multiple factors working in concert. Low portfolio turnover means fewer realized gains, while the ability to choose specific tax lots for sales when rebalancing allows managers to minimize tax impact. ETFs benefit additionally from in-kind redemptions that allow large institutional investors to exit without forcing the fund to sell securities and realize gains.

Tax managed index funds take efficiency even further by explicitly incorporating tax minimization into their investment process. These funds may use techniques like tax loss harvesting at the fund level, avoiding high-dividend stocks in taxable versions, and optimizing trading to minimize tax distributions. For tax efficient investing in taxable accounts, these specialized funds often achieve tax efficiency rivaling or exceeding traditional ETFs.

Comparing ETF vs. Mutual Fund Tax Efficiency

The structural advantages of ETFs in tax efficient investing become apparent when comparing distribution patterns. While over 42% of active mutual funds distributed capital gains averaging 5% of net asset value during 2022’s market decline, most ETFs distributed nothing. This difference stems from ETFs’ unique ability to manage tax lots during creation and redemption processes, effectively purging low-basis shares without triggering taxable distributions.

The tax efficiency gap between ETFs and mutual funds has narrowed for index strategies, particularly at providers like Vanguard where index mutual funds share structures with their ETF counterparts. However, ETFs maintain advantages in active strategies where their structure better accommodates trading without generating distributions. This makes ETFs particularly valuable for tax efficient investing in more dynamic strategies.

International and bond ETFs may not achieve the same tax efficiency as domestic equity ETFs due to different regulatory environments and investment structures. Understanding these nuances helps investors make informed decisions about where ETFs fit into comprehensive tax efficient investing strategies versus other vehicle types.

Retirement Account Optimization Strategies

The interplay between different retirement account types creates sophisticated opportunities for tax efficient investing across multiple time horizons. Traditional 401(k)s and IRAs provide immediate tax deductions but create future tax liabilities, while Roth accounts offer no current deduction but promise tax-free growth and withdrawals. This fundamental difference allows for strategic tax timing that can significantly impact lifetime tax efficiency.

For the year 2025, the 401(k) plan contribution maximum is set at $23,500, with an additional $7,500 catch-up contribution permitted for individuals aged 50 and above. Notably, participants aged 60-63 receive enhanced catch-up contributions of $11,250, recognizing the critical pre-retirement savings period. IRA contribution limits remain at $7,000 with $1,000 catch-up contributions, making 401(k)s the primary vehicle for high-volume retirement savings in tax efficient investing strategies.

Choosing between traditional and Roth 401(k) contributions hinges on whether your present tax rate is higher or lower than your anticipated tax rate during retirement. Tax efficient investing principles suggest that workers in lower tax brackets benefit from Roth contributions, paying taxes now at favorable rates for decades of tax-free growth. Conversely, high earners in peak tax brackets might prefer immediate deductions through traditional contributions, particularly if they expect lower retirement tax rates.

Strategic Roth Conversion Techniques

Roth conversions represent powerful tools for tax efficient investing, allowing investors to move traditional retirement assets to tax-free status. The optimal timing for conversions often occurs during lower-income years, such as early retirement periods or years with significant business losses. By managing conversion amounts carefully, investors can fill lower tax brackets while avoiding jumps to higher rates.

Multi-year conversion strategies spread tax obligations across several years while maximizing the time for tax-free growth. This approach to tax efficient investing requires careful projection of future income and tax rates, but can yield substantial benefits for investors with significant traditional retirement assets. The absence of required minimum distributions from Roth accounts makes them ideal for legacy planning and extended growth periods.

Tax efficient investing through Roth conversions becomes particularly powerful when combined with tax loss harvesting in taxable accounts. Realized losses can offset conversion income, allowing larger conversion amounts without increasing current tax liability. This coordination between account types exemplifies the sophisticated planning required for optimal tax efficient investing outcomes.

Asset Location within Retirement Accounts

The tax treatment differences between traditional and Roth accounts create distinct asset location opportunities within retirement savings. Traditional accounts work well for income-generating assets like bonds and REITs that would otherwise face high ordinary income tax rates. The tax-deferred nature of these accounts allows income to compound without current tax drag.

A smart investing strategy involves placing tax-inefficient assets into tax-advantaged accounts while keeping tax-efficient investments in taxable accounts. Studies reveal that this approach greatly minimizes tax drag, particularly for high-income earners. The majority of the benefits—around 90%—come from replacing taxable bonds with municipal bonds in taxable portfolios and holding passive stock funds there, while positioning actively managed funds inside tax-advantaged accounts. Small-cap stocks, emerging market funds, and other volatile but potentially rewarding investments can compound tax-free for decades. The combination of no current taxes and no required distributions makes Roth accounts ideal for assets intended for maximum long-term growth or wealth transfer purposes.

International investments within retirement accounts require special consideration due to foreign tax credit complications. Despite foreign tax credits commonly being inapplicable in tax-deferred vehicles, the advantage of tax-deferred compounding remains a compelling benefit. Tax efficient investing strategies might place international bonds in traditional accounts while holding international stocks in Roth accounts to optimize growth potential.

Advanced Tax Planning Techniques for 2025

Sophisticated tax efficient investing extends beyond basic strategies to encompass comprehensive planning techniques that coordinate multiple aspects of financial management. Tax location strategies consider not just which assets go in which accounts, but how to sequence withdrawals in retirement to minimize lifetime tax burdens. This approach requires modeling different scenarios and understanding how various income sources interact with tax brackets and Medicare surcharges.

The kiddie tax rules create opportunities for tax efficient investing through strategic asset placement in children’s accounts. While unearned income above certain thresholds faces parental tax rates, careful management can utilize children’s lower brackets for investment income. Education savings accounts like 529 plans offer additional tax-free growth opportunities for families prioritizing educational funding alongside retirement savings.

Estate planning considerations increasingly influence tax efficient investing strategies as account balances grow. The step-up in basis for inherited assets makes holding appreciated securities until death potentially valuable, while Roth accounts provide tax-free inheritance benefits. Charitable giving strategies, including donor-advised funds and charitable remainder trusts, offer additional avenues for tax efficient investing while supporting philanthropic goals.

Coordinating Tax Strategies across Account Types

Comprehensive tax efficient investing requires coordination across all account types to optimize overall tax efficiency. Strategically allocating tax-efficient assets to taxable accounts, income-focused holdings to traditional retirement accounts, and high-growth investments to Roth accounts helps optimize tax outcomes. The goal is creating a tax-diversified portfolio that provides flexibility for managing tax obligations across different market and personal circumstances.

Withdrawal sequencing in retirement represents the culmination of tax efficient investing strategies. The general principle of withdrawing from taxable accounts first, then traditional retirement accounts, and finally Roth accounts may not always prove optimal. Factors like tax bracket management, Medicare surcharge avoidance, and Social Security taxation can all influence the optimal withdrawal sequence for minimizing lifetime taxes.

Dynamic rebalancing strategies can enhance tax efficient investing by using required withdrawals and new contributions to maintain target allocations without triggering additional taxable events. This approach requires careful coordination between accounts but can significantly reduce the tax drag associated with portfolio maintenance over time. The key is maintaining the desired risk and return profile while minimizing unnecessary tax generation.

Common Tax Efficient Investing Mistakes to Avoid

Even well-intentioned investors often make crucial errors that undermine their tax efficient investing strategies. The most common mistake involves focusing exclusively on minimizing taxes while ignoring investment fundamentals. Tax efficiency should enhance investment returns, not drive investment decisions that compromise long-term wealth building. A high-quality taxable investment typically beats a poor-quality tax-free investment after adjusting for risk and return characteristics.

Timing mistakes represent another frequent error in tax efficient investing implementation. Investors might delay beneficial strategies waiting for “perfect” timing, missing years of potential tax savings. Conversely, some investors make hasty decisions based on short-term tax considerations without considering long-term implications. The key is balancing immediate tax benefits with long-term investment objectives and maintaining consistent strategy implementation.

Over-complexity can also undermine tax efficient investing success. While sophisticated strategies can provide meaningful benefits, they often require ongoing management and monitoring that many investors cannot maintain consistently. Simple, systematically implemented strategies often outperform complex approaches that are implemented inconsistently or abandoned during market stress.

Understanding the Wash Sale Rule and Other Pitfalls

The wash sale rule presents one of the most technical challenges in tax efficient investing, prohibiting loss recognition when substantially identical securities are purchased within 30 days before or after a sale. This rule extends to spouses and controlled entities, making coordination essential for married couples implementing loss harvesting strategies. Understanding what constitutes “substantially identical” helps investors avoid inadvertent wash sales that negate intended tax benefits.

Asset location mistakes can also prove costly, such as holding tax-inefficient assets in taxable accounts or tax-efficient assets in tax-advantaged accounts. These errors compound over time as inappropriate placements generate unnecessary tax drag or waste valuable tax-sheltered space. Regular portfolio reviews should include asset location audits to ensure ongoing optimization as portfolios evolve.

Ignoring state tax implications represents another common oversight in tax efficient investing strategies. State tax treatments of different investments can vary dramatically, making strategies optimal in one state suboptimal in another. Municipal bond decisions, in particular, require careful analysis of state-specific tax treatment to avoid strategies that appear beneficial federally but prove disadvantageous after state taxes are considered.

Implementing Your Tax Efficient Investing Strategy

Successfully implementing tax efficient investing demands a systematic and consistent approach that can adapt over long periods. This process begins with a comprehensive evaluation of your current investment holdings across all accounts, identifying opportunities for asset location optimization and tax loss harvesting—two foundational tactics in tax efficient investing.

Conducting a Comprehensive Portfolio Audit

- Inventory all investments across taxable, tax-deferred, and tax-free accounts.

- Analyze tax implications of each holding, focusing on dividends, interest, and capital gains.

- Identify assets that incur high tax burdens in taxable accounts.

- Recognize open positions showing unrealized losses that are ideal candidates for tax loss harvesting.

This portfolio baseline allows you to tailor strategies aligned with your unique tax situations and financial goals, ensuring that every dollar works harder by minimizing tax drag.

Utilize Technology and Professional Tools

Modern investing platforms and robo-advisors increasingly feature automated tax efficient investing tools. These include:

- Automated tax loss harvesting systems that continuously detect and execute loss-selling opportunities year-round.

- Tax-lot optimization technology that selects the most tax-advantageous lots for sale.

- Portfolio rebalancing that balances tax impact with investment objectives.

Such tools help maintain complex tax efficient investing strategies consistently, while freeing you to focus on higher-level planning and coordination across account types.

Importance of Ongoing Monitoring and Rebalancing

Staying tax-efficient with investments requires adapting to ongoing changes in both tax regulations and personal financial circumstances. As tax laws and individual goals shift, actively reviewing and optimizing a portfolio increases tax efficiency and helps maximize after-tax returns.

Tax-Efficient Investing Strategy

Tax efficiency means arranging an investment portfolio to reduce tax liabilities and boost wealth growth over time. This involves choosing tax-advantaged accounts, prioritizing investments that generate long-term capital gains, and being selective with products such as municipal bonds, exchange-traded funds (ETFs), and equity-linked savings schemes (ELSS) that are naturally tax-efficient.

Adapting to Evolving Tax Laws

New regulations, policy changes, and revised tax thresholds can impact investment returns and strategies. Successful portfolio optimization requires ongoing monitoring and adjustment to account for these legislative modifications, ensuring access to current tax benefits and compliance across jurisdictions.

Adjusting for Personal Circumstances

Life events such as salary changes, retirement, marriage, or inheritance can all influence optimal investment strategy and tax planning. Regular portfolio reviews allow investors to rebalance holdings, harvest tax losses, and fine-tune asset allocation according to current needs and goals.

Action Steps for Continuous Tax Efficiency

- Review investment portfolio periodically to identify gains, losses, and tax-saving opportunities.

- Adjust allocations to maintain alignment with new tax brackets, deductions, and personal objectives.

- Use tax-advantaged accounts and tax-efficient products to reduce overall liabilities.

By frequently reevaluating accounts and strategies, investors stay ahead of the changing tax landscape, ensuring their wealth management approach remains efficient, compliant, and optimized for long-term growth.

Creating a Sustainable Long-Term Plan for Tax Efficient Investing

For lasting success in tax efficient investing, devise strategies that are dynamic and flexible, able to evolve while preserving core principles.

Building Flexibility into Your Strategy

- Choose investment vehicles (e.g., ETFs, municipal bonds, tax-managed funds) that remain tax-efficient across different tax regimes.

- Utilize account structures offering a mix of tax deferral and tax-free growth (traditional IRAs, Roth IRAs, HSAs).

- Plan for changes in income, life stages, and tax regulations to adapt without disruption.

- Avoid overly rigid methods that are difficult to maintain or adjust.

Leveraging Education and Professional Guidance

- Consult tax professionals, financial planners, and estate attorneys familiar with tax efficient investing nuances.

- Seek advisors who integrate tax strategy with portfolio management, not treat them as separate silos.

- Continually educate yourself to understand how emerging tax policies may affect your investments.

Documentation and Record-Keeping

- Maintain detailed records of tax lot acquisitions and dispositions.

- Track adjustments related to wash sales and carryforwards.

- Monitor annual metrics like tax efficiency ratios and realized tax savings.

- Use software or spreadsheets to create a straightforward tracking system.

A well-documented system not only ensures compliance but empowers you to optimize tax efficient investing results year after year.

Conclusion

Mastering tax efficient investing is a crucial step for any American investor seeking to maximize after-tax returns and build lasting wealth in 2025 and beyond. Understanding how capital gains taxes, dividend taxes, and ordinary income taxes interact with your investment decisions empowers you to strategically allocate assets and execute thoughtful tax planning. By leveraging core tactics such as asset location, tax loss harvesting, and optimizing retirement account usage, you can reduce your tax burden substantially. This ensures that a greater portion of your hard-earned investment returns stays in your portfolio to grow over time.

The power of tax efficient investing goes beyond just minimizing taxes today, it is about compounding the benefits over decades. Reducing tax drag yields a larger portfolio, which can translate into earlier and more comfortable retirement or intergenerational wealth transfer. Employing tax-efficient investment vehicles like municipal bonds in taxable accounts, using Roth and traditional accounts strategically, and capitalizing on Health Savings Accounts’ triple tax advantages are foundational pillars of building a resilient tax-smart financial plan. The integration of these strategies requires consistent effort, ongoing monitoring, and adaptation to new tax laws and personal circumstances.

Successful implementation also calls for embracing technology and professional guidance. Automated tools such as tax loss harvesting algorithms and tax-lot optimization features simplify complexity and help maintain discipline in your investment approach. Meanwhile, partnering with tax professionals or financial advisors who understand the intricacies of tax efficient investing can improve personalization and tax planning precision. Documentation and record-keeping further safeguard compliance and enhance your ability to track tax efficiency over time, ensuring you don’t miss any opportunities.

Ultimately, tax efficient investing is not about chasing every tax loophole but rather weaving tax considerations into your broader investment strategy to optimize risk-adjusted returns. It demands a balance between tax minimization and sound portfolio construction. By committing to this balanced and systematic approach, you position yourself to harness the full potential of your investments, retain more after taxes, and achieve your long-term financial goals with confidence.

Now is the time to act thoughtfully by reviewing your portfolio, optimizing asset location, harvesting losses where appropriate, and staying informed on tax regulations. Over time, these disciplined actions turn tax efficiency from a complex concept into a powerful tool for financial empowerment and legacy building.

The comprehensive tax-efficient investment blueprint for 2025 is designed to empower investors with strategies that maximize wealth accumulation, enhance long-term financial security, and provide peace of mind through effective tax management. By adopting this blueprint, investors can confidently navigate their portfolios with a focus on minimizing tax liabilities, optimizing returns, and ensuring a sustainable growth path that supports their financial goals for years to come.

Frequently Asked Questions

1. What is the most important tax efficient investing strategy for beginners in 2025?

The most impactful starting point for tax efficient investing is maximizing contributions to employer 401(k) plans, especially when employer matching is available. This provides immediate tax deductions, tax-deferred growth, and potential employer contributions that represent guaranteed returns. In 2025, the contribution limit is set at $23,500, with an extra catch-up allowance of $7,500 available for individuals aged 50 and above. Focus on capturing the full employer match first, then consider increasing contributions to reduce current tax obligations while building retirement wealth.

2. How much can tax loss harvesting actually save in taxes annually?

Tax loss harvesting savings depend on your tax bracket and the amount of losses available to harvest. A real-world example illustrates how $30,000 in losses can offset $25,000 in capital gains—resulting in a tax saving of $3,750 at a 15% rate—and reduce $3,000 in ordinary income, saving $1,050 at a 35% rate, while carrying forward $2,000 in losses to future tax years. High-income investors might save $5,000-$15,000 annually through systematic loss harvesting, while moderate-income investors typically save hundreds to low thousands annually. The key is implementing it consistently rather than waiting for large losses.

3. Are municipal bonds worth it for middle-income investors in 2025?

Municipal bonds become attractive when your marginal tax rate exceeds the break-even point, typically around 22%. For someone in the 24% bracket, a 3% municipal bond provides the equivalent of a 3.95% taxable bond. However, middle-income investors should compare total returns, not just tax benefits. If high-quality corporate bonds or CDs offer significantly higher yields, they might provide better after-tax returns despite their taxable nature. Consider municipal bonds when you’re in the 22% bracket or higher and want stable, predictable income.

4. What’s the difference between tax-deferred and tax-free accounts for long-term investing?

Tax-deferred accounts like traditional 401(k)s and IRAs provide immediate tax deductions but create future tax obligations on withdrawals. Tax-free accounts like Roth IRAs and Roth 401(k)s offer no current deduction but provide tax-free growth and withdrawals in retirement. The choice depends on whether you expect higher or lower tax rates in retirement. If you’re currently in low tax brackets or expect higher future rates, Roth accounts often prove superior. If you’re in peak earning years with high current rates, traditional accounts might be better.

5. How should I coordinate asset location across different account types?

Effective asset location places tax-inefficient investments in tax-advantaged accounts and tax-efficient investments in taxable accounts. Put bonds, REITs, and high-turnover funds in traditional IRAs or 401(k)s to shelter their income from current taxes. Hold stocks, index funds, and municipal bonds in taxable accounts where their favorable tax treatment can be utilized. Place your highest-growth potential investments in Roth accounts for decades of tax-free compounding. The key is matching each asset’s tax characteristics with the most beneficial account type.

6. What are the biggest tax efficient investing mistakes to avoid in 2025?

The most costly mistakes include: letting tax considerations override sound investment principles, violating the wash sale rule during tax loss harvesting, holding tax-inefficient assets in taxable accounts, and failing to coordinate strategies across account types. Also avoid waiting for “perfect” timing to implement strategies, over-complicating approaches beyond your ability to maintain them, and ignoring state tax implications when making investment decisions. Focus on simple, consistent implementation of proven strategies rather than complex optimization that you can’t sustain.

Citations

- https://www.bankrate.com/investing/long-term-capital-gains-tax/

- https://www.nerdwallet.com/article/taxes/capital-gains-tax-rates

- https://www.fidelity.com/viewpoints/personal-finance/tax-loss-harvesting

- https://www.investopedia.com/terms/c/capital_gains_tax.asp

- https://smartasset.com/investing/capital-gains-tax-calculator

- https://en.wikipedia.org/wiki/Capital_gains_tax_in_the_United_States

- https://money.howstuffworks.com/personal-finance/financial-planning/municipal-bond2.htm

- https://www.investopedia.com/articles/investing-strategy/090116/think-twice-buying-taxfree-municipal-bonds.asp

- https://www.irs.gov/taxtopics/tc409

- https://www.schwab.com/learn/story/how-asset-location-can-help-save-on-taxes

- https://investor.vanguard.com/investor-resources-education/article/asset-location-can-lead-to-lower-taxes

- https://www.investopedia.com/articles/tax/08/asset-location.asp

- https://smartasset.com/financial-advisor/asset-location

- https://www.fidelity.com/learning-center/smart-money/ira-vs-401k

- https://www.investopedia.com/ask/answers/12/401k.asp

- https://www.fidelity.com/learning-center/wealth-management-insights/asset-location-minimize-taxes

- https://www.cnb.com/personal-banking/insights/roth-ira-traditional-ira.html

- https://www.investopedia.com/retirement/roth-vs-traditional-ira-which-is-right-for-you/

- https://investor.vanguard.com/investor-resources-education/taxes/tax-saving-investments

- https://www.fidelity.com/learning-center/investment-products/etf/etfs-tax-efficiency

- https://www.morningstar.com/funds/25-top-picks-tax-efficient-etfs-mutual-funds

- https://www.ameriprise.com/financial-goals-priorities/insurance-health/benefits-health-savings-accounts

- https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

- https://www.hsacentral.net/consumers/tax-benefits-health-savings-account/

- https://www.nerdwallet.com/article/investing/how-to-invest-hsa

- https://www.schwab.com/learn/story/potential-long-term-benefits-investing-your-hsa

- https://www.morganstanley.com/articles/health-savings-account-retirement-tax-advantages

- https://investor.vanguard.com/investor-resources-education/taxes/offset-gains-loss-harvesting

- https://www.ameriprise.com/financial-goals-priorities/taxes/tax-harvesting

- https://www.investopedia.com/articles/financial-advisors/121914/pros-and-cons-annual-taxloss-harvesting.asp

- https://www.bajajfinserv.in/municipal-bonds

- https://www.angelone.in/knowledge-center/share-market/what-are-municipal-bonds

- https://www.bondbazaar.com/blog-detail/municipal-bonds

- https://am.jpmorgan.com/us/en/asset-management/adv/insights/etf-insights/tax-efficiency-of-etfs/

- https://www.investopedia.com/articles/investing/090215/comparing-etfs-vs-mutual-funds-tax-efficiency.asp

- https://investor.vanguard.com/investor-resources-education/iras/roth-vs-traditional-ira

- https://www.missionsq.org/products-and-services/iras/which-ira-is-right-for-me.html

- https://www.schwab.com/learn/story/saving-retirement-ira-vs-401k

- https://www.schwab.com/ira/roth-vs-traditional-ira

- https://www.investopedia.com/articles/stocks/11/intro-tax-efficient-investing.asp

- https://www.morganstanley.com/articles/tax-efficient-investments-keeping-your-return

- https://www.shriramfinance.in/article-top-6-strategies-to-make-a-wise-investment

- https://groww.in/blog/tax-loss-harvesting

- https://cacult.com/tax-efficient-investing-in-2025-elss-vs-nps-vs-ppf/

- https://www.dbs.com/in/treasures/articles/learning-centre/best-tax-saving-mutual-funds-investment-options

- https://www.wealth-firstonline.com/tax-planning-tax-management-strategies/

- https://cleartax.in/s/tax-loss-harvesting

- https://www.bajajfinserv.in/investments/tax-efficient-investing

- https://taxsummaries.pwc.com/quick-charts/capital-gains-tax-cgt-rates

- https://centraltrust.net/ira-vs-401k-whats-the-difference-and-how-do-i-choose-the-right-one/

- https://www.tiaa.org/public/retire/financial-products/iras/roth-ira

- https://investor.vanguard.com/investor-resources-education/iras/401k-vs-ira

- https://www.investopedia.com/articles/personal-finance/090814/pros-and-cons-health-savings-account-hsa.asp

- https://www.morganstanley.com/cs/pdf/MSVA-401k-vs-IRA-Accounts-Overview.pdf

- https://www.fidelity.com/retirement-ira/ira-comparison

- https://www.blackrock.com/us/financial-professionals/insights/asset-location-for-tax-efficient-investing-financial-advisors

- https://www.investopedia.com/terms/m/municipalbond.asp

- https://www.icicietf.com/knowledge-center/blogs/the-tax-efficiency-of-etfs

- https://www.tiaa.org/public/invest/services/wealth-management/perspectives/assetlocation

- https://groww.in/p/municipal-bonds