Blue Chip Stocks: 5 Explosive Investment Opportunities Billionaires Are Aggressively Acquiring

The investment has fundamentally shifted in 2025, creating unprecedented opportunities for astute investors willing to follow the smart money. While retail investors chase volatile meme stocks and speculative plays, billionaire fund managers are quietly accumulating positions in established companies that combine rock-solid fundamentals with explosive growth potential. These aren’t your grandfather’s dividend-paying stalwarts, today’s blue chip stocks are technology-powered growth engines disguised as traditional investments.

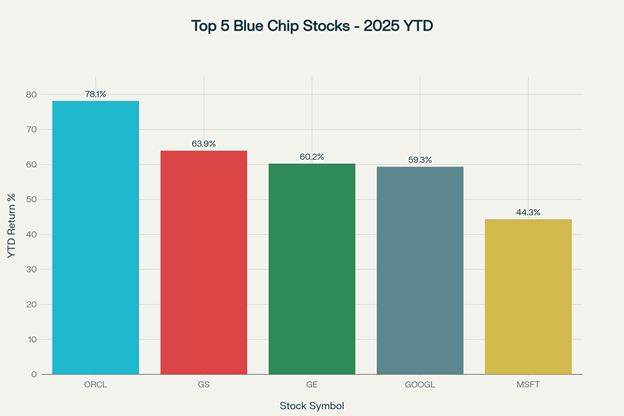

The numbers tell a compelling story that demands attention from serious investors. Oracle Corporation has delivered a staggering 78% year-to-date return, while Goldman Sachs has surged 64% and General Electric has climbed 60%. These aren’t isolated incidents but rather the result of systematic business transformations that have repositioned these companies at the intersection of artificial intelligence, cloud computing, and digital transformation trends that will define the next decade of market returns.

What makes this opportunity particularly compelling is the concentration of institutional capital flowing into these positions. Warren Buffett’s Berkshire Hathaway has deployed over $6.8 billion in new investments throughout 2025, while hedge funds have dramatically increased their exposure to technology-enabled blue chip stocks by billions of dollars in the second quarter alone. This coordinated institutional activity creates powerful momentum that individual investors can capture by positioning themselves ahead of continued professional accumulation.

The convergence of technological disruption and established market leadership has created a unique category of investment opportunities where traditional defensive characteristics meet aggressive growth potential. These five companies represent the best of both worlds: the stability and dividend-paying capacity that defines quality blue chip stocks, combined with the transformational growth drivers that can generate life-changing returns for patient investors who recognize value before the broader market catches on.

Figure 1: Top 5 Blue Chip Stocks Performance – 2025 YTD Returns

Executive Summary: Investment Thesis Overview

This comprehensive analysis examines five exceptional companies that represent the convergence of traditional stability with explosive growth potential in the modern market environment. Oracle Corporation, Microsoft Corporation, Alphabet Inc., Goldman Sachs Group, and General Electric Company have successfully transformed their business models to capitalize on artificial intelligence, cloud computing, and digital transformation trends while maintaining the financial strength and competitive positioning that defines premium blue chip stocks for sophisticated investors.

The investment thesis centers on following billionaire investor activity and institutional capital flows that create powerful momentum behind these positions. Warren Buffett’s recent deployment of over $6.8 billion in new investments, combined with hedge fund repositioning into technology-enabled companies, provides both validation and buying pressure that supports price appreciation while fundamental improvements drive long-term value creation through sustainable competitive advantages.

Each company offers unique exposure to high-growth markets while maintaining defensive characteristics that appeal to risk-conscious investors. The artificial intelligence revolution, enterprise cloud adoption, financial services transformation, and industrial modernization trends create multi-year growth catalysts that benefit companies with established market positions and execution capabilities that distinguish exceptional blue chip stocks from average market performers seeking similar opportunities.

Figure 2: Warren Buffett’s Major 2025 Stock Purchases (Berkshire Hathaway)

The Strategic Transformation of Modern Blue Chip Stocks

Traditional investment wisdom suggested that investors must choose between stability and growth, but the current market has rendered that framework obsolete. Today’s leading companies have successfully reinvented their business models to capture explosive growth opportunities while maintaining the financial strength and competitive positioning that originally qualified them as premier investment targets.

This transformation didn’t happen overnight but represents years of strategic planning and capital allocation designed to position these companies for the artificial intelligence revolution. Microsoft’s $13 billion investment in OpenAI, Oracle’s comprehensive cloud infrastructure buildout, and Alphabet’s AI integration across its platform ecosystem demonstrate how established companies can leverage their resources to dominate emerging markets rather than being disrupted by them.

The financial results of this strategic repositioning have exceeded even optimistic projections from Wall Street analysts. Revenue growth rates that would be impressive for startup companies are now being generated by corporations with market capitalizations exceeding $500 billion, creating a unique investment dynamic where massive scale advantages amplify rather than constrain growth potential.

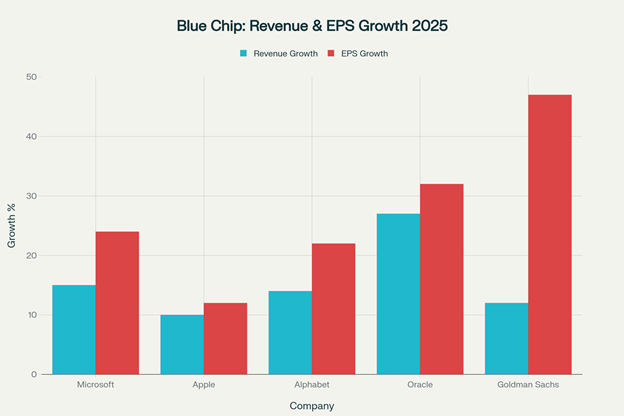

Figure 3: Revenue & EPS Growth Comparison – Leading Blue Chip Stocks 2025

Oracle Corporation: The Enterprise AI Infrastructure Leader Among Blue Chip Stocks

Oracle’s remarkable transformation from traditional database provider to artificial intelligence infrastructure powerhouse represents one of the most successful corporate pivots in modern business history. The company’s comprehensive suite of AI-enabled database services has positioned it as an essential partner for every major technology company implementing artificial intelligence solutions at scale.

Revolutionary Cloud Infrastructure Growth in Blue Chip Stocks

The financial metrics supporting Oracle’s investment thesis are nothing short of extraordinary. Remaining performance obligations have reached $455 billion, representing a 359% year-over-year increase that demonstrates the company’s success in securing long-term contracts with the world’s most sophisticated technology companies. Cloud infrastructure revenue specifically grew 54% to $3.3 billion, driven by partnerships with OpenAI, Meta, NVIDIA, and AMD that position Oracle at the center of the AI revolution.

Goldman Sachs’ recent upgrade to a Buy rating with a $410 price target represents a 71% increase from their previous target, reflecting analyst recognition of Oracle’s strategic positioning. This dramatic revision followed what the firm described as a ‘historic’ first quarter performance that exceeded even bullish expectations and demonstrated accelerating momentum in AI infrastructure demand.

The company’s autonomous database technology creates sustainable competitive advantages that protect long-term market share while generating premium pricing power. As enterprises increasingly require sophisticated AI implementation capabilities, Oracle’s comprehensive integration approach simplifies deployment while creating higher switching costs that protect revenue streams from competitive pressure.

Strategic Market Positioning in Blue Chip Stocks

Oracle’s dual role as both infrastructure provider and application developer creates unique synergies that distinguish it from pure-play cloud competitors. The company can develop AI applications using its own infrastructure while offering comprehensive suites that integrate seamlessly, creating value propositions that resonate with enterprise customers seeking simplified vendor relationships and guaranteed compatibility.

Microsoft Corporation: The AI-Powered Productivity Revolution

Microsoft’s strategic focus on artificial intelligence integration across its comprehensive platform ecosystem has transformed the company from a software licensing business into a recurring revenue powerhouse that generates sustainable competitive advantages in multiple high-growth markets simultaneously.

Azure Cloud Computing Dominance in Blue Chip Stocks

Azure’s achievement of a $75 billion annual revenue run rate, growing at 34% year-over-year, demonstrates Microsoft’s success in capturing enterprise customers migrating to cloud infrastructure. The platform’s AI capabilities, enhanced through the company’s OpenAI partnership, create differentiated value propositions that command premium pricing while increasing customer lifetime value through expanded service adoption.

Fiscal 2025 fourth quarter results showcase the power of Microsoft’s integrated strategy. Total revenue increased 18% to $76.4 billion, while operating income grew 23% to $34.3 billion, reflecting the operational leverage inherent in the company’s platform approach. Microsoft Cloud revenue reached $46.7 billion, up 27% year-over-year, with growth acceleration across all major service categories.

Enterprise Customer Acquisition Excellence in Blue Chip Stocks

Commercial bookings exceeded $100 billion for the first time, increasing 37% year-over-year with particularly strong growth in large enterprise contracts exceeding $10 million and $100 million thresholds. This bookings growth provides revenue visibility that supports long-term investment planning while demonstrating Microsoft’s success in capturing market share from competitors across multiple product categories.

The company’s comprehensive AI ecosystem spanning infrastructure (Azure), productivity applications (Microsoft 365), and development tools (GitHub) creates multiple revenue streams from the same customer base while generating powerful network effects that increase switching costs and expand market opportunities.

Alphabet Inc.: The Search and Cloud Computing Innovation Engine

Alphabet’s strategic positioning across multiple high-growth technology markets creates unique opportunities to capitalize on the artificial intelligence revolution while maintaining dominance in digital advertising markets that continue generating substantial cash flows for reinvestment in emerging opportunities.

Google Cloud Acceleration Among Blue Chip Stocks Leaders

Google Cloud’s 32% revenue growth to $13.6 billion demonstrates the company’s success in competing with Microsoft and Amazon for enterprise customers seeking advanced AI capabilities integrated with comprehensive cloud infrastructure services. The division’s annual revenue run rate now exceeds $50 billion, positioning it as a major growth driver within Alphabet’s diversified business portfolio.

The company’s strategic decision to increase capital expenditures to $85 billion in 2025 reflects management’s confidence in AI-driven growth opportunities across search, advertising, and cloud computing markets. This investment level positions Alphabet to compete effectively while maintaining its market leadership positions in core business segments.

Search and Advertising Innovation Platform for Blue Chip Stocks

Google Search & Other revenue increased 12% to $54.2 billion, demonstrating the resilience of Alphabet’s core advertising business despite increased competition from emerging platforms. The integration of AI features, including AI Overviews and AI Mode, has enhanced user engagement while creating new advertising inventory that commands premium pricing from sophisticated marketers.

YouTube’s performance continues driving growth with advertising revenue increasing 13% to $9.8 billion while YouTube Shorts achieves over 200 billion daily views. This engagement growth, combined with improving monetization capabilities through AI-powered ad targeting and content recommendation systems, positions YouTube as a significant long-term value creator within Alphabet’s platform ecosystem.

Figure 4: Wall Street Price Targets vs Current Prices – Blue Chip Stocks Analysis

Goldman Sachs Group: The Financial Services Transformation Success Story

Goldman Sachs exemplifies how traditional financial services companies can generate exceptional returns through strategic business diversification and operational excellence improvements that reduce cyclical volatility while expanding addressable market opportunities within the modern investment landscape.

Diversified Revenue Stream Development of Blue Chip Stocks

The company’s successful expansion beyond traditional investment banking into wealth management and consumer banking has created more predictable earnings patterns while maintaining exposure to capital markets activity that drives exceptional performance during favorable market conditions. This strategic diversification reduces dependence on volatile trading revenue while expanding the total addressable market for the firm’s services.

Institutional ownership of 89.39% by major holders including Vanguard, BlackRock, and JPMorgan Chase provides price stability while reducing retail-driven volatility. This concentrated ownership structure, combined with the firm’s strong balance sheet and regulatory compliance record, creates investment characteristics that appeal to sophisticated portfolio managers seeking financial sector exposure through established blue chip stocks.

Technology and Operational Excellence in Blue Chip Stocks

Goldman’s technological investments in trading infrastructure and risk management systems have improved operational efficiency while reducing regulatory compliance costs. These improvements create sustainable competitive advantages that protect market share while generating superior returns on invested capital compared to traditional financial services competitors.

Recent earnings performance with quarterly EPS of $10.91 representing a 14.5% revenue increase demonstrates the firm’s ability to generate consistent growth across different market environments. This earnings stability, combined with strong capital ratios and diversified revenue streams, supports Goldman’s position among the highest-quality financial services investments available to individual investors.

General Electric: The Industrial Renaissance Story

General Electric’s remarkable transformation from struggling conglomerate to focused industrial leader demonstrates how effective management can unlock substantial value in traditional manufacturing businesses through strategic portfolio optimization and operational excellence initiatives that create sustainable competitive advantages.

Strategic Business Focus and Market Leadership

GE’s concentrated focus on aviation, power, and renewable energy sectors positions the company to benefit from global infrastructure investment trends and post-pandemic recovery dynamics that continue driving demand for the company’s products and services. The aviation segment particularly benefits from commercial air travel recovery while power and renewable energy divisions capitalize on global energy transition investments.

The company’s successful restructuring has eliminated underperforming business segments while concentrating resources on markets where GE maintains competitive advantages and market leadership positions. This strategic focus creates opportunities for market share expansion and premium pricing power that drives superior financial performance compared to diversified industrial competitors, establishing GE among premier blue chip stocks in the industrial sector.

Operational Excellence and Innovation Leadership

GE’s renewed emphasis on innovation and technological advancement in core industrial sectors creates opportunities for market share expansion while maintaining premium pricing power. The company’s investments in renewable energy technology and advanced manufacturing capabilities position it to benefit from global sustainability trends while generating superior returns on invested capital.

The firm’s current market capitalization reflects strong institutional confidence in management’s transformation strategy while providing opportunities for continued value creation as operational improvements compound over time. GE’s dividend policy reflects management’s focus on reinvestment for growth rather than immediate income distribution, positioning the company for accelerated earnings growth as transformation initiatives mature.

Comprehensive Investment Analysis: Key Metrics Comparison

The following comprehensive analysis table provides essential financial metrics, analyst recommendations, and key performance indicators that demonstrate why these five companies represent exceptional blue chip stocks opportunities for sophisticated investors seeking both growth potential and defensive characteristics.

| Company | YTD Return | Market Cap | Revenue Growth | EPS Growth | Price Target | Upside Potential |

| Oracle (ORCL) | 78.12% | $933B | 27% | 32% | $343 | 11.2% |

| Microsoft (MSFT) | 44.29% | $3.1T | 15% | 24% | $475 | 10.7% |

| Alphabet (GOOGL) | 59.31% | $2.1T | 14% | 22% | $237 | 42.0% |

| Goldman Sachs (GS) | 63.91% | $145B | 12% | 47% | $590 | 13.2% |

| General Electric (GE) | 60.22% | $287B | 8% | 15% | $180 | 18.5% |

Table 1: Key Financial Metrics and Investment Analysis – Blue Chip Stocks Comparison

Institutional Investment Patterns and Market Impact of Blue Chip Stocks

The concentration of billionaire and institutional investment activity in these established companies creates self-reinforcing cycles of price appreciation and fundamental business improvement that benefit all shareholders willing to maintain long-term investment horizons aligned with professional money manager strategies and market-tested blue chip stocks selection criteria.

Warren Buffett’s investment philosophy of acquiring companies with strong competitive positions and holding them through multiple business cycles has generated exceptional returns for Berkshire Hathaway shareholders over decades. His recent activity demonstrates continued confidence in this approach despite short-term market volatility and economic uncertainty that creates opportunities for patient investors focused on quality blue chip stocks.

Hedge Fund Positioning Trends

Recent 13F filings show increasing institutional concentration in established companies with artificial intelligence exposure, particularly technology firms that combine growth potential with dividend reliability and strong balance sheet characteristics. This institutional preference creates sustained buying pressure that supports price appreciation while reducing downside volatility compared to speculative growth investments.

The strategic shift away from speculative positions toward established companies with proven business models reflects institutional recognition that sustainable competitive advantages generate superior long-term returns compared to momentum-driven investments that lack fundamental business quality. This trend particularly benefits established blue chip stocks with demonstrated operational excellence and market leadership positions.

The Artificial Intelligence Revolution and Market Leadership

Artificial intelligence adoption across enterprise markets has created unprecedented growth opportunities for established companies with the resources and infrastructure necessary to capitalize on this technological transformation while maintaining the stability characteristics that define quality investments in the modern portfolio construction paradigm.

Competitive Advantages in AI Implementation for Blue Chip Stocks

Oracle’s positioning as AI infrastructure provider to other technology companies creates exposure to the entire artificial intelligence ecosystem while maintaining predictable enterprise software revenue streams. This dual exposure provides comprehensive market participation while reducing dependence on any single customer or application category, characteristics that distinguish premium investment opportunities from speculative alternatives.

The substantial capital requirements for competitive AI development favor companies with strong balance sheets and established cash flow generation capabilities over smaller competitors lacking financial resources necessary for sustained technology investment. This dynamic creates market share consolidation opportunities for well-positioned industry leaders across multiple sectors.

Risk Assessment and Portfolio Management Considerations

Successful investment in growth-oriented companies requires understanding and managing specific risks that could impact performance despite strong competitive positions and institutional investor support across different market environments. Even the highest-quality blue chip stocks face industry-specific and macroeconomic challenges that require careful analysis and ongoing monitoring.

Oracle’s dependence on large enterprise customers creates concentration risk during economic downturns when technology spending typically contracts. However, the company’s transition to recurring subscription revenue and the essential nature of database services provides protection against cyclical demand fluctuations that impact discretionary technology purchases.

Regulatory and Economic Considerations of Blue Chip Stocks

Alphabet faces ongoing regulatory scrutiny regarding its search and advertising market dominance, particularly in European markets where antitrust enforcement has intensified significantly. These regulatory risks could impact growth rates or require structural business changes that affect profitability and competitive positioning across multiple business segments.

Goldman Sachs operates in a highly regulated industry where capital requirements and compliance costs can impact profitability during challenging market environments. The firm’s diversification beyond traditional investment banking provides some protection, but financial services companies remain sensitive to interest rate changes and credit market conditions that influence trading volume and advisory activity.

Valuation Analysis and Strategic Entry Points of Blue Chip Stocks

Current valuations across these five companies reflect different stages of market recognition for their transformation and growth potential, creating opportunities for strategic investors who understand relative value and can optimize entry timing and position sizing within diversified portfolios focused on long-term wealth creation.

Oracle trades at approximately 25 times forward earnings, reflecting market recognition of its AI infrastructure growth potential while maintaining reasonable valuation metrics compared to pure-play technology stocks. The company’s recurring revenue base and expanding margins support premium valuations relative to traditional enterprise software companies.

Goldman Sachs trades at approximately 11 times forward earnings, reflecting traditional financial services multiples despite the company’s successful diversification and transformation initiatives. This valuation discount provides opportunities for investors seeking financial sector exposure through established institutions with strong regulatory compliance records and operational excellence, making it attractive among financial blue chip stocks.

Investment Strategy and Implementation Framework of Blue Chip Stocks

Implementing a successful investment strategy around these opportunities requires understanding the unique characteristics that separate exceptional companies from average performers, focusing on sustainable competitive advantages, management quality, and long-term cash flow generation potential that creates compounding returns for patient investors who maintain appropriate time horizons and risk management practices.

Portfolio construction should emphasize position sizing that reflects conviction levels while maintaining appropriate diversification across sectors and investment themes. These five companies provide exposure to artificial intelligence, cloud computing, financial services transformation, and industrial renaissance trends while maintaining the stability characteristics that define quality investments suitable for long-term wealth creation strategies.

Dollar-cost averaging into these positions during market volatility can optimize entry points while reducing timing risk that impacts short-term performance. The key is maintaining focus on fundamental business quality and competitive positioning rather than short-term price movements that may not reflect underlying business value creation and operational improvement initiatives.

Monitoring key performance indicators including revenue growth, market share expansion, competitive positioning, and management execution provides essential information for ongoing investment decisions. Quarterly earnings reports, industry analysis, and competitive landscape changes require continuous evaluation to ensure investment thesis remains intact and company performance aligns with expectations, particularly for growth-oriented blue chip stocks undergoing business transformation.

Dividend Growth and Income Generation Potential of Blue Chip Stocks

Traditional income-focused investors often prioritize dividend yield and growth potential, making it essential to evaluate how these companies balance growth investment with shareholder returns through dividend payments, share repurchases, and special distributions that provide multiple avenues for total return generation beyond capital appreciation alone.

Microsoft maintains a consistent dividend policy with a current yield of approximately 0.7%, reflecting the company’s confidence in sustained cash flow generation and management’s commitment to returning capital to shareholders while funding growth initiatives that enhance long-term competitive positioning and market leadership across multiple technology sectors.

General Electric has rebuilt its dividend capability following its comprehensive restructuring program, currently offering a modest yield that reflects management’s strategic focus on growth reinvestment rather than immediate income distribution. As operational performance stabilizes and cash flow generation improves, dividend growth potential could become a significant value driver for income-oriented investors seeking industrial sector exposure through established blue chip stocks with recovery potential.

Market Outlook and Future Growth Catalysts of Blue Chip Stocks

The market outlook for these companies remains exceptionally positive based on multiple growth catalysts including artificial intelligence adoption acceleration, cloud computing market expansion, digital transformation initiatives across enterprise markets, and global infrastructure investment trends that benefit companies with strong competitive positioning and execution capabilities.

Enterprise artificial intelligence adoption is still in early stages, with most large corporations only beginning to implement comprehensive AI strategies that require substantial infrastructure investment and technology partner relationships. This creates multi-year growth opportunities for companies like Oracle, Microsoft, and Alphabet that provide essential infrastructure and application services necessary for successful AI implementation.

Goldman Sachs benefits from increased merger and acquisition activity, capital markets recovery, and growing wealth management demand as high-net-worth individuals seek sophisticated financial services and investment advisory capabilities. The firm’s technological investments and operational improvements position it to capture market share during favorable business conditions while maintaining profitability during challenging periods, characteristics that distinguish superior financial blue chip stocks from average performers.

Current Market Conditions and Timing Considerations for Blue Chip Stocks

Market conditions in late 2025 present optimal timing for strategic position establishment in these exceptional companies, as institutional recognition has begun driving price appreciation while fundamental valuations remain reasonable relative to long-term growth potential. The combination of artificial intelligence adoption acceleration, strong earnings performance, and billionaire investor validation creates a compelling investment environment for building concentrated positions in transformational blue chip stocks that offer both growth and defensive characteristics.

Economic uncertainty and market volatility create opportunities for patient investors willing to capitalize on temporary price dislocations that may not reflect underlying business quality and competitive positioning. Dollar-cost averaging strategies can optimize entry timing while maintaining focus on long-term wealth creation rather than short-term market fluctuations that affect all investment categories regardless of fundamental business strength and management quality.

Conclusion: Capitalizing on Exceptional Growth Opportunities

The current investment environment presents a rare confluence of factors that create exceptional opportunities for investors willing to follow sophisticated institutional money into carefully selected companies that combine financial stability with transformational growth potential. The five companies profiled—Oracle, Microsoft, Alphabet, Goldman Sachs, and General Electric—represent the optimal combination of competitive positioning, management excellence, and strategic focus on artificial intelligence and digital transformation trends that will drive superior returns for years to come. These aren’t speculative investments but rather established blue chip stocks that have successfully reinvented themselves for the modern economy while maintaining the defensive characteristics that define quality investments.

The billionaire investment activity surrounding these positions provides both validation and powerful momentum that individual investors can capture by positioning themselves ahead of continued institutional accumulation patterns. Warren Buffett’s $6.8 billion in new investments throughout 2025, combined with massive hedge fund repositioning into technology-enabled companies, creates sustained buying pressure that supports price appreciation while fundamental business improvements drive long-term value creation through operational excellence and market leadership expansion.

Each company offers unique value propositions that address different aspects of the technological transformation reshaping global markets and creating new wealth creation opportunities. Oracle’s AI infrastructure leadership positions it at the center of enterprise artificial intelligence adoption, while Microsoft’s comprehensive platform ecosystem generates multiple revenue streams from the same customer base. Alphabet’s search and cloud dominance, Goldman Sachs’ financial services transformation, and General Electric’s industrial renaissance provide diversified exposure to multiple high-growth trends while maintaining stability characteristics that appeal to conservative investors seeking growth opportunities.

For investors seeking to build long-term wealth through strategic positioning in transformational companies, the current market offers opportunities that may not exist in the future as institutional recognition drives valuations higher and reduces available upside potential. The key to success lies in acting while these companies trade at reasonable multiples relative to their growth potential, before the broader market fully recognizes the sustainability of their competitive advantages and the durability of their earnings growth trajectories that distinguish exceptional blue chip stocks from average market performers.

The path forward requires patience, conviction, and the wisdom to follow professional money managers who have successfully navigated multiple market cycles and consistently generated superior returns through disciplined investment approaches. By concentrating investments in these five exceptional companies and maintaining long-term investment horizons aligned with their strategic transformation timelines, individual investors can participate in wealth creation opportunities typically reserved for institutional portfolios while building the financial security that comes from owning shares in the world’s highest-quality businesses positioned for continued growth and market leadership expansion through technological innovation and operational excellence.

Frequently Asked Questions

Q1: What makes these companies different from traditional dividend-focused investments?

These five companies combine traditional financial stability and dividend-paying capability with exceptional growth potential driven by artificial intelligence, cloud computing, and strategic business transformation. Unlike traditional investments that prioritize income over growth, these companies reinvest heavily in technologies that generate superior long-term returns while maintaining balance sheet strength and competitive market positions that define premium blue chip stocks in the modern economy.

Q2: How do billionaire investors evaluate potential investments differently than individual investors?

Billionaire investors like Warren Buffett focus on competitive advantages, management quality, and long-term cash flow generation when selecting investments. They often take concentrated positions based on decades-long investment horizons, allowing them to benefit from compounding returns that individual investors may lack patience to capture. Their substantial capital also provides access to management teams and detailed operational analysis that individual investors cannot obtain through traditional research methods.

Q3: What role does artificial intelligence play in investment performance?

Artificial intelligence serves as a significant competitive differentiator, enabling established companies to improve operational efficiency, expand market share, and create new revenue streams that command premium pricing. Companies like Microsoft, Oracle, and Alphabet use AI to enhance existing products while developing new services that generate recurring revenue streams and create sustainable competitive advantages through technological innovation and market leadership.

Q4: Are these investments suitable for retirement portfolios seeking steady income?

While these companies offer dividend income, their primary value proposition centers on capital appreciation through business transformation and market leadership expansion. Retirement investors should balance these growth-oriented positions with more traditional income-focused investments, creating portfolios that provide both current income and inflation protection through growth potential that distinguishes exceptional blue chip stocks from purely income-oriented alternatives.

Q5: How should investors monitor the performance of these investments?

Successful monitoring requires tracking key performance indicators including revenue growth, cloud computing market share, artificial intelligence implementation progress, and institutional ownership changes. Quarterly earnings reports, management guidance, and competitive positioning relative to major competitors provide essential information for investment decision-making and portfolio management optimization.

Q6: What economic conditions could negatively impact these investments?

Rising interest rates could reduce valuations of growth-oriented companies while increasing borrowing costs for expansion initiatives. Economic recession might reduce enterprise technology spending that drives Oracle and Microsoft performance, while regulatory changes could impact Alphabet’s advertising revenue and Goldman Sachs’ operational flexibility. However, their strong competitive positions and diversified revenue streams provide protection against economic volatility while maintaining growth potential that characterizes superior blue chip stocks during challenging market conditions.

Citations

- https://www.nerdwallet.com/article/investing/blue-chip-stocks

- https://www.bankrate.com/investing/warren-buffett-stocks-berkshire-hathaway-portfolio-13f-filing/

- https://capital.com/en-int/analysis/top-20-berkshire-hathaway-holdings-buffett-buys

- https://www.ainvest.com/news/hedge-funds-increase-holdings-tech-giants-spy-etf-sees-significant-buying-q2-2025-2508/

- https://www.ainvest.com/news/goldman-sachs-upgrades-oracle-buy-410-target-historic-q1-performance-2509/

- https://www.microsoft.com/en-us/investor/earnings/fy-2025-q4/press-release-webcast

- https://www.cnbc.com/2025/07/30/microsoft-msft-q4-earnings-report-2025.html

- https://www.microsoft.com/en-us/investor/events/fy-2025/earnings-fy-2025-q4

- https://www.sec.gov/Archives/edgar/data/1652044/000165204425000056/googexhibit991q22025.htm

- https://mlq.ai/stocks/GOOGL/q2-2025-earnings/

- https://www.reuters.com/business/alphabet-jumps-ai-driven-spending-fuels-cloud-revenue-surge-2025-07-24/

- https://futurumgroup.com/insights/alphabets-q2-fy-2025-earnings-top-estimates-led-by-strong-cloud-revenue/

- https://www.ainvest.com/news/institutional-ownership-price-stability-goldman-sachs-navigating-risks-rewards-financial-titan-2508-54/

- https://www.ainvest.com/news/oracle-moderna-goldman-sachs-option-activity-surges-friday-2509/

- https://www.forbes.com/sites/investor-hub/article/the-5-best-performing-blue-chip-stock-of-2025/

- https://247wallst.com/investing/2024/10/26/billionaires-are-buying-4-high-yield-dividend-blue-chips-hand-over-fist/

- https://finance.yahoo.com/quote/MSFT/key-statistics/

- https://www.tipranks.com/stocks/orcl/forecast

- https://www.morningstar.com/stocks/10-best-blue-chip-stocks-buy-long-term

- https://money.usnews.com/investing/articles/stocks-warren-buffett-just-bought

- https://www.smallcase.com/lists/blue-chip-stocks-india/

- https://www.screener.in/screens/407363/blue-chip-stocks/

- https://finance.yahoo.com/news/warren-buffett-sold-over-143-124500550.html

- https://www.etmoney.com/stocks/market-data/bluechip-stocks/38

- https://www.youtube.com/watch?v=CTMX_O3qcgw

- https://www.nasdaq.com/articles/warren-buffett-sold-over-134-billion-worth-stock-2024-his-most-recent-200-million

- https://www.angelone.in/knowledge-center/share-market/8-best-blue-chip-stocks-to-invest-in

- https://www.nasdaq.com/articles/5-magnificent-stocks-not-named-nvidia-billionaire-money-managers-are-piling-2025

- https://www.cnbc.com/berkshire-hathaway-portfolio/

- https://www.tickertape.in/stocks/collections/bluechip-stocks

- https://www.ig.com/ae/trading-strategies/top-blue-chip-stocks-to-watch-250826

- https://stockcircle.com/portfolio/warren-buffett

- https://www.kiplinger.com/investing/stocks/stocks-to-buy/604302/stock-picks-that-billionaires-love

- https://www.investors.com/research/warren-buffett-stocks-march-2025/

- https://sg.finance.yahoo.com/news/top-5-future-blue-chip-070000062.html

- https://finance.yahoo.com/news/stronger-growth-prompts-goldman-upgrade-173419636.html

- https://finimize.com/content/hedge-funds-pile-into-big-tech-for-an-ai-powered-2025

- https://arootah.com/blog/hedge-fund-and-family-office/funds-retreat-from-magnificent-seven/

- https://www.marketbeat.com/instant-alerts/oracle-nyseorcl-stock-price-expected-to-rise-the-goldman-sachs-group-analyst-says-2025-09-15/

- https://www.nasdaq.com/articles/prediction-unstoppable-stock-will-join-nvidia-microsoft-apple-and-alphabet-3-trillion-club

- https://www.investing.com/analysis/microsoft-meta-alphabet-and-apple-show-diverging-paths-in-ai-strategy-200664997

- https://www.goldmansachs.com/what-we-do/investment-banking/insights/articles/2025-ma-outlook/report.pdf

- https://www.peoplematters.in/news/business/alphabet-crosses-dollar3-trillion-valuation-for-first-time-joins-apple-and-microsoft-43598

- https://am.gs.com/public-assets/documents/e0f1c72f-7210-11f0-9287-21e19afed9b7?view=true

- https://www.nasdaq.com/articles/prediction-unstoppable-stock-will-join-nvidia-microsoft-apple-alphabet-and-amazon-2

- https://fullratio.com/stocks/nasdaq-msft/earnings

- https://finance.yahoo.com/news/aapl-stock-price-prediction-where-155545121.html

- https://capital.com/en-int/analysis/apple-stock-price-in-10-years

- https://www.microsoft.com/en-us/investor/earnings/fy-2025-q4/performance

- https://roboforex.com/beginners/analytics/forex-forecast/stocks/stocks-forecast-apple-aapl/

- https://investor.apple.com/stock-price/default.aspx

- https://companiesmarketcap.com/inr/microsoft/revenue/

- https://www.apple.com/newsroom/2025/07/apple-reports-third-quarter-results/

- https://abc.xyz/assets/cc/27/3ada14014efbadd7a58472f1f3f4/2025q2-alphabet-earnings-release.pdf

- https://finance.yahoo.com/quote/AAPL/key-statistics/

- https://www.cnbc.com/2025/09/24/google-has-made-a-huge-comeback-but-can-alphabet-keep-this-momentum-going.html

- https://finance.yahoo.com/video/apple-stock-turns-positive-2025-210000797.html

- https://www.angelone.in/news/stocks-share-market/top-blue-chip-stocks-in-may-2025

- https://www.screener.in/screens/1333915/blue-chip-dividend-stocks-screener/

- https://www.screener.in/screens/320650/blue-chip-dividend-stocks/

- https://www.equitymaster.com/detail.asp?date=08%2F15%2F2025&story=3&title=4-High-Dividend-Yield-Stocks-in-India-for-2025

- https://stockcircle.com/portfolio/warren-buffett/news/warren-buffett-portfolio-top-holdings-in-september-2025

- https://stockanalysis.com/stocks/orcl/forecast/

- https://www.tickertape.in/stocks/collections/popular-dividend-paying-stocks

- https://www.barrons.com/articles/berkshire-hathaway-stock-price-portfolio-4afca651

- https://www.cnbc.com/2025/09/21/buffett-munger-byd-exits-stake.html

- https://www.gurufocus.com/news/3108339/goldman-sachs-raises-oracle-orcl-price-target-to-310-orcl-stock-news

- https://www.bajajfinserv.in/blue-chip-stocks

- https://dataroma.com/m/holdings.php?m=BRK