10 Best Business Credit Building Tips for Success

One of the smartest moves you can make as a business owner is building a strong credit profile for your company. It’s not just about getting loans, though that’s certainly part of it. The Federal Reserve found that 59% of small businesses applied for financing last year, and whether they got approved (and what terms they received) came down largely to their creditworthiness.

Here’s the thing: good business credit opens doors. It helps you get better deals with suppliers, protects your personal finances from business risks, and gives you access to the capital you need to grow. But I’ve seen so many entrepreneurs struggle with this. They either don’t know where to start or they underestimate just how much having solid business credit can give them an edge over competitors.

When you build your business credit the right way, the benefits go way beyond just getting approved for loans. Companies with excellent credit scores (we’re talking 80 or above on the PAYDEX scale) get access to higher credit limits and lower interest rates. Even better, they can qualify for financing based on how the business is doing, not on their personal guarantees. That means you can grow faster without putting everything on the line personally.

There’s another huge benefit that doesn’t get talked about enough: building business credit creates a buffer between your personal credit and your business finances. About 42% of business owners say this separation is crucial for protecting their personal wealth, and I completely agree.

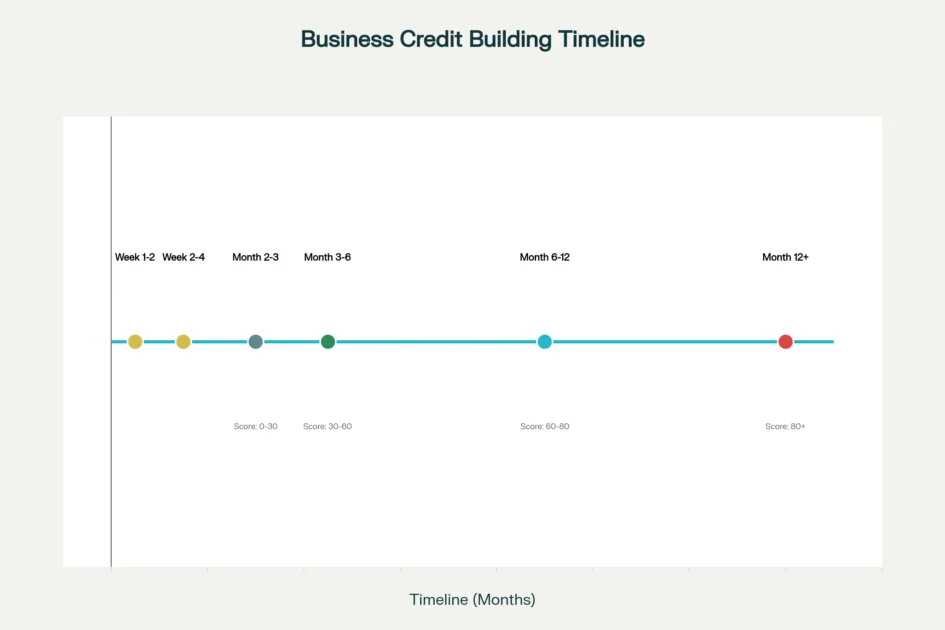

Now, building great business credit doesn’t happen overnight, but it’s not as complicated as you might think. Most businesses can establish a solid credit foundation within six to twelve months if they’re strategic about it. Getting to excellent credit scores might take a bit longer, but it’s absolutely worth the effort.

I’ve put together ten practical tips based on over a decade of working with businesses and studying data from the three major business credit bureaus: Dun & Bradstreet, Experian, and Equifax. These aren’t just theoretical ideas; they’re proven strategies that actually work in the real world.

The bottom line? Taking business credit seriously pays off. Recent data shows that companies with strong credit strategies can access financing at rates up to 40% lower than those relying only on personal credit. You’ll also get higher credit limits, faster approvals, better relationships with vendors, and even a higher company valuation if you ever decide to sell.

The businesses that prioritize building credit early on set themselves up for sustainable growth and financial stability, no matter what the economy throws at them. It’s one of those foundational pieces that can make or break your long term success.

Understanding Business Credit Fundamentals

Business credit building tips differ fundamentally from personal credit in structure, scoring methodology, and strategic implications. While personal FICO scores range from 300 to 850 and are tied to Social Security numbers, business credit scores typically span 0 to 100 and link to Employer Identification Numbers (EINs). This distinction creates opportunities for entrepreneurs to access substantially higher credit limits—potentially $100,000 or more—compared to the $25,000 typical of personal credit cards.

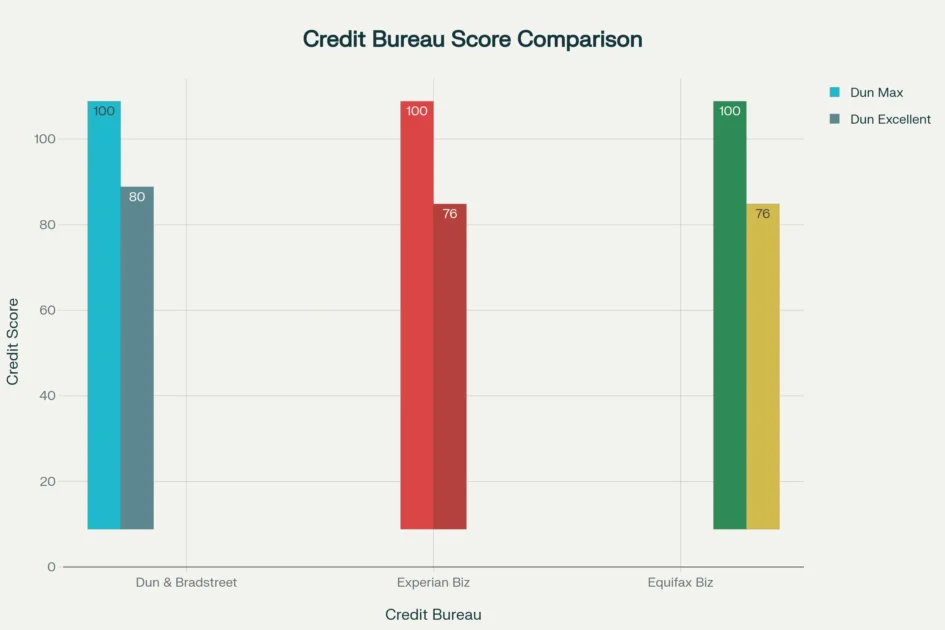

The three primary business credit bureaus each employ unique algorithms and data sources. Dun & Bradstreet, founded in 1841, assigns every business a unique D-U-N-S Number and generates the widely recognized PAYDEX score, which emphasizes payment timing. A PAYDEX score of 80 or higher indicates prompt or early payment, while scores below 50 signal serious delinquency issues.

Experian Business utilizes its Intelliscore Plus model, evaluating over 800 data points including payment history, public records, credit utilization, and demographic information. Scores above 76 on Experian’s 0-100 scale typically indicate low risk to lenders. Equifax Business provides Payment Index scores and Business Credit Risk Scores, frequently consulted by banks and large financial institutions for credit decisions.

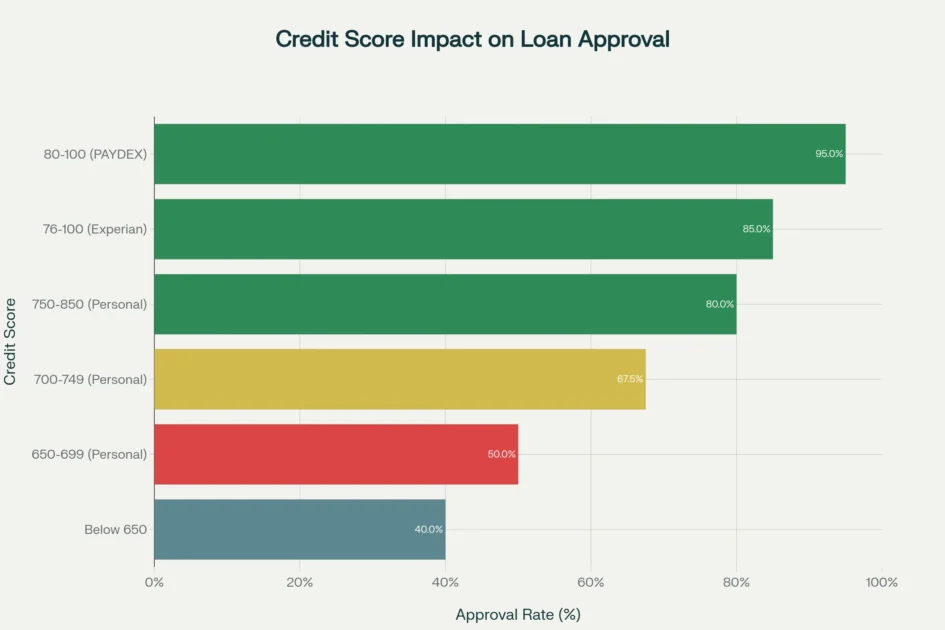

Impact of business credit scores on loan approval rates across different credit score ranges

Understanding these scoring variations proves essential for implementing effective business credit building tips. Payment history constitutes the dominant factor across all three bureaus, accounting for the largest portion of score calculations. Credit utilization—the percentage of available credit currently used—ranks as the second most influential element, with experts recommending maintaining ratios below 30% and ideally under 10% for optimal scores. Additional factors include length of credit history, types of credit used, public records such as liens or bankruptcies, and industry risk considerations.

Business credit building tips provide tangible advantages beyond personal credit capabilities. First, it protects personal assets by creating legal separation between business debts and personal finances. Second, it enables access to significantly higher credit limits based on company performance rather than personal wealth. Third, it improves vendor relationships, as suppliers often check business credit before extending net-30 or net-60 payment terms.

Fourth, it increases company valuation for potential buyers, who conduct thorough due diligence examining standalone financial histories. Fifth, strong business credit facilitates faster loan approvals with more favorable interest rates, potentially saving tens of thousands of dollars on larger financing.

Tip 1: Establish Proper Legal Business Structure

Creating appropriate legal separation between personal and business finances stands as the foundational step in implementing effective business credit building tips. Forming a limited liability company (LLC) or corporation establishes your business as a distinct legal entity, enabling it to develop an independent credit profile separate from personal credit history.

This structural separation proves critical because credit bureaus track business credit through EINs rather than Social Security numbers, preventing business activities from directly impacting personal credit scores. Entrepreneurs who skip this foundational step often regret it later when personal assets become entangled in business liabilities and lenders refuse to extend business credit without personal guarantees.

Selecting the right business structure requires careful consideration of liability protection, tax implications, and growth objectives—all factors that influence long-term business credit building tips implementation. LLCs offer flexibility with pass-through taxation and simplified administrative requirements, making them popular among small businesses and startups seeking to separate personal and business finances quickly.

S-corporations provide similar liability protection while enabling potential tax savings for profitable companies, though they require more formal governance structures and quarterly compliance filings. Sole proprietorships and general partnerships offer simplicity but critically fail to create legal separation, potentially exposing personal assets to business liabilities and significantly complicating business credit building tips efforts from inception.

The registration process varies by jurisdiction but generally requires filing articles of incorporation or organization with the state’s Secretary of State office—a process that typically takes 5-15 business days depending on state efficiency. Delaware attracts many businesses due to favorable corporate laws and robust court systems protecting business interests, though most small companies register in their primary operational state for simplicity and reduced costs.

Required documentation typically includes business name verification (ensuring no conflicts with existing entities), registered agent designation, operating agreement or bylaws, and payment of filing fees ranging from $50 to $500 depending on the state. Consulting with attorneys and certified public accountants helps ensure compliance with all regulatory requirements while optimizing tax treatment and establishing strong foundations for business credit building tips success.

Proper legal structure implementation creates multiple immediate and long-term benefits for business credit building tips. It enables opening business bank accounts exclusively for company transactions, establishing clear financial separation that credit bureaus recognize and reward with better score calculations. It allows applying for credit products solely in the business name, building standalone credit history that grows independently from personal finances.

It provides essential liability protection, shielding personal assets from business debts and legal judgments that could otherwise devastate personal wealth. Additionally, it enhances professional credibility with lenders, vendors, and potential partners who view properly incorporated entities as more established, trustworthy, and serious about long-term business operations—factors that materially improve credit approval rates.

Real-World Case Study: Sarah, a marketing consultant in Texas, operated as a sole proprietor for 18 months using personal credit for business expenses. When she attempted to secure a $50,000 business line of credit, lenders rejected her application because she had no business credit history and substantial personal debt. After forming an LLC and implementing strategic business credit building tips, she rebuilt her financing profile within 12 months and successfully obtained a $75,000 line of credit at 9.5% interest rates—compared to the 18% she would have faced on personal unsecured loans.

This transformation occurred simply by establishing proper legal structure and maintaining disciplined financial separation between personal and business finances, demonstrating the powerful impact of foundational business credit building tips that many entrepreneurs underestimate initially

Tip 2: Obtain an Employer Identification Number (EIN)

Acquiring an Employer Identification Number from the Internal Revenue Service represents one of the most essential business credit building tips that establishes your company’s unique federal tax identifier in government systems. The EIN functions similarly to a Social Security number for businesses, enabling credit bureaus to track credit activity associated specifically with your company rather than personal finances tied to your SSN. This nine-digit number appears on all credit applications, vendor agreements, financial documents, and bank account registrations, serving as the primary identifier that business credit bureaus and lenders use for credit reporting and decision-making. Entrepreneurs should obtain an EIN even before forming their business entity, as the number becomes foundational to all subsequent business credit building tips implementation efforts.

Obtaining an EIN costs absolutely nothing and can be completed quickly through the IRS website, typically providing immediate confirmation and verification for online applications submitted during business hours. The application process requires only basic business information including legal business name, physical address, business structure type, ownership details, number of employees, and the reason for requesting the number—information that takes less than five minutes to compile.

Most business types qualify for an EIN automatically, including LLCs, corporations, partnerships, S-corporations, sole proprietorships with employees, nonprofit organizations, and companies required to file certain tax returns or employment documents. The entire online application process generally completes in 15 minutes or less, with confirmation received immediately upon submission through the IRS systems—making business credit building tips implementation exceptionally fast and accessible.

The EIN serves multiple critical functions that extend far beyond basic tax reporting requirements and directly support business credit building tips effectiveness. It enables opening business bank accounts that specifically require federal tax identification for account setup and regulatory compliance purposes. It allows applying for business credit cards and loans without using personal Social Security numbers, a critical requirement for building independent business credit that won’t impact personal credit scores.

It facilitates establishing vendor accounts and trade credit relationships that report exclusively to business credit bureaus, creating crucial tradelines that establish credit history from scratch. Additionally, it demonstrates legitimacy to potential partners, clients, and government agencies that often require EIN verification before conducting business transactions or extending credit terms.

Strategic EIN utilization directly accelerates business credit building tips implementation and maximizes benefits from every credit decision. Always use the EIN rather than personal SSN on all credit applications to ensure activities reported to business rather than personal credit files maintained by consumer credit bureaus. Include the EIN on all business documentation, vendor applications, financial statements, and communications to establish consistent identity across all three business credit bureaus (Dun & Bradstreet, Experian, and Equifax).

Register the EIN with each business credit bureau to create your initial credit file and begin accumulating tradelines that establish creditworthiness—a step many entrepreneurs overlook but that significantly accelerates credit building timelines. Maintain accurate records linking the EIN to your business name, address, phone number, and contact information, as inconsistencies can delay credit reporting or create duplicate files that complicate score calculations.

90-Day Implementation Timeline for Business Credit Building Tips Success:

Upon receiving your EIN, immediately register it with Dun & Bradstreet to claim your D-U-N-S Number profile and begin establishing PAYDEX scores. Within 30 days, register with Experian Business and Equifax Business to ensure comprehensive credit tracking across all three major bureaus. Begin opening vendor and credit card accounts within 60 days, specifically requesting that suppliers report payment activity to all three bureaus where possible.

This sequential approach creates multiple reporting channels that accelerate credit history accumulation and score improvements within the first 90 days—compared to 180-360 days when businesses haphazardly apply for credit without systematic strategy of business credit building tips. Documentation showing consistent EIN usage from inception demonstrates credibility that lenders evaluate positively during credit decisions.

Tip 3: Open Dedicated Business Bank Accounts

Establishing separate business bank accounts constitutes one the leading business credit building tips that creates clear financial boundaries between personal and company transactions. Opening a business checking account in your company’s legal name using its EIN demonstrates professionalism to credit bureaus and lenders while providing the transaction history necessary for credit evaluation.

Financial institutions require business accounts for credit applications, as they assess deposit patterns, cash flow consistency, and account management responsibility when determining creditworthiness—factors that directly influence lending decisions and available credit terms.

Selecting the appropriate banking relationship involves evaluating multiple factors that significantly impact long-term business credit building tips effectiveness. Small banks and credit unions often provide personalized service and demonstrate dramatically higher approval rates—54% of small bank applicants received full financing approval compared to 38% at larger institutions according to the 2024 Small Business Credit Survey.

Community banks typically maintain stronger relationships with local business owners, potentially facilitating easier credit access as relationships develop over time and payment history accumulates. However, larger banks may offer more sophisticated online tools, broader branch networks, and specialized business credit products that support business credit building tips objectives for rapidly scaling companies.

The business account opening process requires specific documentation that varies by financial institution. Banks typically request the business formation documents (articles of incorporation or organization), EIN confirmation letter from the IRS, business license or operating permits, identification for all authorized signers, and initial deposit amounts that vary significantly by institution—ranging from $0 to $2,500 minimums.

Some banks also require personal guarantees from business owners, particularly for newer companies without established financial histories, which is important to negotiate upfront. Comparing account fees ($0-$50 monthly), minimum balance requirements ($0-$5,000), transaction limits, foreign exchange capabilities, and credit product availability helps identify the most suitable banking partner for long-term business credit building tips implementation.

Maintaining disciplined account management practices strengthens credit profiles and accelerates business credit building tips results. Conduct absolutely all business transactions exclusively through business accounts to establish the clear financial separation that credit bureaus and lenders actively recognize and reward. Avoid overdrafts completely and maintain consistently positive balances, as banking relationships and account standing directly influence some lenders’ credit decisions and willingness to extend credit.

Keep meticulous detailed records of deposits, withdrawals, and transactions to demonstrate consistent cash flow patterns and professional financial management—documentation that lenders request during credit evaluation. Consider strategically establishing relationships with multiple banks to diversify banking services, access different credit products as the business grows, and maintain backup account access if primary account limitations emerge.

Practical Banking Strategy Example:

Michael, a software developer in California, initially mixed personal and business transactions across accounts for 14 months before implementing systematic business credit building tips. After opening a dedicated business account and documenting three months of clean transaction history, he applied for a $30,000 business line of credit and received approval within 10 days versus 30+ days competitors reported.

His bank specifically commented during approval that the disciplined account management demonstrated financial responsibility and justified lower interest rates (8.2% versus typical 12-15%). This real-world outcome illustrates how dedicated business accounts directly translate business credit building tips efforts into measurable financing advantages and significantly accelerates credit establishment timelines.

Tip 4: Register for a D-U-N-S Number

Obtaining a Data Universal Numbering System identifier from Dun & Bradstreet ranks among the most important business credit building tips for establishing credibility with major corporations and government entities. The D-U-N-S Number serves as a unique nine-digit identifier that Dun & Bradstreet assigns to track business credit information across its global database of over 500 million business records used by lenders, suppliers, and creditors worldwide.

Many large companies, government agencies requiring procurement compliance, and international trading partners require D-U-N-S numbers before extending credit terms or conducting business relationships—a requirement that directly impacts business credit building tips success and financing access.

The D-U-N-S Number application process typically costs absolutely nothing for standard processing, though expedited services range from $229 to $349 in the United States for faster turnaround that accelerates business credit building tips implementation. Standard applications generally process within 30 business days, while expedited options deliver numbers within 5-10 business days depending on service level selected—a worthwhile investment for businesses requiring immediate financing or vendor relationships.

The application requires only basic business information including legal name, physical address, business structure, ownership details, number of employees, and business operations description. Applicants can submit requests quickly online through Dun & Bradstreet’s official website or by contacting their customer service directly with minimal documentation requirements.

Once assigned, the D-U-N-S Number becomes permanently associated with the specific business entity and location, creating a stable foundation for long-term business credit building tips tracking. Dun & Bradstreet uses this identifier to compile comprehensive credit reports containing trade payment history, public records, financial statements, business demographics, and the widely recognized PAYDEX score that influences vendor relationships and credit decisions.

The PAYDEX score ranges from 1 to 100, with scores of 80 or higher indicating prompt or early payment—the threshold most vendors require for extending favorable credit terms and maximum credit limits. This scoring system differs fundamentally from other bureaus by focusing primarily on payment timing rather than overall credit utilization, making consistent early payments particularly valuable for business credit building tips strategies that emphasize vendor relationship strength.

Strategic PAYDEX score optimization requires understanding the specific payment timing scoring methodology that rewards early payment behavior. Payments received 30+ days early generate scores of 100 (exceptional), payments received 16-30 days early generate scores of 95 (excellent), payments received 1-15 days early generate scores of 90 (very good), and payments received exactly on time generate scores of 80 (good). Payments 1-30 days late produce scores of 70, while 31-60 days late produce scores of 50, and 61+ days late produce scores below 50—critical threshold warnings that severely damage business credit building tips progress.

Understanding this granular PAYDEX scoring structure enables business credit building tips strategies that specifically optimize payment timing rather than merely targeting on-time payments, unlocking substantially higher scores for companies willing to pay vendors early when cash flow permits.

Comprehensive D-U-N-S Number Implementation for Business Credit Building Tips Success:

Register the D-U-N-S Number immediately after receiving it to begin building credit history as early as possible, typically within days if pursuing expedited approval. Ensure all vendor and supplier accounts specifically report payment activity to Dun & Bradstreet by explicitly requesting this when establishing trade credit relationships—many suppliers will report if asked despite not doing so automatically.

Monitor your Dun & Bradstreet business credit report quarterly to verify accurate reporting, catch errors immediately, and track PAYDEX score improvements resulting from business credit building tips implementation efforts. Update business information promptly whenever changes occur in location, ownership, contact information, or operations to maintain accurate records across credit bureaus. Most importantly, implement a systematic payment strategy prioritizing early payments to key vendors that report PAYDEX scores, as even 15-day early payments can increase scores from 80 to 90-95 range—transforming lender perceptions and vendor willingness to extend higher credit limits that accelerate growth

Tip 5: Establish Vendor Trade Credit Accounts

Developing relationships with vendors that report to business credit bureaus represents one of the most effective business credit building tips for companies without extensive credit histories or existing relationships. Vendor trade credit—also called net-30, net-60, or net-90 accounts—allows businesses to receive goods or services and pay within specified timeframes rather than immediately at purchase.

These arrangements create tradelines that appear on business credit reports, establishing genuine payment history without requiring significant upfront capital, personal guarantees, or existing credit scores—a crucial advantage for startups implementing business credit building tips strategies.

Selecting appropriate vendors requires thorough research into their credit reporting practices and payment term flexibility. Not all suppliers report payment history to business credit bureaus, significantly limiting their value for business credit building tips implementation and credit score development. Companies should specifically inquire whether vendors report to Dun & Bradstreet, Experian Business, and Equifax Business before establishing accounts, as reporting activity directly determines whether the vendor relationship strengthens business credit.

Starter vendors known for reporting to credit bureaus and offering easier approval with favorable net-30 terms include major office supply companies (Staples, Office Depot, Amazon Business), telecommunications providers (Verizon Business, AT&T), utility companies (water, electricity, internet providers), and specialized services in business credit building tips. Some vendors charge annual membership fees ($50-$200) but provide guaranteed credit reporting and established tradelines, potentially justifying the investment for aggressive business credit building tips execution.

The application process for vendor accounts typically requires comprehensive business identification information including legal name, EIN, business address, phone number, banking details, and business type classification. Some vendors conduct preliminary credit checks using existing credit bureau information, while others offer guaranteed approval for businesses meeting basic criteria (registered business entity, positive bank history, active business phone).

Initial credit limits typically start modestly—$500 to $2,500—but increase substantially as payment history demonstrates reliability and business creditworthiness improves. Companies should systematically start with three to five vendor accounts reporting to different credit bureaus to establish diverse tradelines quickly, with each bureau providing independent validation of payment performance for business credit building tips verification.

Payment management strategies maximize vendor account benefits and accelerate business credit building tips results significantly. Pay invoices consistently early whenever possible—ideally 15-30 days before due dates—as Dun & Bradstreet’s PAYDEX score awards substantially higher points for payments received before stated due dates. Set up fully automated payments or strict calendar reminders to ensure absolutely no late payments occur, as even single-day delays can negatively impact business credit reports and derail business credit building tips progress.

Request formal credit limit increases after six to twelve months of absolutely perfect payment history to improve credit utilization ratios and signal strength to other potential creditors. Document meticulously all vendor relationships, payment confirmations, and credit bureau reports to verify accurate reporting and identify any discrepancies requiring immediate correction.

Comparison of the three major business credit bureaus and their scoring systems

Real-World Vendor Trade Credit Case Study:

Jennifer, an e-commerce entrepreneur in Florida, started her business in January 2024 with no existing business credit. By March, she had established accounts with five reporting vendors (Staples, AWS, Twilio, Square, and a local supplier), each offering net-30 terms. Making early payments every month (15 days before due dates), her PAYDEX score reached 95 by September 2024—just nine months of consistent activity.

This strong PAYDEX foundation enabled her to secure a $40,000 business line of credit at 7.8% interest rates despite having no prior business credit history, demonstrating how implementing systematic business credit building tips through vendor relationships can generate immediate, measurable financing advantages and accelerate business growth trajectories dramatically.

Tip 6: Apply for Business Credit Cards Strategically

Securing business credit cards designed specifically for commercial use ranks among the most impactful and accessible business credit building tips when executed with careful strategic planning. Business credit cards provide revolving credit that demonstrates ongoing credit management capability while offering practical operational benefits including expense tracking, employee cards, purchase protection, fraud monitoring, and rewards programs.

Unlike consumer credit cards, many business credit cards report exclusively to business credit bureaus, building company credit scores without affecting personal credit reports—though this varies by issuer and requires verification during application research for proper business credit building tips implementation.

Selecting appropriate business credit cards requires evaluating multiple critical factors that align with business stage and creditworthiness profile. Cards specifically marketed for startups or businesses with limited credit history often provide easier approval with 90%+ success rates but may include lower initial limits ($500-$2,000) and fewer rewards benefits that limit tangible value. Secured business credit cards requiring cash deposits ($500-$5,000) guarantee approval for companies without existing credit, converting automatically to unsecured cards after 12-24 months of responsible payment patterns, making them ideal for business credit building tips implementation.

Cards from banks where existing business relationships exist typically offer higher approval rates (70-85%) and superior terms compared to applications to unfamiliar institutions. Comparing annual fees ($0-$150), interest rates (9-25% depending on creditworthiness), rewards structures (1-3% cash back or points), and explicit credit reporting practices ensures optimal alignment with business credit building tips objectives and operational needs.

The application process for business credit cards typically requires comprehensive business identification documents (EIN letter, business license), recent financial statements (business tax returns or profit/loss statements), personal revenue information, and often personal guarantees from primary owners. Many card issuers conduct both detailed business credit checks and personal credit evaluations, particularly for newer companies without established independent business credit histories.

Initial credit limits typically range conservatively from $500 to $10,000 for startups with no credit history, while established businesses with strong documented credit profiles can access limits exceeding $25,000 to $100,000 or more. Application decisions vary significantly—some premium programs deliver instant approval decisions (within minutes), while others require additional documentation review and manual underwriting (5-10 business days), making timing considerations important for business credit building tips sequencing.

Optimal usage practices amplify business credit building tips effectiveness and accelerate score improvements dramatically. Maintain strictly regulated credit utilization below 30% of available limits, with ratios under 10% generating the most favorable credit score impacts and demonstrating exceptional financial management to bureaus and future creditors. Pay statement balances in full each month to eliminate interest charges while simultaneously demonstrating strong cash flow management and financial discipline that lenders reward.

Use cards regularly for business expenses to establish consistent monthly activity patterns, as credit bureaus actively favor accounts with demonstrated transaction history over dormant accounts that generate no activity. Request formal credit limit increases every six to twelve months as business performance improves and payment history strengthens, as higher aggregate credit limits immediately reduce utilization ratios and signal creditworthiness to all three business credit bureaus simultaneously.

Strategic Business Credit Card Implementation Example:

Robert, an IT consultant in Texas, applied for three different business credit cards in December 2023 spread across consecutive weeks, each from banks with whom he had no prior relationship. His first application (secured card) received instant approval with $1,000 credit limit, his second application (startup card) approved within three days with $3,000 limit, and his third application (premium rewards card) required manual review but approved within seven days with $5,000 limit.

Over nine months, making small monthly charges ($500-$1,000 per card) and paying in full every month, his aggregate credit utilization stayed under 15% while his business credit score improved from zero to 72—enabling him to secure $50,000 in financing at 9.5% rates. This demonstrates how strategic business credit building tips, application timing, diversified card portfolio management, and disciplined usage practices transform startups into creditworthy businesses within less than one year, substantially accelerating access to larger financing opportunities.

Tip 7: Maintain Optimal Credit Utilization Ratios

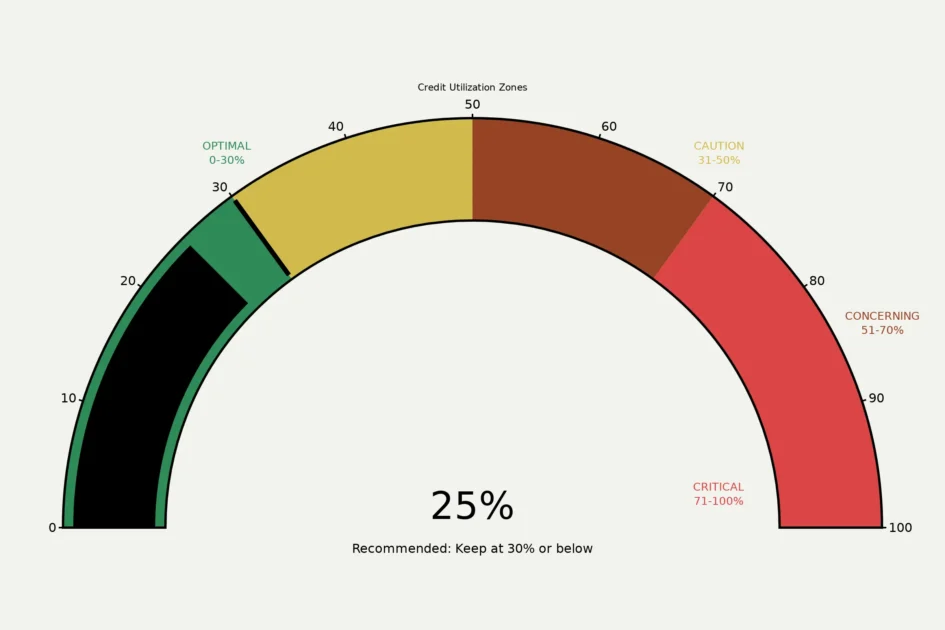

Managing credit utilization strategically constitutes one of the critical business credit building tips that significantly influences creditworthiness across all three major business credit bureaus. Credit utilization ratio—calculated by dividing total outstanding balances by total available credit—represents the second most influential factor in business credit scores after payment history. Lenders and vendors view utilization as a key indicator of financial health, with lower ratios suggesting responsible credit management and higher ratios potentially signaling financial stress.

Industry experts consistently recommend maintaining credit utilization below 30% of available limits, with ratios under 10% generating optimal credit score benefits. Research indicates that businesses with utilization rates exceeding 30% face increased difficulty securing favorable financing terms and may experience credit score decreases ranging from moderate to significant depending on overall financial profiles. Conversely, companies maintaining single-digit utilization ratios demonstrate exceptional credit management that appeals to lenders offering the lowest interest rates and highest credit limits.

Credit utilization ratio zones showing optimal, acceptable, and critical ranges for business credit health

Calculating utilization requires aggregating all outstanding revolving credit balances across business credit cards, lines of credit, and similar accounts, then dividing by total available credit limits. For example, a business with $15,000 in outstanding balances and $50,000 in total credit limits maintains a 30% utilization ratio. This calculation applies to overall utilization across all accounts and to individual account utilization, with both metrics influencing credit scores. Credit bureaus typically update utilization data monthly based on statement closing dates, meaning strategic payment timing can optimize reported ratios.

Implementing utilization management strategies enhances business credit building tips outcomes. Pay down outstanding balances before statement closing dates to reduce reported utilization even if carrying balances month-to-month. Request credit limit increases from existing creditors to expand available credit without increasing balances, immediately improving utilization ratios. Distribute charges across multiple cards rather than concentrating usage on single accounts to maintain low per-card utilization. Monitor utilization weekly using credit card dashboards or accounting software to prevent approaching concerning thresholds. Consider making multiple payments throughout the month rather than single monthly payments to keep running balances lower.

Tip 8: Monitor and Manage Business Credit Reports

Regular credit report monitoring represents one of the essential business credit building tips that enables identifying errors, tracking progress, and addressing issues before they impact financing opportunities. Business credit reports contain comprehensive information including payment histories, credit inquiries, public records, business demographics, and credit scores from each bureau. Unlike personal credit reports which consumers can access free annually, business credit reports typically require purchasing from credit bureaus, though some services offer limited free access.

Each major business credit bureau provides distinct reporting services and access mechanisms. Dun & Bradstreet offers various report levels ranging from basic summaries to comprehensive analyses including PAYDEX scores, credit ratings, and financial stress indicators. Experian Business provides credit reports featuring Intelliscore Plus scores, payment histories, and industry comparisons through their online platform. Equifax Business delivers reports containing Payment Index scores, Business Credit Risk Scores, and detailed trade payment information. Accessing reports from all three bureaus ensures comprehensive understanding of how different lenders may evaluate creditworthiness.

Common credit report errors can significantly damage credit scores if left unaddressed. Frequent issues include incorrect payment histories showing late payments that occurred on time, duplicate accounts appearing multiple times, accounts belonging to other businesses with similar names, outdated business information including old addresses or ownership, and public records that have been resolved but remain listed. Research suggests that addressing credit report errors can provide quick credit score improvements, particularly when negative information appears incorrectly.

Implementing systematic monitoring practices strengthens business credit building tips effectiveness. Review credit reports from all three bureaus quarterly to identify discrepancies early and track score progression. Document all business credit activities including vendor payments, credit card transactions, and loan payments to verify accurate reporting.

Dispute errors immediately using bureau-specific processes, providing supporting documentation such as payment confirmations and account statements. Set up credit monitoring alerts when available to receive notifications of significant changes, new inquiries, or potential fraud. Maintain detailed files of all credit-related correspondence and dispute resolutions for future reference.

Tip 9: Prioritize Consistent On-Time Payments

Establishing flawless payment history stands as part of the most critical business credit building tips, as payment patterns constitute the primary factor influencing business credit scores across all major bureaus. Dun & Bradstreet’s PAYDEX score derives entirely from payment timing, with early payments generating scores of 80-100, on-time payments producing scores of 50-79, and late payments resulting in scores below 50. Experian and Equifax similarly weight payment history heavily, analyzing patterns across all credit accounts, vendor relationships, and loan obligations.

The impact of payment timing extends beyond simple on-time versus late distinctions. Dun & Bradstreet specifically rewards payments received before due dates, assigning higher PAYDEX scores to consistently early payments. For example, payments received 30 days early can generate PAYDEX scores approaching 100, while payments made exactly on due dates typically produce scores around 80. This unique scoring approach creates opportunities for strategic business credit building tips implementation by systematically paying invoices early whenever cash flow permits.

Late payments produce severe and lasting negative impacts on business credit profiles. Credit bureaus may report payments as late when received even one day after due dates, immediately damaging credit scores. Late payment notations typically remain on business credit reports for three years, continuing to depress scores throughout that period. The severity of late payment impact increases with payment delay duration, with payments 30, 60, and 90+ days late producing progressively worse score effects. Additionally, patterns of late payments can result in account closures, reduced credit limits, and difficulty accessing new financing.

Implementing payment management systems ensures consistent on-time performance. Automate payments for recurring obligations including utilities, subscriptions, and minimum credit card payments to eliminate missed deadlines. Establish calendar reminders seven days before payment due dates to allow processing time and prevent last-minute issues. Negotiate extended payment terms with vendors when cash flow constraints emerge rather than risking late payments. Maintain cash reserves sufficient to cover at least three months of credit obligations as a buffer against revenue fluctuations. Prioritize credit payments over discretionary expenses during tight financial periods to protect credit scores.

Strategic timeline for business credit building tips from zero to excellent scores over 12+ months

Tip 10: Separate Personal and Business Finances Completely

Maintaining absolute separation between personal and business finances represents part of the most foundational business credit building tips that protects personal assets while maximizing business credit development. Mixing personal and business transactions creates numerous problems including unclear financial records, tax complications, liability exposure, and prevention of independent business credit establishment. The 2024 Small Business Credit Survey found that businesses maintaining distinct credit profiles accessed higher credit limits and more favorable terms compared to companies relying primarily on personal credit.

Legal and financial separation requires systematic implementation across all business activities. Conduct all business transactions exclusively through business bank accounts linked to the company’s EIN rather than personal accounts tied to Social Security numbers. Apply for all business credit using the company name and EIN rather than personal identification, ensuring activities report to business rather than personal credit files. Avoid personal guarantees when possible, though many lenders require them for newer businesses without established credit histories. Pay business expenses from business accounts and personal expenses from personal accounts without exception, maintaining clear boundaries credit bureaus recognize.

The benefits of financial separation extend far beyond credit building alone, creating multiple strategic advantages that compound over time. It creates essential liability protection, shielding personal assets including homes, savings, and investments from business debts and legal judgments that could otherwise devastate personal wealth. It enables building substantially higher business credit limits—potentially $100,000 or more—compared to typical personal credit card limits of $25,000, demonstrating a core principle of effective business credit building tips.

It simplifies accounting and tax preparation by creating clear transaction categories and eliminating the frustrating need to separate mixed expenses during year-end reconciliation. It enhances company valuation substantially for potential buyers who require standalone financial histories demonstrating independent profitability and sustainable operations. It prevents business financial challenges from damaging personal credit scores that affect personal lending terms, insurance rates, employment opportunities, and long-term financial stability for business owners.

Entrepreneurs face particularly acute challenges maintaining this critical separation during startup phases when business revenue may not initially cover all operational expenses and cash flow constraints test financial discipline. Resist the temptation to use personal credit cards for business purchases even when business credit limits seem insufficient or temporary, as this mixing strategy undermines all business credit building tips progress systematically.

If personal funds must be injected into the business, structure them meticulously as formal loans or capital contributions with proper documentation and promissory notes rather than treating them as mixed transactions that confuse business records. Keep absolutely meticulous records distinguishing business and personal expenses, particularly for items that might serve dual purposes like vehicles, home office equipment, or technology tools used across both domains. Establish business credit early and aggressively in the company lifecycle—ideally within the first 90 days of business formation—to reduce reliance on personal credit as growth accelerates and financing needs expand beyond what business credit building tips alone can sustain.

Advanced Strategies for Accelerated Credit Growth

Beyond fundamental business credit building tips, sophisticated strategies can accelerate credit development and maximize financial opportunities. Diversifying credit types demonstrates comprehensive credit management capability to bureaus that evaluate credit mix as a scoring factor. Combining vendor trade accounts, business credit cards, equipment financing, and business lines of credit creates varied tradelines that collectively strengthen credit profiles. Each credit type contributes unique data points about different aspects of financial management, from short-term cash flow handling to long-term debt servicing capability.

Strategic credit limit management provides multiple benefits for business credit building tips implementation. Requesting credit limit increases every six to twelve months expands available credit, immediately improving utilization ratios without requiring additional spending. Some creditors grant increases automatically based on payment history and account usage patterns, while others require formal requests accompanied by updated financial information. Higher aggregate credit limits signal stronger creditworthiness to lenders evaluating total available credit as a stability indicator. However, requesting too many increases simultaneously can generate multiple credit inquiries that temporarily decrease scores.

Building relationships with credit-reporting vendors accelerates tradeline accumulation. Prioritize suppliers and service providers who consistently report payment data to all three major business credit bureaus. Specifically request credit reporting when establishing new vendor accounts, as many suppliers will report if asked despite not doing so automatically. Consider services specializing in credit building that report multiple tradeline types to bureaus, potentially accelerating credit profile development. Maintain vendor relationships even after credit establishment, as longer credit history lengths contribute positively to overall scores.

Professional business profile establishment enhances creditworthiness beyond numerical scores. Create and optimize Google Business Profile listings with accurate business information including name, address, and phone number. Maintain a professional website with current contact information and business descriptions that lenders may review. Establish consistent business information across online directories, social media platforms, and business listings. Ensure business phone numbers appear in directory assistance databases rather than personal mobile numbers. These elements create comprehensive digital footprints that supplement credit reports when lenders conduct due diligence.

Common Mistakes That Undermine Business Credit

Understanding frequent errors helps businesses avoid setbacks in implementing business credit building tips effectively. Missing or late payments ranks as the most damaging mistake, severely decreasing credit scores and requiring 12-24 months for recovery. Even single late payments can drop scores significantly, while patterns of delinquency may result in account closures and denial of future credit applications. Automated payment systems and calendar management tools provide essential safeguards against this critical error.

Maintaining excessive credit utilization above 30% signals financial stress to lenders and credit bureaus, moderately decreasing scores and limiting access to favorable terms. Utilization above 50% creates particularly concerning profiles that may result in credit limit reductions or application denials. Recovery requires three to six months of reduced balances and disciplined spending management. Businesses should monitor utilization weekly and adjust spending patterns before approaching concerning thresholds.

Applying for too many credit accounts simultaneously generates multiple hard inquiries that collectively decrease credit scores and suggest desperation to lenders. Each credit application typically produces inquiry notations that remain on credit reports for two years, though their score impact diminishes over time. Strategic credit applications spaced at least three to six months apart minimize cumulative inquiry effects. Businesses should research credit products thoroughly before applying and pursue only those matching their credit profile and needs.

Closing old credit accounts reduces total available credit, increases utilization ratios, and shortens average credit history length—all negatively impacting credit scores. This mistake particularly affects businesses that opened starter vendor accounts with modest limits and later obtained higher-limit cards. Recovery requires six to twelve months as remaining accounts age and new credit history develops. Businesses should maintain older accounts with small periodic charges to preserve credit history benefits even when no longer actively used.

Neglecting credit report monitoring allows errors to persist undetected, potentially causing application denials or unfavorable terms when businesses seek critical financing. Common undetected issues include incorrect late payment notations, accounts belonging to other businesses, outdated information, and resolved public records still appearing on reports. Immediate error correction prevents ongoing damage, while delayed action may extend negative impacts for years. Quarterly credit report reviews from all three bureaus provide essential oversight.

Measuring Success and Tracking Progress

Establishing metrics and milestones enables systematic evaluation of business credit building tips effectiveness. Credit score progression provides the most direct success indicator, with scores increasing from zero to 30-60 within three to six months of consistent credit activity, then advancing to 60-80 within six to twelve months, and potentially reaching excellent levels above 80 within twelve to eighteen months of exemplary management. Tracking scores monthly from all three bureaus reveals trends and identifies which strategies produce strongest results.

Credit limit growth demonstrates increasing lender confidence and expanded financing access. Initial credit limits typically start at $500 to $2,500 for vendor accounts and business credit cards, then increase to $5,000 to $15,000 within six months of perfect payment history. Established businesses with strong credit profiles can access limits exceeding $50,000 to $100,000 or more. Systematic credit limit increase requests every six months accelerate this progression.

Financing approval rates and terms reveal practical credit building outcomes beyond numerical scores. Businesses transitioning from 40-60% approval rates at application to 75-90% approval rates demonstrate substantial creditworthiness improvements. Interest rate reductions from initial rates of 15-25% to preferred rates of 8-12% or lower quantify cost savings and competitive positioning. Extended payment terms from net-30 to net-60 or net-90 reflect enhanced vendor confidence and improved cash flow management capability.

Additional success indicators include number of active tradelines reporting to credit bureaus, diversity of credit types in use, length of established credit history, and absence of negative items on credit reports. Companies successfully implementing business credit building tips typically maintain at least five to ten active tradelines across vendor accounts and credit cards, demonstrate credit mix including both revolving and installment credit, establish credit histories exceeding twelve months, and maintain reports free of late payments, collections, liens, or judgments.

Conclusion: Building Business Credit for Long-Term Success

Implementing comprehensive business credit building tips creates transformative opportunities for companies seeking growth capital, operational flexibility, and competitive advantages in increasingly dynamic markets. Research consistently demonstrates that businesses with excellent credit scores access substantially better financing terms—potentially saving tens of thousands of dollars through lower interest rates while securing credit limits exceeding $100,000 based on company performance rather than personal guarantees. These advantages compound over time as strong credit enables seizing expansion opportunities, negotiating favorable vendor terms, and weathering economic uncertainties with financial resilience.

The ten business credit building tips presented throughout this guide reflect proven strategies supported by data from millions of business credit profiles tracked by Dun & Bradstreet, Experian, and Equifax. Establishing proper legal structure, obtaining essential identifiers including EINs and D-U-N-S Numbers, opening dedicated business accounts, building vendor relationships, managing credit cards strategically, maintaining optimal utilization ratios, monitoring credit reports, prioritizing on-time payments, separating personal and business finances, and implementing advanced growth strategies collectively create robust credit profiles that lenders reward with exceptional terms.

Success requires patience, discipline, and systematic execution over sustained periods. While some businesses establish respectable credit within six months, achieving excellent scores typically demands twelve to eighteen months of consistent on-time payments, low credit utilization, and diversified credit relationships. The Federal Reserve’s 2024 Small Business Credit Survey revealed that businesses maintaining these practices achieved higher financing approval rates, accessed larger credit amounts, and reported greater satisfaction with lender relationships compared to companies with weaker credit management. These outcomes justify the effort required for implementing business credit building tips systematically.

Avoiding common mistakes proves equally important as executing positive strategies. Missing payments, maintaining excessive credit utilization, mixing personal and business finances, applying for too much credit simultaneously, and neglecting credit report monitoring each undermine progress and extend timelines for achieving excellent credit. Businesses recognize these pitfalls and implement safeguards—automated payments, utilization monitoring, separate accounts, strategic applications, and quarterly report reviews—protect their credit-building investments while accelerating positive outcomes.

The competitive landscape increasingly favors businesses with strong independent credit profiles. According to the 2024 Small Business Credit Survey, 79% of small businesses use business credit cards for operations, while 53% relied on credit as an external funding source when facing financial challenges. Companies without established business credit face significant disadvantages including higher borrowing costs, limited credit access, personal liability exposure, and reduced operational flexibility. Conversely, those implementing business credit building tips position themselves for sustainable growth, enhanced valuation, and long-term financial success regardless of economic conditions.

Take action today to begin building exceptional business credit. Start by establishing proper legal structure if not already incorporated, obtaining your EIN and D-U-N-S Number, opening dedicated business bank accounts, and identifying three to five credit-reporting vendors for initial tradelines. Commit to 100% on-time payments, maintain credit utilization below 30%, monitor credit reports quarterly, and keep personal and business finances completely separate. These fundamental business credit building tips, executed consistently over twelve to eighteen months, will transform your company’s financial capabilities and competitive positioning for decades to come.

Citations

- https://www.fedsmallbusiness.org/reports/survey/2025/2025-report-on-employer-firms

- https://www.nav.com/resource/business-credit-bureaus/

- https://tipalti.com/blog/vendors-that-report-business-credit/

- https://www.nationalbusinesscapital.com/blog/business-credit-vs-personal-credit/

- https://nchinc.com/blog/business-credit/separating-personal-and-business-credit-why-it-matters/

- https://blog.queuebuster.co/the-fastest-way-to-build-business-credit-a-step-by-step-guide-for-entrepreneurs/

- https://www.brex.com/spend-trends/corporate-credit-cards/business-credit-card-vs-personal-credit-card

- https://www.investopedia.com/terms/b/business-credit-score.asp

- https://ramp.com/blog/business-credit-bureaus

- https://www.score.org/resource/article/understanding-three-major-business-credit-bureaus

- https://www.revenued.com/articles/business-credit/credit-utilization-ratio-business/

- https://gaviti.com/glossary/credit-utilization-ratio/

- https://www.hdfcbank.com/personal/resources/learning-centre/borrow/factors-affecting-credit-score-for-business-loans

- https://www.uschamber.com/co/start/strategy/small-business-credit-score

- https://www.nav.com/resource/net-30-accounts/

- https://www.oxyzo.in/blogs/the-impact-of-credit-score-on-business-loan-approval/133203

- https://statrys.com/blog/how-to-build-business-credit

- https://www.hiscox.com/blog/business-credit-strategies

- https://www.shriramfinance.in/article-build-a-business-credit-score-from-scratch-for-a-new-business

- https://tipalti.com/resources/learn/business-credit/

- https://www.signzy.com/blogs/role-of-an-ein-in-business-credit-building-2025-guide

- https://www.bankatfirst.com/business/resources/flourish/build-business-credit.html

- https://www.sciencedirect.com/science/article/abs/pii/S1572308924000755

- https://www.redflagalert.com/knowledge-base/guides/top-5-business-credit-report-providers

- https://intertoons.com/what-is-dun-bradstreet-and-d-u-n-s-number-its-charges.html

- https://charteredhelp.com/duns-number-in-india/

- https://taxguru.in/corporate-law/obtaining-duns-registration-organizations.html

- https://www.onlinelabels.com/articles/how-to-build-business-credit-using-net-30

- https://www.creditsuite.com/blog/7-vendor-accounts-that-build-your-business-credit/

- https://resolvepay.com/blog/the-top-10-net-30-vendors-to-build-your-business-credit-score

- https://www.bluevine.com/blog/credit-management-for-small-business

- https://www.chase.com/business/knowledge-center/manage/business-credit-affect-personal-credit

- https://ramp.com/blog/business-credit-card-statistics-and-metrics

- https://aspireapp.com/blog/mistakes-that-can-ruin-your-business-credit-score

- https://www.shriramfinance.in/article-how-to-improve-your-credit-score-before-applying-for-a-startup-loan

- https://www.highradius.com/resources/Blog/credit-utilization-ratio/

- https://www.experian.com/blogs/ask-experian/what-is-the-best-percentile-for-credit-utilization/

- https://pursuitlending.com/resources/credit-utilization-ratio/

- https://www.experian.com/small-business/business-credit-reports

- https://www.kenstonecapital.in/mistakes-that-can-ruin-your-business-credit-score/

- https://capitalise.com/gb/insights/business-credit-scores/common-mistakes-that-can-impact-your-business-credit-score

- https://www.britecap.com/business-credit-vs-personal-credit/

- https://www.enkash.com/resources/blog/credit-mistakes-to-avoid-as-a-growing-business

- https://asymmetric.pro/5-trends-in-small-business-financing/

- https://wise.com/us/blog/list-of-net-30-companies

- https://theunitybank.com/blog/business-loan/impact-of-credit-scores-on-unsecured-loan-approval-how-your-creditworthiness-shapes-loan-outcomes

- https://www.sba.gov/business-guide/plan-your-business/establish-business-credit

- https://www.highradius.com/resources/Blog/top-credit-scoring-companies/

- https://www.nav.com

- https://www.tatacapital.com/blog/loan-for-business/top-7-ways-to-build-business-credit/

- https://business.bankofamerica.com/en/resources/what-is-business-credit-and-how-do-i-build-it

- https://www.reddit.com/r/indianstartups/comments/1kbb983/help_duns_number_update_in_india_being_asked_to/

- https://www.dnb.co.in/duns/get-a-duns

- https://startupsavant.com/startup-finance/net-30-vendors

- https://www.crifhighmark.com/blog/good-credit-utilization-ratio

- https://www.dnb.com/en-us/smb/duns/get-a-duns.html

- https://www.investopedia.com/terms/c/credit-utilization-rate.asp

- https://www.experian.com/business/thought-leadership/case-studies

- https://gdslink.com/case-studies/

- https://vantagescore.com/why-vantagescore/success-stories

- https://www.fylehq.com/blog/expense-management-case-studies

- https://www.legalrecoveries.com/industry-specific-debt-recovery-success-stories-and-case-studies/

- https://ryan.com/practice-areas/credits–incentives/success-stories/

- https://www.biz2credit.com/business-loan/top-mistakes-to-avoid-small-business-financing

- https://squareup.com/us/en/the-bottom-line/starting-your-business/business-credit-vs-personal-credit

- https://brsvt.com/rd-tax-credits/case-studies/

- https://www.nav.com/blog/avoidinng-common-business-credit-mistakes-3736510/

- https://www.fedsmallbusiness.org/reports/survey

- https://www.shriramfinance.in/article-the-role-of-credit-scores-in-msme-loan-approvals

- https://www.philadelphiafed.org/community-development/credit-and-capital/small-business-credit-survey-2025-new-jersey-insights

- https://www.volopay.com/au/blog/how-do-credit-scores-affect-business-loan-approval/

- https://www.federalreserve.gov/publications/2025-march-consumer-community-context.htm

- https://home.treasury.gov/system/files/136/Financing-Small-Business-Landscape-and-Recommendations.pdf

- https://www.ecofy.co.in/blogs/how-improve-your-business-credit-score-better-sme-loan-rates

- https://www.clevelandfed.org/publications/small-business-credit-survey

- https://republicebank.com/credit-score-impact-on-small-business-financing-options/

- https://www.idfcfirstbank.com/finfirst-blogs/business-banking/credit-score-business-loan-approval

- https://finance.yahoo.com/news/small-business-statistics-2023-220151558.html

- https://www.getdefacto.com/article/small-business-lending-statistics