11 Best Forex Trading Platforms for Maximum Profit

The foreign exchange market stands as the world’s largest financial marketplace, processing over $7.5 trillion in daily trading volume as of 2025. For US traders seeking to capitalize on currency fluctuations and maximize profit potential, selecting the right forex trading platforms represents a critical decision that can dramatically impact trading outcomes. The forex trading landscape has transformed substantially over the past decade, with regulatory frameworks tightening to protect retail investors while technological advancements have made sophisticated trading tools accessible to everyone from beginners to seasoned professionals.

However, navigating this complex ecosystem requires understanding not just which platforms offer the tightest spreads or most currency pairs, but which ones align with your specific trading style, risk tolerance, and profit objectives.

Research consistently demonstrates that platform selection significantly influences trading success, with factors such as execution speed, regulatory compliance, fee structures, and available analytical tools playing pivotal roles in profitability. In the United States, forex trading operates under stringent oversight from the Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA), creating one of the safest regulatory environments globally while simultaneously limiting the number of brokers available to American traders.

This comprehensive analysis examines eleven exceptional forex trading platforms that have emerged as industry leaders in 2025, each offering unique advantages for traders pursuing maximum profit potential. Whether you’re implementing scalping strategies requiring ultra-tight spreads, seeking advanced charting capabilities for technical analysis, or looking for educational resources to accelerate your learning curve, this guide provides the detailed insights necessary to make an informed platform selection that aligns with your trading objectives and maximizes your profit opportunities in the dynamic forex market.

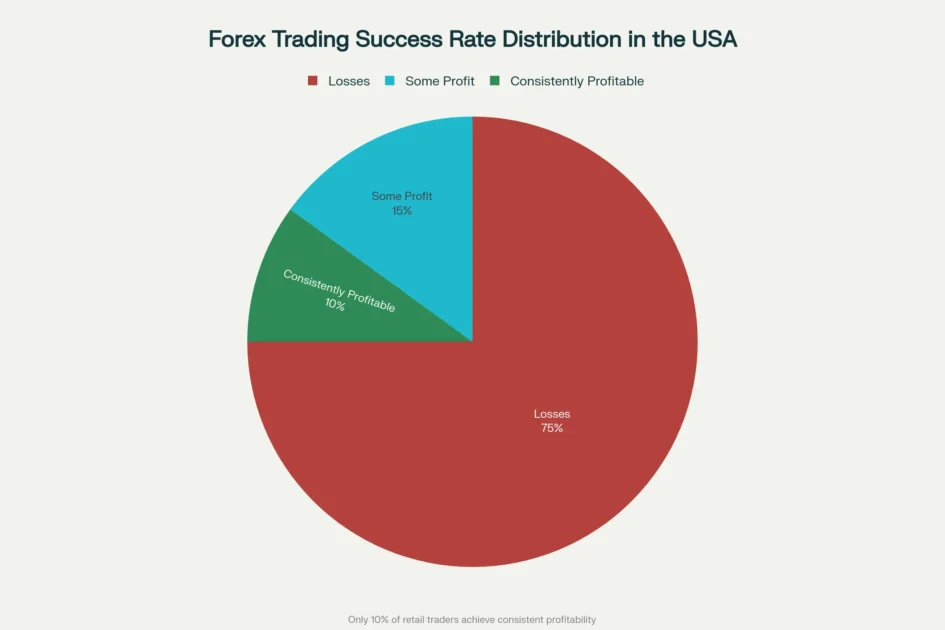

Distribution of forex trader profitability in the United States, illustrating that only a small percentage of retail traders achieve consistent long-term success

Understanding the US Forex Trading Platforms

The United States forex market operates under one of the world’s most rigorous regulatory frameworks, establishing a foundation of trader protection that distinguishes American forex trading platforms from international alternatives. The CFTC maintains jurisdiction over retail foreign exchange transactions, while the NFA serves as a self-regulatory organization responsible for registering and monitoring forex dealer members.

This dual-layer oversight system requires all legitimate forex trading platforms operating in the United States to register as either Retail Foreign Exchange Dealers (RFEDs) or Futures Commission Merchants (FCMs), maintaining a minimum capital requirement of $20 million plus additional volume-based reserves.

These stringent regulatory requirements have created a selective marketplace where only financially robust and compliant forex trading platforms can serve American clients, effectively filtering out less reputable operators. For traders, this regulatory environment provides substantial protections including segregated client funds, mandatory risk disclosure statements, comprehensive recordkeeping requirements, and mechanisms for dispute resolution through official channels.

The Securities Investor Protection Corporation (SIPC) provides additional insurance coverage of up to $500,000 for eligible accounts at certain platforms, offering an extra layer of financial security that distinguishes US-regulated forex trading platforms from offshore alternatives.

Leverage restrictions represent another defining characteristic of American forex trading platforms, with CFTC regulations limiting retail traders to maximum leverage of 50:1 on major currency pairs and 20:1 on minor pairs. While these constraints are more conservative than leverage levels available through offshore platforms, they serve to protect retail traders from excessive risk exposure that could lead to catastrophic account losses. Understanding these regulatory parameters helps traders appreciate why US-regulated forex trading platforms may offer different terms than international competitors, and why choosing CFTC/NFA-registered platforms provides superior legal protections and recourse mechanisms should disputes arise.

Top 11 Forex Trading Platforms Evaluated

1. Interactive Brokers: The Professional’s Choice

Interactive Brokers has established itself as the premier option among forex trading platforms for sophisticated traders and institutional investors seeking professional-grade capabilities. Founded in 1978 and publicly traded on NASDAQ under ticker symbol IBKR, this platform maintains one of the industry’s strongest financial positions with over $14.7 billion in equity capital. The regulatory oversight extends across nine global jurisdictions including the SEC, CFTC, FINRA, and FCA, positioning Interactive Brokers among the most thoroughly regulated forex-trading platforms available to American traders.

The platform’s trading technology delivers exceptional value through its Trader Workstation (TWS) and IBKR Mobile platforms, supporting true interbank forex access across more than 100 currency pairs—the broadest selection among US-regulated forex trading platforms. Interactive Brokers distinguishes itself with remarkably tight spreads averaging just 0.62 pips on EUR/USD, among the lowest in the industry, combined with commission-free pricing on forex transactions.

Maximum leverage reaches 50:1 on major pairs in compliance with CFTC regulations, while the platform requires no minimum deposit for standard individual or joint accounts, making it accessible despite its sophisticated capabilities.

Advanced traders particularly value Interactive Brokers’ comprehensive order types, algorithmic trading support through FIX API connections, and sophisticated risk management tools unavailable on most retail forex trading platforms. The platform provides direct market access to forex liquidity providers, ensuring transparent pricing and fast execution speeds.

Educational resources include webinars, trading tutorials, and extensive documentation supporting traders at all experience levels, though the platform’s complexity may present a steeper learning curve for beginners compared to more streamlined forex trading platforms.

2. tastyfx: Best Overall for Active Traders

tastyfx has rapidly ascended to prominence among forex-trading platforms, earning recognition as the #1 Overall Broker from ForexBrokers.com in 2025. Backed by IG Group, an established institution founded in 1974 with over 300,000 clients worldwide, tastyfx combines financial stability with innovative trading solutions specifically designed for active forex traders. The platform operates under full CFTC and NFA regulation, maintaining the capital reserves and compliance standards required for US retail forex operations.

The tastyfx platform delivers competitive pricing with spreads starting from 0.6 pips on commission-free trading, representing excellent value among US-regulated forex trading platforms. Traders gain access to over 80 currency pairs with maximum leverage of 50:1 on major pairs, while the minimum deposit requirement of $100 establishes a reasonable entry point. Execution speed averages an impressive 0.03 seconds, critical for traders implementing short-term strategies where milliseconds can determine profit or loss.

Platform diversity stands as a key strength, with tastyfx offering seamless integration with TradingView, MetaTrader 4, MetaTrader 5, and ProRealTime in addition to its proprietary platforms. This multi-platform approach enables traders to select the interface and tools that best match their trading methodology, whether that involves advanced charting in TradingView or algorithmic strategies on MT5. Prime accounts introduce an innovative feature set including up to 6% annual percentage yield on idle cash balances and cashback rebates of up to 15% on spreads paid, effectively reducing trading costs for high-volume traders. These features distinguish tastyfx from competing forex trading platforms by rewarding active participation and account loyalty.

3. OANDA: Optimal for Beginners

OANDA has operated as a trusted name among forex-trading platforms since the late 1990s, building a reputation for transparency, competitive pricing, and user-friendly interfaces that particularly benefit beginning traders. The platform maintains full CFTC and NFA registration, ensuring compliance with all regulatory requirements governing US retail forex operations. With no minimum deposit requirement and flexible account types, OANDA removes common barriers that prevent new traders from entering the forex market.

The spread-only pricing model simplifies cost calculations for beginners, with average spreads of 1.0 pip on EUR/USD representing competitive mid-range pricing among forex trading platforms. OANDA offers 68 currency pairs with 50:1 leverage on majors, providing sufficient variety for traders developing their strategies without overwhelming newcomers with excessive options. The platform supports both its proprietary OANDA Trade platform and MetaTrader 4, giving users flexibility to choose between a streamlined interface optimized for beginners or the feature-rich MT4 environment favored by more experienced traders.

Educational resources represent a standout feature distinguishing OANDA from other forex-trading platforms targeting beginners. The company provides extensive webinars, articles, video tutorials, and market analysis helping traders understand fundamental concepts, develop technical analysis skills, and implement sound risk management practices. Integration with Autochartist delivers automated technical analysis including chart pattern recognition, Fibonacci projections, and key level identification, enabling beginners to benefit from professional-grade analysis tools while building their own analytical capabilities. Premium Plus Trader accounts unlock core pricing with spreads starting from 0.0 pips plus commissions, offering a growth path as traders develop more sophisticated strategies requiring tighter execution costs.

4. Charles Schwab: Premier Integration for US Investors

Charles Schwab brings institutional credibility and comprehensive financial services integration to forex trading platforms, making it an exceptional choice for American investors seeking unified portfolio management. Following the 2020 acquisition of TD Ameritrade, Schwab now offers the award-winning thinkorswim platform suite, previously available only through Ameritrade, combining it with Schwab’s extensive banking and investment services. This integration enables traders to manage stocks, options, futures, and forex within a single account ecosystem, streamlining position monitoring and capital allocation across asset classes.

Regulatory oversight includes the SEC, CFTC, FINRA, and NFA, establishing Schwab among the most thoroughly regulated forex trading platforms available anywhere. The thinkorswim platform provides access to over 73 currency pairs with commission-free pricing and average EUR/USD spreads of 1.32 pips, positioning it competitively within the mid-range of US forex trading platforms. Maximum leverage reaches 50:1 on major pairs with no minimum deposit requirement, though the minimum trade size of 10,000 units (0.1 lots) means traders need approximately $500 in available margin to open positions.

The thinkorswim platform distinguishes itself through sophisticated charting capabilities featuring hundreds of technical indicators, customizable workspaces, and paper trading functionality enabling risk-free strategy development. Advanced order types including brackets, OCO (one-cancels-other), and conditional orders provide professional-grade position management tools seldom found on retail forex trading platforms. Schwab provides 24/5 support from dedicated forex specialists, extensive educational content including courses, webinars, and market commentary, plus the financial security of trading with one of America’s largest financial institutions managing over $10 trillion in client assets.

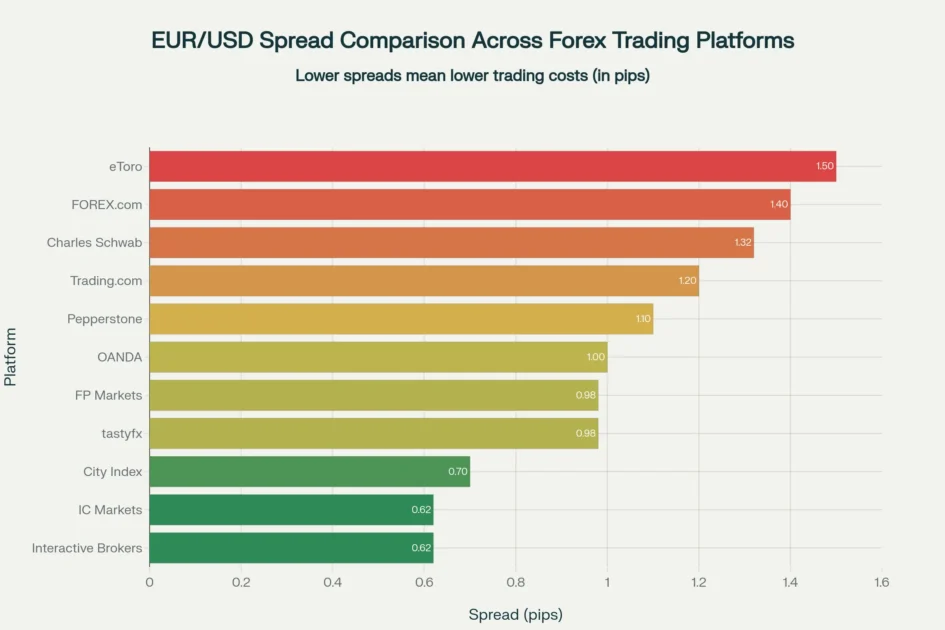

Comparison of EUR/USD spreads across major forex trading platforms available to US traders, showing platforms with the tightest and most competitive spreads

5. FOREX.com: Comprehensive All-Round Platform

FOREX.com operates as one of the most established names among forex trading platforms, serving traders worldwide through its parent company StoneX Group, a publicly traded entity on NASDAQ with a stellar trust score of 99 out of 99. The platform maintains CFTC and NFA registration for US operations while holding regulatory authorizations from seven additional Tier-1 jurisdictions globally, demonstrating commitment to compliance across multiple markets. This extensive regulatory oversight provides traders confidence in the platform’s financial stability and adherence to industry best practices.

FOREX.com provides access to 80 currency pairs with average EUR/USD spreads of 1.4 pips through a commission-free pricing model, representing standard mid-tier costs among US forex trading platforms. The minimum deposit of $100 establishes a reasonable entry point, while maximum leverage of 50:1 on major pairs complies with CFTC regulations. Multiple account types cater to different trader profiles, with RAW Spread accounts offering institutional-grade pricing with spreads as low as 0.13 pips before commissions for high-volume traders seeking optimal execution costs.

Platform variety stands as a defining strength, with FOREX.com offering its flagship Advanced Trading desktop platform, browser-based Web Trading powered by TradingView charting, plus MetaTrader 4 and 5 support. This multi-platform approach enables traders to select environments matching their preferences, whether that involves the streamlined interface of Web Trading, the familiarity of MT4/MT5, or the advanced capabilities of the proprietary desktop solution. Mobile applications mirror desktop functionality with real-time price alerts, one-swipe order placement, and sophisticated technical analysis tools, ensuring traders maintain market connectivity regardless of location. Educational resources include trading guides, webinars, and market analysis supporting skill development across all experience levels, making FOREX.com a well-rounded choice among forex trading platforms.

6. Trading.com: Emerging US Option

Trading.com has emerged as a noteworthy addition to CFTC and NFA-registered forex trading platforms, operating as the US brand under the XM Group’s parent company Trading Point. The platform has garnered industry recognition including Best FX Broker US 2025 from World Finance and Best Brokerage for Forex 2024 from Benzinga Global Fintech, signaling growing acceptance within the American trading community. No minimum deposit requirement reduces barriers to entry, while full regulatory compliance provides the legal protections American traders require.

The platform delivers competitive mid-range pricing with average EUR/USD spreads around 1.2 pips through commission-free trading on 65 currency pairs. Maximum leverage reaches 50:1 on major pairs in accordance with CFTC regulations, providing standard risk exposure parameters. Trading.com supports both MetaTrader 4 and MetaTrader 5 platforms, giving traders access to the industry-standard environments preferred by millions of forex participants worldwide. These platforms provide advanced charting with dozens of technical indicators, algorithmic trading support through Expert Advisors, and mobile compatibility for trading on the go.

The platform particularly appeals to traders new to US-regulated forex trading platforms who seek straightforward account opening, responsive customer service, and educational resources supporting skill development. While Trading.com may lack some advanced features found on more established platforms like Interactive Brokers or Charles Schwab, its focus on core forex functionality, competitive pricing, and regulatory compliance makes it a solid option for traders prioritizing simplicity and security over extensive multi-asset capabilities.

7. eToro: Social Trading Innovation

eToro has revolutionized retail trading through its pioneering social trading features, though its availability on US forex trading platforms remains limited compared to international operations. The platform’s signature CopyTrader functionality enables users to automatically replicate the trades of successful investors, creating a unique learning opportunity for beginners while providing experienced traders potential additional income streams from followers. This social dimension distinguishes eToro from traditional forex trading platforms by fostering a community-driven ecosystem where trading strategies and market insights flow freely among participants.

US traders can access approximately 50 currency pairs through eToro’s proprietary platform, which emphasizes user-friendliness with intuitive interfaces designed for traders at all experience levels. Average EUR/USD spreads stand at approximately 1.5 pips, positioning eToro in the higher range among forex trading platforms, though the social trading features and educational value may justify these costs for certain user profiles. Maximum leverage for US accounts reaches 30:1 due to regulatory considerations, lower than the 50:1 standard on most American forex trading platforms but still sufficient for profitable trading strategies when combined with proper risk management.

The platform supports trading across multiple asset classes beyond forex including stocks, cryptocurrencies, commodities, and indices, enabling portfolio diversification within a single interface. Educational resources extend beyond traditional materials to include the collective wisdom of the trading community, with users sharing analysis, strategies, and real-time trading decisions. While eToro may not offer the tightest spreads or most advanced technical analysis tools found on other forex trading platforms, its unique social trading ecosystem provides distinctive value for traders who learn effectively through observation and community engagement, particularly beginners seeking to accelerate their development by studying successful traders’ approaches.

8. Pepperstone: Advanced Tools for Scalpers

Pepperstone has built a strong reputation among forex trading platforms for delivering institutional-grade execution speeds, ultra-tight spreads, and sophisticated platform options that particularly benefit scalpers and day traders. While based in Australia and primarily regulated by ASIC and CySEC rather than CFTC/NFA, Pepperstone serves some US clients through specific account structures, making it worth consideration for American traders seeking premium execution quality. The platform has earned recognition with multiple industry awards acknowledging its trading conditions, platform technology, and customer service excellence.

No minimum deposit requirement removes entry barriers, while the RAW Spread account delivers some of the market’s tightest pricing with EUR/USD spreads averaging just 0.19 pips plus $3.50 commission per standard lot. This commission-based model often results in lower total trading costs compared to wider spread-only pricing on other forex trading platforms, particularly advantageous for high-frequency traders executing dozens or hundreds of trades monthly. During testing, Pepperstone maintained zero-pip spreads on major pairs 100% of the time outside rollover periods, demonstrating exceptional consistency compared to forex trading platforms where spread widening during volatile periods can significantly impact trading costs.

Platform diversity represents a key differentiator, with Pepperstone supporting MetaTrader 4, MetaTrader 5, cTrader, and TradingView integration—more options than most forex trading platforms provide. The cTrader platform particularly appeals to scalpers with its Level II pricing, fast execution, and advanced order types including depth of market visibility. Access to 93 currency pairs provides extensive opportunities for discovering trading setups across major, minor, and exotic pairs. Maximum leverage reaches 50:1 for major pairs, though regulatory considerations may limit availability for US traders depending on account structure. Customer service operates 24/5 with multilingual support, ensuring assistance availability during active trading sessions across global time zones.

9. IC Markets: Ultra-Low-Cost Execution

IC Markets has established itself among forex trading platforms for delivering some of the industry’s absolute tightest spreads combined with raw account pricing that appeals to cost-conscious traders. Regulated by ASIC and CySEC, IC Markets operates primarily outside US jurisdiction but merits inclusion for traders comparing global forex trading platforms and considering offshore alternatives. The platform’s focus on institutional-grade execution and minimal markup pricing has attracted over 200,000 active traders worldwide seeking to minimize trading costs.

The RAW Spread account delivers exceptional value with EUR/USD spreads averaging just 0.62 pips combined with $3.50 commission per standard lot, resulting in total trading costs among the lowest available on forex trading platforms globally. IC Markets maintains zero-pip spreads 97.83% of the time outside rollover periods, demonstrating remarkable consistency that enables precise cost calculations for strategy development. The minimum deposit of $200 remains accessible, while the platform provides 61+ currency pairs covering major, minor, and exotic options.

Platform technology centers on MetaTrader 4, MetaTrader 5, and cTrader, the three most respected trading environments among retail forex trading platforms. Support for algorithmic trading through Expert Advisors on MT4/MT5 and cBots on cTrader enables automated strategy implementation with institutional-quality execution speeds. Maximum leverage typically reaches 500:1 on IC Markets’ international accounts, dramatically higher than CFTC-regulated forex trading platforms, though US traders cannot access these leverage levels through direct accounts due to regulatory restrictions. The platform particularly suits experienced traders comfortable with offshore brokers who prioritize minimal trading costs and fast execution over the legal protections provided by US-regulated forex trading platforms.

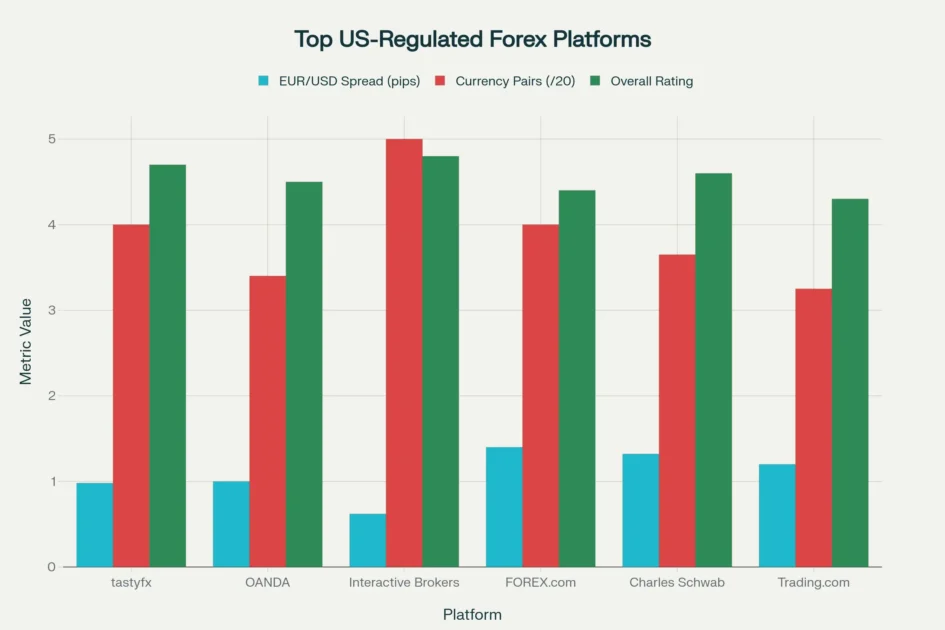

Comprehensive comparison of the top 6 CFTC/NFA-regulated forex trading platforms showing spreads, available currency pairs, and overall ratings

10. FP Markets: Multi-Asset Excellence

FP Markets has operated since 2005, building a solid reputation among forex trading platforms through competitive pricing, extensive asset selection, and professional trading conditions. ASIC and CySEC regulation provides oversight, though like several platforms discussed here, FP Markets operates primarily outside CFTC jurisdiction, limiting direct US access. The platform serves over 10,000 tradable instruments spanning forex, stocks, indices, commodities, cryptocurrencies, and ETFs, enabling comprehensive portfolio diversification within a single trading environment.

Two account types cater to different trader preferences, with the Standard account offering commission-free trading and the Raw account delivering tighter spreads from 0.0 pips plus $6 round-turn commission per standard lot. Average EUR/USD spreads on the Raw account measure approximately 0.2 pips before commissions, positioning FP Markets competitively among low-cost forex trading platforms. The minimum deposit of $50 ($100 AUD) establishes a reasonable entry point, while 70+ currency pairs provide adequate variety for most trading strategies.

MetaTrader 4 and MetaTrader 5 support enables traders to leverage familiar interfaces with extensive indicators, charting capabilities, and algorithmic trading through Expert Advisors. The platform particularly appeals to traders seeking exposure across multiple asset classes who want to consolidate positions on fewer forex trading platforms rather than maintaining separate accounts for stocks, forex, and cryptocurrencies. Educational resources include webinars, trading guides, and market analysis supporting skill development, though the depth may not match platforms like OANDA or Charles Schwab that emphasize educational content. Maximum leverage varies by jurisdiction, with international accounts accessing higher ratios than permitted on US-regulated forex trading platforms.

11. City Index: Technical Analysis Power

City Index has served traders since 1983, establishing itself among forex trading platforms through strong technical analysis tools, competitive spreads, and reliable execution. FCA and ASIC regulation provides oversight, with the platform operating primarily in UK and Australian markets rather than under CFTC jurisdiction. The RAW FX Account delivers exceptional value with commissions of just $2.50 USD per lot combined with spreads averaging 0.25 pips on EUR/USD, among the tightest available on forex trading platforms globally.

No minimum deposit requirement removes entry barriers, while 84 currency pairs provide extensive selection covering major, minor, and exotic options. Platform options include MetaTrader 4, TradingView integration, and City Index’s proprietary WebTrader, giving traders flexibility to select environments matching their analysis preferences. The TradingView integration particularly benefits technical analysts who value that platform’s superior charting capabilities, community-driven scripts, and sophisticated drawing tools unavailable on standard MT4 implementations.

Maximum leverage reaches 50:1 on major pairs for accounts structured appropriately, though US traders face limitations accessing this platform directly. The platform charges no deposit or withdrawal fees, though an inactivity fee of $15 monthly applies to dormant accounts, encouraging active participation. City Index particularly suits traders prioritizing technical analysis who seek feature-rich charting combined with competitive execution costs, distinguishing it from forex trading platforms that emphasize other attributes like educational content or social trading features. The platform’s longevity and established reputation provide confidence in financial stability, though traders should verify current regulatory status and account availability based on their jurisdiction.

Key Features Comparison Across Platforms

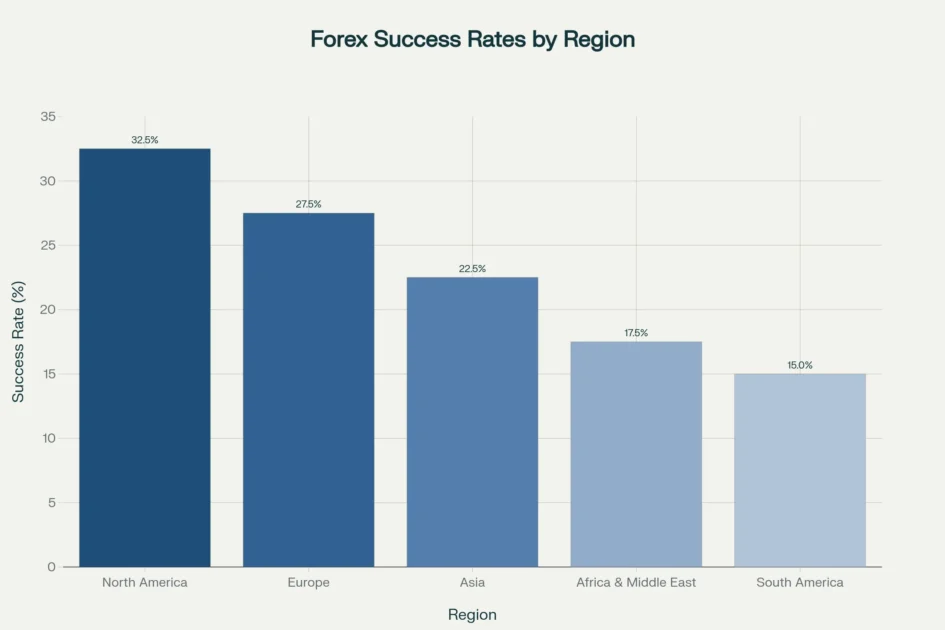

Global comparison of forex trading success rates across five major regions, highlighting North America’s leading position in trader profitability

Understanding how different forex trading platforms compare across critical dimensions enables informed selection aligned with individual trading objectives and styles. Spread costs represent the most visible expense on a forex trading platform, with the difference between buying and selling prices directly impacting profitability on every trade. Interactive Brokers and IC Markets lead with ultra-tight EUR/USD spreads of 0.62 pips, followed closely by City Index at 0.70 pips, making these platforms optimal for traders executing high-frequency strategies where even fractional pip differences compound significantly over hundreds of trades.

Commission structures vary substantially across forex trading platforms, with some like tastyfx, OANDA, and FOREX.com embedding costs entirely within spreads, simplifying calculations for beginners. Alternative models offered by Pepperstone, IC Markets, and FP Markets charge explicit commissions ranging from $2.50 to $3.50 per standard lot while offering dramatically tighter raw spreads, often resulting in lower total costs for active traders. Understanding total cost requires calculating spread costs plus commissions for a complete comparison across forex trading platforms with different pricing philosophies.

Regulatory oversight emerges as perhaps the most consequential differentiator among forex trading platforms serving American traders. Platforms like Interactive Brokers, tastyfx, OANDA, FOREX.com, Charles Schwab, and Trading.com maintain full CFTC and NFA registration, providing legal protections including segregated client funds, dispute resolution mechanisms, and capital requirements ensuring financial stability. International platforms such as Pepperstone, IC Markets, FP Markets, and City Index operate under ASIC, FCA, or CySEC oversight—respected regulators offering solid protections—but may present challenges for US traders seeking accounts or legal recourse should disputes arise.

Platform technology and tool availability vary considerably across forex trading platforms, influencing which environments best support different trading methodologies. MetaTrader 4 and 5 remain industry standards supported by most platforms, offering familiar interfaces, extensive indicators, and algorithmic trading through Expert Advisors. Proprietary platforms like thinkorswim from Charles Schwab, TWS from Interactive Brokers, and OANDA Trade provide unique capabilities optimized for their respective ecosystems. Integration with TradingView has emerged as a valuable differentiator on platforms like tastyfx, Pepperstone, and City Index, giving traders access to superior charting, community-driven analysis, and social features enhancing decision-making capabilities.

Platform Selection Strategies for Maximum Profit

Matching forex trading platform to specific trading styles represents the most critical decision impacting long-term profitability. Scalpers executing dozens or hundreds of trades daily prioritize ultra-tight spreads and fast execution above all else, making platforms like IC Markets, Interactive Brokers, City Index, and Pepperstone optimal choices where fractional pip savings compound dramatically over high trade volumes. These traders should calculate total costs including both spreads and commissions, often finding commission-based models with raw spreads deliver superior economics despite apparent complexity.

Day traders holding positions for hours rather than minutes can tolerate slightly wider spreads if compensated by superior analysis tools, educational resources, or platform reliability. FOREX.com, Charles Schwab, and tastyfx excel in this segment, offering comprehensive charting, market analysis, and stable platforms supporting active intraday trading without the extreme cost sensitivity of scalping strategies. Access to multiple timeframe analysis, customizable indicators, and fast order execution remain priorities, though spread differences of 0.3-0.5 pips matter less when trades target movements of 20-50 pips or more.

Swing traders and position traders holding for days or weeks shift priorities toward comprehensive fundamental analysis tools, economic calendars, and platforms supporting larger position sizes without execution concerns. Charles Schwab and Interactive Brokers particularly suit this trading style through integration with broader investment portfolios, extensive research capabilities, and financial strength supporting large account values. These traders can accept wider spreads since their targeted movements of hundreds of pips dwarf spread costs, though they should verify overnight financing charges don’t erode profits on extended positions.

Beginners developing trading skills require forex trading platforms emphasizing education, intuitive interfaces, and supportive resources over absolute minimum costs. OANDA stands out with exceptional educational content, transparent pricing, no minimum deposits, and demo accounts enabling risk-free practice. eToro’s social trading features provide unique learning opportunities through observing experienced traders’ strategies and decisions in real-time. These platforms help beginners avoid costly mistakes during the learning phase when 85% of new traders experience losses, making educational value and risk management support more valuable than marginal spread savings.

Regulatory Considerations and Trader Protection

The CFTC and NFA regulatory framework distinguishing US forex trading platforms from international alternatives provides substantial legal protections though imposes trading constraints some find restrictive. Maximum leverage limitations of 50:1 on major currency pairs and 20:1 on minor pairs prevent the extreme leverage ratios of 100:1, 500:1, or even 1000:1 available through offshore platforms. While experienced traders may chafe at these restrictions, research consistently demonstrates excessive leverage as a primary factor in retail trader losses, with the overwhelming majority of accounts using high leverage experiencing complete capital loss.

Minimum capital requirements of $20 million for firms operating as forex trading platforms in the United States filter out undercapitalized operators who might struggle to fulfill client obligations during market stress. This regulatory barrier explains why only six or seven platforms maintain active CFTC/NFA registration compared to hundreds of international brokers serving other markets. For traders, this consolidation means fewer choices but dramatically higher average quality and financial stability among available forex trading platforms.

Segregated client fund requirements mandate that US-regulated forex trading platforms maintain client deposits separate from operational capital, preventing commingling that could expose trader funds to business risks. This protection proved invaluable during previous broker failures where segregated funds enabled client reimbursement despite firm insolvency. SIPC insurance providing coverage up to $500,000 adds another protection layer unavailable through most international forex trading platforms. These regulatory safeguards justify accepting slightly higher spreads or lower leverage on US platforms versus offshore alternatives promising rock-bottom costs but operating outside protective regulatory frameworks.

Understanding Success Rates and Profitability

Realistic expectations about forex trading success rates prove essential for platform selection and strategy development. Research consistently indicates approximately 85% of retail forex traders experience net losses, with only 10-15% achieving profitability and merely 10% reaching sustainable success enabling trading as a primary income source. These sobering statistics don’t reflect forex trading platforms’ quality but rather the inherent difficulty of consistently profiting in highly efficient markets where participants include sophisticated institutional traders, algorithmic systems, and professional money managers with resources dwarfing retail accounts.

Profitability rates improve dramatically with experience and education, with studies showing 85% of traders active for four or more years eventually achieve profitability compared to the dismal 10% success rate among beginners. This progression emphasizes the importance of selecting forex trading platforms offering robust educational resources, demo accounts for risk-free practice, and reasonable minimum deposits enabling extended learning periods without excessive capital at risk. Platforms like OANDA, Charles Schwab, and tastyfx that invest heavily in trader education and provide comprehensive learning resources potentially improve user success rates by accelerating skill development.

Regional variations in success rates reveal North American traders achieving the highest profitability at approximately 30-35%, attributed to superior access to education, professional analytical tools, and stringent regulatory oversight ensuring fair market conditions. European traders follow at 25-30%, Asian traders at 20-25%, and other regions showing lower success rates correlated with reduced educational access and regulatory protections. These statistics reinforce the value proposition of US-regulated forex trading platforms despite potentially higher costs, as the transparent pricing, legal protections, and educational resources potentially improve the odds of joining the minority of successful traders.

Advanced Platform Features and Tools

MetaTrader 4 and MetaTrader 5 dominate as the most widely adopted platforms across forex trading platforms globally, though understanding their differences helps traders select optimal environments. MT4 launched initially for forex trading with a straightforward interface, 30 built-in indicators, 9 timeframes, and MQL4 programming language enabling custom indicator and Expert Advisor development. The platform’s simplicity and widespread adoption created an extensive community developing thousands of free and commercial indicators, EAs, and educational resources making MT4 the de facto standard particularly for forex-focused traders.

MT5 represents a comprehensive evolution supporting multi-asset trading across forex, stocks, futures, and options with more sophisticated capabilities. Key improvements include 21 timeframes versus 9 in MT4, 38 technical indicators versus 30, advanced order types including Buy/Sell Stop Limit, and significantly faster backtesting through multi-threaded optimization. The MQL5 programming language offers object-oriented capabilities resembling C++, enabling more complex algorithmic strategies and faster execution compared to MT4’s procedural MQL4. MT5’s Depth of Market feature provides transparency into order book liquidity unavailable in MT4, valuable for understanding available liquidity at different price levels.

Despite MT5’s technical superiority, MT4 maintains larger user bases on many forex trading platforms due to familiarity, extensive third-party resources, and simpler learning curves. Traders should consider MT4 when focusing exclusively on forex with proven strategies not requiring MT5’s advanced features, while MT5 suits those trading multiple asset classes, developing complex algorithms, or seeking cutting-edge platform capabilities. Most leading forex trading platforms including tastyfx, FOREX.com, Pepperstone, and IC Markets support both versions, enabling traders to test each environment and migrate as needs evolve.

TradingView integration has emerged as a valuable differentiator on forex trading platforms, providing institutional-quality charting, social networking features, and Pine Script programming for custom indicators. The platform’s browser-based operation eliminates software installation requirements, while cloud synchronization enables seamless transitions between desktop and mobile devices. Community features including published trading ideas, chat rooms, and strategy sharing create collaborative environments unavailable on traditional platforms. Platforms like tastyfx, Pepperstone, and City Index enabling direct trade execution through TradingView charts combine superior analysis with efficient order placement.

Risk Management and Trading Psychology

Successful trading on forex trading platforms requires disciplined risk management more than perfect market timing or sophisticated strategies. The 2% rule, limiting risk on any single trade to 2% of account capital, remains the most fundamental protection against catastrophic losses that end trading careers. With this approach, traders can withstand consecutive losing streaks of 10-15 trades without substantial account damage, critical given that even the best strategies experience extended drawdown periods.

Position sizing calculations become essential across all forex trading platforms, with appropriate lot sizes determined by stop-loss distance and account risk tolerance rather than arbitrary percentages of capital. A $10,000 account risking 2% ($200) per trade with a 50-pip stop-loss should trade 0.4 standard lots ($4 per pip), not 0.5 or 1.0 lots regardless of conviction level. Platforms like Charles Schwab’s thinkorswim and Interactive Brokers’ TWS provide built-in risk calculators automating these computations, reducing mathematical errors that lead to oversized positions.

Psychological discipline separates consistently profitable traders from the 85% who experience losses on forex trading platforms. Common psychological pitfalls include revenge trading after losses, moving stop-losses to avoid taking planned losses, overleveraging on “can’t miss” setups, and failing to take profits at predetermined targets due to greed. Demo accounts available on platforms like OANDA, Charles Schwab, and tastyfx enable traders to test both strategies and psychological responses under simulated pressure before risking actual capital.

The majority of trader failures stem not from poor platform selection among forex trading platforms but from psychological mistakes, inadequate risk management, and unrealistic expectations about profitability timelines. Successful traders typically require 2-4 years developing skills, testing strategies, and building psychological discipline before achieving consistent profitability. Platform selection that prioritizes educational resources, demo accounts, and reasonable minimum deposits supporting extended learning periods often contributes more to eventual success than marginal cost savings on spreads.

Mobile Trading Capabilities

Mobile trading has transitioned from convenience feature to essential capability on modern forex trading platforms as traders demand constant market connectivity and order management capabilities from smartphones and tablets. Leading platforms like tastyfx, OANDA, Interactive Brokers, and Charles Schwab provide native iOS and Android applications replicating critical desktop functionality including real-time quotes, advanced charting, full order types, and account management. These mobile platforms enable traders to monitor positions, execute trades, and respond to market developments regardless of location, critical in 24-hour forex markets where significant moves can occur overnight for US traders.

The mobile experience varies considerably across forex trading platforms, with sophisticated implementations offering customizable layouts, dozens of technical indicators, drawing tools, and simultaneous multiple-chart viewing approaching desktop capabilities. Interactive Brokers’ IBKR Mobile and Charles Schwab’s thinkorswim mobile applications exemplify premium mobile experiences rivaling desktop platforms. More basic mobile implementations on some forex trading platforms provide essential functionality like placing market orders and checking account balances but lack advanced charting or analytical tools limiting their utility for serious technical analysis.

Push notification capabilities for price alerts, economic news, and position updates distinguish superior mobile implementations on forex trading platforms. Traders can set alerts for technical levels, percentage moves, or indicator crossovers, receiving instant notifications enabling rapid responses without constant chart monitoring. Platforms integrating mobile trading with broader ecosystems like TradingView or MetaTrader enable seamless transitions between devices, with workspace configurations and indicator settings synchronized automatically.

Security considerations become paramount on mobile devices accessing forex trading platforms containing substantial capital. Two-factor authentication, biometric login options, and automatic logout features protect against unauthorized access if devices are lost or stolen. Leading platforms encrypt communications using bank-grade SSL protocols, though traders should avoid executing trades on public Wi-Fi networks potentially exposing credentials to interception. Regular software updates addressing security vulnerabilities remain essential, making platforms with active development and rapid update deployment preferable from a security perspective among forex trading platforms.

Making the Final Platform Decision

Selecting optimal forex trading platforms requires synthesizing multiple factors into a decision matrix aligned with individual trading objectives, experience levels, and strategic approaches. Beginners should prioritize educational resources, intuitive interfaces, and demo accounts over absolute minimum costs, making OANDA, Charles Schwab, or eToro excellent starting points offering extensive learning resources alongside trading capabilities. The initial months or years focus on skill development rather than profit maximization, making educational support potentially more valuable than marginal spread savings.

Experienced traders with proven profitable strategies should calculate total costs across different forex trading platforms based on their specific trading patterns. High-frequency scalpers executing hundreds of trades monthly find that platforms like IC Markets, Interactive Brokers, or Pepperstone offering ultra-tight spreads can save thousands of dollars annually compared to mid-range platforms despite seeming small per-trade differences. Swing traders holding positions for days or weeks can accept slightly wider spreads if compensated by superior research tools, platform stability, or integration with broader investment portfolios offered by platforms like Charles Schwab or Interactive Brokers.

Regulatory considerations warrant careful evaluation, particularly for traders managing substantial account values. US-regulated forex trading platforms like tastyfx, OANDA, Interactive Brokers, FOREX.com, Charles Schwab, and Trading.com provide legal protections, segregated funds, and dispute resolution mechanisms justifying potentially higher costs compared to offshore alternatives. International platforms like Pepperstone, IC Markets, and FP Markets may offer superior pricing but operate outside US regulatory frameworks, potentially complicating legal recourse if disputes arise.

Testing multiple forex trading platforms through demo accounts before committing capital enables direct comparison of user interfaces, execution quality, and tool availability. Most platforms including OANDA, Charles Schwab, tastyfx, and Interactive Brokers provide unlimited or extended demo accounts enabling comprehensive evaluation without financial risk. Traders should execute their actual strategies on demo accounts, testing order types, charting capabilities, and platform stability during volatile markets when some platforms experience slowdowns or requotes affecting execution quality.

Conclusion

The forex market presents exceptional opportunities for informed traders who approach currency trading with realistic expectations, disciplined risk management, and appropriate platform selection aligned with their trading objectives. This comprehensive evaluation of eleven leading forex trading platforms reveals significant variations in pricing structures, regulatory oversight, technological capabilities, and trader support services that can dramatically impact long-term profitability. For American traders, platforms like Interactive Brokers, tastyfx, OANDA, Charles Schwab, and FOREX.com deliver the regulatory protections, competitive pricing, and professional-grade tools necessary for pursuing maximum profit potential while operating within the secure framework of CFTC and NFA oversight.

The sobering reality that 85% of retail forex traders experience net losses underscores the importance of selecting a forex trading platform emphasizing education, risk management tools, and demo trading capabilities alongside competitive execution costs. Success in forex markets derives not from finding the platform with absolutely lowest spreads but from developing disciplined trading strategies, maintaining rigorous risk management, and continuously improving analytical skills through education and experience. The minority of traders who achieve consistent profitability typically invest years developing expertise, suggesting platform selection should support long-term development rather than focusing exclusively on immediate cost minimization.

As forex trading platforms continue evolving with technological advancements including artificial intelligence, machine learning analytics, and increasingly sophisticated mobile capabilities, traders must regularly reassess whether their current platforms align with changing needs and strategies. The platforms examined in this analysis represent the current industry leaders, though competitive dynamics ensure continuous innovation in pricing, tools, and services. Traders should maintain awareness of new platform entrants and evolving capabilities on existing platforms, recognizing that optimal platform selection today may shift as personal trading styles mature and market conditions evolve.

Ultimately, maximizing profit potential in forex markets requires viewing platform selection as one component of a comprehensive trading approach encompassing strategy development, risk management, psychological discipline, and continuous education. The forex trading platforms discussed provide the technological foundation and market access necessary for success, but they cannot substitute for the hard work, discipline, and realistic expectations that separate the 10% of traders who achieve consistent profitability from the majority who struggle.

By carefully matching platform capabilities to individual trading styles, prioritizing regulatory protection and educational resources, and maintaining disciplined risk management regardless of which platform is selected, traders position themselves among the minority who successfully navigate forex markets toward sustained profitability and trading success.

Citations

- https://www.forexbrokers.com/guides/united-states

- https://www.tradingpedia.com/united-states/

- https://www.bestbrokers.com/forex-brokers/

- https://www.compareforexbrokers.com/us/

- https://www.dailyforex.com/forex-brokers/best-forex-brokers

- https://www.investmentlawgroup.com/perspectives/a-new-era-of-regulation-for-retail-forex-traders-brokers/

- https://www.investing.com/brokers/reviews/interactive-brokers/

- https://www.dailyforex.com/forex-brokers/interactive-brokers-review

- https://www.cftc.gov/sites/default/files/idc/groups/public/@newsroom/documents/file/forexfinalrule_qa.pdf

- https://www.cftc.gov/LearnAndProtect/AdvisoriesAndArticles/ForeignCurrencyTrading/index.htm

- https://www.investopedia.com/articles/forex/073115/can-forex-trading-make-you-rich.asp

- https://alphapoint.com/blog/best-forex-white-label-programs-2/

- https://en.wikipedia.org/wiki/Interactive_Brokers

- https://www.forexbrokers.com/reviews/charles-schwab

- https://www.investopedia.com/articles/active-trading/121014/best-technical-analysis-trading-software.asp

- https://www.tastyfx.com

- https://www.markets.com/research/best-forex-trading-platforms-june-2025-oanda-tastyfx-e-toro-and-more

- https://www.tastyfx.com/accounts/pricing/

- https://statrys.com/blog/top-forex-platforms

- https://www.oanda.com/us-en/trading/forex/

- https://www.bestbrokers.com/reviews/oanda/spreads-fees-and-commissions/

- https://www.oanda.com/sg-en/trading/our-pricing/

- https://www.oanda.com/us-en/trading/our-pricing/

- https://www.oanda.com/au-en/trading/our-pricing/

- https://www.oanda.com/us-en/trading/tools/technical-analysis/

- https://pressroom.aboutschwab.com/press-releases/press-release/2024/Schwab-Introduces-Futures-Forex-and-Portfolio-Margin-on-thinkorswim/default.aspx

- https://brokerchooser.com/broker-reviews/charles-schwab-review/charles-schwab-forex

- https://www.schwab.com/learn/story/what-is-forex-trading

- https://www.schwab.com/forex

- https://www.forexbrokers.com/guides/india

- https://www.forexfactory.com/brokers/united-states

- https://www.trading.com/us/

- https://b2broker.com/news/mt4-vs-mt5/

- https://www.avatrade.com/trading-platforms/metatrader-4/what-is-metatrader

- https://fxnewsgroup.com/forex-news/platforms/metatrader-4-vs-metatrader-5-key-differences-explained/

- https://www.investing.com/brokers/forex-brokers/

- https://scribehow.com/page/_Top_10_Forex_Trading_Platforms_in_2025__Best_Brokers_for_Traders__S1dWpr7oRPepc8LzPLPcxA

- https://www.compareforexbrokers.com/awards/low-commissions/

- https://brokerchooser.com/best-brokers/best-lowest-spread-forex-brokers/india

- https://mondfx.com/how-many-people-make-a-profit-in-forex/

- https://www.dailyforex.com/forex-articles/2020/09/forex-industry-statistics/150275

- https://mondfx.com/why-do-95-percent-of-traders-lose/

- https://www.bestbrokers.com/forex-trading/forex-trading-statistics/

- https://www.bestbrokers.com/forex-trading/us-forex-trading-demographics/

- https://hmarkets.com/blog/metatrader-4-vs-metatrader-5/

- https://www.newtrading.io/technical-analysis-tools-software/

- https://tradeciety.com/24-statistics-why-most-traders-lose-money

- https://www.investopedia.com/articles/forex/12/calculating-profits-and-losses-of-forex-trades.asp

- https://www.myfxbook.com/forex-broker-spreads

- https://www.dailyforex.com/forex-brokers/brokers-directory-list

- https://www.bestbrokers.com/forex-brokers/best-forex-brokers-india/

- https://www.reddit.com/r/Daytrading/comments/1bh13i4/where_are_the_good_us_forex_brokers/

- https://fxscouts.com/in/forex-brokers/lowest-spread-forex-brokers/

- https://fxnewsgroup.com/forex-news/retail-forex/interactive-brokers-to-pay-150k-fine-for-alleged-violations-of-finra-rules/

- https://www.interactivebrokers.com/en/general/about/commoditySegregationDisclosure.php

- https://www.oanda.com/us-en/trading/our-charges/

- https://www.interactivebrokers.com/en/trading/products-spot-currencies.php

- https://www.oanda.com/bvi-en/cfds/our-charges/

- https://www.schwab.com/forex/trade-forex

- https://www.interactivebrokers.co.in/en/trading/margin-forex.php

- https://www.oanda.com/bvi-en/cfds/our-pricing/

- https://www.onlinenifm.com/blog/post/210/technical-analysis/top-technical-analysis-tools-for-smart-traders

- https://www.dailyforex.com/forex-brokers/best-forex-brokers/automated-trading

- https://www.milesweb.com/blog/hosting/vps/forex-trading-apps/

- https://www.investing.com/brokers/guides/forex/metatrader-4-vs-metatrader-5-choosing-the-right-platform-for-you/

- https://www.prorealtime.com/en/

- https://www.onlinenifm.com/blog/post/242/derivatives/best-forex-trading-platform-in-india-2025

- https://www.milesweb.com/blog/hosting/vps/mt4-vs-mt5/

- https://www.theknowledgeacademy.com/blog/forex-trading-tools/

- https://www.fxempire.com/brokers/best/forex-software-platforms

- https://fbs.com/fbs-academy/traders-blog/metatrader-5-vs-metatrader-4-which-one-is-better-in-2024

- https://tradethatswing.com/the-day-trading-success-rate-the-real-answer-and-statistics/

- https://www.forextime.com/trading-tools/trading-calculator/profit-calculator

- https://www.cftc.gov/sites/default/files/idc/groups/public/@newsroom/documents/file/forexfinalrulefactsheet.pdf

- https://www.reddit.com/r/Forex/comments/vg13sc/how_much_did_you_lose_trading_forex_before_being/

- https://www.compareforexbrokers.com/trading/statistics/

- https://www.nfa.futures.org/members/member-resources/files/forex-regulatory-guide.html

- https://www.dukascopy.com/swiss/english/marketwatch/articles/top-10-most-successful-forex-traders-in-the-world/

- https://www.cftc.gov/PressRoom/PressReleases/5883-10

- https://www.ecfr.gov/current/title-17/chapter-I/part-5