9 Best Asset Allocation Strategies for Maximum Growth

Financial success hinges not merely on selecting winning investments, but on constructing a resilient portfolio structure that can weather market storms while capturing upside potential. Asset allocation strategies represent the cornerstone of intelligent investing, determining approximately 90% of portfolio performance variability according to landmark research in Modern Portfolio Theory.

As US markets navigate unprecedented technological disruption, demographic shifts, and monetary policy transitions in 2025, understanding and implementing sophisticated asset allocation tactics has never been more critical for wealth accumulation. This comprehensive analysis examines nine proven asset allocation strategies that American investors can deploy to maximize risk-adjusted returns across varying life stages, risk tolerances, and financial objectives.

Drawing from decades of empirical evidence, institutional best practices, and behavioral finance research, these asset allocation strategies provide actionable blueprints for building portfolios designed to compound wealth over time. From the time-tested 60/40 balanced approach that recently demonstrated remarkable resilience with a 29.7% cumulative return following 2022’s challenges, to cutting-edge risk parity methodologies employed by sophisticated institutional investors, each strategy offers distinct advantages suited to specific investor profiles and market environments.

The following exploration integrates real-world performance data from US pension funds, academic research on rebalancing frequencies, and practical implementation considerations including tax efficiency and behavioral pitfalls that can derail even the most carefully constructed asset allocation strategies.

Understanding Asset Allocation Fundamentals

Asset allocation strategies constitute the systematic approach to distributing investment capital across various asset classes—including equities, fixed income, real estate, commodities, and alternative investments—to optimize the balance between expected returns and acceptable risk levels. This foundational investment principle, pioneered by Nobel laureate Harry Markowitz through his groundbreaking Modern Portfolio Theory in the 1950s, posits that portfolio construction through effective asset allocation plans matters more than individual security selection.

The theory demonstrates that combining assets with low or negative correlations through strategic asset allocation strategies can substantially reduce overall portfolio volatility while maintaining attractive return prospects, creating what economists term an “efficient frontier” where investors achieve maximum returns for a given level of risk.

The mathematical underpinnings of asset allocation strategies rest on the relationship between risk, measured as standard deviation of returns, and expected performance across asset classes. Historical data spanning 200 years reveals that strategic asset allocation schemes can deliver compounded annual growth rates exceeding 7% while experiencing simultaneous negative returns in stocks and bonds only 8% of the time.

This remarkable resilience stems from the diversification benefit—the reduction in portfolio risk achieved by holding imperfectly correlated assets through disciplined asset-allocation strategies that respond differently to economic conditions. For instance, when unexpected inflation pressures emerge, inflation-linked bonds may perform strongly while traditional equities struggle, yet a diversified portfolio maintained through sound asset allocation tactics maintains stability through these offsetting movements.

Historical performance comparison showing how different stock-bond allocation ratios performed from 2014-2024, demonstrating the risk-return trade-off across varying market conditions

Contemporary asset allocation strategies extend beyond the simple stock-bond dichotomy to incorporate multiple asset classes including domestic and international equities, various fixed-income instruments, real estate investment trusts, commodities, and alternative investments.

US corporate pension funds, managing trillions in retirement assets through sophisticated asset allocation strategies, allocated an average of 24.6% to equities, 52.4% to fixed income, and 23.0% to other investments including alternatives at the end of 2024, reflecting the institutional embrace of diversified allocation approaches. This multi-asset framework inherent in modern asset allocation strategies enables investors to capture returns from different economic regimes—growth versus recession, inflation versus deflation, domestic expansion versus international opportunities—while managing downside exposure during market dislocations.

Strategic Asset Allocation: The Foundation Strategy

Strategic asset allocation represents the bedrock approach among all asset allocation strategies for long-term investors, establishing target percentages for each asset class based on individual risk tolerance, time horizon, and financial objectives, then maintaining those allocations through periodic rebalancing.

This buy-and-hold methodology treats short-term market fluctuations as noise rather than signals, adhering to predetermined allocation targets regardless of prevailing market sentiment or economic forecasts. The classic 60/40 portfolio exemplifies this strategy among traditional asset allocation strategies, allocating 60% to equities for growth potential and 40% to bonds for stability and income generation.

The 60/40 balanced portfolio, as one of the most enduring asset-allocation strategies, has demonstrated remarkable longevity and resilience across diverse market environments. Following the challenging 2022 period when this allocation declined approximately 16% as both stocks and bonds fell simultaneously, the strategy rebounded with a 17.2% return in 2023 and achieved a 29.7% cumulative gain through September 2024.

Over the past decade ending 2024, despite including the 2022 drawdown, the global 60/40 portfolio generated a 6.9% annualized return, matching its long-term historical average and confirming the strategy’s enduring viability among passive asset-allocation strategies for moderate-risk investors. Goldman Sachs research projects this allocation should offer 4-5% returns with improved risk-reward characteristics as central banks transition from tightening to easing monetary policy.

Implementation of strategic asset allocation requires disciplined rebalancing to maintain target weights as market movements cause allocations to drift from their intended proportions. When one asset class outperforms, its portfolio weight increases, elevating overall risk beyond the investor’s original target; rebalancing involves selling appreciated assets and purchasing underperforming ones to restore the strategic mix.

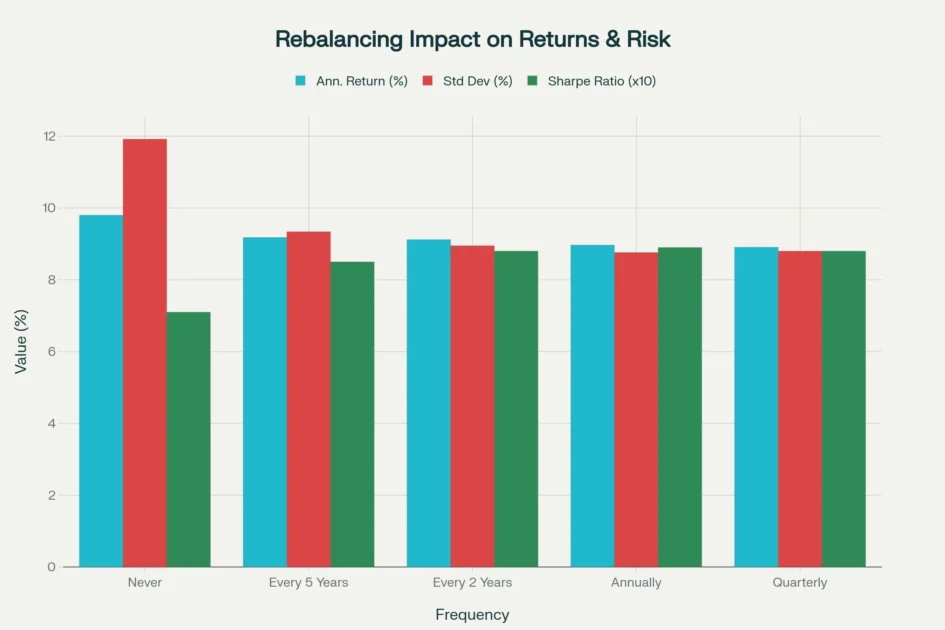

Research examining various asset allocation strategies and rebalancing frequencies reveals that annual rebalancing typically provides optimal results, generating an 8.97% annualized return with 8.76% standard deviation, slightly lower than more infrequent approaches but with superior risk-adjusted performance as measured by Sharpe ratio. A common rule suggests rebalancing when any asset class deviates more than 5% from its target allocation, providing systematic discipline for buying low and selling high.

The strategic approach proves particularly suitable for investors seeking simplicity, cost efficiency, and a passive management style that removes emotional decision-making from the investment process through well-designed asset allocation strategies. By establishing allocations aligned with long-term goals and maintaining them through market cycles, investors avoid the twin dangers of panic selling during downturns and euphoric overbuying during bubbles.

For retirement-focused Americans, strategic asset allocation form the core of target-date funds, which automatically adjust the stock-bond mix based on anticipated retirement dates, managing over $3 trillion in assets as of 2025.

Tactical Asset Allocation: Opportunistic Flexibility

Tactical asset allocation introduces deliberate short-term deviations from strategic targets to capitalize on perceived market inefficiencies, valuation dislocations, or favorable economic conditions. While maintaining a long-term strategic framework as the portfolio’s anchor, tactical asset allocation allows investors to temporarily overweight asset classes expected to outperform or reduce exposure to areas facing headwinds. This moderately active approach among contemporary asset allocation requires returning to strategic allocations once short-term opportunities mature, distinguishing it from undisciplined market timing.

The tactical methodology appeals to investors who believe they can identify temporary mispricing or economic regime shifts that create asymmetric risk-reward opportunities through active asset allocation strategies.

For example, if market analysis suggests increased equity volatility due to economic uncertainty, a tactical investor might temporarily reduce stock exposure from 60% to 50% while increasing bond holdings, then revert to the 60/40 strategic mix once conditions normalize. Similarly, rising inflation expectations might prompt a tactical shift toward commodities or Treasury Inflation-Protected Securities to capture returns from the inflation trend while protecting purchasing power through dynamic asset-allocation strategies.

Empirical evidence on tactical asset allocation presents a mixed picture regarding their effectiveness relative to purely strategic approaches. Morningstar research found that tactical allocation funds charge expense ratios averaging 50% higher than strategic funds, yet many fail to deliver commensurate outperformance, suggesting that implementation costs and timing difficulties can erode theoretical benefits of active asset allocation strategies.

Academic studies indicate tactical asset allocation works best when applied within a core-satellite framework, where 70-80% of assets maintain strategic allocations while 20-30% pursue tactical opportunities, limiting downside exposure if tactical calls prove incorrect.

Risk-return scatter plot illustrating the fundamental investment principle that higher expected returns typically require accepting greater volatility across asset classes

Successful tactical asset allocation demand several capabilities often absent among retail investors: the ability to correctly forecast market movements, discipline to reverse tactical positions at appropriate times, and emotional fortitude to act contrary to prevailing sentiment.

Behavioral finance research reveals that overconfidence bias frequently undermines tactical approaches among active asset allocation strategies, as 76% of professional fund managers surveyed believed they possessed above-average skill despite statistical impossibility. The strategy suits experienced investors who can dedicate time to market analysis, tolerate higher portfolio turnover and associated costs, and maintain sufficient liquidity to execute tactical shifts without incurring excessive transaction expenses.

Dynamic Asset Allocation: Continuous Adaptation

Dynamic asset allocation represents the most active strategic framework among all asset allocation strategies, continuously adjusting portfolio weights in response to evolving market trends, economic indicators, and valuation metrics. Unlike tactical allocation’s temporary deviations from strategic targets, dynamic asset allocation tactics may shift allocations significantly and maintain those positions for extended periods as market conditions dictate.

This methodology treats asset allocation itself as the primary source of returns rather than a risk management tool, actively positioning the portfolio to ride favorable trends while reducing exposure to deteriorating sectors through aggressive asset-allocation strategies.

Portfolio managers implementing dynamic asset allocation strategies monitor a constellation of indicators including relative asset class valuations, momentum signals, economic growth trajectories, inflation trends, and policy developments to inform allocation decisions. During economic expansions characterized by accelerating growth and moderate inflation, dynamic asset allocation typically increases equity allocations to capture market appreciation.

Conversely, as economic indicators signal slowdown or recession risks, these approaches rotate toward defensive positioning with higher bond weights and increased cash reserves. The strategy’s responsiveness distinguishes it from strategic allocation’s stability and tactical allocation’s temporary adjustments among various asset allocation strategies.

Evidence from Indian markets, where dynamic asset allocation have been extensively studied, demonstrates that monthly rebalancing frequency optimizes risk-adjusted returns for momentum-based dynamic approaches. However, dynamic asset allocation comes with substantial challenges.

The strategy requires sophisticated analytical capabilities, continuous monitoring, and decisive execution—resources typically available only to professional investment managers implementing advanced asset allocation strategies or institutional investors. Transaction costs from frequent rebalancing can significantly erode gross returns, particularly in taxable accounts where capital gains taxes apply to each sale.

The dynamic approach proves most suitable for active traders, hedge fund managers, and sophisticated investors who possess both the analytical tools and time commitment necessary for continuous portfolio management through complex asset allocation strategies. For most individual investors, the complexity, costs, and risk of poor timing decisions make purely dynamic asset allocation impractical.

Many financial advisors instead recommend hybrid approaches that combine a strategic core with dynamically managed satellite positions, capturing some benefits of market responsiveness while maintaining portfolio stability through balanced asset allocation.

Core-Satellite Strategy: Balanced Sophistication

The core-satellite approach represents a hybrid among modern asset allocation strategies that combines the stability of passive indexing with the return-enhancement potential of active management. This framework, as one of the most flexible asset allocation tactics, allocates 60-80% of portfolio assets to a diversified “core” of low-cost index funds or exchange-traded funds tracking broad market benchmarks, while dedicating the remaining 20-40% to actively managed “satellite” positions targeting specific opportunities.

The core provides reliable market returns with minimal costs, while satellites pursue outperformance through thematic investments, sector rotation, or alternative strategies within this balanced approach to asset allocation strategies.

Construction of effective core-satellite asset allocation strategies begins with establishing the core allocation using broadly diversified, low-cost index funds covering major asset classes. A typical core might include a total US stock market index fund, international equity index, bond index fund, and real estate investment trust allocation, capturing global market returns across multiple asset categories through foundational asset allocation.

This passive foundation ensures the portfolio benefits from long-term market growth while maintaining low expense ratios, often below 0.10% annually for leading index products. Research consistently demonstrates that asset allocation decisions drive 90% of portfolio performance variance, making the core’s strategic allocation the primary determinant of long-term success among all asset allocation strategies.

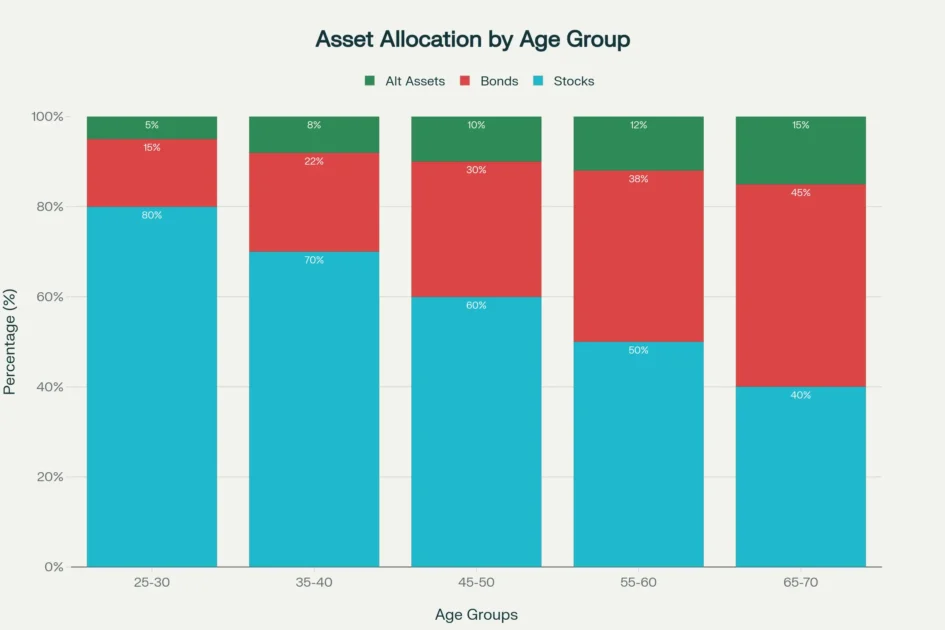

Age-based asset allocation showing the gradual shift from aggressive stock holdings in younger years to conservative bond allocations as retirement approaches

The satellite portion of these hybrid asset allocation introduces active management aimed at generating “alpha”—returns exceeding market benchmarks—through concentrated positions in promising sectors, emerging markets, thematic investments, or alternative asset classes.

Satellite allocations within core-satellite asset allocation might include sector-specific funds targeting technology or healthcare, actively managed small-cap strategies, emerging market exposure, commodities, or specialty real estate investment trusts. By limiting satellite positions to 20-40% of total assets, the strategy controls downside risk from active management mistakes while preserving upside potential if satellite positions succeed.

Vanguard’s implementation guidance emphasizes that successful core-satellite asset allocation prioritises getting the overall asset allocation correct first, then determining how much of each asset class to allocate between indexed core and active satellites based on factors including risk tolerance and tax efficiency.

The approach particularly suits balanced investors seeking market-matching returns from the core while maintaining flexibility to pursue tactical opportunities or express investment convictions through satellite positions in diversified asset allocation strategies. Implementation requires periodic review and rebalancing, typically semi-annually, to ensure satellite positions don’t grow disproportionately large through outperformance or shrink excessively through underperformance.

Risk Parity: Equalizing Risk Contributions

Risk parity represents an innovative approach among quantitative asset allocation strategies that focuses on balancing risk contributions from different asset classes rather than simply equalizing capital allocations. Traditional balanced portfolios like the 60/40 allocation, despite appearing diversified by capital, actually concentrate risk heavily in equities because stocks exhibit 4-5 times greater volatility than bonds. A 50/50 stock-bond portfolio by capital allocation translates to approximately 95% of portfolio risk coming from the equity allocation, creating far less diversification than the capital split suggests among conventional asset allocation strategies.

The risk parity methodology addresses this imbalance through sophisticated asset allocation strategies by sizing positions inversely to their volatility, resulting in equal risk contributions from each asset class. Implementation of risk parity asset-allocation strategies involves estimating each asset’s volatility, computing the inverse of these volatility measures (lower volatility assets receive higher weights), and normalizing these inverse volatilities to determine final allocations.

For a portfolio targeting equal risk contributions between stocks and bonds, risk parity asset allocation strategies would typically allocate approximately 15% to equities and 85% to fixed income, dramatically different from traditional balanced portfolios. To achieve desired return targets despite lower equity exposure, risk parity asset allocation often employ leverage on the fixed-income allocation, effectively creating a levered bond position that matches equity risk contribution.

Risk parity portfolios, as alternative asset allocation strategies, demonstrated superior resilience during the 2008 financial crisis, generating positive returns while traditional portfolios suffered substantial losses, spurring increased institutional adoption. The approach’s theoretical foundation rests on the principle that asset classes with lower volatility often deliver superior risk-adjusted returns, exploiting what academics call the “volatility puzzle”. By equalizing risk contributions and leveraging lower-volatility assets through quantitative asset allocation strategies, risk parity seeks to maximize Sharpe ratios—returns per unit of risk—across market environments.

However, risk parity asset allocation faces meaningful challenges and limitations. The approach requires accurate volatility and correlation forecasts, which can shift dramatically during market stress, potentially undermining portfolio balance. The strategy proved vulnerable during the March 2020 COVID-19 sell-off when correlations across asset classes converged, causing significant underperformance among leveraged asset allocation.

The use of leverage to boost bond exposure introduces additional risks including margin calls during extreme volatility and higher implementation costs. Additionally, by ignoring expected returns and focusing solely on risk, these asset allocation strategies may overweight low-return assets like government bonds, potentially limiting long-term wealth accumulation.

Risk parity suits sophisticated investors comfortable with leverage and seeking lower overall portfolio volatility with potentially enhanced risk-adjusted returns through advanced asset allocation strategies. Institutional investors including pension funds and endowments employ risk parity as part of diversified asset allocation, though recent performance challenges have prompted reassessment of the approach’s assumptions. For individual investors, accessing risk parity asset allocation typically requires specialized mutual funds or separately managed accounts, as the leverage requirements and continuous rebalancing demands exceed most retail capabilities.

Age-Based Lifecycle Allocation: Automatic Risk Reduction

Age-based asset allocation strategies systematically reduce portfolio risk as investors approach retirement, reflecting the diminishing time available to recover from market downturns. These lifecycle asset allocation, popularized through target-date retirement funds managing over $3 trillion in US retirement accounts, automatically adjust the stock-bond allocation according to predetermined “glide paths” that shift from aggressive growth-oriented portfolios in early working years toward conservative income-focused allocations near retirement.

The foundational principle of age-based asset allocation recognizes that younger investors with decades until retirement can tolerate higher equity exposure and short-term volatility to capture long-term market appreciation, while older investors nearing retirement need capital preservation to ensure sufficient funds when regular paychecks cease.

The traditional “Rule of 100” provided simple guidance for age-based asset allocation strategies: subtract your age from 100 to determine the appropriate equity allocation percentage, with the remainder in bonds. A 30-year-old following this rule within age-based asset allocation would allocate 70% to stocks and 30% to bonds, while a 60-year-old would hold 40% stocks and 60% bonds.

However, increasing life expectancies and concerns about retirement savings lasting 30+ years have prompted financial professionals to update these asset allocations to the “Rule of 110” or even “Rule of 120,” maintaining higher equity allocations longer to ensure sufficient growth. Under the Rule of 110 among updated asset allocation, a 30-year-old would allocate 80% to equities, and a 60-year-old would maintain 50% equity exposure, providing more aggressive growth orientation throughout accumulation years.

Target-date funds operationalize lifecycle asset allocation strategies by offering funds with target years in their names—for example, “Target Retirement 2050 Fund”—that automatically rebalance toward more conservative allocations as the target date approaches. Vanguard, Fidelity, and T. Rowe Price manages the largest target-date fund complexes implementing automated asset allocation, with distinct glide paths reflecting different philosophies about optimal risk reduction trajectories.

Research shows vast majorities of these funds receive 4- or 5-star Morningstar ratings based on risk-adjusted returns, confirming the strategy’s effectiveness for retirement accumulation through lifecycle asset allocation. The funds’ “through-retirement” glide paths continue adjusting allocations for approximately 30 years beyond the target date, recognizing that retirement spans decades requiring ongoing growth to combat inflation.

Rebalancing frequency analysis demonstrating that annual rebalancing often provides the optimal balance between risk management and return generation

Despite their popularity and convenience, lifecycle asset allocation presents limitations. The one-size-fits-all approach may not align with individual circumstances including risk tolerance, other income sources, health status, or specific financial goals. A 60-year-old with substantial pension income and minimal healthcare concerns can tolerate more equity risk than generic asset allocation suggests, while someone with high expenses or risk aversion might require earlier risk reduction.

Additionally, lifecycle funds typically charge higher expense ratios than simple index portfolios, though competition has driven fees downward with leading providers offering options below 0.15% annually. For retirement savers seeking automatic risk management without ongoing portfolio decisions, lifecycle asset allocation provides valuable structure, but investors should verify that generic age-based allocations match their unique situations.

Constant Weighting: Disciplined Rebalancing

Constant weighting asset allocation strategies maintain portfolio allocations through systematic rebalancing whenever positions drift beyond predetermined thresholds, imposing discipline on the buy-low-sell-high principle without emotional decision-making. Rather than rebalancing on fixed calendar schedules, constant weighting asset allocation triggers rebalancing trades only when asset class weights deviate from targets by specified amounts, typically 5% relative or absolute.

For instance, if a 60/40 stock-bond target shifts to 65/35 due to equity appreciation, the investor implementing threshold-based asset allocation strategies would sell 5% stocks and purchase bonds to restore the strategic allocation.

The threshold-based approach among disciplined asset allocation offers several advantages over calendar-based rebalancing including responsiveness to market movements, potential transaction cost savings by avoiding unnecessary trades when allocations remain near targets, and automatic enforcement of contrarian discipline.

Research comparing rebalancing methodologies found that tolerance band approaches using 5% thresholds within constant weighting asset allocation typically generate superior risk-adjusted returns compared to fixed quarterly or annual schedules, achieving better Sharpe ratios while requiring fewer rebalancing trades. The strategy inherently implements a “buy low, sell high” discipline as rebalancing purchases assets that have declined (thus are “on sale”) while selling appreciated assets (taking profits).

Implementation of constant weighting asset allocation requires establishing both strategic target allocations and rebalancing thresholds for each asset class. Many investors combine threshold triggers with minimum time periods, creating hybrid approaches that rebalance no more frequently than annually but trigger immediate rebalancing if thresholds are breached within systematic asset allocation strategies.

Investment platforms increasingly offer automated rebalancing tools that monitor allocations continuously and execute trades when thresholds are violated, removing the monitoring burden from investors implementing these asset allocation. For taxable accounts, sophisticated investors coordinate rebalancing with tax-loss harvesting opportunities, selling positions with losses first to minimize capital gains tax liability while restoring target allocations through tax-efficient asset allocation strategies.

The constant weighting strategy suits disciplined investors focused on risk management who can tolerate the monitoring requirements or utilize technology platforms providing automated oversight for threshold-based asset allocation strategies. The approach proves particularly valuable during volatile markets when allocations can drift substantially from targets, potentially exposing portfolios to unintended risk levels.

However, aggressive thresholds or excessive rebalancing frequency can generate high transaction costs and tax consequences that erode net returns, particularly in taxable brokerage accounts implementing these asset allocation strategies. Financial advisors typically recommend 5% thresholds with annual review schedules as optimal for balancing rebalancing benefits against implementation costs within constant weighting asset allocation.

Dollar-Cost Averaging: Systematic Risk Mitigation

Dollar-cost averaging constitutes an investment strategy where investors deploy capital into markets through regular fixed-dollar purchases rather than lump-sum investments, reducing the impact of market timing on portfolio outcomes through systematic asset allocation. This systematic approach among time-tested asset allocation strategies, first formalized by Benjamin Graham in his 1949 investment classic “The Intelligent Investor,” involves investing the same dollar amount at regular intervals—typically monthly or quarterly—regardless of prevailing market prices.

By maintaining consistent purchase amounts within dollar-cost averaging asset allocation tactics, investors automatically buy more shares when prices decline and fewer shares when prices rise, potentially lowering the average cost per share over time.

The mathematical mechanics demonstrate dollar-cost averaging’s benefits as one of the risk-mitigation asset allocation during volatile markets. Consider an investor allocating $500 monthly to an S&P 500 index fund: when share prices trade at $50, the investor purchases 10 shares; if prices fall to $40, the same $500 buys 12.5 shares; when prices recover to $55, only 9.1 shares are purchased.

Over a 10-month period with fluctuating prices averaging $50, the investor might accumulate 47.71 shares at an average cost of $10.48 per share versus 45.45 shares at $11.00 per share from a single lump-sum purchase, benefiting from price volatility rather than being harmed by it through systematic asset allocation strategies.

Dollar-cost averaging addresses perhaps the most challenging aspect of investing for individuals: determining optimal entry timing when market levels appear elevated or uncertain through these practical asset allocation strategies. By removing timing decisions and enforcing consistent accumulation regardless of market sentiment, dollar-cost averaging asset allocation combats behavioral biases including fear during market declines and greed during bubbles.

The approach proves particularly valuable for investors receiving regular paychecks who can dedicate consistent portions toward investment accounts through automated contributions to 401(k) plans, IRAs, or taxable brokerage accounts implementing accumulation-focused asset allocation.

Academic research examining dollar-cost averaging versus lump-sum investing presents nuanced conclusions about these asset allocation strategies. Studies generally find that immediate lump-sum investment outperforms dollar-cost averaging approximately 66% of the time over 12-month horizons because markets trend upward more often than downward, making delays costly.

However, dollar-cost averaging asset allocation generates superior outcomes during protracted bear markets or volatile periods, and provides meaningful psychological benefits by reducing regret risk from investing substantial sums immediately before market declines. For investors with existing capital to deploy, many advisors recommend a compromise: dollar-cost averaging over 6-12 months to balance statistical expectations favoring immediate investment against behavioral comfort from gradual entry within phased asset allocation strategies.

Tax-Loss Harvesting: Maximizing After-Tax Returns

Tax-loss harvesting represents a sophisticated approach among tax-efficient asset allocation strategies focused on enhancing after-tax portfolio returns by strategically realizing investment losses to offset capital gains and ordinary income. This tax-efficient technique involves selling securities trading below their purchase price to recognize losses for tax purposes, then immediately reinvesting proceeds into similar but not identical securities to maintain market exposure and desired asset allocation. The realized losses offset capital gains from other profitable investments dollar-for-dollar, and up to $3,000 of excess losses can offset ordinary income annually, with remaining losses carried forward indefinitely to future tax years within tax-optimized asset allocation strategies.

The mechanics of tax loss harvesting asset allocation generate substantial value for taxable account holders. Consider an investor who realizes $30,000 in capital gains from selling appreciated technology stocks. If simultaneously selling an underperforming position generates a $25,000 loss, the investor owes taxes only on $5,000 of net gains rather than the full $30,000, saving approximately $3,750 in taxes at 15% capital gains rates through tax-efficient asset allocation strategies.

The $5,000 remaining loss can offset $3,000 of ordinary income, potentially saving another $750-$1,050 depending on tax brackets, with the final $2,000 loss carried forward for future years. Importantly, by immediately purchasing a similar investment—such as swapping from one S&P 500 index fund to another provider’s equivalent fund—the investor maintains essentially identical market exposure while harvesting the tax benefit within these tax-advantaged asset allocation strategies.

Successful tax-loss harvesting asset allocation strategies require understanding IRS wash-sale rules prohibiting claiming losses on securities repurchased within 30 days before or after the sale. Investors must either wait 31 days before repurchasing the identical security or substitute a similar but not substantially identical investment to maintain market exposure within compliant asset allocation strategies.

Exchange-traded funds’ proliferation has made wash-sale compliance easier for tax-loss harvesting asset allocation strategies, as numerous similar-but-not-identical index funds tracking the same benchmarks enable seamless substitution. Professional portfolio managers incorporate tax-loss harvesting into portfolio construction through deliberate asset allocation, deliberately using multiple similar holdings rather than single large positions to create more harvesting opportunities as individual securities and sectors fluctuate.

The strategy proves most valuable for high-income investors in elevated tax brackets who face substantial capital gains in taxable accounts implementing tax-optimized asset allocation strategies. Incorporating tax-loss harvesting into year-round investment processes rather than limiting it to December tax-planning can enhance benefits substantially, with research suggesting potential annual tax alpha of 0.5-1.0% for actively harvested portfolios using these asset allocation strategies.

The approach coordinates naturally with portfolio rebalancing, as selling lagging positions for tax losses while trimming winners to restore target allocations achieves both tax efficiency and risk management objectives simultaneously through integrated asset allocation. However, tax-loss harvesting provides no benefits within tax-advantaged retirement accounts like 401(k)s or IRAs where gains aren’t taxed, making these asset allocation strategies exclusively relevant for taxable brokerage accounts.

Implementation Considerations and Behavioral Pitfalls

Successful implementation of asset allocation strategies extends beyond selecting appropriate frameworks to encompass practical execution considerations, cost management, and behavioral discipline that separates theoretical plans from realized outcomes. Research in behavioral finance reveals that psychological biases and emotional decision-making undermine even well-designed asset allocation strategies, with studies suggesting behavioral mistakes cost investors 2-3% annually in lost returns compared to disciplined adherence to strategic plans. Understanding common pitfalls and implementing guardrails against emotional decisions proves as critical as selecting optimal asset mixes within comprehensive asset allocation strategies.

Overconfidence bias represents perhaps the most pervasive behavioral threat to effective asset allocation strategies, manifesting when investors overestimate their ability to forecast market movements or identify superior investments. Survey data revealing 76% of professional fund managers believing they possess above-average skills—a statistical impossibility—demonstrates this bias’s prevalence even among investment experts implementing active asset allocation.

Overconfidence frequently leads tactical investors to make excessive portfolio adjustments, trade too frequently with attendant costs and taxes, or concentrate positions in perceived opportunities that fail to materialize. Implementing strict position-sizing limits, requiring multiple sources of evidence before tactical shifts, and maintaining trading journals documenting decision rationales can help counter overconfidence tendencies within disciplined asset allocation.

Herding behavior and confirmation bias create dangerous feedback loops during market extremes, as investors seek information supporting prevailing sentiment while ignoring contrary evidence, undermining rational asset allocation strategies. During bull markets, herding drives investors to increase equity exposure precisely when valuations become stretched and forward returns diminish; conversely, panic selling during bear markets locks in losses at market bottoms.

The 2022 period exemplified these dynamics as investors fled balanced portfolios during the 60/40 strategy’s worst year, missing the subsequent 29.7% rebound. Behavioral economists recommend pre-commitment strategies including written investment policy statements specifying allocation targets and rebalancing triggers that remain binding regardless of market sentiment within documented asset allocation.

Loss aversion bias—the tendency to feel losses more acutely than equivalent gains—causes investors to sell winners prematurely to lock in profits while holding losers hoping for recovery, directly opposite to optimal tax and performance outcomes within rational asset allocation strategies. This emotional pattern undermines tax-loss harvesting strategies and rebalancing discipline.

Implementing systematic, rules-based rebalancing schedules or threshold triggers removes real-time emotional decisions, while educating investors about the statistical prevalence of temporary drawdowns can build tolerance for necessary volatility within long-term asset allocation strategies. Financial advisors emphasize that the primary value they provide lies less in security selection than in behavioral coaching that keeps clients committed to strategic allocations through emotional market periods.

Asset allocation strategies ultimately succeed or fail based on consistent implementation over multi-decade time horizons spanning numerous market cycles. The mathematical advantages of diversification, rebalancing discipline, and tax efficiency compound meaningfully only through sustained adherence to well-designed asset allocation.

Investors should regularly reassess whether current allocations align with evolving life circumstances, risk tolerance, and financial goals, but avoid reactionary changes driven by recent market performance or media narratives. By combining evidence-based strategic frameworks with awareness of behavioral pitfalls and systematic implementation processes, American investors can harness asset allocation strategies to build enduring wealth across generations.

Conclusion: Constructing Your Optimal Allocation Framework

Asset allocation strategies represent the most consequential investment decisions individuals make, determining the majority of long-term portfolio performance while managing risk exposure aligned with personal circumstances and objectives. The nine frameworks examined—strategic, tactical, dynamic, core-satellite, risk parity, age-based lifecycle, constant weighting, dollar-cost averaging, and tax-loss harvesting asset allocation—provide comprehensive tools spanning the spectrum from passive simplicity to active sophistication, each offering distinct advantages suited to specific investor profiles, risk tolerances, and market environments.

No single approach universally dominates among these asset allocation strategies; optimal strategy selection depends on individual factors including investment time horizon, risk capacity, tax situation, behavioral temperament, and available time for portfolio management.

For most American investors, a foundation built on strategic asset allocation provides reliable long-term results through market cycles. The 60/40 balanced portfolio’s recovery to generate 6.9% annualized returns over the past decade, including 2022’s challenging period, demonstrates the enduring power of diversified buy-and-hold asset allocation strategies for moderate-risk investors.

Younger accumulators benefit from age-based lifecycle asset allocation that maintain aggressive equity exposure during decades with recovery time from volatility, while systematically reducing risk as retirement approaches. These foundational asset allocation gain enhanced efficiency through complementary strategies including systematic dollar-cost averaging for regular contributions, annual rebalancing to enforce buy-low-sell-high discipline, and tax-loss harvesting in taxable accounts to maximize after-tax returns.

Investors seeking to enhance returns beyond market-matching baseline approaches can layer additional sophistication through core-satellite asset allocation that combines passive index core holdings with active satellite positions targeting specific opportunities.

This hybrid structure among balanced asset allocation tactics captures broad market returns cost-effectively while preserving flexibility for tactical adjustments or thematic investments, balancing the simplicity and reliability of strategic allocation with the return-enhancement potential of selective active management.

However, these more complex asset allocation strategies demand greater time commitment, analytical capabilities, and emotional discipline to avoid behavioral pitfalls including overconfidence, herding, and loss aversion that consistently undermine investment outcomes.

The mathematical certainty that asset allocation determines 90% of portfolio performance variability, combined with extensive historical evidence spanning centuries demonstrating diversification’s power to enhance risk-adjusted returns, establishes these frameworks as non-negotiable foundations for intelligent investing. As US markets navigate technological disruption, demographic transitions, and evolving monetary policy landscapes in 2025 and beyond, disciplined adherence to evidence-based asset allocation provides the surest path to long-term wealth accumulation.

Begin by honestly assessing your risk tolerance, time horizon, and behavioral tendencies; select an appropriate primary framework from the asset allocation examined; implement systematic rebalancing and contribution processes; and maintain steadfast commitment through inevitable market volatility. This disciplined approach, more than any security selection or market timing skill, will determine your investment success over decades.

Take action today: Review your current portfolio allocation against the asset allocation outlined in this analysis. If your holdings don’t align with a coherent framework suited to your circumstances, commit to restructuring toward an evidence-based approach among proven asset-allocation strategies.

For retirement accounts, investigate low-cost target-date funds matching your retirement timeline that implement lifecycle asset allocation. For taxable accounts, implement tax-loss harvesting opportunities this year to enhance after-tax returns through tax-efficient asset allocation. Most importantly, document your chosen allocation strategy in a written investment policy statement specifying target allocations, rebalancing triggers, and commitment to ignore short-term market noise.

Your future financial security depends not on predicting market movements, but on implementing and maintaining asset allocation strategies aligned with your life journey—the ultimate investment discipline that separates wealth builders from market speculators.

Citations

- https://firstavenue.co.za/quarterly_report_art/asset-allocation-modern-portfolio-theory/

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/modern-portfolio-theory-mpt/

- https://corporate.vanguard.com/content/corporatesite/us/en/corp/articles/global-60-40-portfolio-steady-as-it-goes.html

- https://www.vanguard.co.uk/professional/insights-education/insights/the-global-60-40-portfolio-steady-as-she-goes

- https://www.wiseradvisor.com/article/determining-the-optimal-rebalancing-frequency-221/

- https://www.kitces.com/blog/best-opportunistic-rebalancing-frequency-time-horizons-vs-tolerance-band-thresholds/

- https://www.milliman.com/en/insight/2025-corporate-pension-funding-study

- https://equable.org/wp-content/uploads/2025/01/SOP-2024_January-Update_Final.pdf

- https://en.wikipedia.org/wiki/Risk_parity

- https://spacecoastdaily.com/2025/10/etf-trading-strategies-tax-loss-harvesting-and-rebalancing-techniques/

- https://www.pyrmontwm.com/5-asset-allocation-mistakes-and-how-you-can-avoid-them/

- https://www.schwab.com/learn/story/how-to-cut-your-tax-bill-with-tax-loss-harvesting

- https://www.museodelrisparmio.it/blog/errors-in-behavioral-finance-what-they-are-and-how-to-avoid-them/

- https://www.finedge.in/blog/portfolio-review/asset-allocation-strategies

- https://www.angelone.in/knowledge-center/online-share-trading/modern-portfolio-theory

- https://www.righthorizons.com/blogs/best-asset-allocation-methods/

- https://www.range.com/blog/modern-portfolio-theory-explained-a-guide-for-investors

- https://www.moneycontrol.com/news/business/personal-finance/asset-allocation-in-2025-optimise-and-diversify-your-portfolio-to-thrive-in-uncertain-times-12943317.html

- https://www.investopedia.com/articles/company-insights/083016/example-applying-modern-portfolio-theory-mps.asp

- https://www.morganstanley.com/im/publication/insights/articles/article_bigpicturereturnofthe6040_ltr.pdf

- https://www.morganstanley.com/im/en-au/institutional-investor/insights/articles/big-picture-return-of-the-60-40.html

- https://www.straitsfinancial.com/insights/building-asset-allocation-strategies

- https://www.morningstar.com/portfolios/top-5-portfolio-moves-2025

- https://www.investopedia.com/investing/6-asset-allocation-strategies-work/

- https://www.goldmansachs.com/insights/articles/the-60-40-portfolio-should-offer-a-better-risk-reward-in-2024

- https://www.nl.vanguard/professional/insights/market-commentary/the-global-60-40-portfolio-steady-as-she-goes

- https://www.miraeassetmf.co.in/knowledge-center/types-of-asset-allocation

- https://retirementresearcher.com/rebalancing-frequency/

- https://smartasset.com/investing/strategic-vs-tactical-asset-allocation

- https://www.falconwealthplanning.com/falcon-articles/strategic-vs-tactical-asset-allocation-which-approach-builds-wealth-smarter/

- https://www.nerdwallet.com/article/investing/what-is-a-target-date-fund-and-when-should-you-invest-in-one

- https://www.tiaa.org/public/retire/financial-products/target-date-funds

- https://www.capitalgroup.com/individual/investments/target-date.html

- https://firstfinancial.is/strategic-vs-tactical-asset-allocation/

- https://streetgains.in/insights/strategic-vs-tactical-asset-allocation-finding-your-balance/

- https://blog.vrid.in/2024/08/20/what-is-the-core-and-satellite-portfolio-strategy-is-it-effective-should-you-use-it/

- https://www.shriramfinance.in/article-understanding-asset-allocation-the-key-to-smarter-investments

- https://cornerstoneportfolioresearch.com/financial-planning/strategic-vs-tactical-asset-allocation-key-differences-explained/

- https://www.wrightresearch.in/blog/optimal-rebalancing-frequency-how-often-rebalance-momentum-portfolio/

- https://www.smallcase.com/blog/optimal-rebalancing-frequency-how-often-should-you-rebalance-your-momentum-portfolio/

- https://www.home.saxo/en-sg/learn/guides/diversification/core-satellite-approach-a-smarter-way-to-diversify-your-investments

- https://www.vanguard.com.au/personal/learn/smart-investing/investing-strategy/core-satellite-investing

- https://www.smallcase.com/blog/core-satellite-investing/

- https://en.wikipedia.org/wiki/Core_&_Satellite

- https://www.dbs.com.sg/personal/articles/nav/investing/what-is-a-core-satellite-portfolio

- https://www.angelone.in/knowledge-center/mutual-funds/what-is-core-and-satellite-portfolio

- https://blog.quantinsti.com/risk-parity-portfolio/

- https://www.aqr.com/-/media/AQR/Documents/Insights/White-Papers/Understanding-Risk-Parity.pdf

- https://caia.org/sites/default/files/aiar.8.2_-_risk_parity.pdf

- https://www.spglobal.com/spdji/en/documents/research/research-indexing-risk-parity-strategies.pdf

- https://www.seic.com/sites/default/files/2023-10/SEI-InvestmentFundamental-Risk-Parity.pdf

- https://www.ifswf.org/media-download/15227

- https://smartasset.com/retirement/rule-of-110

- https://www.sofi.com/learn/content/asset-allocation-by-age/

- https://arthgyaan.com/blog/ageWiseEquityAllocation.html

- https://www.justetf.com/en/academy/100-minus-age-rule.html

- https://www.fool.com/terms/r/rule-of-110/

- https://cleartax.in/s/asset-allocation-by-age

- https://www.fidelity.com/mutual-funds/fidelity-fund-portfolios/freedom-funds

- https://www.nuveen.com/en-us/mutual-funds/nuveen-lifecycle-2025-fund

- https://www.reddit.com/r/Bogleheads/comments/13bzbcg/how_often_to_rebalance_portfolio/

- https://www.morganstanley.com/articles/tax-loss-harvesting

- https://www.schwab.com/learn/story/what-is-dollar-cost-averaging

- https://www.investopedia.com/terms/d/dollarcostaveraging.asp

- https://en.wikipedia.org/wiki/Dollar_cost_averaging

- https://corporatefinanceinstitute.com/resources/wealth-management/dollar-cost-averaging-dca/

- https://www.nationaldebtrelief.com/es/blog/financial-wellness/saving-and-investing/dollar-cost-averaging-strategy-for-beginners/

- https://www.sc.com/ng/wealth-insights/dollar-cost-averaging/

- https://www.blackrock.com/us/financial-professionals/investments/products/managed-accounts/tax-loss-harvesting

- https://www.fidelity.com/viewpoints/personal-finance/tax-loss-harvesting

- https://investor.vanguard.com/investor-resources-education/taxes/offset-gains-loss-harvesting

- https://lnwadvisors.com/behavioral-finance-recognizing-biases-and-avoiding-mistakes/

- https://russellinvestments.com/us/blog/b-is-for-behavioral-mistakes-how-much-value-comes-from-prevention

- https://www.manning-napier.com/insights/Avoiding-Common-Behavioral-Mistakes

- https://www.kubera.com/blog/behavioral-investing

- https://investor.vanguard.com/investor-resources-education/education/model-portfolio-allocation

- https://smartasset.com/investing/asset-allocation-calculator

- https://b2broker.com/news/best-portfolio-asset-allocation-methods/

- https://www.paulmerriman.com/ultimate-buy-hold-update-2025

- https://www.njwealth.in/blog/insights/asset-allocation

- https://www.cnbc.com/2025/10/23/jim-cramer-formula-for-building-long-term-wealth.html

- https://en.wikipedia.org/wiki/Modern_portfolio_theory

- https://8figures.com/blog/portfolio-allocations/the-60-40-portfolio-in-2025-still-relevant-or-outdated

- https://www.reddit.com/r/investing/comments/1b0temf/is_100_age_still_a_valid_formula_for_allocation/

- https://www.manulifeim.com.sg/insights/dollar-cost-averaging.html

- https://bfccapital.com/blog/the-role-of-alternative-investments/

- https://am.gs.com/en-int/advisors/insights/article/2024/us-corporate-pension-review-and-preview-2024

- https://www.bajajfinserv.in/investments/what-are-alternative-investments

- https://www.axa-im.com/document/6493/download

- https://www.investopedia.com/terms/a/alternative_investment.asp

- https://mutualfund.adityabirlacapital.com/blog/top-alternative-investment-funds-2025

- https://www.investmentcouncil.org/new-study-private-equity-delivers-the-strongest-returns-for-retirees-across-america/

- https://www.cfainstitute.org/insights/professional-learning/refresher-readings/2025/asset-allocation-to-alternative-investments

- https://www.newfinancial.org/reports/comparing-the-asset-allocation-of-global-pension-systems

- https://am.jpmorgan.com/content/dam/jpm-am-aem/americas/us/en/insights/portfolio-insights/know-your-alternatives.pdf

- https://www.blackrock.com/institutions/en-us/insights/2024-corporate-pensions-themes

- https://www.investopedia.com/terms/t/target-date_fund.asp

- https://www.youtube.com/watch?v=eL0fbaTKg1Y

- https://cleartax.in/s/tax-loss-harvesting